Fillable Printable Form S-240 - Wisconsin Department Of Revenue

Fillable Printable Form S-240 - Wisconsin Department Of Revenue

Form S-240 - Wisconsin Department Of Revenue

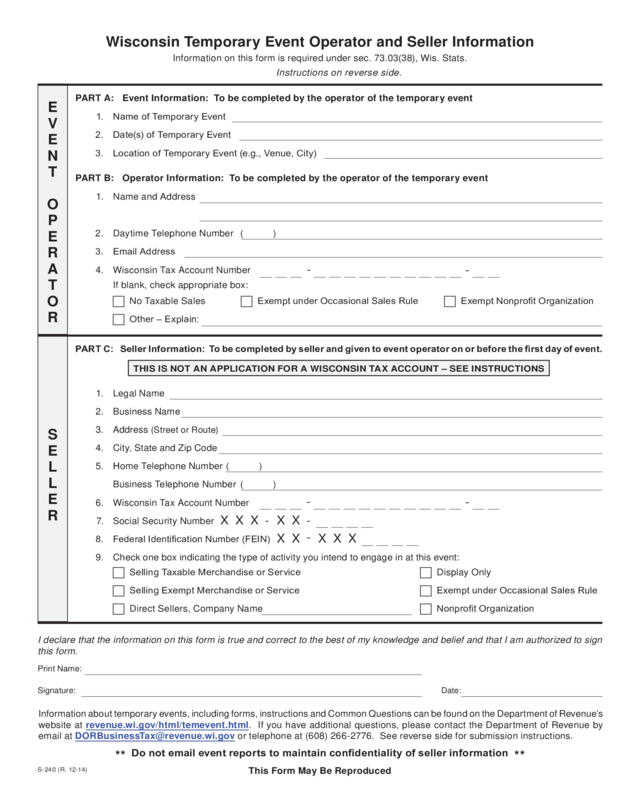

1. Legal Name

2. Business Name

3. Address (Street or Route)

4. City, State an d Zip Code

5. Home Telep hone Nu m ber ( )

Busin ess Tele phone N u m ber ( )

6. Wi sco n s i n Tax Ac count N u m ber

7. Social Security Number

8. FederalIdenticationNumber(FEIN)

9. Che ck one b ox in dicat i ng the type o f activ i ty you inte n d t o e n gage in at t h i s event:

X X X

-

X X

S

E

L

L

E

R

E

V

E

N

T

O

P

E

R

A

T

O

R

PART B: Oper a t o r Informat ion: To be com p let ed by th e ope rator of t he te m por ary even t

1. Na me a n d Ad dr e s s

2. Daytime Telephone Number ( )

3. EmailAddress

4. Wisconsi n Ta x A cco u nt Nu mb e r

If blank, check appr o p riate box:

Thi s Form M ay B e R e p r o duc e d

Wisconsin Temporary Event Operator and Seller Infor mation

S -2 4 0 ( R . 12-14)

Informati o n o n t h is f o rm is re qui r e d un de r s e c . 73. 0 3 (38), Wis. St at s.

Instr uc ti ons on r everse s ide.

PART A: Event In f o rm a tio n: To b e c omp let e d by the o per ato r o f t he temp o rary event

1. NameofTemporaryEvent

2. Date(s)ofTemporaryEvent

3. LocationofTemporaryEvent(e.g.,Venue,City)

Other–Explain:

No Taxable Sales ExemptunderOccasionalSalesRule ExemptNonprotOrganization

Direct Se ller s, C om pany Name

SellingExemptMerchandiseorService

Display Only

ExemptunderOccasionalSalesRule

NonprotOrganization

I dec lar e t hat th e i nfo rmati on o n th is fo rm is tr ue a nd cor r ect to the bes t of my know le d ge a nd b el i ef an d that I a m au tho rized to sig n

this form.

Print Name:

Information about temporary events, including forms, instructions and Common Questions can be found on the Department of Revenue’s

website at revenue.wi.gov/html/temevent.html. If you have additional questions, please contact the Depar tment of Revenue by

email at DORBusinessTax@revenue.wi.gov

or tele p h o ne at (608) 26 6-2776. See rever s e si d e f o r sub m issio n in st ruc t i o ns.

PART C: Seller Information: To be completed by seller and given to event operator on or before the rst day of event .

SellingTaxableMerchandiseorService

THIS IS NOT AN A PPL ICATION FO R A WIS CONS IN TAX ACCOUNT – S EE IN ST R U C T ION S

Signature: Date:

-

-

-

-

-

X X

-

X XX

**

Do not email event reports to maintain condentiality of seller information

**

Instructions

TAB through to navigate. Use mouse to check

applicable boxes, press spacebar, or press Enter.

Save

Print

Clear

Instructions for Completing Operator and Seller Information

EVENT OPERATOR:

An “operator” is defined as a person or entity (such as an

individual, ass ociati on, par tners hip, cor porati on, or non -

profit organization) that arranges, organizes, promotes,

or spons ors an event. An op erator may also be referred

to as an organizer, exhibitor, or decorator. An operator

may or ma y not be the owner of the property or premises

where the event takes place. An operator may also be a

seller at the event.

Note: A Wisconsin tax account number (formerly

seller’s permit) is required i f selling taxable merchandise

or services. Admission fees are subject to sales tax in

Wisconsin.

Ste p 1: Co mp l ete Parts A and B.

Step 2: Provide a c opy of Wisconsin Temporar y Event

Operator and Seller Information (Form S-240) with Parts A

and B completed to each seller participating in your event.

To obtain additional copies of Form S-240 go to the

Department of Revenue’s website at revenue.wi.gov/

forms/sales/index.html. If you prefer, you may use the

f ill-in for m available fro m t h e s am e website.

Ste p 3: Submission–EventOperator.

Submit compiled vendor information to the department

as soon as possible but no later than 10 days from ev en t

clos ing us in g o ne of t he f o ll ow ing m eth ods:

• Electronic Reporting: If you have all the required

sellers’information, use the Excel spreadsheet

provided at revenue.wi.gov/html/temevent.html.(Excel

viewer is available.) Fill in the information for all

seller s participating at the event and submit using the

department’s secure le transmission application at

revenue.wi.gov/eserv/wteptran.htmlorbyU.S.Mail.Do

not email event reports to maintain condentiality

of seller inform ation.

• Paper Reporting:MailcompletedFormsS‑240ora

printed versi o n of spr eadsh e et to:

TemporaryEventsProgram

Wisconsin Department of Revenue

PO Box 8910

MadisonWI53708‑8910

SELLER:

A “seller” is defined as a person or entity involved with

selling merchandise or providing taxable services at a

temporary event. A seller may also be referred to as a

vendor, exhibitor, or b ooth owner.

Important: This form is not an application for a

Wisconsin Tax Account Number. If you do not already

have a tax account number but are required to, you

will need to apply for one directly with the Department

of Revenue prior to the event. You can apply online or

download an application, Application for Business Tax

Registration (Form BTR-101) on the department’s website,

revenue.wi.gov/forms/sales/index.html. Not all sellers

are required to obtain a W isconsin ta x acco unt number.

Some of the reasons a seller may not need a tax account

number are:

• The seller only sells tax-exempt items, such as

vegetables fo r ho m e consumptio n.

• The seller is only displaying at the event, no onsite

orders are being taken, and taxable merchandise is not

later shipped into Wisconsin.

• The seller qu alif ies for th e occ asion al sale exemptio n.

(See Publication 228, Tempor a ry Events.)

If you hav e questions regarding applying for a Wisconsin

tax account number , contact any Department of Re venue

off i ce, visit our website, or call (6 08) 266-2776.

Ste p 1: C omplete Par t C (event operator should c om-

plete Par ts A an d B).

Line1: Enteryourindividual,partnership,association,or

corporate name.

Line2: Enteryourbusinessname,ifdifferent.

Line3: Entertheaddressofthephysicallocationofyour

business. If different, also provide your mailing

address.

Line6: Enteryour15‑digitWisconsintaxaccountnumber.

You can find this number o n your Form ST-12 .

This number is not your 6-digit seller’s permit

number issued to you prior to December 31, 2002.

Lines7&8:Enterthelastfourdigitsofyoursocialsecurity

number and/or federal employer identification

number. This is required under sec. 73.03(38), Wis.

Stats., if you do not provide a tax account number .

Ste p 2: Submit compl eted form to event operator on o r

before the fir st day of the event.

Revenue Field Agents attend temporary events

to verify registration of sellers. Sellers must have

evidence of their Wisconsin tax account number

at the event.

Return to Page 1

Return to Page 1