Fillable Printable Fuel Tax Application

Fillable Printable Fuel Tax Application

Fuel Tax Application

Fuel Tax Application

Use this application to obtain a Fuel Tax license. You can also apply online through the Taxpayer Access Point (TAP) at:

https://wadolprft.gentax.com/TAP/_/

License types

Supplier License: Allows the purchase and storage of non-taxed fuel within the bulk transfer-terminal system. It also

allows for export and import of fuel.

Distributor License: Allows the tax-free purchase of fuel from a licensed supplier for immediate export to a destination

outside the state and the importation of fuel into the state by rail car or tanker truck. It also allows a tax-deferred purchase

of motor fuel or special fuel from a licensed supplier and the tax-exempt sale of fuel to qualifying entities.

Blender License: Allows the blending of taxed fuel with untaxed liquids to produce motor or special fuel, including

alternative fuels (biodiesel, ethanol, etc.) and for the production of alternative fuels outside the bulk transfer-terminal

system. Tax is imposed upon the volume of product not previously taxed.

Aircraft Fuel Distributor License: Allows the purchase of non-taxed aircraft fuel for resale.

Terminal License: Requires the reporting of fuel movement in IRS registered terminals within Washington State. A

separate license is required for each terminal location. However, you may apply for all locations using a single application.

Fuel Carrier License: For railroads operating in Washington.

Licensing requirements checklist

Use this checklist to complete your application for a fuel tax license. Do not include it with your application documents.

Prior to completing your fuel tax license application, register your business with Business Licensing Services at the

Department of Revenue (www.dor.wa.gov) to obtain a Unified Business Identifier (UBI). If registering as a corporation,

limited liability company, or partnership, contact the Secretary of State’s office (www.sos.wa.gov).

General Requirements:

Application

Each corporate officer or partner listed on the application (limit 3) must complete the employment or business history

section of this application.

Provide an original surety tax bond. Instructions for calculating the bond amount are included in the bond instructions.

An aircraft license requires a separate bond. Terminal operators and fuel carriers are not required to have bond

coverage.

Fuel Terminal operators provide:

Copy of the federal excise tax registration (IRS form 637) authorizing tax-free transactions in the bulk transfer-terminal

system.

Fuel suppliers provide:

Copy of the federal excise tax registration (IRS form 637) authorizing tax-free transactions in the bulk transfer-terminal

system.

Copies of licenses issued by jurisdictions (states and Canadian Provinces) from which fuel is imported from or to where

fuel is exported. If you plan to import from or export to a jurisdiction which does not require a license, you must provide

a written statement.

Fuel distributors provide:

Copies of licenses issued by jurisdictions (states and Canadian Provinces) from which fuel is imported from or to where

fuel is exported. If you plan to import from or export to a jurisdiction which does not require a license, you must provide

a written statement.

Fuel Blenders provide:

Copy of federal excise tax registration (IRS form 637) authorizing the production of biodiesel or ethanol and the

blending of these with petroleum products. If you are blending other products to make taxable fuel, contact us regarding

requirements.

For questions, contact us at (360) 664-1852.

WAC 308-77, 308-78. RCW 82.38, 82.42

FT-441-750 (R/7/17)WA Page 1 of 3

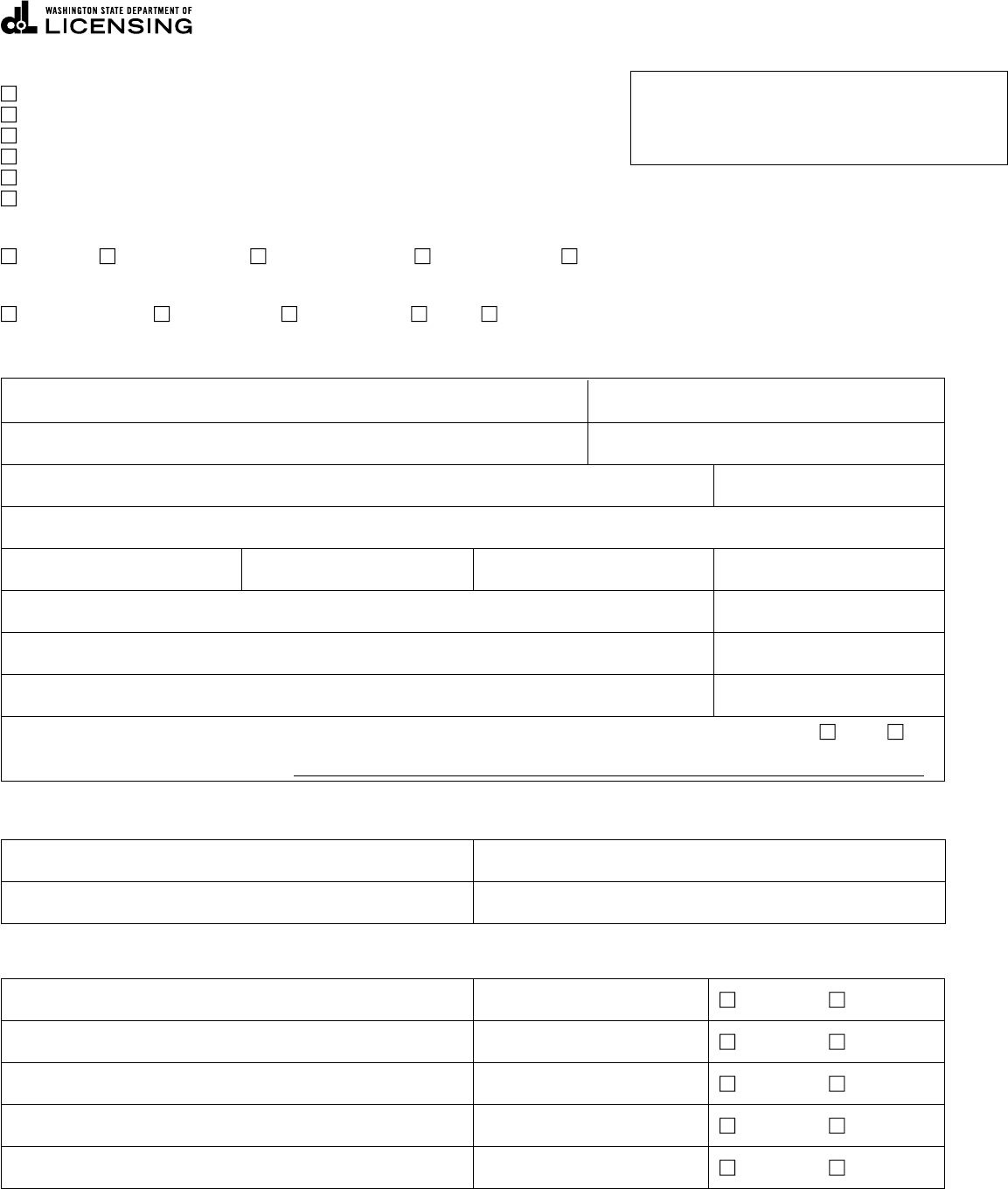

For office use

108-030-248-0001

Fuel Tax Application

Type of license (check all that apply)

Supplier

Distributor

Blender

Aircraft distributor

Terminal operator

Fuel carrier

Application type (check all that apply)

Original Reinstatement Address change Name change Ownership/Corporation change

Business structure (check one)

Sole proprietor Partnership Corporation LLC LLP

Business information

Legal name Trade name or DBA

Federal Employer Identification Number (FEIN) Unifed Business Identifier (UBI)

Mailing address, City, State, ZIP code (Area code) Telephone number

Applicant’s physical location address (no PO boxes), City, State, ZIP code

Contact person (Area code) Telephone number Email (Area code) Fax number

Name corporate officer or partner (limit 3 individuals) Title

1.

Name corporate officer or partner Title

2.

Name corporate officer or partner Title

3.

Have you ever held a fuel tax license in Washington State? .................................... Yes No

If yes, list business name on license

Terminal operators

List the IRS-registered terminals you operate in Washington State (attach additional pages if needed)

Terminal name Location

Terminal name Location

Suppliers, distributors, blender

List all jurisdictions with which you are exporting and importing fuel (attach additional pages if needed):

Jurisdiction License number

Import Export

Jurisdiction License number

Import Export

Jurisdiction License number

Import Export

Jurisdiction License number

Import Export

Jurisdiction License number

Import Export

FT-441-750 (R/7/17

)WA Page 2 of 3 (continued on next page)

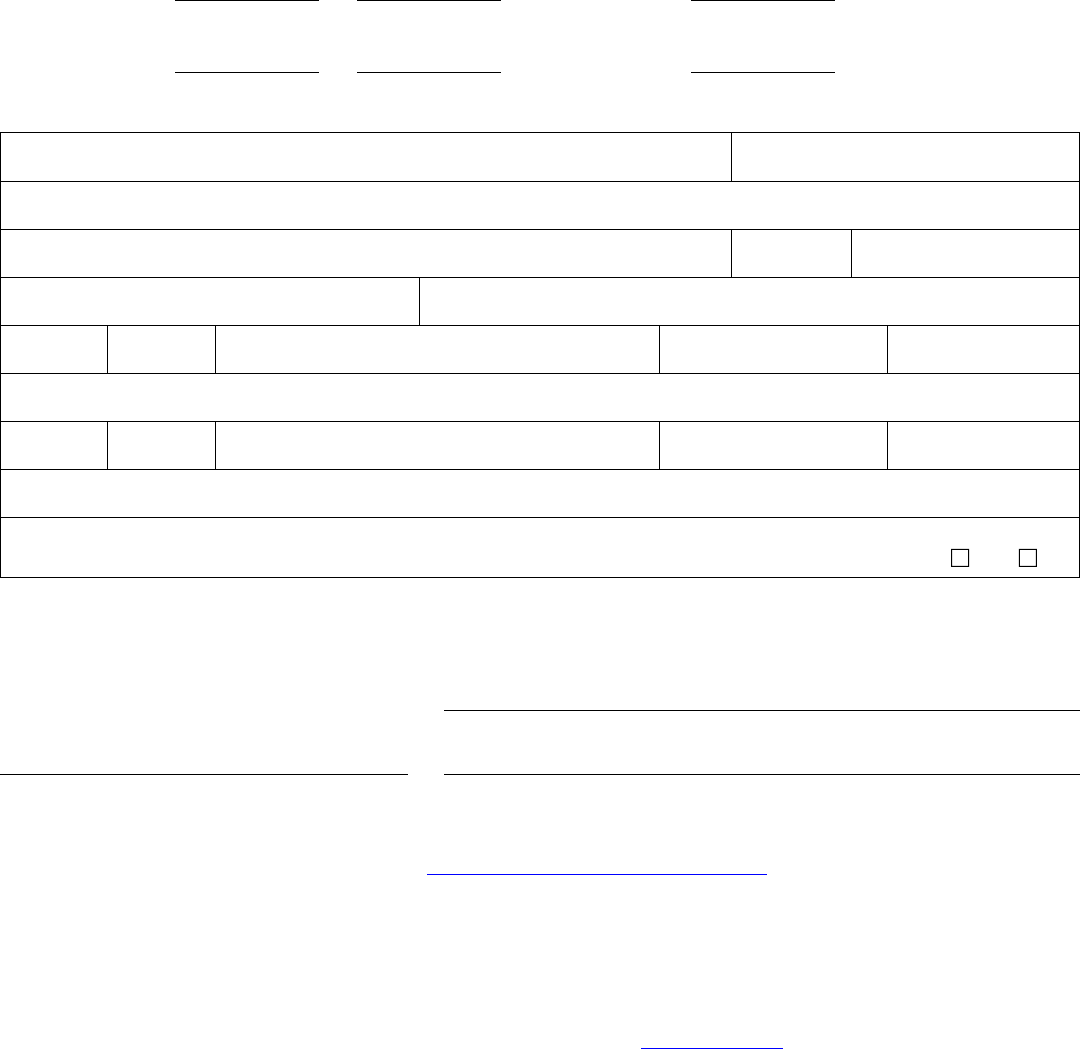

X

Bond requirements

The total amount of the bond, per license, is 3 times the estimated monthly fuel tax liability and cannot be less than $5,000

or more than $100,000.

For Motor and Special fuel:

Net taxable gallons x 3 x $0.494 (tax rate) = bond amount.

For Aircraft:

Net taxable gallons x 3 x $0.11 (tax rate) = bond amount.

History– Officer or Partner

Officer or owner name Date of birth

Street address

City State ZIP code

(Area code) Home telephone number Email address

From To Name of company Job title Immediate supervisor

Address (Street, City, State, ZIP code)

From To Name of company Job title Immediate supervisor

Address (Street, City, State, ZIP code)

Has this officer or partner been convicted of a crime or suffered a civil judgment directly related

to the distribution and sale of fuel within the past 10 years? ..................................... Yes No

Certification

I certify under penalty of perjury under the laws of the state of Washington that the foregoing is true and correct.

Applicant name

Date and place Signature

Submit your report and supporting documents:

Online: Taxpayer Access Point (TAP) at https://wadolprft.gentax.com/TAP/_/

Mail: Department of Licensing

Fuel Tax Unit

PO Box 9228

Olympia, WA 98507-9228

Questions

Contact us at (360) 664-1852. For more information, visit our website at www.dol.wa.gov.

FT-441-750 (R/7/17)WA Page 3 of 3