Fillable Printable Health Insurance Application/Change Form

Fillable Printable Health Insurance Application/Change Form

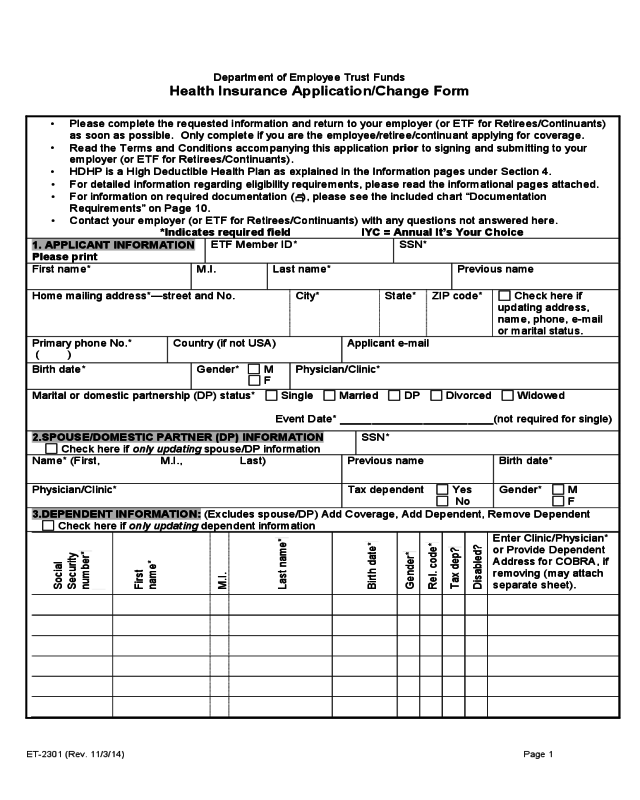

Health Insurance Application/Change Form

Department of Employee Trust Funds

Health Insurance Application/Change Form

•

Please complete the requested information and return to your employer (or ETF for Retirees/Continuants)

as soon as possible. Only complete if you are the employee/retiree/continuant applying for coverage.

•

Read the Terms and Conditions accompanying this application prior to signing and submitting to your

employer (or ETF for Retirees/Continuants).

•

HDHP is a High Deductible Health Plan as explained in the Information pages under Section 4.

•

For detailed information regarding eligibility requirements, please read the informational pages attached.

•

For information on required documentation (

), please see the included chart “Documentation

Requirements” on Page 10.

•

Contact your employer (or ETF for Retirees/Continuants) with any questions not answered here.

*Indicates required field IYC = Annual It’s Your Choice

1. APPLICANT INFORMATION

Please print

ETF Member ID* SSN*

First name* M.I. Last name* Previous name

Home mailing address*—street and No. City* State* ZIP code* Check here if

updating address,

name, phone, e-mail

or marital status.

Primary phone No.*

( )

Country (if not USA) Applicant e-mail

Birth date* Gender*

M

F

Physician/Clinic*

Marital or domestic partnership (DP) status* Single Married DP Divorced Widowed

Event Date* ________________________(not required for single)

2.SPOUSE/DOMESTIC PARTNER (DP) INFORMATION

Check here if only updating spouse/DP information

SSN*

Name* (First, M.I., Last) Previous name Birth date*

Physician/Clinic* Tax dependent Yes

No

Gender* M

F

3.DEPENDENT INFORMATION: (Excludes spouse/DP) Add Coverage, Add Dependent, Remove Dependent

Check here if only updating dependent information

Social

Security

number*

First

name*

M.I.

Last name*

Birth date*

Gender*

Rel. code*

Tax dep?

Disabled?

Enter Clinic/Physician*

or Provide Dependent

Address for COBRA, if

removing (may attach

separate sheet).

ET-2301 (Rev. 11/3/14) Page 1

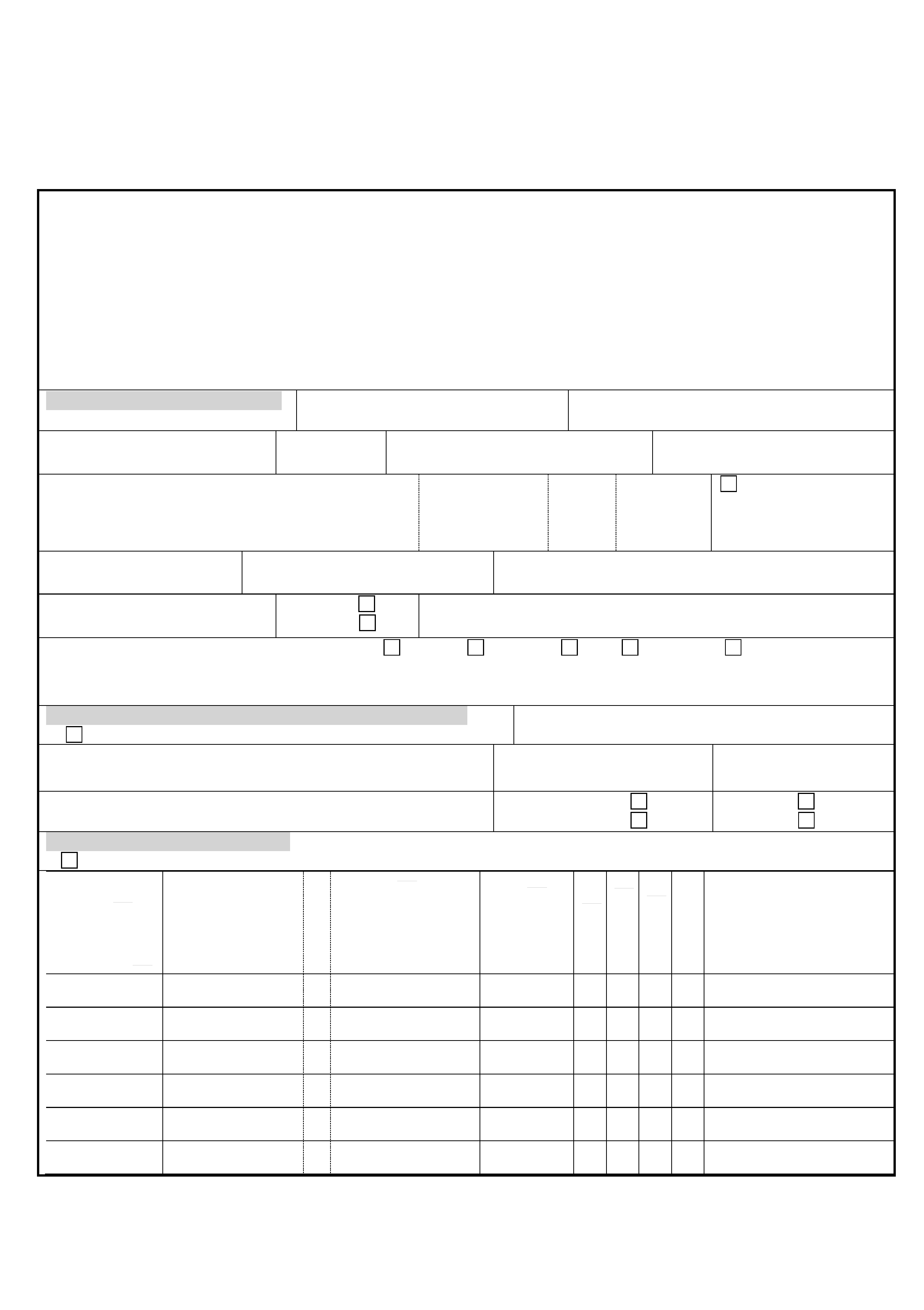

MID_____________________ SSN______________________

4.ENROLLMENT

INFORMATION

New Hire or Return from Leave and Coverage has Lapsed—I want my coverage to

be effective:

When employer contributes to premiums I Decline/Waive Coverage

As soon as possible (employee will pay entire I Decline coverage because I

monthly premium until eligible for employer have other coverage

contribution)

Eligibility reason* Employee Graduate assistant Continuant (COBRA) Retired Survivor

Coverage desired*

Single

Family

Are you

selecting an

HDHP health

plan?

Yes No

Health plan selected*

(enter plan name)

5.REASON FOR APPLICATION*

Please select the event that allows you to enroll outside of initial hire. Reasons marked with

require supporting

documentation. See Page 10 for required documentation listing. IYC = Annual It’s Your Choice

Add Coverage

Spouse/DP to spouse/DP transfer

Transfer from one employer to

another employer

Previous Employer*___________

HIPAA (birth, adoption

, marriage,

DP

, divorce

)

LTE new hire (state only)

Loss of Other Coverage/Employer

Contributions

IYC (eff. Jan. 1)

COBRA (ET-2311 required)

State retiree re-enroll

Effective date* ______________

Other ______________________

Event date* ____________________

Add dependent

HIPAA (birth, adoption

,

marriage, DP

, divorce

)

National medical support

notice

Paternity acknowledgment

Legal ward/guardianship

Eligible dependent not

on initial enrollment

(excludes DP and adult

dependents)

Loss of other coverage/

employer contributions

Disabled, age 26+

IYC (eff. Jan. 1)

Other ___________________

Event date* ________________

Remove dependent

Divorce

/DP terminated

Death of dependent

Legal ward/guardianship ends

Disabled dependent: Disability

ends or support and maintenance

less than 50%.

Grandchild’s parent turns age 18

Adult dependent eligible for other

coverage

IYC (eff. Jan 1)

Other _____________________

Event date* __________________

Change Health Plan (Check one box below, enter new county for a move from service area, indicate current

health plan, provide date of event, update Section 1, if applicable.)

Move from service area Eligible Status Change

Annual IYC (Jan.1)

Status Change event*: _____________________

New county* Current health plan* Event date*_____________

Family to Single Coverage: If your employee premium share is taken pre-tax, IRC Section 125 restricts midyear

changes to your coverage.

My employee-required premium contribution is deducted: (Check one box, list event date and update Section 1.)

Pre-tax and my employee premium contribution has increased significantly

Pre-tax eligible Status Change event

: Event ______________________

Pre-tax change to single during annual It’s Your Choice (Jan. 1)

Post-tax (midyear changes to coverage level can be made at any time)

Event date*______________________________________________

For more information on IRC

Section 125 limitations, see

the Information Pages Section

5 attached to this application

If adding or removing

dependents, please list them in

Section 3.

If removing dependents, please

list their address in Section 3 if

it is different from your own.

Status Change events may include birth, adoption, marriage, creation of DP, divorce or termination of DP.

State and some WPE employees (see

your employer) may select the HDHP

(High Deductible Health Plan) as explained

in the Information Pages Section 4.

ET-2301 (Rev. 11/3/14) Page 2

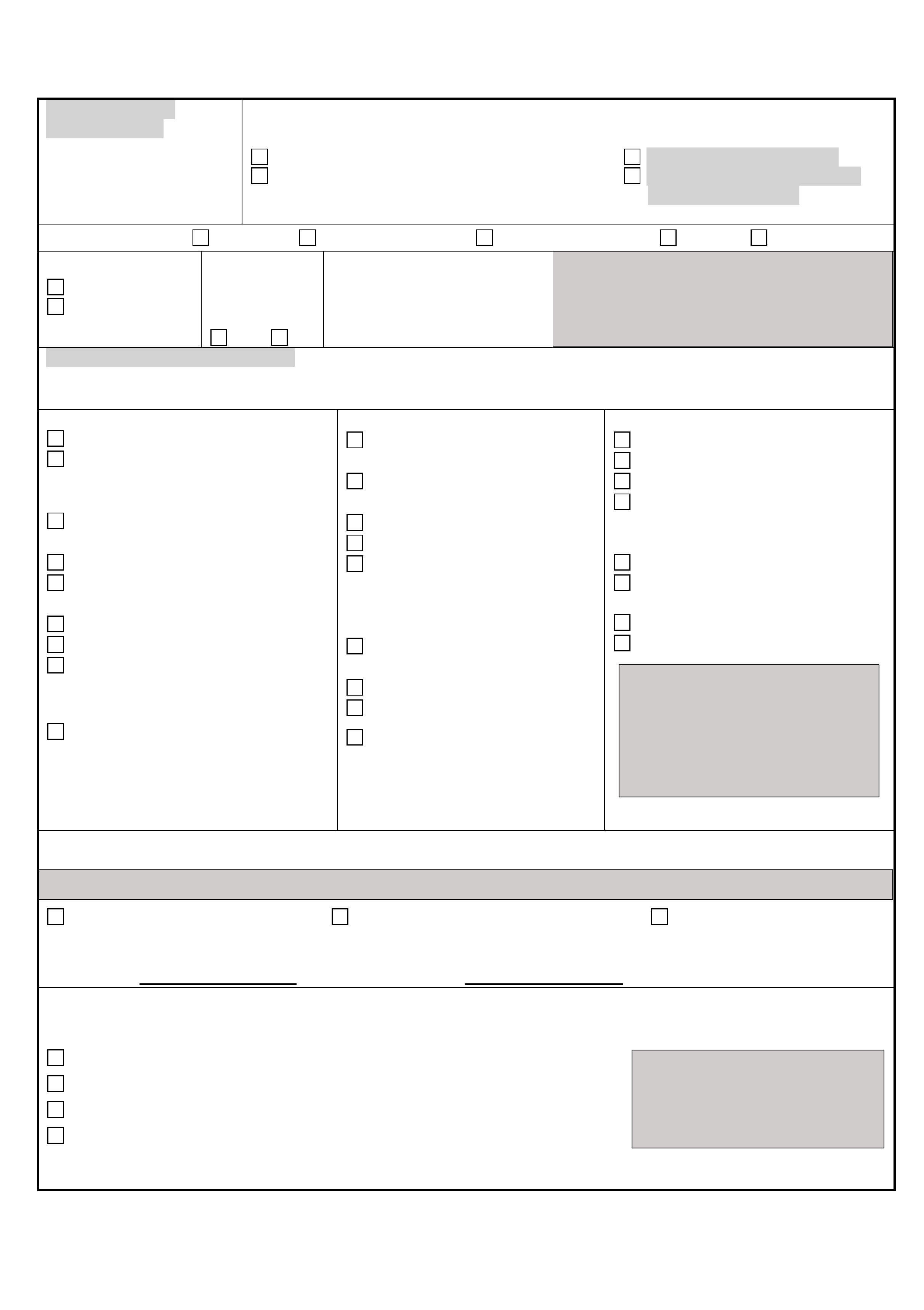

MID_____________________ SSN______________________

Cancel Coverage – If your premiums are deducted on a post-tax basis, you may cancel coverage at any time. If

they are deducted on a pre-tax basis, you must provide the event allowing midyear cancellation. If transfering

family coverage to your spouse/DP, please indicate the IRC Section 125 Status Change Event below.

Retiree sick leave depleted—effective end date of coverage ____________________

My Premiums are Deducted:

Pre-tax (select an event below)

Post-tax (no event required)

I am terminating employment I and all eligible dependents became eligible for

I am going on unpaid leave of absence and enrolled in other coverage

My employee premium share has increased significantly

Spouse/DP to Spouse/DP Transfer

Annual It’s Your Choice Enrollment (Jan. 1)

Status Change Event* ____________________

Additional Information* Is any dependent listed under Section 3 your or your spouse/DP’s grandchild?

No Yes If yes, name of parent_______________________________________________________

Medicare Information/Update Medicare Information*

Are you or any person you insure, covered by Medicare?

No Yes

If yes, list the eligibility reason, names of insured and Medicare Parts A and B effective dates.

Medicare eligible reason: Age Disabled End stage renal disease

Name:___________________ HIC# ___________________ Dates: Part A___________ Part B____________

Name:___________________ HIC# ___________________ Dates: Part A___________ Part B____________

Other Health Insurance Coverage/Update* (State employees are ineligible for HDHP if they have other coverage.)

Do you or any of your dependents have other medical or health care Flexible Spending Account coverage that has

a balance available as of the effective date of this coverage? (excludes dental or vision)

No Yes If yes, complete the following.

Name of company______________________ Policy No. __________________ Group No. ________________

Name(s) of Insured:__________________________________________________________________________

6.SIGNATURE* (Read the Terms and Conditions on Page 4 and sign and date the application.)

By signing this application, I apply for the insurance under the indicated health insurance contract made available

to me through the state of Wisconsin and I have read and agreed to the Terms and Conditions. A copy of this

application is considered as valid as the original. In addition, to the best of my knowledge, all statements and

answers in this application are complete and true. Providing false information is punishable under Wis. Stat.

§943.395. Additional documentation may be required by ETF at any time to verify eligibility.

Sign and date Here & Date Signed (mm/dd/yy)

return to employer (ETF

for Retirees/Continuants) _______________________________________ ___________________

7.EMPLOYER COMPLETES (Coding instructions are in the Employer Health Insurance Administration Manual.)

EIN 69-036- Employer name Payroll representative e-mail

Group number

Employee

type

Coverage

code

Health plan name/suffix

Employment status: Full time Part time LTE Employee deductions: Pre-tax Post-tax

Previous service – complete information

1. Are you a WRS participating employer? Yes No (If yes, answer remaining questions)

2. Previous service check completed? Yes No

3. Did employee participate in the WRS prior to being hired by you? Yes No

4. Source of previous service check? Online Network for Employers (ONE) ETF

Date WRS eligible employment or

graduate appointment began or hire

date

Employer received

date

Event date Prospective coverage date

Payroll representative signature Phone number

( )

ET-2301 (Rev. 11/3/14) Page 3

MID_____________________ SSN______________________

TERMS AND CONDITIONS

1. To the best of my knowledge, all statements and answers in this application are complete and true. I understand that if I provide

false or fraudulent information, misrepresentation or fail to provide complete or timely information on this application, I may face

action, including, but not limited to, loss of coverage, employment action, and/or criminal charges/sanctions under Wis. Stat. §

943.395.

2. I authorize the Department of Employee Trust Funds (ETF) to obtain any information from any source necessary to administer

this insurance.

3. I agree to pay in advance the current premium for this insurance, and I authorize my employer (the remitting agent) to deduct

from my wages or salary an amount sufficient to provide for regular premium payments that are not otherwise contributed. The

remitting agent shall send the premium on my behalf to ETF.

4. I understand that eligibility for benefits may be conditioned upon my willingness to provide written authorization permitting my

health plan and/or ETF to obtain medical records from health care providers who have treated me or any dependent(s). If

medical records are needed, my health plan and/or ETF will provide me with an authorization form. I agree to respond to

questions from health plans and ETF, including, but not limited to, audits, in a timely manner.

5. I have reviewed and understand the eligibility criteria for dependents under this coverage and affirm that all listed dependents are

eligible. I understand that children may be covered through the end of the month they turn 26. Children may also be covered

beyond age 26 if they:

• have a disability of long standing duration, are dependent on me or the other parent for at least 50% of support and

maintenance, and are incapable of self-support; or

•

are full-time students and were called to federal active duty when they were under the age of 27 years and while they were

attending, on a full-time basis, an institution of higher education.

6. I understand that if my insured domestic partner and/or dependent child(ren) of my insured domestic partner are not considered

“tax dependents” under federal law, my income will include the fair market value of the health insurance benefits provided to my

domestic partner and/or domestic partner’s dependent child(ren). Furthermore, I understand this may affect my taxable income

and increase my tax liability.

7. I understand that it is my responsibility to notify the employer, or if I am a retiree or continuant to notify ETF, if there is a change

affecting my coverage, including but not limited to, a change in eligibility due to divorce, marriage or domestic partnership, a

change in the “tax dependent” status of my domestic partner and/or domestic partner’s dependent children, or an address

change due to a residential move. Furthermore, failure to provide timely notice may result in loss of coverage, delay in payment

of claims, loss of continuation rights and/or liability for claims paid in error. Upon request, I agree to provide any documentation

that ETF deems necessary to substantiate my eligibility or that of my dependent(s).

8. I understand that if there is a qualifying event in which a qualified beneficiary (me or any dependent(s)) ceases to be covered

under this program, the beneficiary(ies) may elect to continue group coverage as permitted by state or federal law for a maximum

of 18, 29, or 36 months, depending on the type of qualifying event, from the date of the qualifying event or the date of the notice

from my employer, whichever is later. I also understand that if continuation coverage is elected by the affected qualified

beneficiary(ies) and there is a second qualifying event (i.e, loss of eligibility for coverage due to death, divorce, marriage but not

including non-payment of premium) or a change in disability status as determined by the Social Security Administration,

continuation coverage, if elected subsequent to the second qualifying event, will not extend beyond the maximum of the initial

months of continuation coverage. I understand that timely notification of these qualifying events must be made to ETF.

9. I understand that if I am declining enrollment for myself or my dependent(s) (including spouse or domestic partner) because of

other health insurance coverage, I may be able to enroll myself and my dependent(s) in this plan if I or my dependent(s) lose

eligibility for that other coverage (or if the employer stops contributing toward that other coverage). However, I must request

enrollment within 30 days after my or my dependents’ other coverage ends (or after the employer stops contributing toward the

other coverage). In addition, if I have (a) new dependent(s) as a result of marriage, domestic partnership, birth,

acknowledgement of paternity, adoption, or placement for adoption, I may be able to enroll myself and my dependent(s) if I

request enrollment within 30 days after the marriage or effective date of the domestic partnership, or within 60 days after the

birth, acknowledgement of paternity, adoption, or placement for adoption. To request special enrollment or obtain more

information, I should contact my employer (or ETF if I am a retiree or continuant).

10. I understand that I am responsible for enrolling in Medicare Parts A and B when I am first eligible and required by this coverage,

and that as the subscriber I am responsible for ensuring my spouse, domestic partner and any other eligible dependents also

enroll in Medicare Parts A and B when they are first eligible, to ensure proper coordination of benefits with Medicare. In the

event I or any eligible dependent does not enroll in Medicare Parts A and B when first eligible and required by this group health

insurance program, I understand that I will be financially liable for the portion of claims Medicare would have paid had proper

Medicare enrollment been attained.

11. I agree to abide by the terms of my benefit plan, as explained in any written materials I receive from ETF or my health plan,

including, without limitation, the It’s Your Choice guides.

ET-2301 (Rev. 11/3/14) Page 4

Information Pages

Initial Eligibility

You must enroll online through myETF Benefits or submit this application to your employer if you are

actively employed, or to the Department of Employee Trust Funds if you are a retiree or on

continuation. Your initial enrollment period is as follows:

a) Within 30 days of your date of hire to be effective the first of the month on or following receipt

of application by the employer; or

b)

Active State Employees only – Before becoming eligible for state employer contributions

(completion of two months of state service under the Wisconsin Retirement System for

permanent or project employees). Limited Term Employees (LTE) must complete six months

of state service to be eligible for employer contributions. Employees of WISCRAFT must

complete 1,000 hours of service to be eligible for employer contributions. This does not apply

to UW unclassified faculty/academic staff.

c)

Wisconsin Public Employers’ participants only – Within 30 days prior to becoming eligible

for employer contribution as determined by your employer, not to exceed six months.

d)

Graduate Assistants only – When you are notified of your appointment, immediately contact

your benefits/payroll/personnel office for health insurance enrollment information and an

application. If eligible, you may enroll for single or family coverage in any of the available

health plans. Your benefits/payroll/personnel office must receive your application within 30

days of the date of your first eligible appointment. Your health insurance coverage will be

effective the first day of the month on or following receipt of your application by your

employer.

If this is not your first eligible appointment, you may still be eligible for the initial 30-day

enrollment period if you had a 30-day employment break in service between appointments. If

you are currently or later become an active participant under the WRS, you will not be eligible

for coverage under the graduate assistant program as a WRS participant.

e)

Retirees only – Health insurance continues automatically upon retirement. To change or

cancel your existing coverage during the open enrollment period, complete this application or

go online to myETF Benefits at myetf.wi.gov/ETFmMEBWeb/mMEB/mMEBLogon.jsp

.

Changes become effective the first of the year and cancellations are effective the end of the

month in which they are received or a future end of the month if specified. Cancellations

cannot be back-dated but can be done at any time of the year by mailing or faxing a signed

request to ETF - Retiree Services Section.

If you choose to enroll within your initial enrollment period, we recommend that you submit this

application to your employer immediately upon employment. If you missed your enrollment

opportunity there may be other enrollment opportunities available. There are no interim effective

dates, except as required by federal HIPAA law. If your application is submitted after these

enrollment opportunities, you will not be eligible to enroll until the annual It’s Your Choice Open

Enrollment period. For complete enrollment and program information, read the It’s Your Choice

Decision and Reference guides.

ET-2301 (Rev. 11/3/14) Page 5

Information Pages

1. Applicant Information

Please provide the information requested in this section as completely as possible. Please provide

physician/clinic information unless you have selected WPS/Standard Plan as your health plan.

Please provide your care system if you have selected WEA Trust NW as your health plan.

Include your e-mail address if you would like ETF to contact you by e-mail if we need to request

information related to your health coverage.

Indicate your marital status and date (single does not require a date). The effective date of a DP is

the date that ETF receives the Affidavit of Domestic Partnership (ET-2371) form; your health

application must be received within 30 days of this date if you also wish to provide health coverage

for your domestic partner (DP). If you are divorced, the entry of judgment of divorce is typically when

the judge signs the divorce decree and the clerk of courts date stamps the decree.

Personal Data Update/Correction: Please check the update box under Section 1, 2, or 3 if you are

only updating demographic information (address, SSN, birth date, marital status, gender, phone or e-

mail) for yourself, your spouse/DP, or your dependents.

2. Spouse/Domestic Partner (DP) Information

The Centers for Medicare and Medicaid Services (CMS) require that ETF report the name, SSN, birth

date, and prior name, if any, for your spouse or DP, even if they are not covered on your health

insurance. If you indicate your marital status is married or DP, you must provide this information even

if you elect single coverage. If you do not file an Affidavit of Domestic Partnership (ET-2371) form

with ETF, then you are not in a domestic partnership for purposes of health insurance, and this

information is not required for your DP. If you apply for family coverage, please also provide gender,

tax dependent status (yes or no) and physician/clinic (required for all covered individuals). If you

select WEA Trust NW, you must select a care system. Exception: you do not need to select a

physician/clinic or care system if you have elected the Standard Plan/WPS.

3. Dependent Information

If you are covering dependents other than your spouse/DP or are updating information for a currently

covered dependent in the Personal Data Update/Correction Section, please provide the information

requested.

For Rel. Code, use the following codes to describe the relationship of dependents to you:

01=Spouse 24=Dependent of Minor Dependent

15=Legal Ward 53=Domestic Partner

17=Stepchild 38=Dependent of Domestic Partner

19=Child

03=Minor Parent of Minor Dependent (This relationship is a Legal Ward, Stepchild, Child, or

Dependent of DP who is younger than age 18 and is the parent of any of your or your spouse’s/DP's

grandchildren listed as an eligible dependent on this application. Grandchildren cannot be covered on

your contract unless the parent of the grandchild is covered and is younger than age 18.)

Indicate “Yes” or “No” if any dependent older than age 26 is disabled.

Indicate “Yes” or “No” if your DP/dependent of DP is considered a “tax dependent” under federal law.

If removing adult dependents, list their address in this section if it is different from your own.

ET-2301 (Rev. 11/3/14) Page 6

Information Pages

4. Enrollment Information

New Hire Only: If you are a newly hired employee, please indicate when you want coverage to start:

1) immediately (as soon as possible) or 2) when you become eligible for the employer contribution

toward the health insurance premium. Coverage will be effective the first of the month following receipt

of the application or eligibility for the employer contribution. If you do not wish to enroll, please mark if

you: 1) decline/waive coverage or 2) decline coverage because you have other coverage.

Eligibility Reason: Please indicate your eligibility reason by indicating if you are an employee,

graduate assistant, COBRA continuant, surviving dependent of a covered employee or you are

retired and receiving an annuity.

A High Deductible Health Plan (HDHP) has a minimum annual deductible and a maximum annual

out-of-pocket limit. An HDHP generally begins paying for health care costs once the annual

deductible has been met. Preventive services mandated by federal law are not subject to the annual

deductible. For more information, please see the It’s Your Choice 2015 Decision and Reference

guides. If you are unsure if you are enrolling in an HDHP, please contact your employer or ETF.

For state employees, you may not select an HDHP if you are enrolled in a health care Flexible

Spending Account or Employee Reimbursement Account that has a balance available as of the

effective date of this coverage, even if you have a qualifying HIPAA event during the plan year.

Coverage Desired: Indicate if you wish to have single coverage (for yourself only), family coverage

(yourself and all eligible dependents), HDHP single coverage (for yourself only), or HDHP family

coverage.

Health Plan Selected: Indicate which health plan you wish to provide your health insurance. A listing

of health plans available is located in the It’s Your Choice Decision Guide.

5. Reason for Application

Indicate if you are using this application to Add Coverage (other than if you are a New Hire), Add

Dependent(s), Remove Dependent(s), Change Health Plan, Switch from Family to Single coverage,

or if you are updating or correcting personal data for yourself, spouse/DP, or dependent(s) by

selecting a reason under the appropriate heading.

If the reason is Add Coverage, Add Dependent, or Remove Dependent and none of the reasons

provided suit your situation, please select other and provide the reason as well as the event date if an

event is associated with your reason. This may result in your request being denied if the reason is not

allowed under the contract. Your employer will be notified if this is the case.

When removing a spouse and stepchildren, if any, due to divorce, the entry of judgment of divorce is

typically when the judge signs the divorce decree and the clerk of courts date stamps the decree.

Adult Dependents younger than age 19 cannot be dropped from coverage when family coverage is in

place. Once the dependent turns 19, that adult dependent can be dropped at the end of the calendar

year they turned 19 during the annual It’s Your Choice (IYC) Open Enrollment period. An adult

dependent older than 19 can be dropped or added during any IYC period.

Change Health Plan: Please indicate the event that makes you eligible to change plans, list your

new county if moving from the service area, your current health plan, and the date of the event that

qualified you to make the change.

If you are changing health plan and wish to change coverage level at the same time due to a HIPAA

qualifying event, you must submit two separate applications. The coverage level change will be

effective on the event date and the carrier change will be effective the first of the month following the

receipt of the applications which must be received within 30 days of the event.

For state employees, you may not select an HDHP if you are enrolled in a health care Flexible

Spending Account or Employee Reimbursement Account, even if you have a qualifying HIPAA event

during the plan year.

ET-2301 (Rev. 11/3/14) Page 7

Information Pages

Family to Single Coverage: To make a change from family to single coverage other than during

annual IYC, you must qualify to do so under one of the reasons provided if your health insurance

premiums are deducted pre-tax. Please select a reason from the list and provide an event date. If

your deductions are taken post-tax, please check the post-tax box.

Retiree premiums are deducted on a post-tax basis and a change from Family to Single Coverage

may be done at any time by submitting this form or by applying online through myETF Benefits at

myetf.wi.gov/ETFmMEBWeb/mMEB/mMEBLogon.jsp. The change will be effective the first of the

month following receipt of your paper or online application.

Internal Revenue Code (IRC) Section 125: If you are enrolled in a Section 125 plan for premium

conversion, medical or dependent day care coverage, then section 125 may limit your ability to make

some changes to your coverage, for example, it will prevent you from canceling coverage at any time

unless you have a change of status event. For the most part, these change of status events

correspond to HIPAA qualifying events, but in certain circumstances we will need to ask you to state

the section 125 change of status event you fall under.

Cancel Coverage: Please indicate if your health insurance premiums are deducted pre-tax or post-

tax. If you are unsure, your human resources person should be able to tell you. After indicating the

tax status of your premiums, please select a reason for your cancellation and provide the change in

status event that is allowing the cancellation if you are cancelling under IRC Section 125.

Cancellation is effective the end of the month on or following receipt of the application by ETF.

Retirees pay premiums post-tax and do not need to provide a reason for cancellation. If you wish to

cancel on a future date, please provide that date on the line provided under Cancel Coverage.

Otherwise, coverage will end at the end of the month following receipt of your request.

Additional Information: Indicate “Yes” or “No” and list the name of your or your spouse/DP’s

grandchild’s parent.

Medicare Information/Update Medicare Information: Indicate “Yes” or “No” if you or any of your

dependents (including your spouse/DP) are covered by Medicare, and list their names. Provide the

Medicare eligibility reason, Health Insurance Claim Number (HIC#), and date(s) Medicare Part A

and/or Part B are effective. This information can be found on the Medicare card of the Medicare

eligible person. Please send a copy of the Medicare card and the Medicare Eligibility Statement

(ET-4307) to ETF.

If you are an active employee and your age 65 or older domestic partner is covered on your

insurance, they must be enrolled in Medicare parts A and B. Medicare will be the primary payer for

your Medicare eligible domestic partner’s medical expenses.

Other Health Insurance Coverage/Update: Please provide any information regarding any other

group health insurance coverage under which you or your dependent(s) (including your spouse/DP)

are covered. For state employees, you are not eligible for the HDHP if you have other health

insurance coverage (including, but not limited to, coverage from a spouse's plan, Medicare,

TRICARE, or a health care Flexible Spending Account or Employee Reimbursement Account).

Note: “Other coverage” does not include supplemental insurance (examples: EPIC or DentalBlue).

For State employees, other coverage does include health care Flexible Spending Accounts or

Employee Reimbursement Accounts for purposes of HDHP eligibility. If you have an available

balance in a health care FSA or ERA as of the effective date of HDHP coverage, then you are

ineligible for HDHP coverage.

During Annual It’s Your Choice, if you are not making any changes to your coverage you do not

need to submit an application.

ET-2301 (Rev. 11/3/14) Page 8

Information Pages

6. SIGNATURE

Your signature is required. Applications without a signature will be rejected.

Read the Terms and Conditions on Page 4 of this application packet. Only after you have read this

should you sign, date, and submit your application to your employer (or to ETF, if you are a retiree or

continuant).

1.

When submitting an application for any reason, you are required to read the Terms and

Conditions on the last page of this application and sign and date the application. By signing

the application, you are acknowledging that you have read and agree to the Terms and

Conditions.

2. Make a copy of the application for your records and submit the original application to your

payroll or benefits representative. If you are a retiree or continuant, please submit your

application directly to ETF.

3. Your employer will complete Section 7 and provide a copy of the application to you. For

retirees or continuants, ETF will complete Section 7 and provide a copy of the application to

you.

ET-2301 (Rev. 11/3/14) Page 9

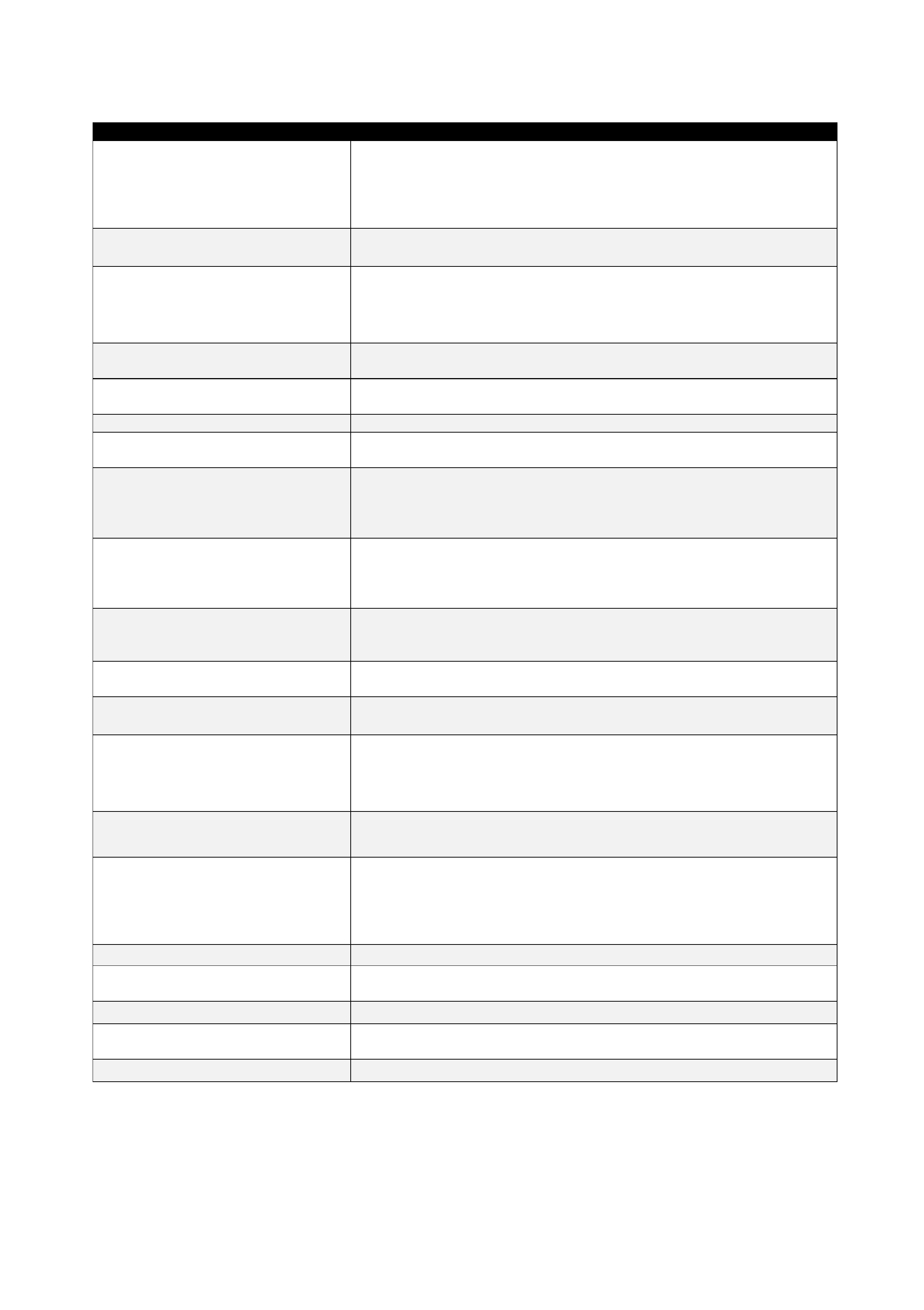

4. Documentation Requirements

Reason for Change or Enrollment Type of Documentation

Loss of Other Coverage

Certificate of Creditable Coverage from health plan; COBRA notice if

coverage end date, covered individuals, and health plan are indicated;

or letter from administrator if self-funded health plan. If loss of

employer premium contributions, letter from employer indicating they

no longer contribute towards their employee’s premium.

Divorce

Family to single

No documents required but ETF may request per the Terms and

Conditions on Page 4 of this application, Number 7.

Divorce

Family coverage remains in place

when more dependents than

spouse/stepchildren covered

Copy of Continuation/Conversion Notice (ET-2311) sent to ex-spouse

of the subscriber (ETF may request copy of divorce decree from clerk

of courts showing date of entry of divorce if needed per the Terms and

Conditions on Page 4 of this application, Number 7).

Adoption Recorded copy of court order granting adoption or letter of placement

for adoption.

Legal Ward

Court Order (Letters of Guardianship) granting permanent

guardianship of person.

National Medical Support Notice Copy of National Medical Support Notice.

Paternity Court order declaring paternity, or Voluntary Paternity

Acknowledgement (HCF-5024) filed w/DHS, or birth certificate.

Creating a domestic partnership

Copy of Acknowledgement Letter (ET-2373) indicating effective date

of domestic partnership submitted to employer by employee. Health

application adding DP should be submitted to employer when Affidavit

of Domestic Partnership (ET-2371) is submitted to ETF.

Cancel coverage due to

enrollment in other health insurance

coverage when premium

contributions are deducted pre-tax

Copy of medical ID card or letter from health plan indicating effective

date of other coverage. Must be received within 30 days of enrollment

in other coverage.**

Family to single because all

dependents enrolled in other

coverage

Same rules as Cancel above.**

Birth

Original birth certificate not required. ETF may request documentation

per the Terms and Conditions on Page 4 of this application, Number 7.

Marriage

Original marriage certificate is not required (ETF may request per the

Terms and Conditions on Page 4 of this application, Number 7).

Ending a domestic partnership

Affidavit of Termination of Domestic Partnership (ET-2372). (ETF

may request copy of marriage certificate if marriage is reason for

termination of domestic partnership per the Terms and Conditions on

Page 4 of this application, Number 7.)

Change of address/telephone

None (ETF may request documentation per the Terms and Conditions

on Page 4 of this application, Number 7.)

Eligible and enrolled in Medicare

Copy of Medicare card and Medicare Eligibility Statement (ET-4307).

(Note: If you are on COBRA Continuation and the subscriber or

dependents become Medicare eligible after the COBRA effective

date, subscriber or dependent(s) is no longer eligible to continue on

COBRA.)

Death Original death certificate.

Legal change of name (other than

due to marriage or divorce)

Copy of court order.

Social Security number change Copy of card or letter from Social Security Administration.

State retiree re-enroll Same as loss of other coverage and an ET-4317. During IYC, no

documentation required.

Disabled, age 26+ Copy of letter from health plan approving disabled status

Documentation Required/Must Be Submitted to ETF.

**Does not apply to retirees.

ET-2301 (Rev. 11/3/14) Page 10