Fillable Printable Fuel Tax Bond

Fillable Printable Fuel Tax Bond

Fuel Tax Bond

Fuel Tax Bond Instructions

In order to qualify for a fuel tax license or to maintain your current license, you must provide proof of bond coverage. Use

this form to determine the amount of bond coverage needed and provide proof of coverage. If you have questions about

your bond requirements, please call the Fuel Tax unit at (360) 664-1852.

Complete the following table. Use your last six months of fuel activity to complete lines 1 through 6. If you do not have

actual gallon figures for this time period, estimate your volume.

If you are a licensed:

• Supplier, use the taxable distribution by fuel type.

• Distributor, use purchases by fuel type, plus any fuel imported into Washington State.

• Blender, use the taxable distribution.

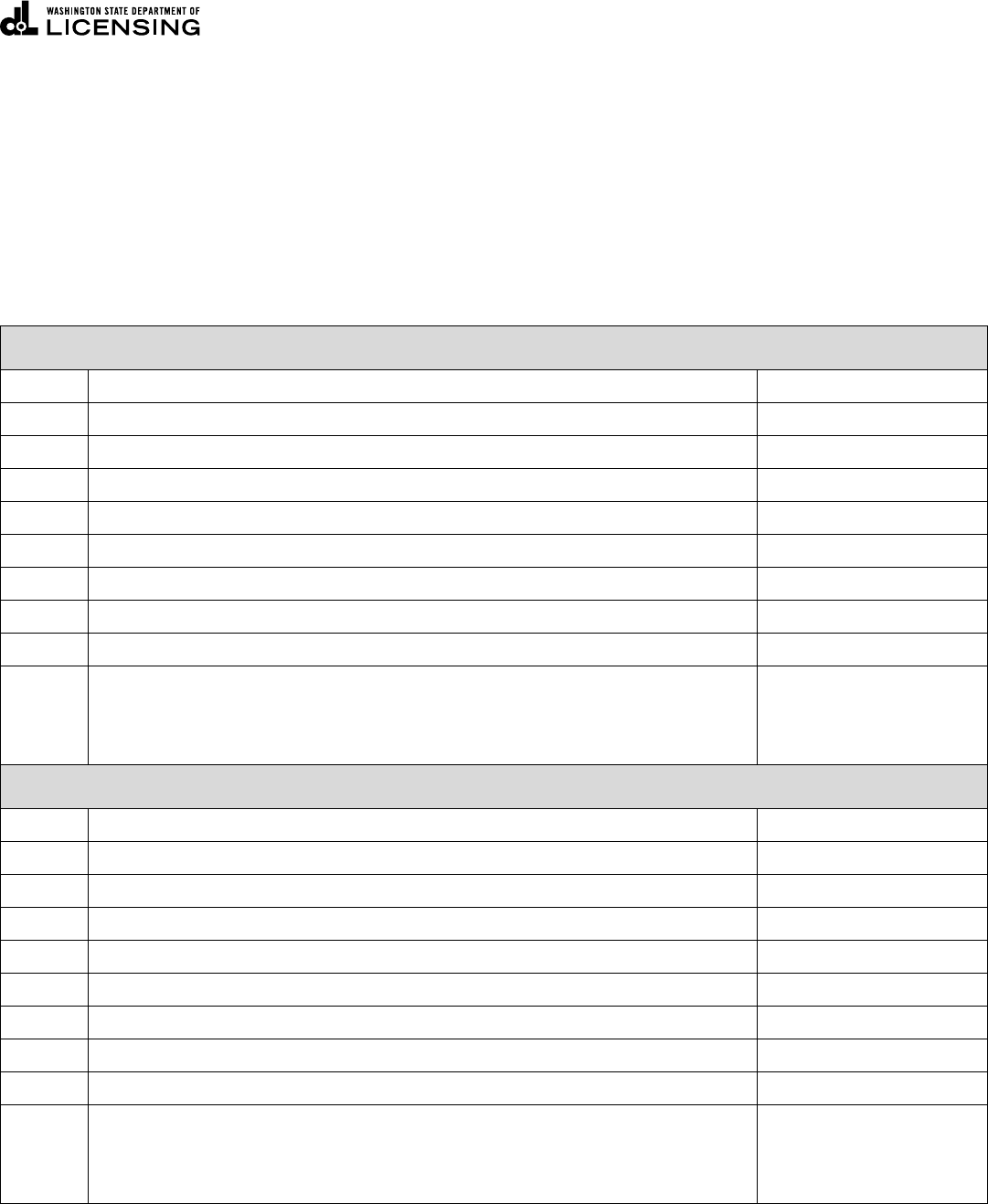

Motor and Special Fuel Bonds

1. Month 1 gallons

2. Month 2 gallons

3. Month 3 gallons

4. Month 4 gallons

5. Month 5 gallons

6. Month 6 gallons

7. Total gallons for the last 6 months. (add lines 1 thru 6)

8. Monthly average (Divide line 7 by 6)

9. Monthly average liability (Multiply line 8 by <tax rate> per gallon) $

10.

Bond coverage amount (Multiply line 9 by 3)

This is your bond amount. Minimum coverage is $5,000 with a maximum of

$100,000.

$

Aircraft Fuel Bonds

1. Month 1 gallons

2. Month 2 gallons

3. Month 3 gallons

4. Month 4 gallons

5. Month 5 gallons

6. Month 6 gallons

7. Total gallons for the last 6 months (add lines 1 thru 6)

8. Monthly average (Divide line 7 by 6)

9. Monthly average liability (Multiply line 8 by <tax rate> per gallon) $

10.

Bond coverage amount (Multiply line 9 by 3)

This is your bond amount. Minimum coverage is $5,000 with a maximum of

$100,000.

$

FT-441-541 (R/12/16)WA

Click here to START or CLEAR, then hit the TAB button

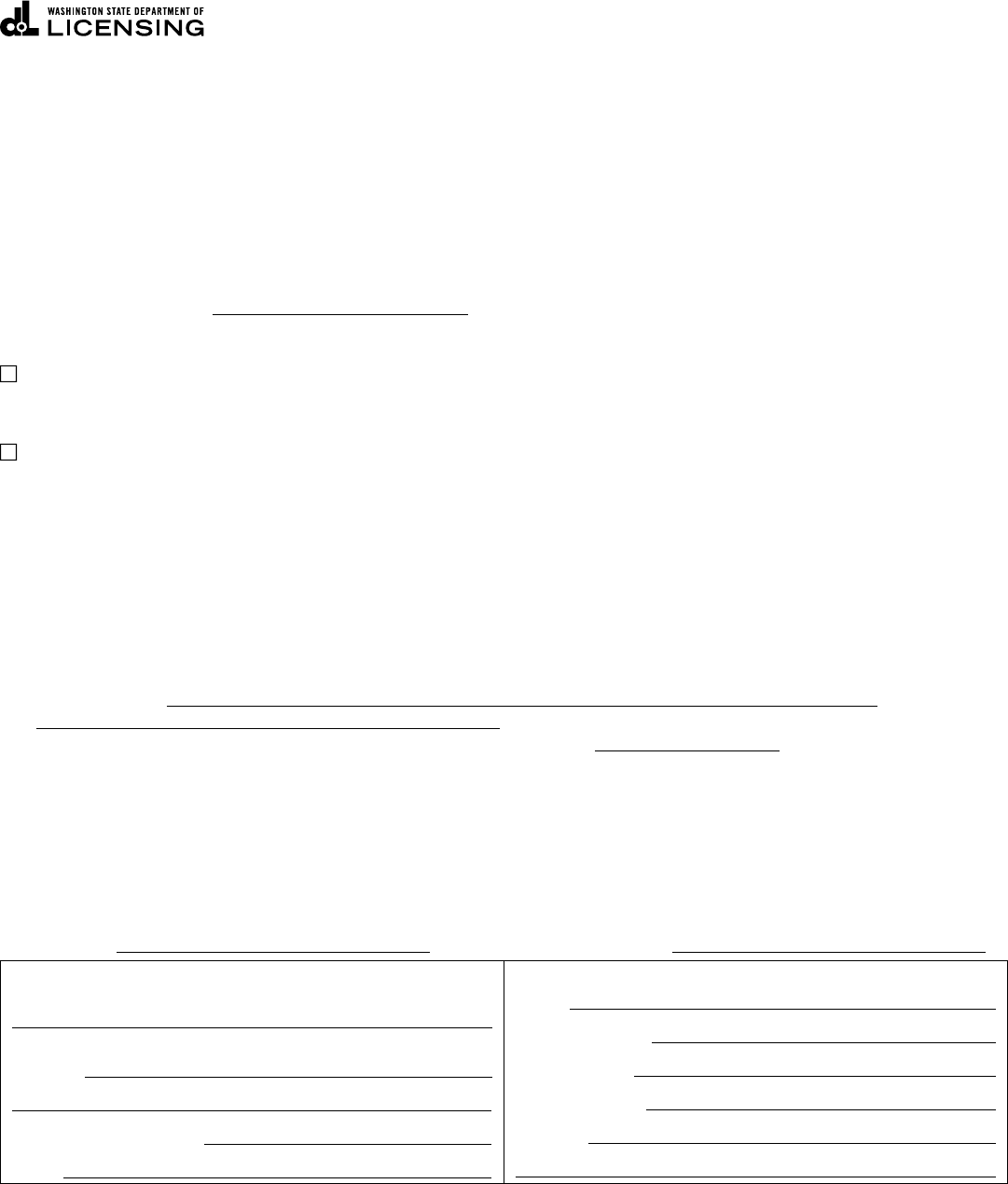

Fuel Tax Bond

Give this form to your insurance company for completion, then submit the completed form:

Online - via Taxpayer Access Point (TAP) at: https://wadolprft.gentax.com/TAP/_/

By mail without payment, mail to:

Department of Licensing

Fuel Tax Unit

PO Box 9228

Olympia, WA 98507-9228

Licensee (if replacing an expired or canceled bond)

Fuel Tax License number

Please check one:

Motor and Special Fuel Tax Bond - Required for suppliers, blenders, and distributors of fuel. RCW 82.38.110 of the

Motor Vehicle and Special Fuel Tax law. Minimum coverage under this Act is $5,000, or three times the estimated

monthly tax, whichever is larger. Maximum of $100,000.

Aircraft Fuel Tax Bond - Required for distributors of aircraft fuel. RCW 82.42.040 of the Aircraft Fuel Tax law.

Minimum coverage under this Act is $5,000, or three times the estimated monthly tax, whichever is larger. Maximum

coverage is $100,000.

Insurance Company

Attorney-in-Fact for surety must personally sign bonds and riders and attach a Power-of-Attorney to all bonds and riders.

Cancellation of bond

If a bond is being canceled, the Department of Licensing must receive a written notice at least 45 days before termination.

The bond remains in effect during this time.

Let it be known that as principal,

and , a corporation authorized to transact surety business in the

state of Washington, are bound to the state of Washington in the sum of dollars for the payment of

which we, jointly and severally, bind ourselves, our heirs, executors, administrators, successors, and assigns.

The condition of this bond is that the above-named principal has applied for a fuel tax license in accordance with the

provisions of the above indicated act. This act requires security for the payments of amounts due, and which become due

from the principal under the prescribed act.

If the said principal complies with all provisions of said act, any amendments, and pays all amounts now due (which shall

be determined due under said act), then this bond shall be void; otherwise it shall remain in full force and effect.

Bond number Effective date of this bond:

Signature of principal

Signature of owner, partner, or officer of corporation. Attach Power-of-Attorney if not.

Address

(Area code) Telephone

Email

Surety

Name

Attorney-in-Fact

Agency name

Resident agent

Address

(Principal seal if incorporated) (Surety seal)

FT-441-541 (R/12/16)WA

X

When you have completed this form, please print it out and sign here.