Fillable Printable Form Wt-4A - Wisconsin Department Of Revenue

Fillable Printable Form Wt-4A - Wisconsin Department Of Revenue

Form Wt-4A - Wisconsin Department Of Revenue

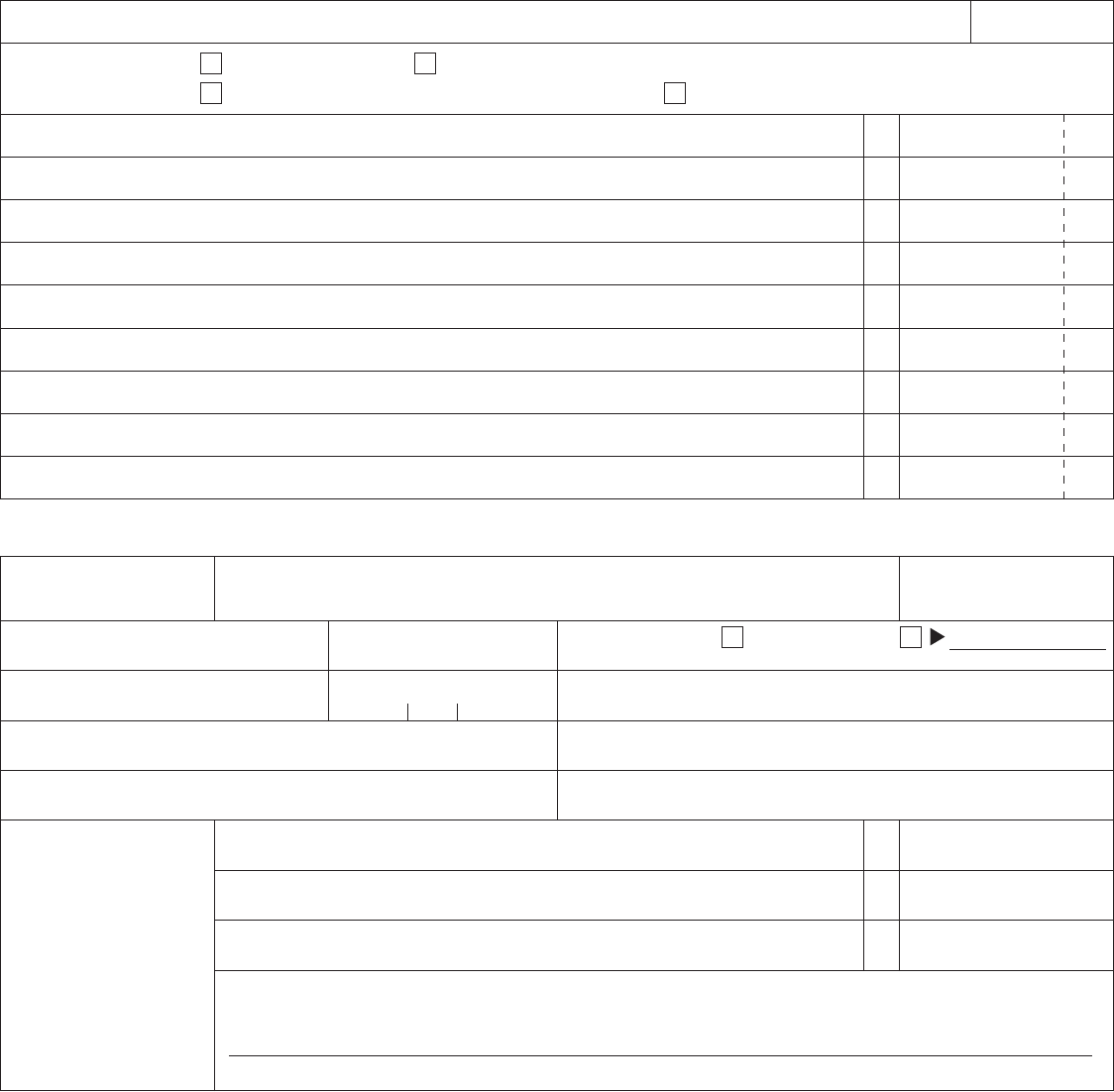

I declare that to the best of my knowledge and belief the information contained in this agreement is true, correct and complete.

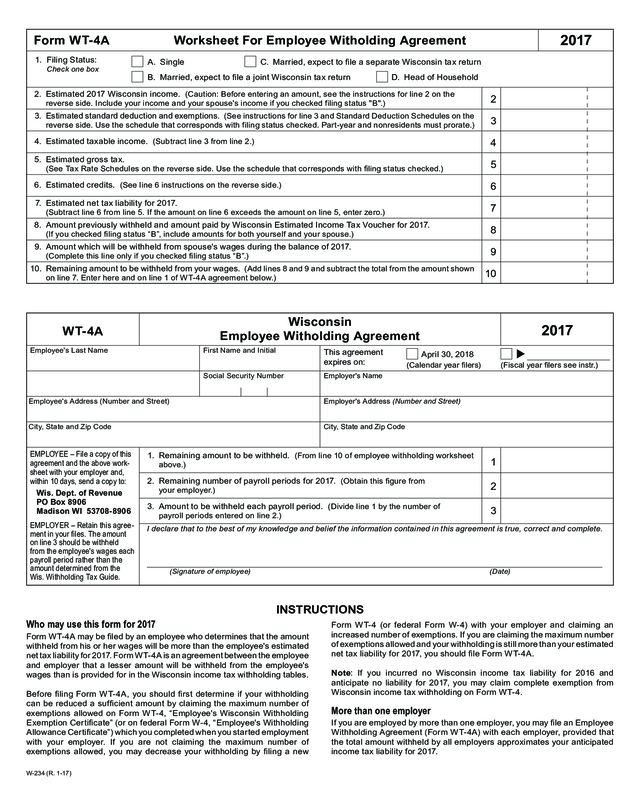

5. Estimated gross tax.

(See Tax Rate Schedules on the reverse side. Use the schedule that corresponds with ling status checked.)

3. Estimated standard deduction and exemptions.

(See instructions for line 3 and Standard Deduction Schedules on the

reverse side. Use the schedule that corresponds with filing status checked. Part-year and nonresidents must prorate.)

2017

2. Estimated 2017 Wisconsin income. (Caution: Before entering an amount, see the instructions for line 2 on the

reverse side. Include your income and your spouse's income if you checked filing status "B".)

4. Estimated taxable income. (Subtract line 3 from line 2.)

A. Single

Worksheet For Employee Witholding AgreementForm WT- 4A

1. Filing Status:

Check one box

INSTRUCTIONS

Who may use this form for 2017

Form WT-4A may be led by an employee who determines that the amount

withheld from his or her wages will be more than the employee's estimated

ne t t a x li a b i l i t y fo r 2 017. Fo r m W T- 4 A is an a g r e e m e n t b e t we e n t h e e m p l oye e

and employer that a lesser amount will be withheld from the employee's

wages than is provided for in the Wisconsin income tax withholding tables.

Before ling Form WT-4A, you should rst determine if your withholding

can be reduced a sufcient amount by claiming the maximum number of

exemptions allowed on Form WT-4, “Employee's Wisconsin Withholding

Exemption Certicate” (or on federal Form W-4, “Employee's Withholding

Allowance Certicate”) which you completed when you started employment

with your employer. If you are not claiming the maximum number of

exemptions allowed, you may decrease your withholding by ling a new

Form WT-4 (or federal Form W-4) with your employer and claiming an

increased number of exemptions. If you are claiming the maximum number

of exemptions allowed and your withholding is still more than your estimated

net tax liability for 2017, you should le Form WT-4A.

Note: If you incurred no Wisconsin income tax liability for 2016 and

anticipate no liability for 2017, you may claim complete exemption from

Wisconsin income tax withholding on Form WT-4.

More than one employer

If you are employed by more than one employer, you may le an Employee

Withholding Agreement (Form WT-4A) with each employer, provided that

the total amount withheld by all employers approximates your anticipated

income tax liability for 2017.

W-234 (R. 1-17)

2

3

4

5

6

7

8

9

10

B. Married, expect to le a joint Wisconsin tax return

April 30, 2018

(Calendar year lers) (Fiscal year lers see instr.)

Employee's Address (Number and Street)

City, State and Zip Code

(Signature of employee) (Date)

1. Remaining amount to be withheld. (From line 10 of employee withholding worksheet

above.)

This agreement

expires on:

3. Amount to be withheld each payroll period. (Divide line 1 by the number of

payroll periods entered on line 2.)

2. Remaining number of payroll periods for 2017. (Obtain this gure from

your employer.)

First Name and Initial

Social Security Number Employer's Name

Employer's Address (Number and Street)

City, State and Zip Code

Employee's Last Name

EMPLOYER – Retain this agree-

ment in your les. The amount

on line 3 should be withheld

from the employee's wages each

payroll period rather than the

amount determined from the

Wis. Withholding Tax Guide.

EMPLOYEE – File a copy of this

agreement and the above work-

sheet with your employer and,

within 10 days, send a copy to:

Wis. Dept. of Revenue

PO Box 8906

Madison WI 53708-8906

D. Head of Household

C. Married, expect to le a separate Wisconsin tax return

6. Estimated credits. (See line 6 instructions on the reverse side.)

7. Estimated net tax liability for 2017.

(Subtract line 6 from line 5. If the amount on line 6 exceeds the amount on line 5, enter zero.)

8. Amount previously withheld and amount paid by Wisconsin Estimated Income Tax Voucher for 2017.

(If you checked ling status “B”, include amounts for both yourself and your spouse.)

9. Amount which will be withheld from spouse's wages during the balance of 2017.

(Complete this line only if you checked ling status “B”.)

10. Remaining amount to be withheld from your wages. (Add lines 8 and 9 and subtract the total from the amount shown

on line 7. Enter here and on line 1 of WT-4A agreement below.)

2017

Wisconsin

Employee Witholding Agreement

WT- 4A

1

2

3

How to file

Complete both the WT-4A worksheet and the withholding agreement.

Provide one copy of the worksheet and the withholding agreement to your

employer. Mail another copy to the Department of Revenue within 10 days

after the WT-4A is filed with your employer.

If you do not send a copy of Form WT-4A (including the worksheet) to the

department within 10 days, t h e law p r ovides for a $10 penalty to b e imposed

against you.

Expiration date of Form WT-4A

Form WT-4A will expire on April 30, 2018 for 2017 calendar year filers.

Calen dar year filers should place an “X” in the April 30, 2018 box on

Form WT-4A. For fiscal year filers, the agreement will expire on the last

day of the fourth month following the close of their fiscal year. Fiscal year

filers should enter the appropriate expiration date in the space provided on

Form WT-4A and place an “X” in the box.

How to amend your agreement

If you have already filed Form WT-4A and you have a substantial increase

or decrease in your 2017 estimated tax liability, you should fill out a new

Form WT-4A. Write the word “AMENDED” at the top of the new form. File one

copy of the amended Form WT-4A with your employer and mail one copy to

the Department of Revenue within 10 days after it is filed with your employer.

Revocation and penalties

If the department determines that the amount to be withheld per the

Employee Withholding Agreement, Form WT-4A, is insufficient, the depart-

ment m ay vo i d the agreem e nt by notif ic a t ion t o th e empl oyer an d empl oyee.

If an employee enters into an agreement with the intent to defeat or evade

the proper withholding of tax, the employee will be subject to a penalty

equal to the difference between the amount required to be withheld and the

amount act ually w i t h h e ld fo r t he p e r iod t h a t the a g r e e m e n t w a s in ef fect . A ny

e m p l oy e e w h o w i l l f u l l y s u p p l i e s a n e m p l o y e r w i t h f a l s e o r f r au du l e nt i n f o r m a -

tion regard ing an Employee Withholding Agreement with the intent to defeat

or evade the proper withholding of tax may be imprisoned not more than

6 months, or fined not more than $500 plus the cost of prosecution, or both.

Completing the worksheet for the Employee Withholding Agreement

Line 2. Refer to the Wisconsin income reported on line 13 of Form 1, line 12

of Form 1A, line 1 of Form WI-Z or line 32 of Form 1NPR of your Wisconsin

income tax return. Your 2017 Wisconsin estimated income should be

computed in the same manner as you computed your 2016 Wisconsin

income, taking into account any changes you expect to occur in 2017.

Line 3. Your exemptions are $700 for yourself, $700 for your spouse if

filing a joint return, and $700 for each dependent. Add $250 to the total if

you are 65 years of age or over and, add $250 if your spouse is 65 years

of age or over. (Exception: If you are claimed as a dependent on someone

else's return, you do not qualify for an exemption.) Nonresidents and

part-year residents prorate the standard deduction as follows: (1) Figure

your standard deduction using your federal adjusted gross income instead

of your Wisconsin income, and (2) prorate using the ratio of Wisconsin

i n c o m e t o f e d e r a l a d j u s t e d g r o s s i n c o m e . E xe m p t i o n s m u s t a l s o b e p r o r a t e d

using the same ratio.

Line 6. Refer to a 2016 Wisconsin Form 1, Form 1A, Form WI-Z, or

Form 1NPR.

Where to get forms and assistance

You may obtain additional forms and assistance in preparing Form WT-4A

at the following Department of Revenue offices:

Appleton – 265 W Northland Avenue

• (920) 832-2727

Eau Claire – State Office Bldg, 718 W Clairemont Ave

• (715) 836-2811

Madison – 2135 Rimrock Road

• (608) 266-2486

Milwaukee – State Office Bldg, 819 N 6th St, Rm 408

• (414) 227-4000

Other offices open on a limited schedule are Green Bay and Wausau.

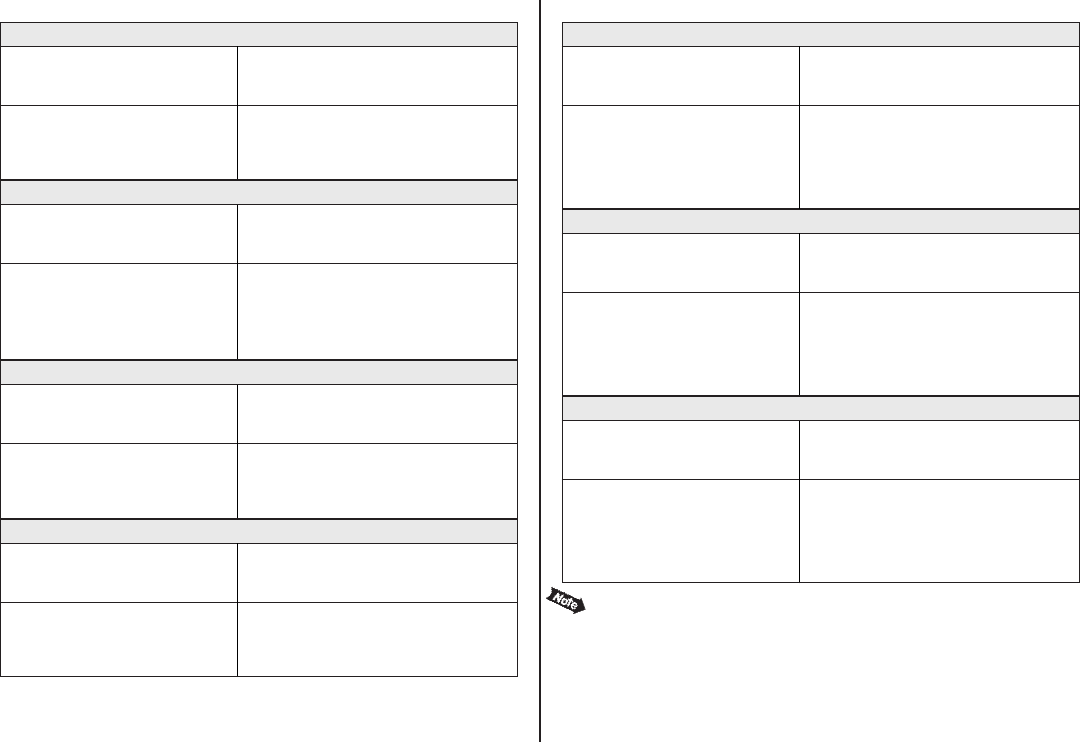

*Nonresidents and part-year residents must prorate the tax brackets

(amounts appearing in the rst two columns of the 2017 Tax Rate Schedules)

based on the ratio of their Wisconsin income to their federal adjusted gross

income. For example, for a single individual the tax brackets are $11,230,

$11,240, and $224,880. Assuming the individual has a ratio of 20%, the rst

$2,246 ($11,230 x .20) is taxed at 4%, the next $2,248 ($11,240 x .20) is taxed

at 5.84%, and the next $44,976 ($224,880 x .20) is taxed at 6.27%. Taxable

income over $49,470 is taxed at 7.65%.

2017 Tax Rate Schedules for Full-Year Residents*2017 Standard Deduction

$ 0 830 $ 14,959 $ 10,380

14,959 101,460 10,380 less 12% ....... $ 14,960

101,460 or over 0

Schedule for Single Taxpayers

but of the

over – not over – amount over –

If Wisconsin income is: The 2017 Standard

Deduction is:

Schedule for Head of Household

$ 50 30 $ 14,959 $ 13,400

14,959 43,681 13,400 less 22.515% $ 14,960

43,681 101,460 10,380 less 12% .......... 14,960

101,460 or over 0

but of the

over – not over – amount over –

If Wisconsin income is: The 2017 Standard

Deduction is:

Schedule for Married Filing Jointly

but of the

over – not over – amount over –

If Wisconsin income is: The 2017 Standard

Deduction is:

$ 50 30 $ 21,589 $ 19,210

21,589 118,718 19,210 less 19.778% $ 21,590

118,718 or over 0

Schedule for Married Filing Separately

but of the

over – not over – amount over –

If Wisconsin income is: The 2017 Standard

Deduction is:

$50 830 $ 10,249 $ 9,130

10,249 56,412 9,130 less 19.778% $ 10,250

56,412 or over 0

Schedule A

– Single, Head of Household, Estates and Trusts

but of the

over – not over – amount over –

If taxable income is: The 2017

Gross Tax is:

$ 0 30 $ 11,230 $ 4.00% ...... $ 0

11,230 22,470 449.20 + 5.84% ............11,230

22,470 247,350 1,105.62 + 6.27% ........... 22,470

247,350 or over 15,205.59 + 7.65% ......... 247,350

Schedule B

– Married Filing Jointly

$ 50 830 $ 14,980 $ 4.00%........$ 0

14,980 29,960 599.20 + 5.84%.............14,980

29,960 329,810 1,474.03 + 6.27%.............29,960

329,810 or over 20,274.63 + 7.65%...........329,810

but of the

over – not over – amount over –

If taxable income is: The 2017

Gross Tax is:

Schedule C

– Married Filing Separately

$ 50 830 $ 7,490 $ 4.00%........$ 0

7,490 14,980 299.60 + 5.84%...............7,490

14,980 164,900 737.02 + 6.27%.............14,980

164,900 or over 10,137.00 + 7.65%...........164,900

but of the

over – not over – amount over –

If taxable income is: The 2017

Gross Tax is: