- Vendor Registration and Disclosure Statement and Small, Women-, and Minority-owned Business Certificate Application

- New Vendor Registration - Monroe

- Vendor Registration Form - World Trade Organization

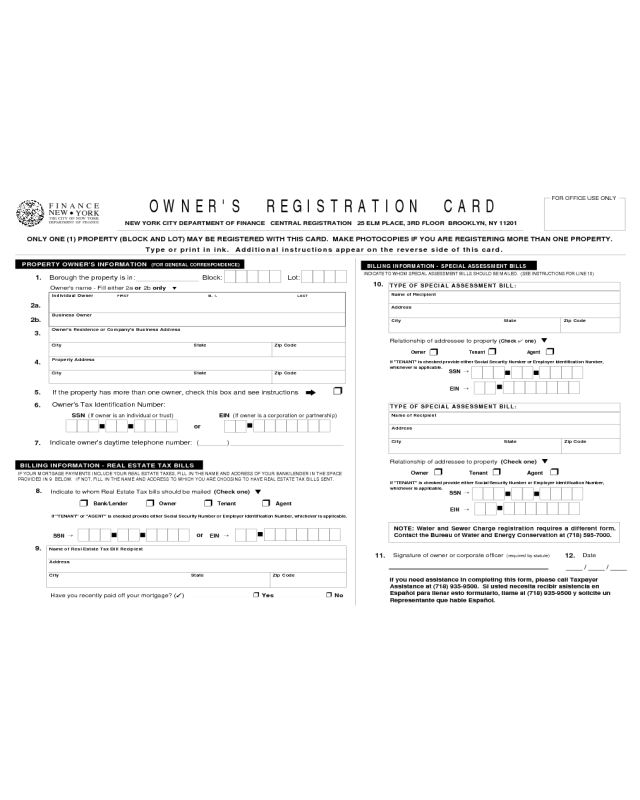

- Form of Owner's Registration Card

- Vendor Registration

- Vendor Registration Supplemental Disclosure Form - New Jersey

Fillable Printable Form of Owner's Registration Card

Fillable Printable Form of Owner's Registration Card

Form of Owner's Registration Card

OWNER'S REGISTRATION CARD

FOR OFFICE USE ONLY

ONLY ONE (1) PROPERTY (BLOCK AND LOT) MAY BE REGISTERED WITH THIS CARD. MAKE PHOTOCOPIES IF YOU ARE REGISTERING MORE THAN ONE PROPERTY.

Name of Recipient

Address

City State Zip Code

TYPE OF SPECIAL ASSESSMENT BILL:

11.

Signature of owner or corporate officer

(required by statute)

12.

Date

10.

NEW YORK CITY DEPARTMENT OF FINANCE CENTRAL REGISTRATION 25 ELM PLACE, 3RD FLOOR BROOKLYN, NY 11201

8.

9.

Indicate to whom Real Estate Tax bills should be mailed

(Check one)

▼

Have you recently paid off your mortgage?

(✓)

❒

Yes

❒

No

Bank/Lender Owner Tenant Agent

❒

Name of Real Estate Tax Bill Recipient

Address

City State Zip Code

IF YOUR MORTGAGE PAYMENTS INCLUDE YOUR REAL ESTATE TAXES, FILL IN THE NAME AND ADDRESS OF YOUR BANK/LENDER IN THE SPACE

PROVIDED IN 9 BELOW. IF NOT, FILL IN THE NAME AND ADDRESS TO WHICH YOU ARE CHOOSING TO HAVE REAL ESTATE TAX BILLS SENT.

If "TENANT" or "AGENT" is checked provide either Social Security Number or Employer Identification Number, whichever is applicable.

Type or print in ink. Additional instructions appear on the reverse side of this card.

PROPERTY OWNER'S INFORMATION

(FOR GENERAL CORRESPONDENCE)

If the property has more than one owner, check this box and see instructions

Owner's Tax Identification Number:

❒

SSN (If owner is an individual or trust)

Individual Owner

FIRST M

.

I

.

LAST

Business Owner

Owner's Residence or Company's Business Address

City State Zip Code

Property Address

City State Zip Code

2a.

2b.

3.

4.

5.

6.

7.

EIN (If owner is a corporation or partnership)

Indicate owner's daytime telephone number: ( )

1. Borough the property is in: Block: Lot:

Owner's name - Fill either 2a or 2b only

▼

NOTE: Water and Sewer Charge registration requires a different form.

Contact the Bureau of Water and Energy Conservation at (718) 595-7000.

FINANCE

NEW

●

YORK

THE CITY OF NEW YORK

DEPARTMENT OF FINANCE

SSN →

EIN →

or

BILLING INFORMATION - REAL ESTATE TAX BILLS

❒

❒❒

or

INDICATE TO WHOM SPECIAL ASSESSMENT BILLS SHOULD BE MAILED. (SEE INSTRUCTIONS FOR LINE 10)

BILLING INFORMATION - SPECIAL ASSESSMENT BILLS

Owner Tenant Agent

If "TENANT" is checked provide either Social Security Number or Employer Identification Number,

whichever is applicable.

❒

❒❒

SSN →

EIN →

Name of Recipient

Address

City State Zip Code

TYPE OF SPECIAL ASSESSMENT BILL:

SSN →

EIN →

Relationship of addressee to property

(Check one)

▼

Owner Tenant Agent

If "TENANT" is checked provide either Social Security Number or Employer Identification Number,

whichever is applicable.

❒

❒❒

If you need assistance in completing this form, please call Taxpayer

Assistance at (718) 935-9500. Si usted necesita recibir asistencia en

Español para llenar esto formulario, llame al (718) 935-9500 y solicite un

Representante que hable Español.

Relationship of addressee to property

(Check ✔ one)

▼

____ / ____ / ____

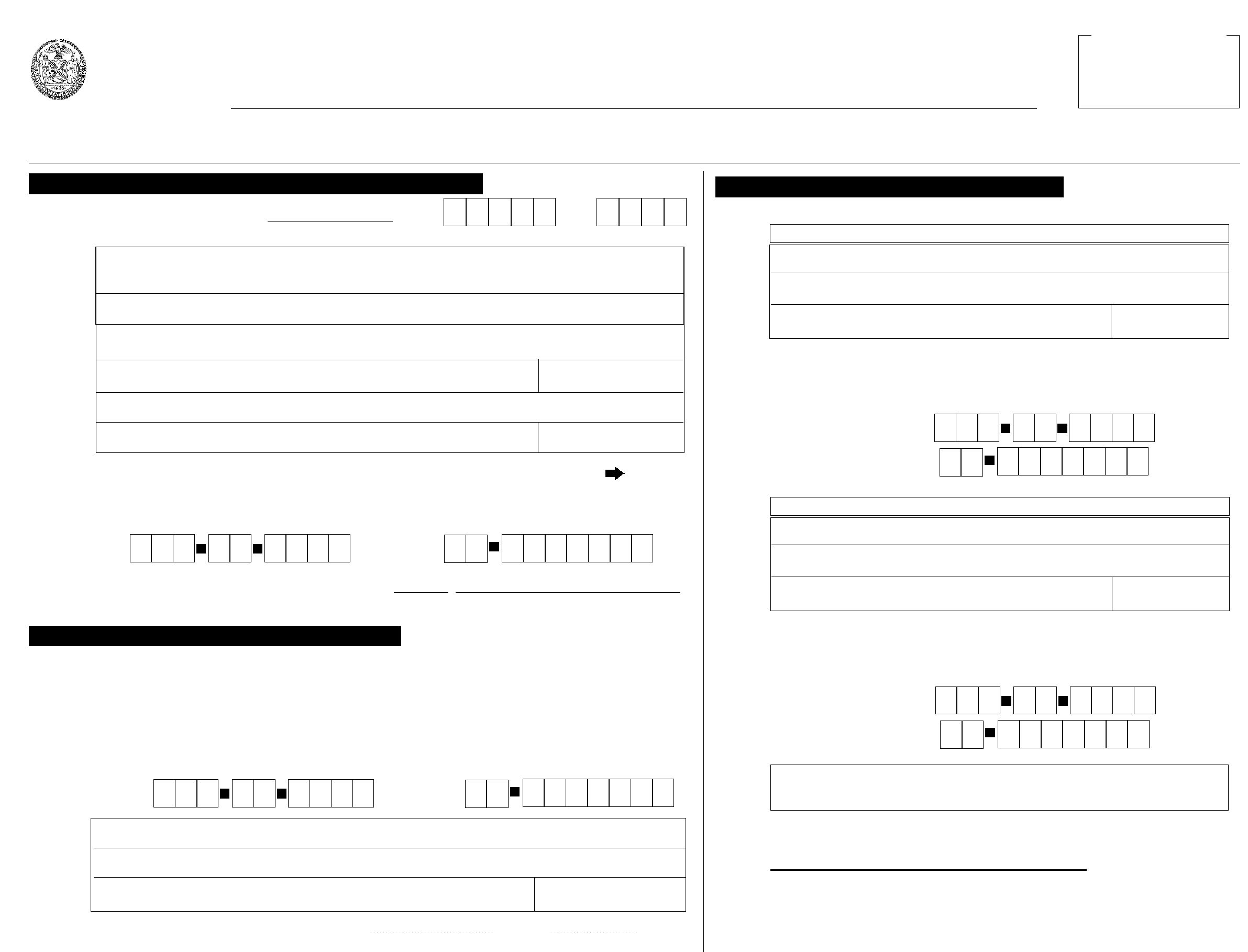

LINE 1

Enter the borough in which the property is located and

the block and lot numbers of the property. Only one

property (block and lot) may be registered with this

card. Make photocopies if you want to register more

than one property.

LINE 2A

Enter the full name of the owner if the property is owned

by an individual. Please DO NOT abbreviate. If the

property has more than one owner, see instructions for

line 5.

LINE 2B

Enter the name of the owner if the property is owned by

a business entity. If the property has more than one

owner, see instructions for line 5.

LINE 3

Enter the address of the owner. (Please note that the

address at which the owner lives, or at which the

company is located, is not necessarily the property

address itself.)

LINE 4

Enter the actual address of the property.

LINE 5

Check the box if the property has more than one owner,

and attach an additional sheet with the name, address

and EIN/SSN of the other owner(s). Include the

property block and lot number.

LINE 6

Enter the owner's Social Security Number, or if the

owner is a corporation or partnership, enter the

Employer Identification Number. This is required by

Section 11-102.1 of the New York City Administrative

Code and will be used for tax compliance purposes.

This will be used for tax compliance purposes. (The

same is true of the tenant and agent identification

number information requested for real estate and

assessment bills.)

LINE 7

In order that we may provide you with better service,

please provide a telephone number at which you can be

reached during normal business hours.

IMPORTANT

If your mortgage payments include your real estate

taxes, fill in the name and address of your bank/lender

in the space provided on line 9. If not, fill in the address

to which you are choosing to have real estate tax bills

sent.

LINE 8

Check the box next to the appropriate relationship. For

example, if bills are to be sent to your bank/lender,

check the box which is marked "Bank/Lender."

LINE 9

Enter the name and address to which you would like

Real Estate Tax bills mailed.

LINE 10

Special Assessment bills are for items such as Sidewalk

Assessment , Mall Maintenance and Boiler and Elevator

Inspection Charges. In most cases the owner should

register to receive these bills. Enter the name and

address to which Special Assessment bills should be

sent.

LINE 11

The owner or corporate officer must sign the

Registration Card in order for it to be valid.

LINE 12

Indicate the date signed.

The law provides that senior citizens and handicapped

taxpayers may designate someone to receive duplicate

tax bills. If you are interested, contact Taxpayer

Assistance at (718) 935-9500 and ask for a third party

notification form.

IF YOU NEED FURTHER ASSISTANCE IN

COMPLETING THIS FORM, PLEASE CALL (718) 935-

6153 OR 935-9500.

SI USTED NECESITA RECIBIR ASISTENCIA EN

ESPANOL PARA LLENAR ESTO FORMULARIO,

LLAME (718) 935-9500.

- INSTRUCTIONS FOR COMPLETING OWNER'S REGISTRATION CARD -