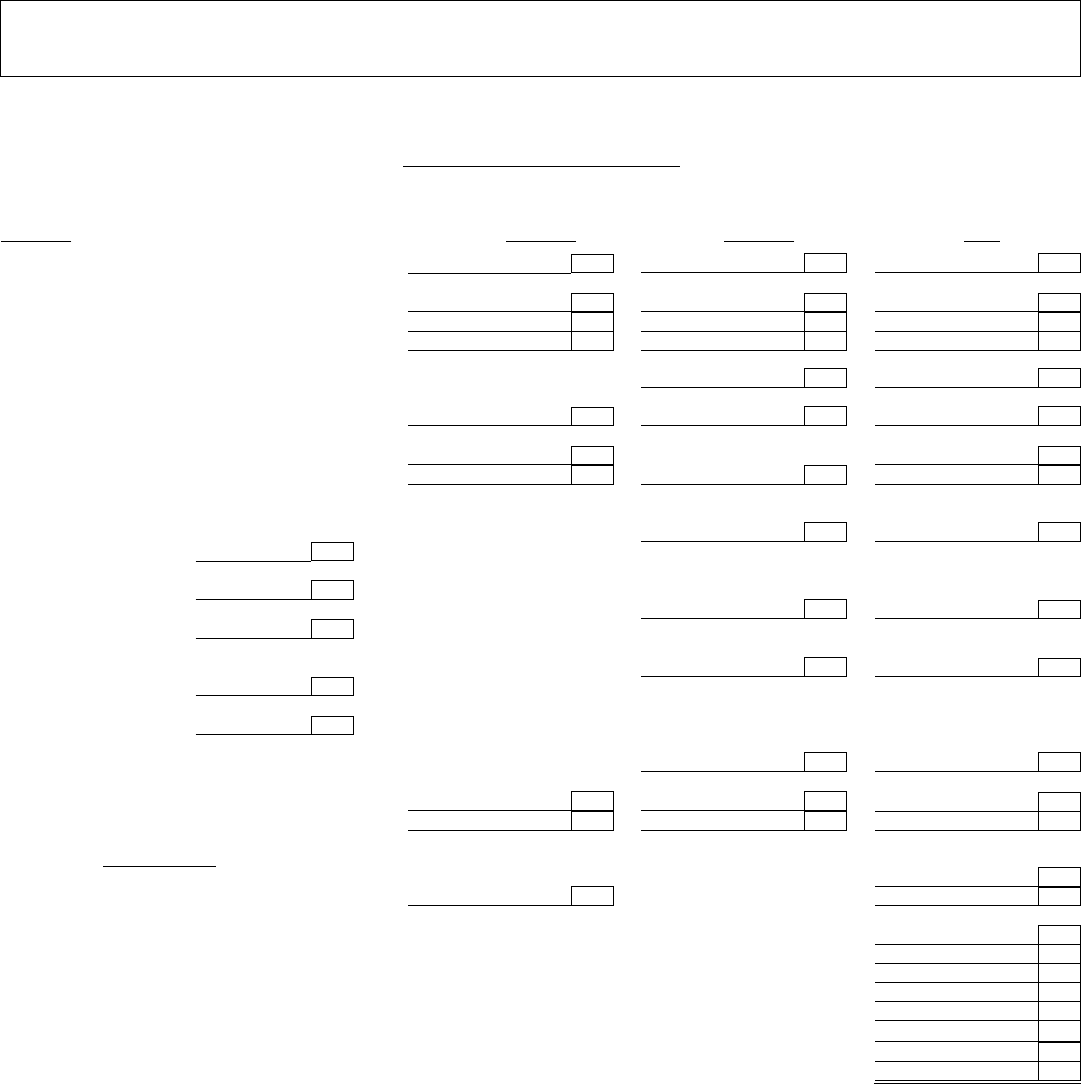

Fillable Printable Form X-17A-5 Part Iia

Fillable Printable Form X-17A-5 Part Iia

Form X-17A-5 Part Iia

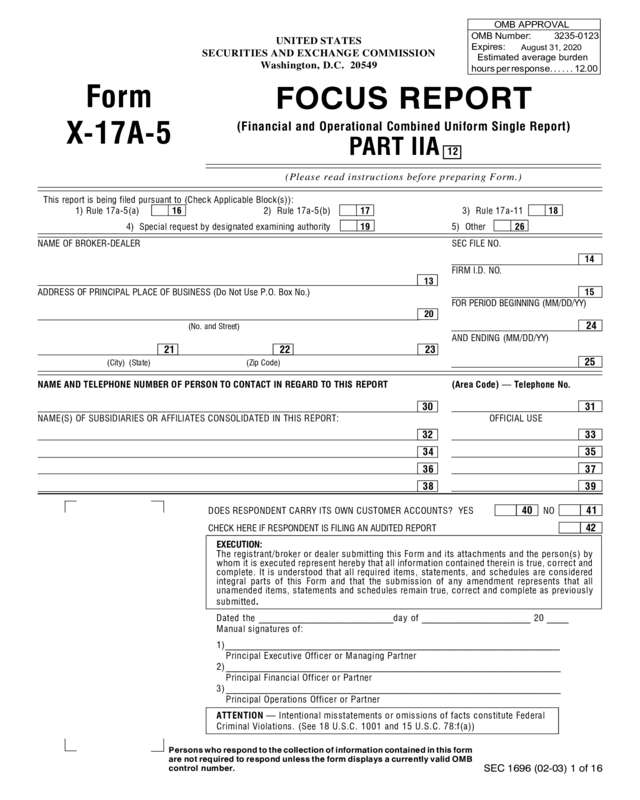

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

OMB APPROVAL

OMB Number:

Expires:

August 31, 2020

Estimated average burden

hours per response. . . . . . 12.00

3235-0123

Form

X-17A-5

FOCUS REPORT

(Financial and Operational Combined Uniform Single Report)

PART IIA 12

(Please read instructions before preparing Form.)

This report is being filed pursuant to (Check Applicable Block(s)):

1) Rule 17a-5(a) 16 2) Rule 17a-5(b) 17 3) Rule 17a-11 18

4) Special request by designated examining authority 19 5) Other 26

NAME OF BROKER-DEALER SEC FILE NO.

14

FIRM I.D. NO.

13

ADDRESS OF PRINCIPAL PLACE OF BUSINESS (Do Not Use P.O. Box No.) 15

FOR PERIOD BEGINNING (MM/DD/YY)

20

(No. and Street) 24

AND ENDING (MM/DD/YY)

21 22 23

(City) (State) (Zip Code) 25

NAME AND TELEPHONE NUMBER OF PERSON TO CONTACT IN REGARD TO THIS REPORT (Area Code) — Telephone No.

30 31

NAME(S) OF SUBSIDIARIES OR AFFILIATES CONSOLIDATED IN THIS REPORT: OFFICIAL USE

32 33

34 35

36 37

38 39

DOES RESPONDENT CARRY ITS OWN CUSTOMER ACCOUNTS? YES 40

NO

41

CHECK HERE IF RESPONDENT IS FILING AN AUDITED REPORT 42

EXECUTION:

The registrant/broker or dealer submitting this Form and its attachments and the person(s) by

whom it is executed represent hereby that all information contained therein is true, correct and

complete. It is understood that all required items, statements, and schedules are considered

integral parts of this Form and that the submission of any amendment represents that all

unamended items, statements and schedules remain true, correct and complete as previously

submitted

.

Dated the _______________________________day of _________________________ 20

Manual signatures of:

1)_________________________________________________________________________

Principal Executive Officer or Managing Partner

2) _________________________________________________________________________

Principal Financial Officer or Partner

3) _________________________________________________________________________

Principal Operations Officer or Partner

ATTENTION — Intentional misstatements or omissions of facts constitute Federal

Criminal Violations. (See 18 U.S.C. 1001 and 15 U.S.C. 78:f(a))

_____

___

___

___

Persons who respond to the collection of information contained in this form

are not required to respond unless the form displays a currently valid OMB

control number.

SEC 1696 (02-03) 1 of 16

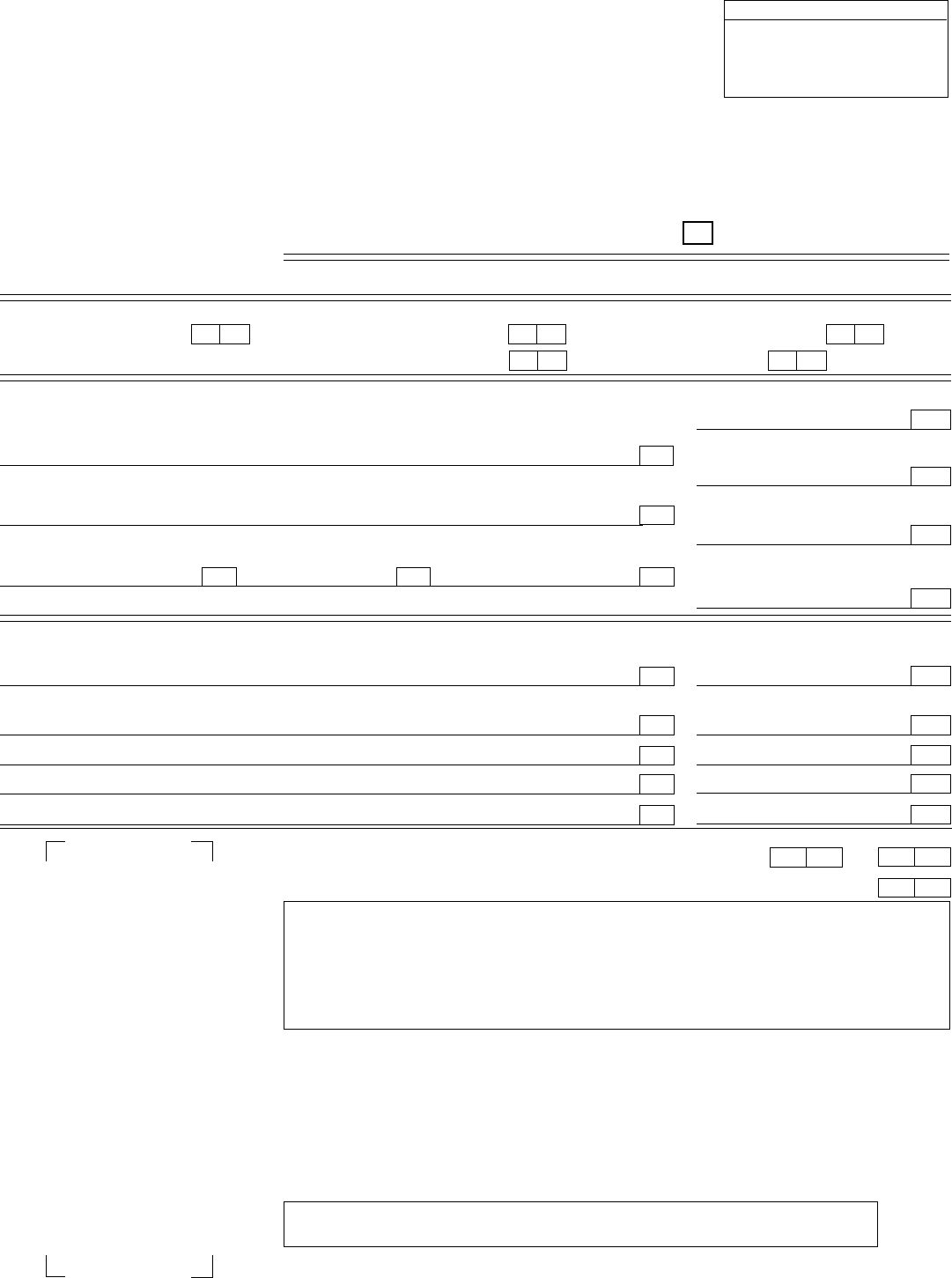

TO BE COMPLETED WITH THE ANNUAL AUDIT REPORT ONLY:

INDEPENDENT PUBLIC ACCOUNTANT whose opinion is contained in this Report

NAME (If individual, state last, first, middle name)

70

ADDRESS

71 72 73 74

Number and Street City State Zip Code

CHECK ONE

Certified Public Accountant FOR SEC USE

Public Accountant

Accountant not resident in United States

or any of its possessions

75

76

77

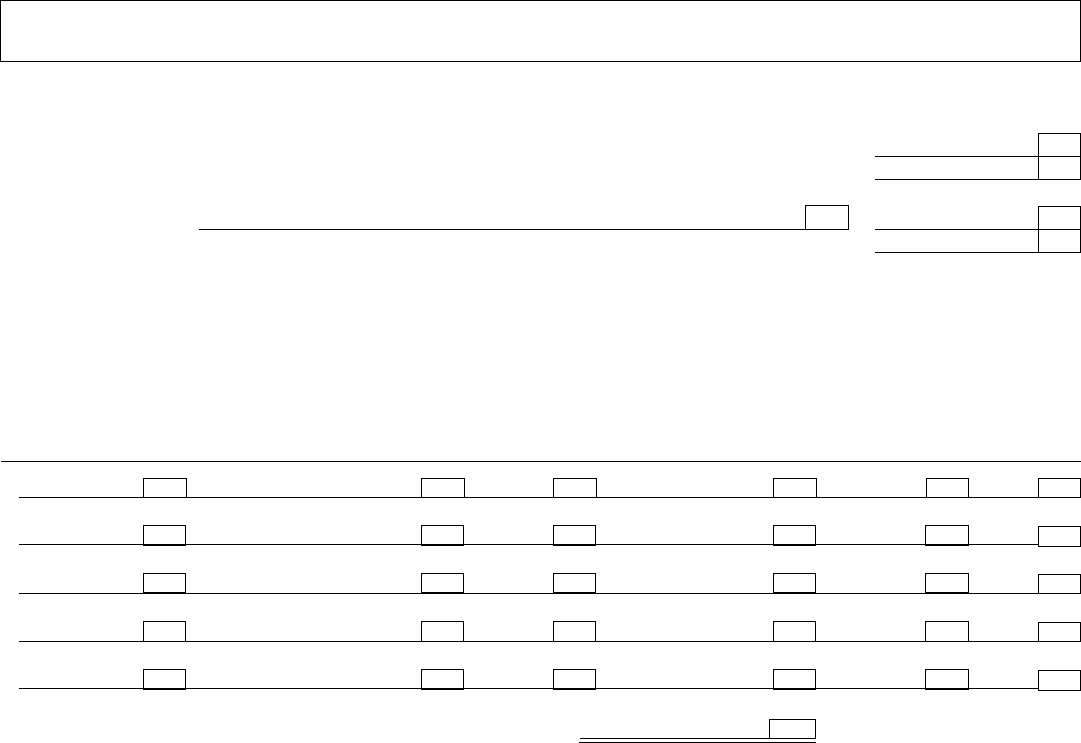

DO NOT WRITE UNDER THIS LINE . . . FOR SEC USE ONLY

WORK LOCATION REPORT DATE DOC. SEQ. NO. CARD

MM/DD/YY

50 51 52 53

SEC 1696 (02-03) 2 of 16

FINANCIAL AND OPERATIONAL COMBINED UNIFORM SINGLE REPORT

PART IIA

BROKER OR DEALER 100

N 3

W

1

STATEMENT OF FINANCIAL CONDITION FOR NONCARRYING, NONCLEARING AND

CERTAIN OTHER BROKERS OR DEALERS

as of (MM/DD/YY)

SEC FILE NO.

99

98

198

199

Consolidated

Unconsolidated

Allowable Non-Allowable Total

200 7501. Cash .............................................................................. $

2. Receivables from brokers or dealers:

$

295

300

355

418

419

420

424

430

W

3

W

4

A. Clearance account ..............................................

B. Other ..................................................................

3. Receivable from non-customers ................................

4. Securities and spot commodities

owned at market value:

A. Exempted securities ...........................................

B. Debt securities ...................................................

C. Options ...............................................................

D. Other securities ..................................................

E. Spot commodities ..............................................

550

600

810

830

$

W

7

850

5. Securities and/or other investments

not readily marketable:

130A. At cost $

W

2

B. At estimated fair value ........................................ 440

6. Securities borrowed under subordination

agreements and partners’ individual and capital

securities accounts, at market value:

A. Exempted

securities $

B. Other

securities $

7. Secured demand notes: ............................................

Market value of collateral:

460

150

160

470

A. Exempted

securities $

B. Other

securities $

8. Memberships in exchanges:

A. Owned, at

market $

170

180

190

B. Owned, at cost ...................................................

C. Contributed for use of the company, at

860

880

610

630

640 890

650

660 900market value ............................................................

W

6

9. Investment in and receivables from affiliates,

subsidiaries and associated partnerships .......................

10. Property, furniture, equipment, leasehold

improvements and rights under lease agreements,

at cost-net of accumulated depreciation and

480 670 910

680

735

740

920

930

940

490

535

540

amortization ...................................................................

11. Other assets ...................................................................

12.

W

TOTAL ASSETS ....................................................... $

5

W

8

$$

OMIT PENNIES

SEC 1696 (02-03) 3 of 16

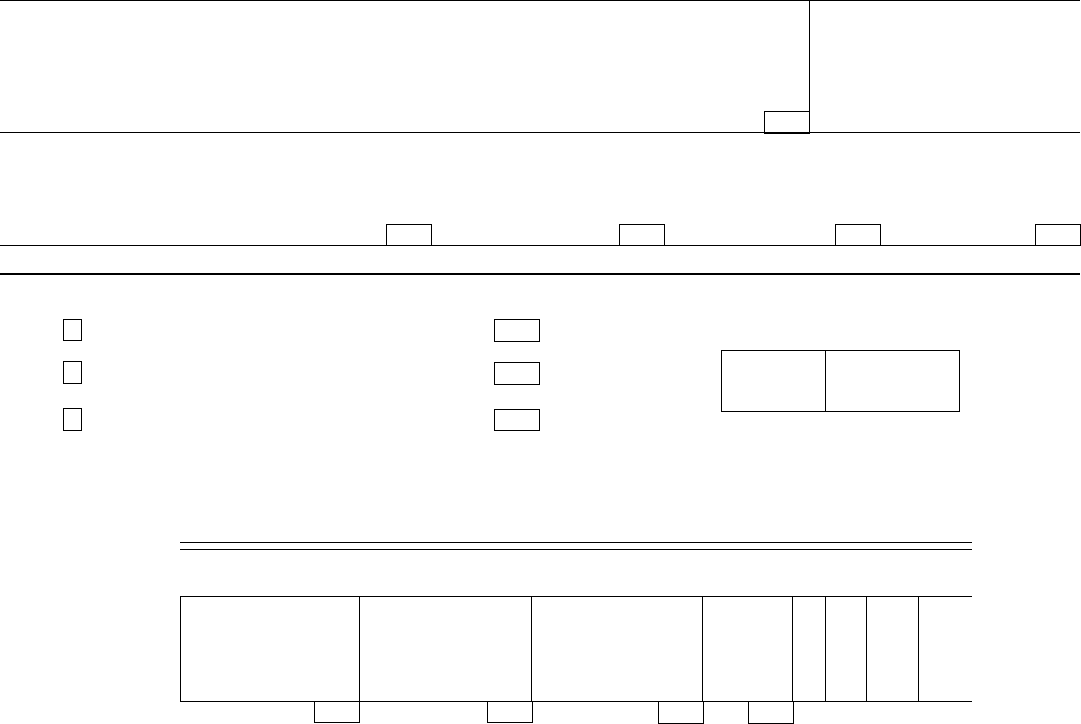

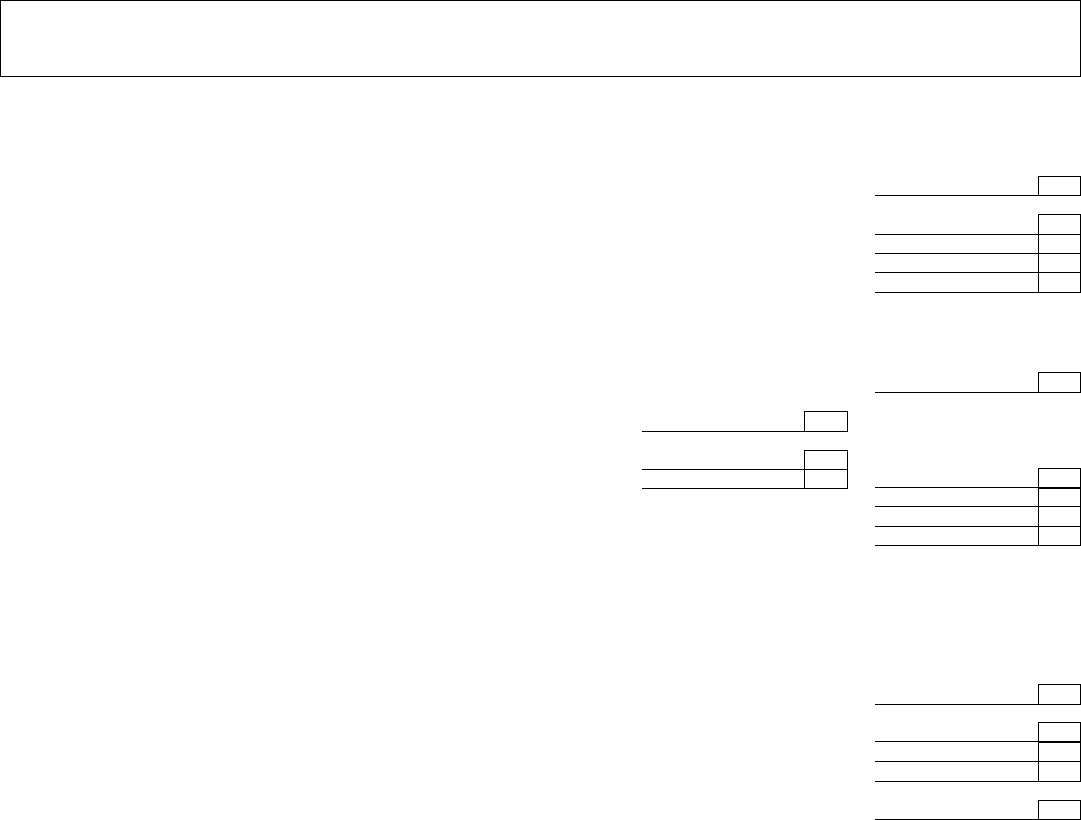

FINANCIAL AND OPERATIONAL COMBINED UNIFORM SINGLE REPORT

PART IIA

BROKER OR DEALER as of _____________________

STATEMENT OF FINANCIAL CONDITION FOR NONCARRYING, NONCLEARING AND

CERTAIN OTHER BROKERS OR DEALERS

LIABILITIES AND OWNERSHIP EQUITY

A.I. Non-A.I.

Liabilities Liabilities Liabilities Total

1045

W

13. Bank loans payable ................................................ $ $

13

$1255

14. Payable to brokers or dealers:

A. Clearance account ...........................................

B. Other ...............................................................

W

10

15. Payable to non-customers .....................................

1114

1115

1155

1315

1305

1355

1560

1540

1610

16. Securities sold not yet purchased,

at market value ....................................................... 1360 1620

17. Accounts payable, accrued liabilities,

expenses and other ................................................ 1205 16851385

18. Notes and mortgages payable:

A. Unsecured ....................................................... 1210

1211

W

1390

W

B. Secured ...........................................................

12 14

19. E. Liabilities subordinated to claims

of general creditors:

A. Cash borrowings: ............................................

970

1400

1690

1700

1710

W

1. from outsiders

9

$

2. includes equity subordination (15c3-1(d))

980of . . . $

B. Securities borrowings, at market value ............

990from outsiders $

1410 1720

C. Pursuant to secured demand note

collateral agreements ...................................... 1420 1730

1. from outsiders $ 1000

2. includes equity subordination (15c3-1(d))

of . . . $ 1010

D. Exchange memberships contributed for

use of company, at market value ........................ 1430 1740

E. Accounts and other borrowings not

qualified for net capital purposes ........................

20. TOTAL LIABILITIES ...................................... $

1220

1230 $

1440

1450 $

Ownership Equity

W

21. Sole Proprietorship ..............................................................................................................................................................................

1020 )

15

$

22. Partnership (limited partners) ....................................

W

11

($

1750

1760

1770

1780

23. Corporation:

A. Preferred stock .............................................................................................................................................................................

B. Common stock .............................................................................................................................................................................

C. Additional paid-in capital ..............................................................................................................................................................

D. Retained earnings .........................................................................................................................................................................

E. Total .............................................................................................................................................................................................

W

F. Less capital stock in treasury .......................................................................................................................................................

16

(

24. TOTAL OWNERSHIP EQUITY ................................................................................................................................................. $

25. TOTAL LIABILITIES AND OWNERSHIP EQUITY ...................................................................................................................... $

1791

1792

1793

1794

1795

) 1796

1800

1810

OMIT PENNIES

SEC 1696 (02-03) 5 of 16

1470

FINANCIAL AND OPERATIONAL COMBINED UNIFORM SINGLE REPORT

PART IIA

BROKER OR DEALER as of _____________________

COMPUTATION OF NET CAPITAL

1. Total ownership equity from Statement of Financial Condition ............................................................................................................. $

W

2. Deduct ownership equity not allowable for Net Capital ........................................................................................................................

19

(

3. Total ownership equity qualified for Net Capital ...................................................................................................................................

4. Add:

A. Liabilities subordinated to claims of general creditors allowable in computation of net capital ......................................................

B. Other (deductions) or allowable credits (List) ...............................................................................................................................

5. Total capital and allowable subordinated liabilities ............................................................................................................................... $

6. Deductions and/or charges:

3480

) 3490

3500

3520

3525

3530

A. Total non-allowable assets from

W

17

Statement of Financial Condition (Notes B and C) ................................................................... $

B. Secured demand note delinquency .........................................................................................

3540

3590

C. Commodity futures contracts and spot commodities –

proprietary capital charges .....................................................................................................

D. Other deductions and/or charges ............................................................................................

3600

3610 ( )

7. Other additions and/or allowable credits (List) ....................................................................................................................................

8. Net capital before haircuts on securities positions ...............................................................................................................................

W

20

$

3620

3630

3640

9. Haircuts on securities (computed, where applicable, pursuant to 15c3-1(f)):

A. Contractual securities commitments .......................................................................................$

B. Subordinated securities borrowings ........................................................................................

C. Trading and investment securities:

3660

3670

3735

3733

3730

3734

3650

3736 (

1. Exempted securities .........................................................................................................

W

2. Debt securities .................................................................................................................

W

3. Options ............................................................................................................................

30

4. Other securities ................................................................................................................

D. Undue Concentration ..............................................................................................................

E. Other (List) ........................................................................................................................

18

) 3740

10. Net Capital .......................................................................................................................................................................................... $

OMIT PENNIES

SEC 1696 (02-03) 7 of 16

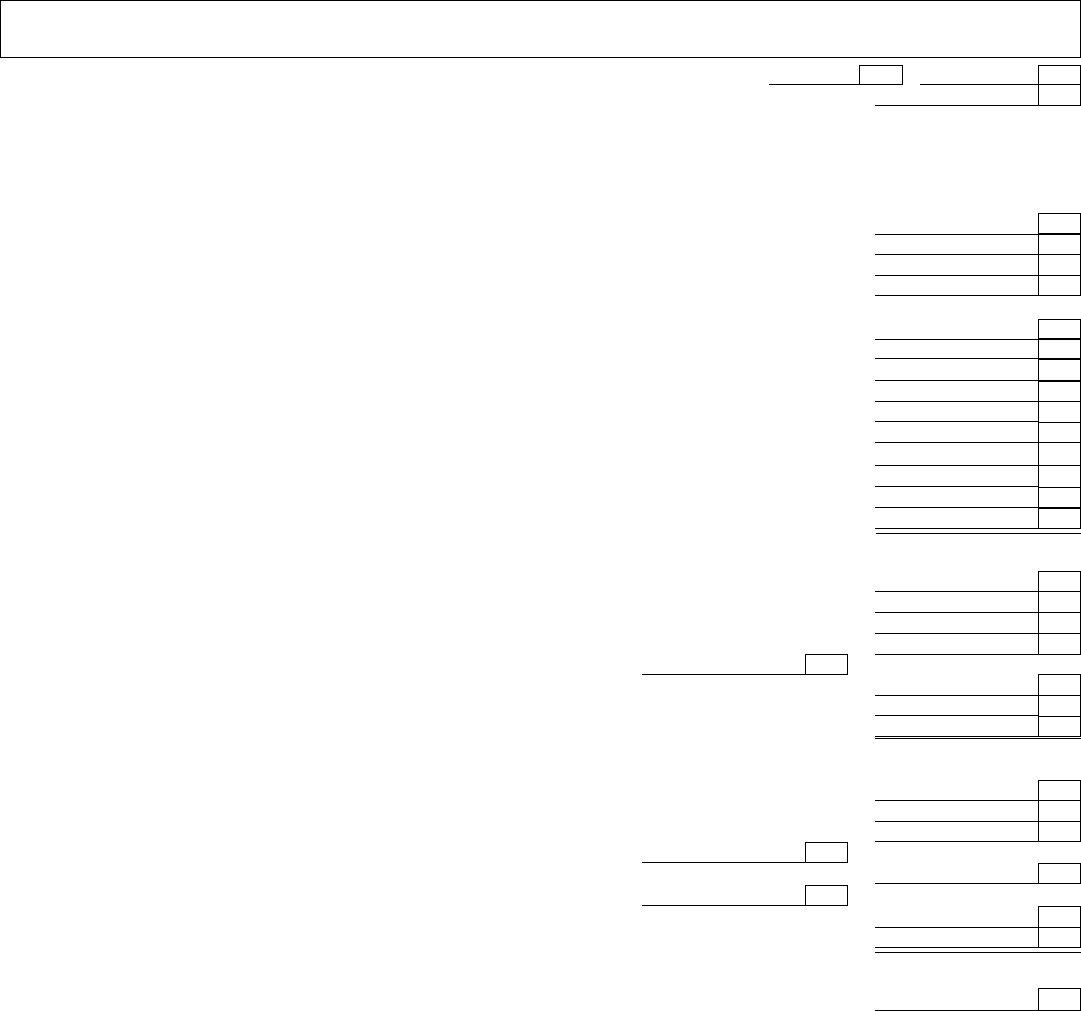

3750

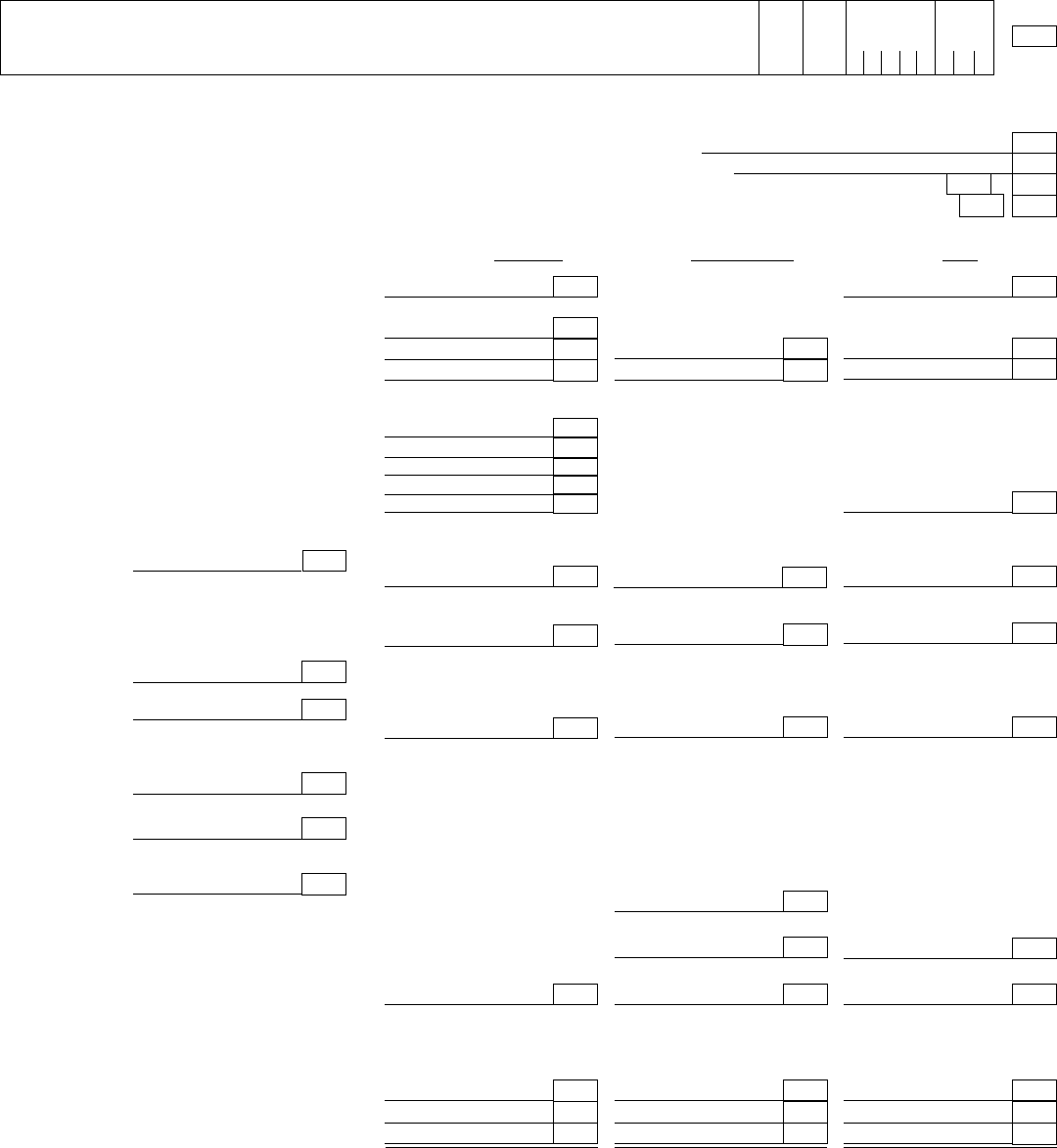

FINANCIAL AND OPERATIONAL COMBINED UNIFORM SINGLE REPORT

PART IIA

BROKER OR DEALER as of _____________________

COMPUTATION OF NET CAPITAL REQUIREMENT

Part A

11. Minimum net capital required (6

2

/

3

% of line 19) ................................................................................................................................... $

12. Minimum dollar net capital requirement of reporting broker or dealer and minimum net capital requirement

of subsidiaries computed in accordance with Note (A) ....................................................................................................................... $

13. Net capital requirement (greater of line 11 or 12) ................................................................................................................................ $

14. Excess net capital (line 10 less 13) ..................................................................................................................................................... $

15. Excess net capital at 1000% (line 10 less 10% of line 19) ..................................................................................................................

W

22

$

COMPUTATION OF AGGREGATE INDEBTEDNESS

16. Total A.I. liabilities from Statement of Financial Condition .................................................................................................................... $

17. Add:

W

A. Drafts for immediate credit ..................................................................................................... $

21

3800

B. Market value of securities borrowed for which no equivalent value

is paid or credited ...................................................................................................................$

C. Other unrecorded amounts (List) ............................................................................................ $

3810

3820 $

18. Total aggregate indebtedness .............................................................................................................................................................. $

19. Percentage of aggregate indebtedness to net capital (line 18 ÷ by line 10) ........................................................................................ %

20. Percentage of debt to debt-equity total computed in accordance with Rule 15c3-1(d) ........................................................................ %

COMPUTATION OF ALTERNATE NET CAPITAL REQUIREMENT

Part B

21. 2% of combined aggregate debit items as shown in Formula for Reserve Requirements pursuant to Rule 15c3-3

prepared as of the date of the net capital computation including both brokers or dealers and consolidated subsidiaries’ debits .......... $

22. Minimum dollar net capital requirement of reporting broker or dealer and minimum net capital requirement of

subsidiaries computed in accordance with Note (A) ............................................................................................................................

W

23

$

23. Net capital requirement (greater of line 21 or 22) ................................................................................................................................ $

24. Excess capital (line 10 less 23)........................................................................................................................................................... $

25. Net capital in excess of the greater of:

A. 5% of combined aggregate debit items or $120,000 .................................................................................................................... $

NOTES:

(A) The minimum net capital requirement should be computed by adding the minimum dollar net capital requirement of the reporting broker dealer and, for each

subsidiary to be consolidated, the greater of:

3756

3758

3760

3770

3780

3790

3830

3840

3850

3860

3970

3880

3760

3910

3920

1. Minimum dollar net capital requirement , or

2. 6

2

/

3

% of aggregate indebtedness or 4% of aggregate debits if alternative method is used.

(B) Do not deduct the value of securities borrowed under subordination agreements or secured demand note covered by subordination agreements not in satisfactory form

and the market values of memberships in exchanges contributed for use of company (contra to item 1740) and partners’ securities which were included in non-allowable

assets.

(C) For reports filed pursuant to paragraph (d) of Rule 17a-5, respondent should provide a list of material non-allowable assets.

SEC 1696 (02-03) 9 of 16

FINANCIAL AND OPERATIONAL COMBINED UNIFORM SINGLE REPORT

PART IIA

BROKER OR DEALER

3932 to

W

24

Number of months included in this statement

STATEMENT OF INCOME (LOSS)

REVENUE

1. Commissions:

a. Commissions on transactions in exchange listed equity securities executed on an exchange ....................................................... $

b. Commissions on listed option transactions ..................................................................................................................................

W

25

c. All other securities commissions ..................................................................................................................................................

d. Total securities commissions .......................................................................................................................................................

2. Gains or losses on firm securities trading accounts

a. From market making in options on a national securities exchange ................................................................................................

b. From all other trading ...................................................................................................................................................................

c. Total gain (loss) ...........................................................................................................................................................................

3. Gains or losses on firm securities investment accounts ......................................................................................................................

W

4. Profit (loss) from underwriting and selling groups ...............................................................................................................................

26

5. Revenue from sale of investment company shares .............................................................................................................................

6. Commodities revenue ..........................................................................................................................................................................

7. Fees for account supervision, investment advisory and administrative services ..................................................................................

8. Other revenue ......................................................................................................................................................................................

9. Total revenue ....................................................................................................................................................................................... $

EXPENSES

10. Salaries and other employment costs for general partners and voting stockholder officers .................................................................

11. Other employee compensation and benefits ........................................................................................................................................

12. Commissions paid to other broker-dealers ..........................................................................................................................................

13. Interest expense ..................................................................................................................................................................................

a. Includes interest on accounts subject to subordination agreements .......................................

For the period (MMDDYY) from

4070

14. Regulatory fees and expenses .............................................................................................................................................................

15. Other expenses ...................................................................................................................................................................................

16. Total expenses .................................................................................................................................................................................... $

NET INCOME

17. Income (loss) before Federal income taxes and items below (Item 9 less Item 16) ............................................................................. $

W

18. Provision for Federal income taxes (for parent only) ............................................................................................................................

28

19. Equity in earnings (losses) of unconsolidated subsidiaries not included above ...................................................................................

a. After Federal income taxes of ................................................................................................. 4338

20. Extraordinary gains (losses) ................................................................................................................................................................

a. After Federal income taxes of ................................................................................................. 4239

21. Cumulative effect of changes in accounting principles ........................................................................................................................

22. Net income (loss) after Federal income taxes and extraordinary items ................................................................................................ $

MONTHLY INCOME

23. Income (current month only) before provision for Federal income taxes and extraordinary items ........................................................ $

3933

3931

3935

3938

3939

3940

3945

3949

3950

3952

3955

3970

3990

3975

3995

4030

4120

4115

4140

4075

4195

4100

4200

4210

4220

4222

4224

4225

4230

4211

SEC 1696 (02-03) 11 of 16

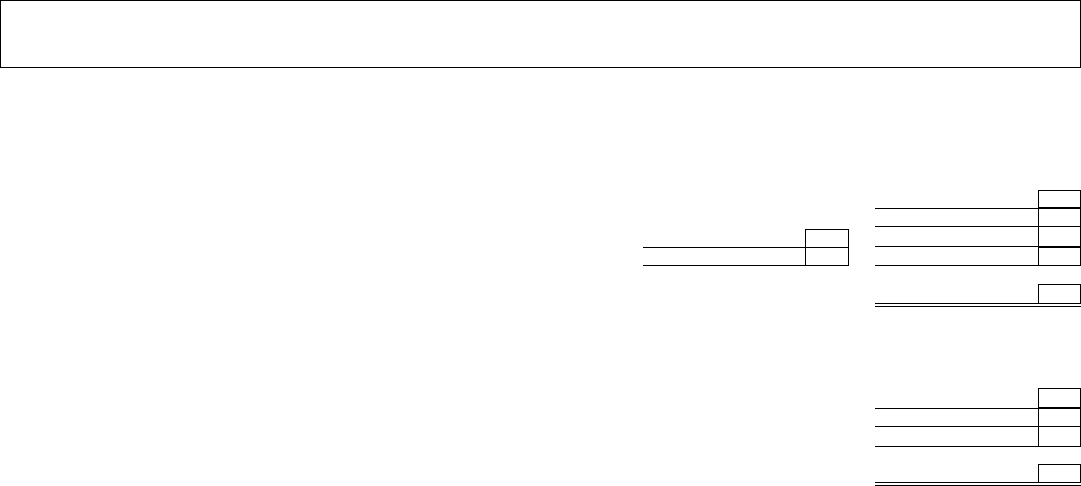

FINANCIAL AND OPERATIONAL COMBINED UNIFORM SINGLE REPORT

PART IIA

BROKER OR DEALER

For the period (MMDDYY) from _____________ to ______________

STATEMENT OF CHANGES IN OWNERSHIP EQUITY

(SOLE PROPRIETORSHIP, PARTNERSHIP OR CORPORATION)

1. Balance, beginning of period ............................................................................................................................................................... $

A. Net income (loss) .........................................................................................................................................................................

W

B. Additions (Includes non-conforming capital of ....................................................................... $

29

C. Deductions (Includes non-conforming capital of ..................................................................... $

4262 )

4272 )

2. Balance, end of period (From item 1800) ............................................................................................................................................

STATEMENT OF CHANGES IN LIABILITIES SUBORDINATED

TO CLAIMS OF GENERAL CREDITORS

$

4240

4250

4260

4270

4290

3. Balance, beginning of period ...............................................................................................................................................................

W

30

$

A. Increases......................................................................................................................................................................................

B. Decreases ....................................................................................................................................................................................

4300

4310

4320

4. Balance, end of period (From item 3520) ............................................................................................................................................ $

OMIT PENNIES

SEC 1696 (02-03) 13 of 16

4330

FINANCIAL AND OPERATIONAL COMBINED UNIFORM SINGLE REPORT

PART IIA

BROKER OR DEALER as of _____________________

EXEMPTIVE PROVISION UNDER RULE 15c3-3

24. If an exemption from Rule 15c3-1 is claimed, identify below the section upon which such exemption is based (check one only)

A. (k)(1) — $2,500 capital category as per Rule 15c3-1 .................................................................................................................

B. (k)(2)(A) — “Special Account for the Exclusive Benefit of customers” maintained .......................................................................

C. (k)(2)(B) — All customer transactions cleared through another broker-dealer on a fully disclosed basis.

W

Name of clearing firm

30

4335

D. (k)(3) — Exempted by order of the Commission (include copy of letter) ......................................................................................

4550

4560

4570

4580

W

33

Ownership Equity and Subordinated Liabilities maturing or proposed to be withdrawn within the next six months

and accruals, (as defined below), which have not been deducted in the computation of Net Capital.

Type of Proposed Amount to be

Withdrawal or Withdrawn (cash (MMDDYY) Expect

Accrual Insider or amount and/or Net Withdrawal or to

(See below Outsider? Capital Value of Maturity Renew

for code ) Name of Lender or Contributor (In or Out) Securities) Date (Yes or No)

4620 4621 4622 4623 4624

4600 4601 4602 4603 4604 4605

W

31

4610 4611 4612 4613 4614 4615

W

32

4630 4631 4632 4633 4634 4635

W

34

4640 4641 4642 4643 4644 4645

W

35

Total $

W

36

4699

OMIT PENNIES

Instructions: Detail Listing must include the total of items maturing during the six month period following the report date, regardless of whether or not the capital contribution is

expected to be renewed. The schedule must also include proposed capital withdrawals scheduled within the six month period following the report date including

the proposed redemption of stock and anticipated accruals which would cause a reduction of Net Capital. These anticipated accruals would include amounts of

bonuses, partners’ drawing accounts, taxes, and interest on capital, voluntary contributions to pension or profit sharing plans, etc., which have not been deducted

in the computation of Net Capital, but which you anticipate will be paid within the next six months.

WITHDRAWAL CODE: DESCRIPTIONS

1. Equity Capital

2. Subordinated Liabilities

3. Accruals

SEC 1696 (02-03) 15 of 16

4625