Fillable Printable Gift Aid Declaration Form - UK

Fillable Printable Gift Aid Declaration Form - UK

Gift Aid Declaration Form - UK

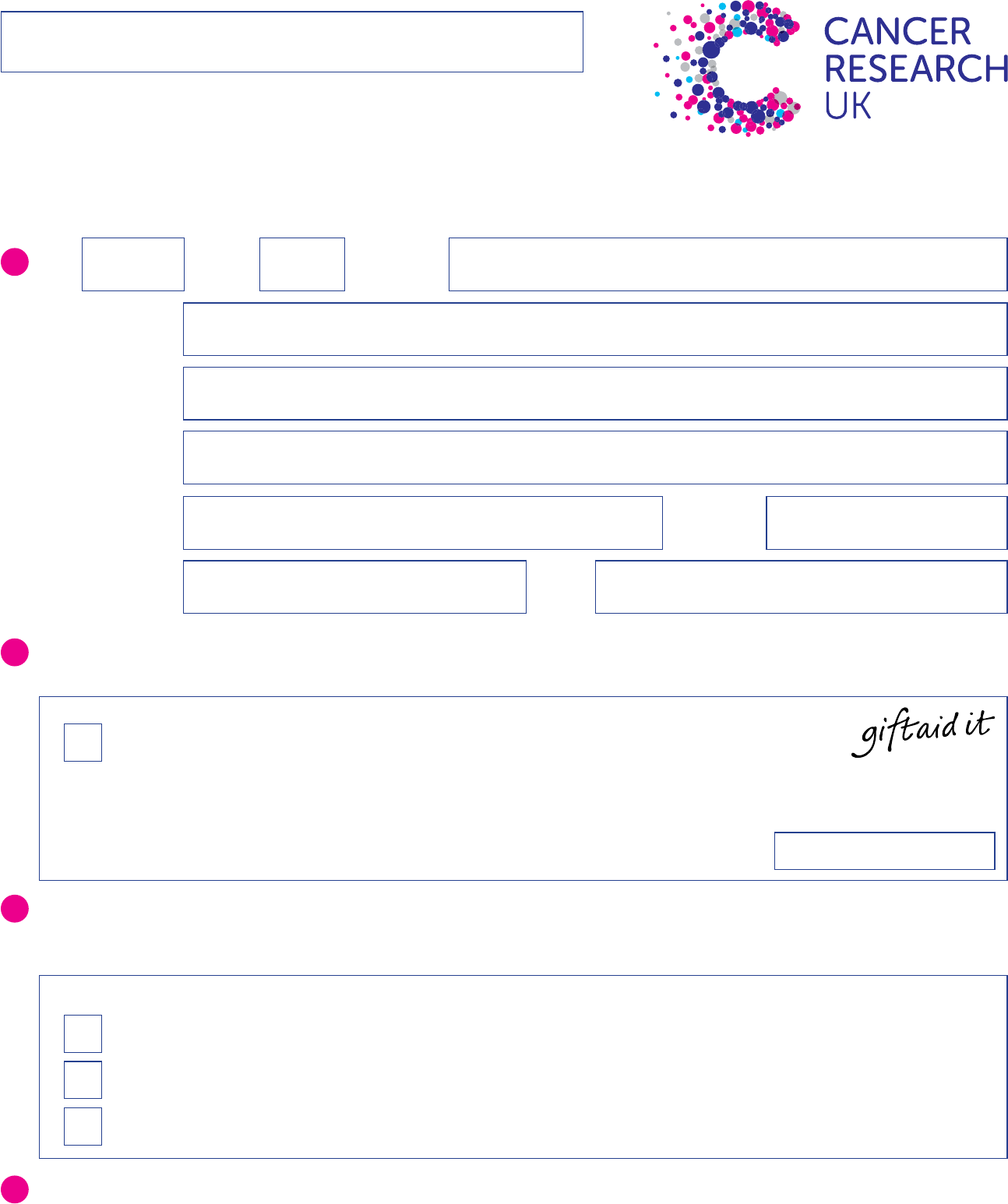

Gift Aid Declaration Form

Title Initial Surname

House Name

Address Line 1

Town

County

Postcode

Telephone

Number

Email

1

2

If you are a UK taxpayer, the value of your donations can increase by 25% under the Gift Aid scheme

– at no additional cost to you! Please tick the box below to join the Gift Aid scheme.

I am a UK taxpayer*. Please treat all donations I make or have made to

Cancer Research UK for the past 4 years as Gift Aid donations until further notice.

* Please be aware that you must have paid an amount of income and/or capital gains tax at least equal to the amount of tax reclaimed

by all charities and Community Amateur Sports Clubs on all your donations in the tax year (6th April one year to 5th April the next).

We can currently receive an extra 25p for every £1 you donate. Other taxes such as Council Tax and VAT do not qualify.

Please let us know if your tax circumstances or name/address Date

change so that we can update our records.

Oce use only

3

It may be that having read the information on this form you feel that your donation does not qualify. If this is the

case please tick the relevant box below and return this form to us. This will ensure you are not asked to complete

a Gift Aid form in the future, should you choose to support us again.

I cannot complete the Gift Aid form because:

I am not a UK taxpayer

I do not pay enough tax each year to cover the tax on the gift

Other (please state)

4

Please return your Gift Aid form together with your donation. If you are only returning the Gift Aid form,please send

it to: Cancer Research UK, PO BOX 232, MELKSHAM, SN12 6WF.

Thank you for your support

Cancer Research UK would also like to contact you about our work and activities and how you may support us.

To receive this information via email or a message to your mobile phone. Please tick the box Email [ ] Mobile [ ]

If you prefer not to receive this information by post or telephone. Please tick this box[ ]

By providing us with any personal data you consent to the terms and conditions of our Privacy Statement

available at www.cruk.org.

As a valued supporter of Cancer Research UK we will treat your details very carefully and will not pass them on

to any other organisations.

If you change your mind you can unsubscribe at any time by contacting Supporter Services at Cancer Research UK,

PO BOX 1561,OXFORD, OX4 9GZ or on 0300 123 1861.

GAD01

Gift Aid Key Facts

When Cancer Research UK Receives a donation from a UK taxpayer, we are

entitled to claim an amount of tax (calculated at the basic rate of income tax

in that year) paid on that donation. Once you have given your permission for

us to do this on your behalf (by filling in this Gift Aid form), there is no need

for you to do anything else.

All that is required is that the amount of income and/or capital gains tax

you pay in a given tax year (6th April one year to 5th April next year) is at least

equal to the amount of tax claimed by all charities and Community Amateur

Sports Clubs on all your donations. As this amount is calculated over the

whole tax year, there is no requirement that tax is paid regularly – it is purely

a question of how much has been paid in the tax year as a whole. Other taxes

such as Council Tax or VAT do not qualify for Gift Aid.

The amount of tax we claim will be 25% of the total value of

your donations in that tax year. Furthermore, if you are a higher tax payer,

you are also entitled to claim the dierence between the basic rate which

we will claim and the amount of tax you have actually paid. For further

details on how you can do this, please contact your tax oce. If your tax

situation changes and your gifts will no longer be eligible for the Gift Aid

scheme please contact us and we will amend your record accordingly.

Cancer Research UK is a registered charity in England and Wales (1089464),

Scotland (SC041666) and the Isle of Man (1103).