Fillable Printable Gift Aid Declaration

Fillable Printable Gift Aid Declaration

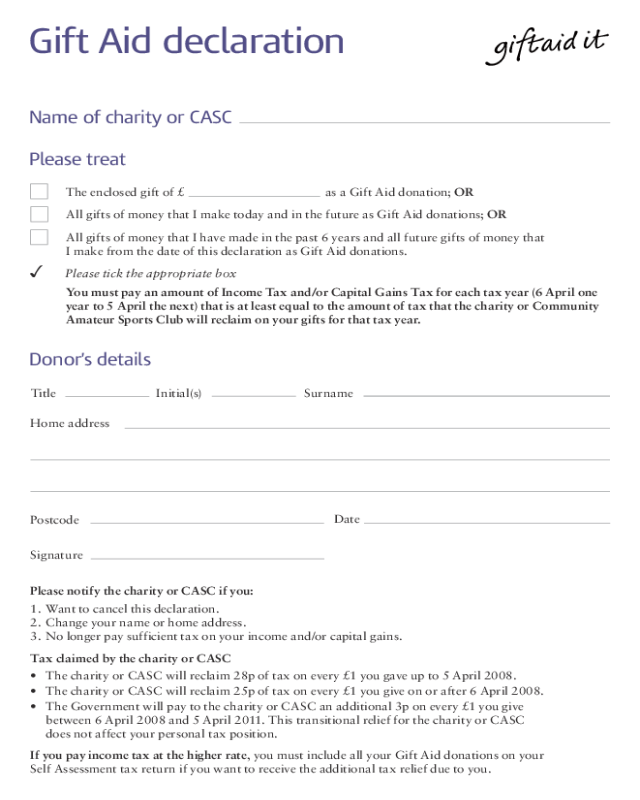

Gift Aid Declaration

Gift Aid declaration

Please notify the charity or CASC if you:

1. Want to cancel this declaration.

2. Change your name or home address.

3. No longer pay sufficient tax on your income and/or capital gains.

Tax claimed by the charity or CASC

• ThecharityorCASCwillreclaim28poftaxonevery£1yougaveupto5April2008.

• ThecharityorCASCwillreclaim25poftaxonevery£1yougiveonorafter6April2008.

• TheGovernmentwillpaytothecharityorCASCanadditional3ponevery£1yougive

between6April2008and5April2011.ThistransitionalreliefforthecharityorCASC

does not affect your personal tax position.

If you pay income tax at the higher rate,youmustincludeallyourGiftAiddonationsonyour

SelfAssessmenttaxreturnifyouwanttoreceivetheadditionaltaxreliefduetoyou.

Please treat

Title Initial(s) Surname

Home address

Donor’s details

Postcode

Date

Theenclosedgiftof£ asaGiftAiddonation;OR

AllgiftsofmoneythatIhavemadeinthepast6yearsandallfuturegiftsofmoneythat

ImakefromthedateofthisdeclarationasGiftAiddonations.

You must pay an amount of Income Tax and/or Capital Gains Tax for each tax year (6 April one

year to 5 April the next) that is at least equal to the amount of tax that the charity or Community

Amateur Sports Club will reclaim on your gifts for that tax year.

3 Please tick the appropriate box

AllgiftsofmoneythatImaketodayandinthefutureasGiftAiddonations;OR

Name of charity or CASC

Signature