Fillable Printable Form P-626 - Wisconsin Department Of Revenue

Fillable Printable Form P-626 - Wisconsin Department Of Revenue

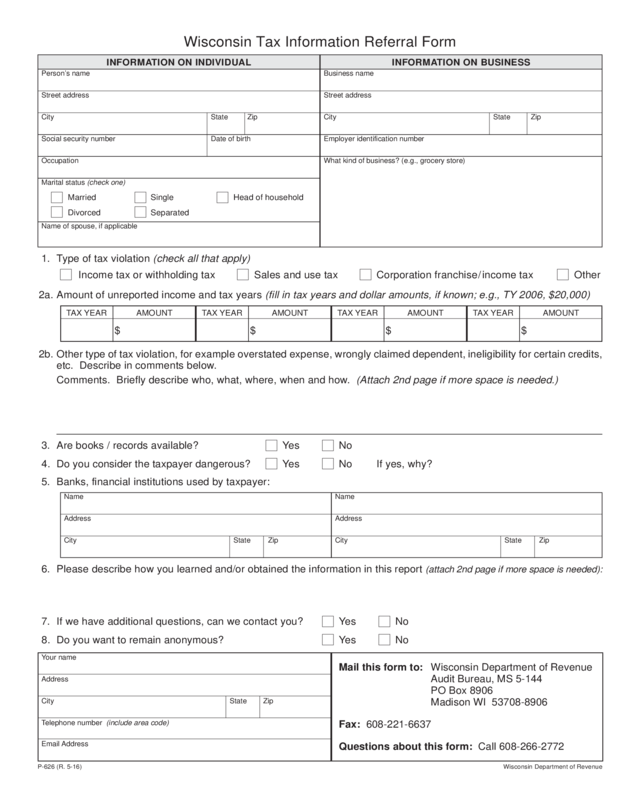

Form P-626 - Wisconsin Department Of Revenue

2a. Amount of unreported income and tax years (fill in tax years and dollar amounts, if known; e.g., TY 2006, $20,000)

2b. Other type of tax violation, for example overstated expense, wrongly claimed dependent, ineligibility for certain credits,

etc. Describe in comments below.

Comments. Briefly describe who, what, where, when and how. (Attach 2nd page if more space is needed.)

1. Type of tax violation (check all that apply)

Income tax or withholding tax Sales and use tax Corporation franchise/income tax Other

INFORMATION ON BUSINESSINFORMATION ON INDIVIDUAL

P-626 (R. 5-16) Wisconsin Department of Revenue

Wisconsin Tax Information Referral Form

Person’s name

Street address

City State Zip

Social security number Date of birth

Occupation

Marital status (check one)

Business name

Street address

City State Zip

Employer identification number

What kind of business? (e.g., grocery store)

Name of spouse, if applicable

Married

Divorced

Single

Separated

Head of household

TAX YEAR AMOUNT

$

TAX YEAR AMOUNT

$

TAX YEAR AMOUNT

$

TAX YEAR AMOUNT

$

3. Are books / records available? Yes No

4. Do you consider the taxpayer dangerous? Yes No If yes, why?

5. Banks, financial institutions used by taxpayer:

6. Please describe how you learned and/or obtained the information in this report (attach 2nd page if more space is needed):

Name

Address

City State Zip

Name

Address

City State Zip

Address

City State Zip

Your name

Telephone number (include area code)

Mail this form to: Wisconsin Department of Revenue

Audit Bureau, MS 5-144

PO Box 8906

Madison WI 53708-8906

Fax: 608-221-6637

Questions about this form: Call 608-266-2772

7. If we have additional questions, can we contact you? Yes No

8. Do you want to remain anonymous? Yes No

Email Address

TAB through to navigate. Use

mouse to check applicable boxes,

press spacebar, or press Enter.

Completed form can be submitted via email by clicking the

"Email" button, or it can be mailed or faxed to DOR using

the contact information at the bottom of the page.

Email

Save

Print

Clear

Go to Page 2

2. Comments. Briefly describe who, what, where, when and how.

P-626 (R. 5-16) - 2 - Wisconsin Department of Revenue

6. Please describe how you learned and/or obtained the information in this report:

Return to Page 1