Fillable Printable Form Or-Drd, Oregon Dividends-Received Deduction

Fillable Printable Form Or-Drd, Oregon Dividends-Received Deduction

Form Or-Drd, Oregon Dividends-Received Deduction

Oregon Department of Revenue

18421601010000

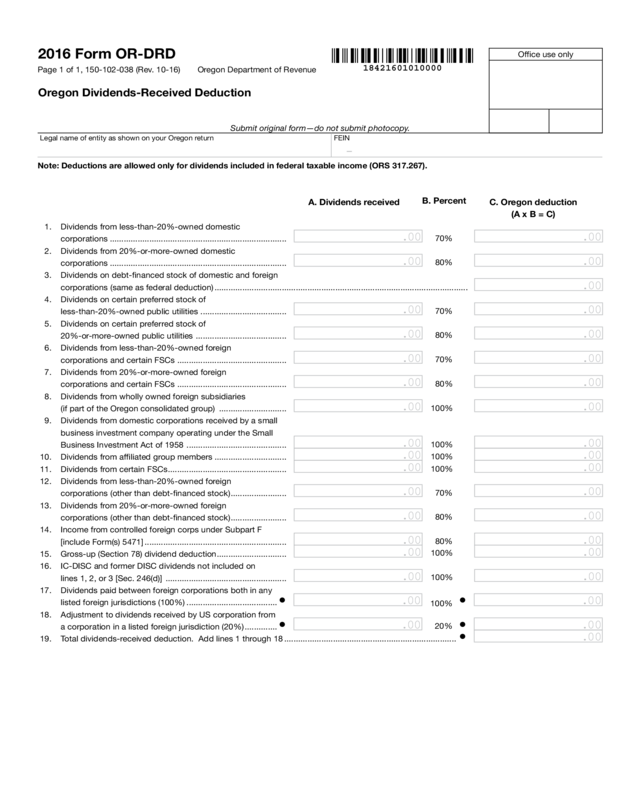

2016 Form OR-DRD

Oregon Dividends-Received Deduction

Submit original form—do not submit photocopy.

Office use only

Page 1 of 1, 150-102-038 (Rev. 10-16)

A. Dividends received

B. Percent

C. Oregon deduction

(A x B = C)

1. Dividends from less-than-20%-owned domestic

corporations ............................................................................

2. Dividends from 20%-or-more-owned domestic

corporations ............................................................................

3. Dividends on debt-nanced stock of domestic and foreign

corporations (same as federal deduction) .............................................................................................................

4. Dividends on certain preferred stock of

less-than-20%-owned public utilities .....................................

5. Dividends on certain preferred stock of

20%-or-more-owned public utilities .......................................

6. Dividends from less-than-20%-owned foreign

corporations and certain FSCs ...............................................

7. Dividends from 20%-or-more-owned foreign

corporations and certain FSCs ...............................................

8. Dividends from wholly owned foreign subsidiaries

(if part of the Oregon consolidated group) .............................

9. Dividends from domestic corporations received by a small

business investment company operating under the Small

Business Investment Act of 1958 ...........................................

10. Dividends from afliated group members ...............................

11. Dividends from certain FSCs ...................................................

12. Dividends from less-than-20%-owned foreign

corporations (other than debt-nanced stock) ........................

13. Dividends from 20%-or-more-owned foreign

corporations (other than debt-nanced stock) ........................

14. Income from controlled foreign corps under Subpart F

[include Form(s) 5471] .............................................................

15. Gross-up (Section 78) dividend deduction ..............................

16. IC-DISC and former DISC dividends not included on

lines 1, 2, or 3 [Sec. 246(d)] ....................................................

17. Dividends paid between foreign corporations both in any

listed foreign jurisdictions (100%) .......................................

18. Adjustment to dividends received by US corporation from

a corporation in a listed foreign jurisdiction (20%) ..............

19. Total dividends-received deduction. Add lines 1 through 18 ..........................................................................

•

•

•

•

•

70%

80%

70%

80%

70%

80%

100%

100%

100%

100%

70%

80%

80%

100%

100%

100%

20%

Note: Deductions are allowed only for dividends included in federal taxable income (ORS 317.267).

Legal name of entity as shown on your Oregon return FEIN

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

–

Clear Form

Schedule OR-DRD

Oregon Dividends-Received Deduction Instructions

This schedule is similar to federal form 1120, Schedule

C. It is not identical. Refer to the instructions for federal

form 1120, Schedule C, for more information on classifi-

cation or definitions of dividends.

Important: Deductions are allowed only for dividends

included in federal taxable income (ORS 317.267).

Column A: Enter only amounts that are included in fed-

eral and Oregon income.

Column B: This is the allowable Oregon percentage for

the specific dividend.

Column C: Multiply column A and B (A x B = C) to deter-

mine the Oregon dividend received deduction.

Line 17. Dividends paid between foreign corporations

in listed foreign jurisdictions are allowed a 100 percent

dividend received deduction if the payor and payee of

the dividend are unitary with the taxpayer [with one

another] and the income of both entities is reported as an

Oregon addition.

Line 18. Dividends received by a US corporation from

a foreign corporation are 80 percent deductible. Divi-

dends received by a US corporation from a foreign cor-

poration that’s incorporated in a listed jurisdiction are

fully deductible if otherwise included in Oregon tax-

able income for the current or previous tax years. If you

deducted 80 percent on lines above, enter the remaining

20 percent on Line 18. Don’t enter dividends that have

already been deducted or subtracted through intercom-

pany eliminations.

Total. Total lines 1 through 18 and enter it on Schedule

OR-ASC-CORP.

150-102-038 (Rev. 10-16)