Fillable Printable Form: Tsp-3, Designation Of Beneficiary (10/2005) - 4 Pages

Fillable Printable Form: Tsp-3, Designation Of Beneficiary (10/2005) - 4 Pages

Form: Tsp-3, Designation Of Beneficiary (10/2005) - 4 Pages

Form TSP-3 (10/2005)

EDITIONS PRIOR TO 8/02 OBSOLETE

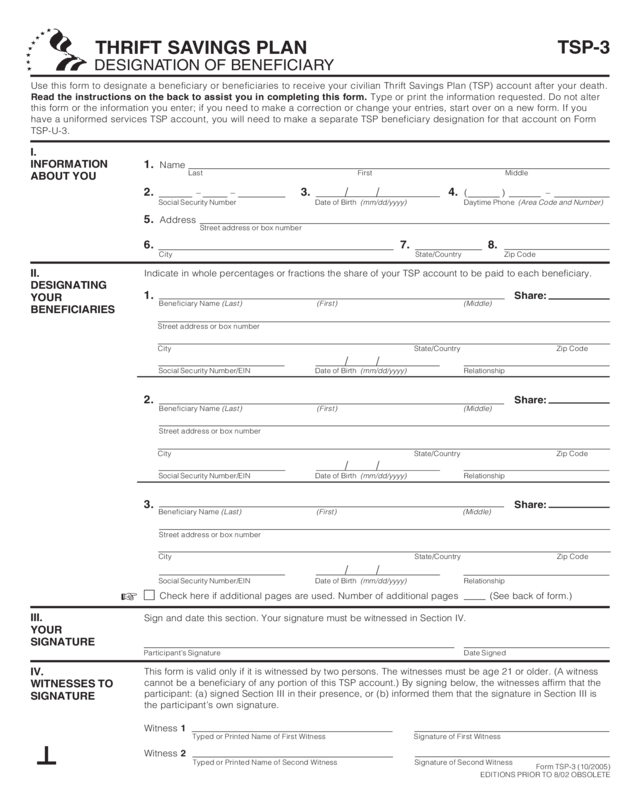

Use this form to designate a beneficiary or beneficiaries to receive your civilian Thrift Savings Plan (TSP) account after your death.

Read the instructions on the back to assist you in completing this form.

Type or print the information requested. Do not alter

this form or the information you enter; if you need to make a correction or change your entries, start over on a new form. If you

have a uniformed services TSP account, you will need to make a separate TSP beneficiary designation for that account on Form

TSP-U-3.

Last First Middle

Typed or Printed Name of Second Witness Signature of Second Witness

Street address or box number

Participant’s Signature Date Signed

Street address or box number

Street address or box number

Beneficiary Name

(Last) (First) (Middle)

Beneficiary Name

(Last) (First) (Middle)

☞

Typed or Printed Name of First Witness Signature of First Witness

1. Name

2. –– 3. // 4. () –

5. Address

6. 7. 8.

Indicate in whole percentages or fractions the share of your TSP account to be paid to each beneficiary.

1. Share:

//

2. Share:

//

3. Share:

//

Check here if additional pages are used. Number of additional pages (See back of form.)

Sign and date this section. Your signature must be witnessed in Section IV.

This form is valid only if it is witnessed by two persons. The witnesses must be age 21 or older. (A witness

cannot be a beneficiary of any portion of this TSP account.) By signing below, the witnesses affirm that the

participant: (a) signed Section III in their presence, or (b) informed them that the signature in Section III is

the participant’s own signature.

Witness 1

Witness 2

Beneficiary Name

(Last) (First) (Middle)

Street address or box number

City State/Country Zip Code

Social Security Number/EIN Date of Birth

(mm/dd/yyyy)

Relationship

Social Security Number/EIN Date of Birth

(mm/dd/yyyy)

Relationship

Social Security Number Date of Birth

(mm/dd/yyyy)

Daytime Phone

(Area Code and Number)

Social Security Number/EIN Date of Birth

(mm/dd/yyyy)

Relationship

II.

DESIGNATING

YOUR

BENEFICIARIES

III.

YOUR

SIGNATURE

IV.

WITNESSES TO

SIGNATURE

City State/Country Zip Code

City State/Country Zip Code

City State/Country Zip Code

I.

INFORMATION

ABOUT YOU

DESIGNATION OF BENEFICIARY

THRIFT SAVINGS PLAN

TSP-3

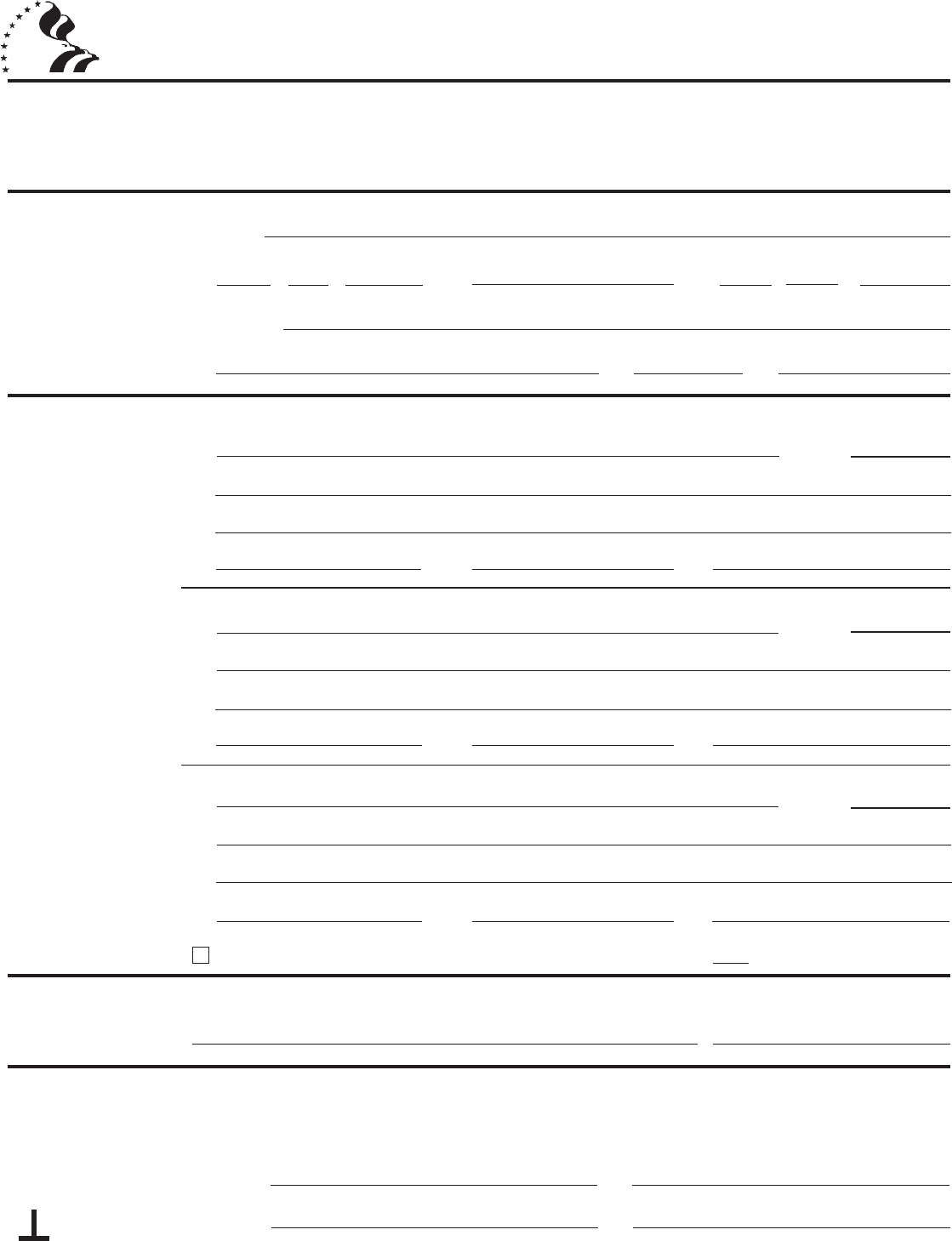

Form TSP-3 (10/2005)

EDITIONS PRIOR TO 8/02 OBSOLETE

INFORMATION AND INSTRUCTIONS

Make a copy of this form for your records. Mail the original to:

TSP Service Office

P.O. Box 385021

Birmingham, AL 35238

Or fax the completed form to our toll-free fax number:

1-866-817-5023

If you have questions, call the (toll-free) ThriftLine at

1-TSP-YOU-FRST (1-877-968-3778) or TDD: 1-TSP-THRIFT5

(1-877-847-4385). Outside the United States and Canada,

please call 404-233-4400 (not toll free).

Your quarterly participant statement will show the date of your

most recent designation.

Designating a beneficiary. This Designation of Beneficiary

form applies only to the disposition of your civilian Thrift

Savings Plan (TSP) account after your death. It does not affect

the disposition of your FERS Basic Annuity, your CSRS annuity,

your uniformed services TSP account (if you have one), or any

other benefits.

It is necessary to designate a beneficiary only if you want

payment to be made in a way other than the following order of

precedence:

1. To your widow or widower.

2. If none, to your child or children equally, and descendants

of deceased children by representation.

3. If none, to your parents equally or to the surviving parent.

4. If none, to the appointed executor or administrator of your

estate.

5. If none, to your next of kin who is entitled to your estate

under the laws of the state in which you resided at the time

of your death.

In this order of precedence, a child includes a natural child

(even if the child was born out of wedlock) and a child adopted

by the participant; it does not include a stepchild who was not

adopted. Note: If the participant’s natural child was adopted by

someone other than the participant’s spouse, that child is not

entitled to a share of the participant’s TSP account under the

statutory order of precedence. “By representation” means that

if a child of the participant dies before the participant dies, that

child’s share will be divided equally among his or her children.

Parent does not include a stepparent, unless the stepparent

adopted the participant.

Making a valid designation. To name beneficiaries to receive

your TSP account after you die, you must complete this form,

and it must be received by the TSP on or before the date of

your death. Only Form TSP-3 is valid for designating a benefi-

ciary to your civilian TSP account; a will is not valid for the

disposition of a TSP account. You may, however, designate

your estate or a trust as a beneficiary on Form TSP-3.

You are responsible for ensuring that your Form TSP-3 is prop-

erly completed, signed, and witnessed (see the Instructions for

Sections II and IV in the right-hand column). Do not submit an

altered form; if you need to correct or change the information

you have entered on the form, start over on a new form.

Changing or cancelling your designation of beneficiary. This

Designation of Beneficiary will stay in effect until you submit an-

other valid Form TSP-3 naming other beneficiaries or cancelling

prior designations. To cancel a Form TSP-3 already on file,

write “Cancel prior designations” in Section II of a new Form

TSP-3, sign and date the form, and have it witnessed.

Keep your designation (and your beneficiaries’ addresses)

current. If your family status changes due to marriage, birth or

adoption of a child, divorce, or death, you may want to change

your designation.

If your beneficiaries predecease you. The share of any

beneficiary who dies before you die will be distributed propor-

tionally

among the surviving designated TSP beneficiaries

unless a designated contingent beneficiary is alive at your

death. If none of your designated beneficiaries is alive at the

time of your death, the standard order of precedence will be

followed.

INSTRUCTIONS FOR SECTION II. You may name as a benefi-

ciary any person, corporation, trust, or legal entity, or your

estate. Note: If the beneficiary is a minor child, benefits will be

made payable directly to the child.

If you need more space, use a blank sheet of paper. Enter your

name, Social Security number, and date of birth, and number

the pages. You must sign and date all additional pages; the

same two witnesses who signed the form must sign each

additional page.

Enter the share for each beneficiary as a whole percentage or a

fraction. Percentages must total 100 percent; fractions must

total 1.

The examples show you how to name a beneficiary or cancel

prior Designations of Beneficiary.

• For each person you designate as a beneficiary, enter the

full name, share, address, Social Security number (SSN),

date of birth, and relationship to you. If you do not have all

the requested information, you must provide at least the

beneficiary’s name, the beneficiary’s share, and either the

SSN or date of birth.

• You may designate one or more contingent beneficiaries

for each primary beneficiary you name on Form TSP-3.

The contingent beneficiary will receive the primary benefi-

ciary’s share if the primary beneficiary dies before you do.

(You cannot designate contingent beneficiaries for contin-

gent beneficiaries.)

• If the beneficiary is a corporation or other legal entity,

enter the name of the entity on the name line. Enter the

legal representative’s name and address on the address

lines. Enter the Employer Identification Number (EIN).

Leave the date of birth and relationship blank.

• If the beneficiary is a trust, enter the name of the trust on

the name line. Enter the trustee’s name and address on

the address lines. Enter the EIN, if available. Leave date

of birth blank. Enter “Trust” on the relationship line.

Note: Filling out this form will not create a trust.

• If the beneficiary is an estate, enter the name of the estate

on the name line. Enter the executor’s name and address

on the address lines. Enter the EIN, if available. Leave

date of birth blank. Enter “Estate” on the relationship line.

• You may cancel a designation of beneficiary by printing

“Cancel prior designation” on the name line. Note: If you

do not submit another Form TSP-3, your account will be

paid according to the order of precedence.

INSTRUCTIONS FOR SECTION IV.

Do not ask the individuals

you name as beneficiaries of your TSP account to witness your

Form TSP-3. A person named as a beneficiary of this TSP

account who is also a witness cannot receive his or her share of

this TSP account.

Form TSP-3 (10/2005)

EDITIONS PRIOR TO 8/02 OBSOLETE

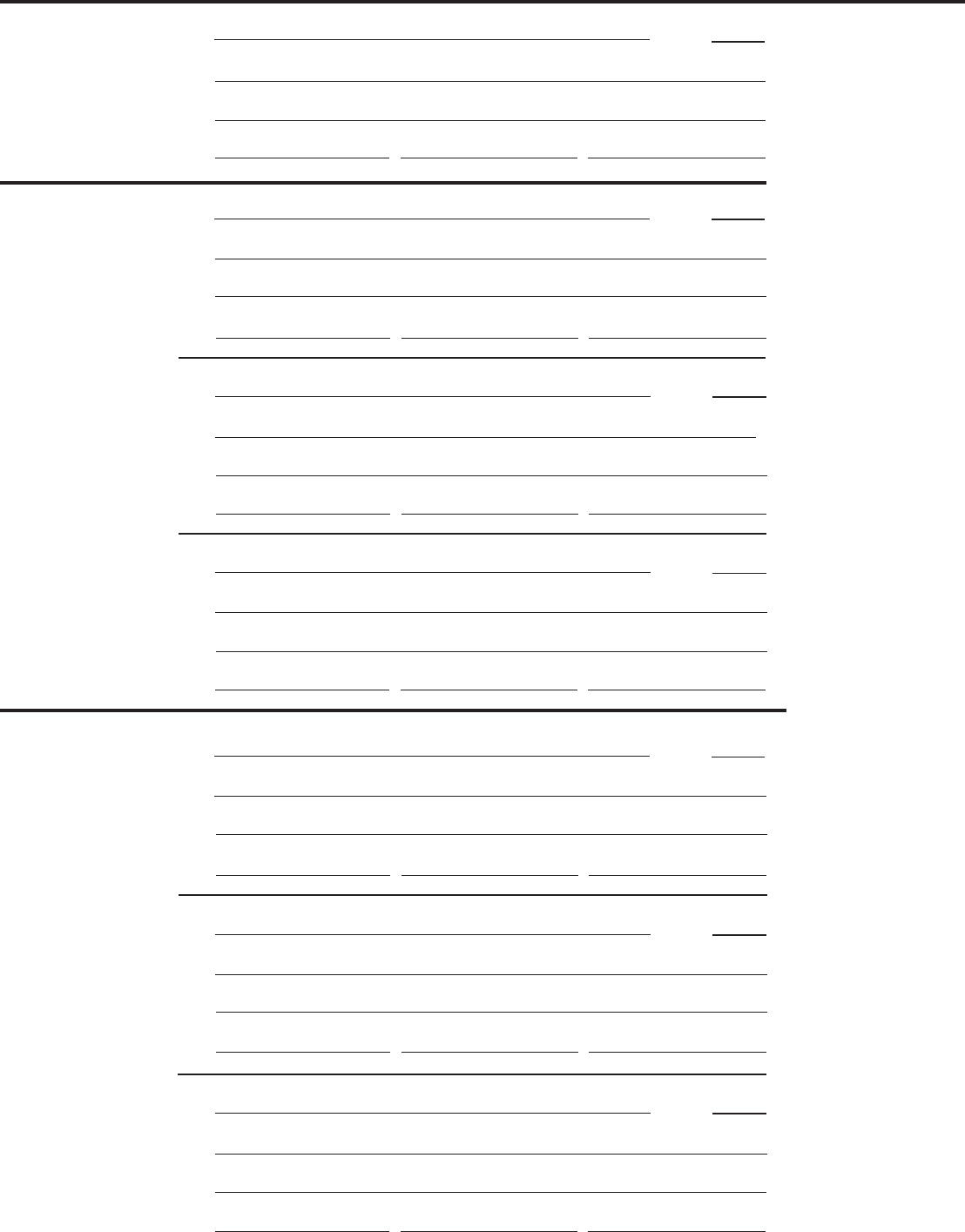

EXAMPLES OF DESIGNATING A BENEFICIARY

1. Morgan Katherine Anne Share: 100%

1279 Lake Avenue

New Orleans LA 70124

923-45-6789 6 22 1942 Sis

ter

Name

(Last) (First) (Middle)

Street address or box number

1. Larson Susan Maria Share: ¼

4231 Oregano Street

Cincinnati OH 45239

934-56-7890 9 7 1950 Sister

Name

(Last) (First) (Middle)

Street address or box number

2. Larson Elliott Harris Share: ¼

4231 Oregano Street

Cincinnati OH 45239

945-67-8901 4 20 1952 Brother

Name

(Last) (First) (Middle)

Street address or box number

Name

(Last) (First) (Middle)

Street address or box number

1. Kraus Michael Thomas Share: 100%

6287 Laurel Post Drive

Stone Mountain GA 30058

967-89-0123 3 12 1936 Father

Name

(Last) (First) (Middle)

Street address or box number

2. Kraus Cecilia Jean Share: 50%

6287 Laurel Post Drive

Stone Mountain GA 30058

978-90-1234 8 16 1968 Daughter

Name

(Last) (First) (Middle)

Street address or box number

Otherwise to:

3. Richardson Melissa Anne Share: 50%

9842 Magnolia Drive

Columbus GA 30161

989-01-2345 11 6 1970 Daughter

Name

(Last) (First) (Middle)

Street address or box number

Be sure that the shares to

be paid to the beneficiaries

total 100 percent if using

percentages, or 1 if using

fractions.

Enter the full name of the

beneficiary. Do not write

name as K.A. Morgan or as

Mrs. Keith H. Morgan.

If you use additional

pages, be sure to put your

name, Social Security

number, and date of birth

on each page. You and the

same two witnesses who

signed the form must sign

each additional page. Put

the date you signed the

form on each additional

page.

You may designate one or

more contingent beneficia-

ries to receive a beneficia-

ry’s share if the primary

beneficiary dies before you

do. To identify the primary

and contingent beneficia-

ries, you must write in ‘‘If

living:’’ above the primary

beneficiary’s name and

‘‘Otherwise to:’’ above the

contingent beneficiary’s

name. If there is more than

one contingent beneficiary

for a primary beneficiary,

write in ‘‘And to:’’ above the

second (and subsequent)

beneficiary’s name.

In this example, Melissa

Richardson and Cecilia

Kraus are both contingent

beneficiaries for Michael

Kraus.

Note: If a named benefi-

ciary dies, you may prefer

to submit another Form

TSP-3 to change your

designation(s).

Detach here

And to:

If living:

3. Steinway Sarah Ruth Share: ½

P.O. Box 812

Covington KY 40117

956-78-9012 12 2 1960 Friend

B.

DESIGNATING

MORE THAN ONE

BENEFICIARY

C.

DESIGNATING

ONE OR MORE

CONTINGENT

BENEFICIARIES

A.

DESIGNATING

ONE

BENEFICIARY

City State/Country Zip Code

City State/Country Zip Code

City State/Country Zip Code

City State/Country Zip Code

City State/Country Zip Code

City State/Country Zip Code

City State/Country Zip Code

//

Social Security Number/EIN Date of Birth

(mm/dd/yyyy)

Relationship

//

Social Security Number/EIN Date of Birth

(mm/dd/yyyy)

Relationship

//

Social Security Number/EIN Date of Birth

(mm/dd/yyyy)

Relationship

//

Social Security Number/EIN Date of Birth

(mm/dd/yyyy)

Relationship

//

Social Security Number/EIN Date of Birth

(mm/dd/yyyy)

Relationship

//

Social Security Number/EIN Date of Birth

(mm/dd/yyyy)

Relationship

//

Social Security Number/EIN Date of Birth

(mm/dd/yyyy)

Relationship

Form TSP-3 (10/2005)

EDITIONS PRIOR TO 8/02 OBSOLETE

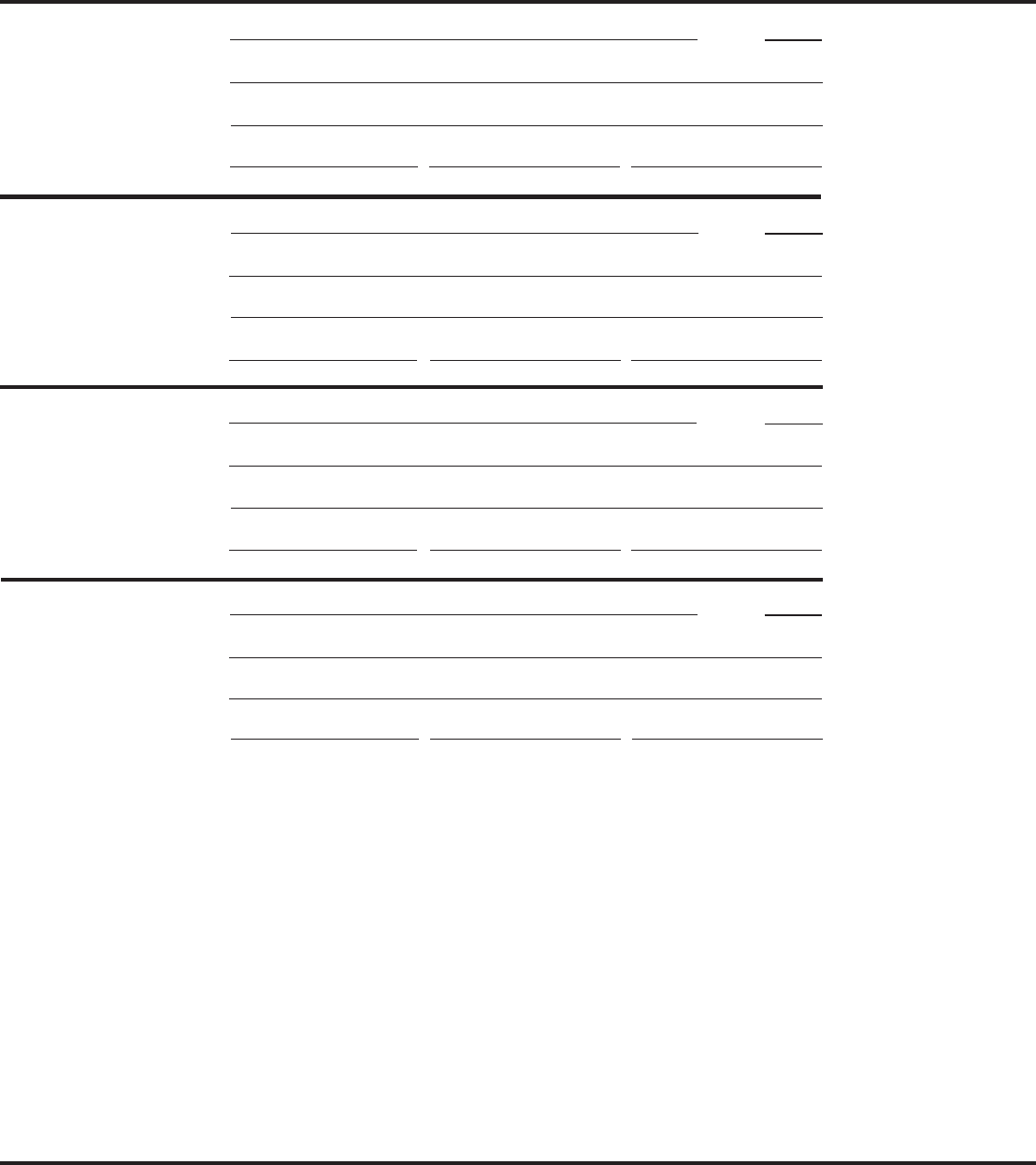

EXAMPLES OF DESIGNATING A BENEFICIARY (continued)

1. John P. Manos Trust Share: 100%

c/o Eric P. Manos, Trustee 1111 Delaware Lane

New York NY 14607

92-3456789 Trust

Name [Name of trust]

Street address or box number [Name of Trustee and Trustee’s address]

Social Security Number/EIN Date of Birth

(mm/dd/yyyy)

Relationship

1. Estate of Ruth R. Jones Share: 100%

c/o Marilyn D. McClain, Executor 150 Rossmoyne Drive

Alameda CA 94510

Estate

Name [Name of estate]

Street address or box number [Name of Executor and Executor’s address]

Social Security Number/EIN Date of Birth

(mm/dd/yyyy)

Relationship

1. The XYZ Foundation Share: 100%

c/o Eleanor Jarvis, Legal Representative 64730 Connecticut Ave.

Bethesda MD 20815

99-0123456

Name [Name of corporation or legal entity]

Street address or box number [Name of Legal Representative and Legal Representative’s address]

Social Security Number/EIN Date of Birth

(mm/dd/yyyy)

Relationship

1. Cancel prior designations Share:

Name

(Last) (First) (Middle)

Street address or box number

City State/Country Zip Code

This will cause your

account to be paid

according to the order

of precedence (unless

you submit another

Form TSP-3).

93-1234567

[Leave blank] [Leave blank]

[Leave blank]

[Leave blank]

Social Security Number/EIN Date of Birth

(mm/dd/yyyy)

Relationship

Be sure your form

cancelling prior designa-

tions is signed, dated, and

witnessed.

//

D.

DESIGNATING A

CORPORATION

OR LEGAL

ENTITY

E.

DESIGNATING

A TRUST

F.

DESIGNATING

AN ESTATE

G.

CANCELLING A

DESIGNATION OF

BENEFICIARY

PRIVACY ACT NOTICE. We are authorized to request this information under 5

U.S.C. chapter 84. Executive Order 9397 authorizes us to ask for your Social Security

number, which will be used to identify your account. We will use the information you

provide on this form to document your choice of beneficiary or beneficiaries to receive

your account after your death. This information may be shared with other Federal

agencies for statistical, auditing, or archiving purposes. In addition, we may share the

information with law enforcement agencies investigating a violation of civil or criminal

law, or agencies implementing a statute, rule, or order. It may be shared with congres-

sional offices, private sector audit firms, spouses, former spouses, and beneficiaries,

and their attorneys. We may also disclose relevant portions of the information to ap-

propriate parties engaged in litigation. You are not required by law to provide this

information, but if you do not provide it, we will not be able to document your choice of

beneficiary(ies).

City State/Country Zip Code

City State/Country Zip Code

City State/Country Zip Code