Fillable Printable Life Insurance Application Form Template

Fillable Printable Life Insurance Application Form Template

Life Insurance Application Form Template

4929L-1197 (Series 0798) -1- LA4929-CA_1102

Life Insurance Application

Application To:

United of Omaha Life Insurance Company

■ ATTN: Life Agency: Mutual of Omaha Plaza, Omaha, NE 68175

■ ATTN: Life Brokerage: P.O. Box 2476, Omaha, NE 68103-2476

For

■ Life Insurance ■ Flexible Premium Variable Universal Life Insurance

■ Adult Life ■ Additional Insured Rider (AIR)

■ Juvenile Life ■ Specified Amount Increase

To The Agent/Broker:

■ Tear off the Notice of Exchange of Information, Summary of Rights Under the Fair Credit Reporting Act and give it to the

Applicant.

■ Have Authorization To Release Information on reverse side of this page signed and dated.

■ Assure that all applicable questions in Part I and Part II are answered in clear printed fashion.

■ Complete Nonmedical Supplement in all cases.

■ Be sure the application is signed by the Proposed Insured(s) and the Applicant if other than Proposed Insured(s).

■ Any changes should be initialed by the Proposed Insured(s) and, if applicable, the Applicant.

■ Use age last birthday.

■ Always provide the attached Temporary Life Insurance Agreement and Receipt when you accept a premium.

Premium Acceptance Guidelines:

Premium should only be accepted if:

(a) Questions 1, 2, 3 and 4 on the Temporary Life Insurance Agreement and Receipt form are answered “No.”

(b) The Temporary Life Insurance Agreement and Receipt form is signed, dated and witnessed by all parties indicated on

the form on the day the application is taken.

(c) A full modal premium is collected at the time of application unless the Bank Service Plan (BSP) is used, in which case

two BSP premiums should be collected.

(d) The total amount of insurance applied for does not exceed $500,000.

4929L-1197 (Series 0798) -2- LA4929-CA_1102

Part I of Application for Life Insurance to

United of Omaha Life Insurance Company

A. General Questions

1 Proposed Insured’s Name: _______________________________ Former Name (if applicable): ________________________

2 Home Phone Number: ( )__________________________________ Best Time to Call: _________ a.m. _________ p.m.

3 Legal Residence Address: _________________________________________________________________________________

Street No., Apt. No. City, State ZIP

4 Mailing Address: __________________________________________________________________________________________

Street No., Apt. No. City, State ZIP

5 Mail Premium Notices to: ■ Residence ■ Owner ■ Business

Address: _________________________________________________________________________________________________

Street No., Apt. No. City, State ZIP

6 Sex: ■ M ■ F Age: __________ Birth Date:____/____/____ Birthplace (state): __________________________

7 Social Security Number: __________________ Driver’s License Number: ____________________ State of Issue: _______

8 Are you a U.S. citizen? ■ Yes ■ No If “No,” date of arrival in U.S. ____________________________________________

Do you have an alien registration receipt “Permanent Visa”? ■ Yes ■ No If “Yes,” Permanent Visa No.: ________________

9 Occupation: ___________________________________________ Duties: __________________________________________

Businessowner? ■ Yes ■ No Retired Military? ■ Yes ■ No Active Duty? ■ Yes ■ No

If “Yes,” are you on flying status or receiving hazardous duty pay? ■ Yes ■ No

If “Yes,” explain type of duty or type of aircraft: _______________________________________________________________

10 Name of your firm or employer: ____________________________________________________________________________

11 Business Phone Number: ( )_______________________________ Best Time to Call: _________ a.m. _________ p.m.

12 Local Business Address: __________________________________________________________________________________

Street No., Apt. No. City, State ZIP

13 Do you use tobacco in any form? ■ Yes. What form? ____________________________________ No. per day: _________

■ No. ■ Never Used. ■ Stopped on _____/_____/_____

14 Applicant/Owner Name (if different from Proposed Insured or if Proposed Insured is under Age 15):

Address: _______________________________________________________________________________________________

Street No., Apt. No. City, State ZIP

Relationship to Proposed Insured:_________________________Social Security No. (or Taxpayer ID No.): _______________

15 Complete only if Spouse/Children (must be full time student if over age 19) are Proposed for Insurance:

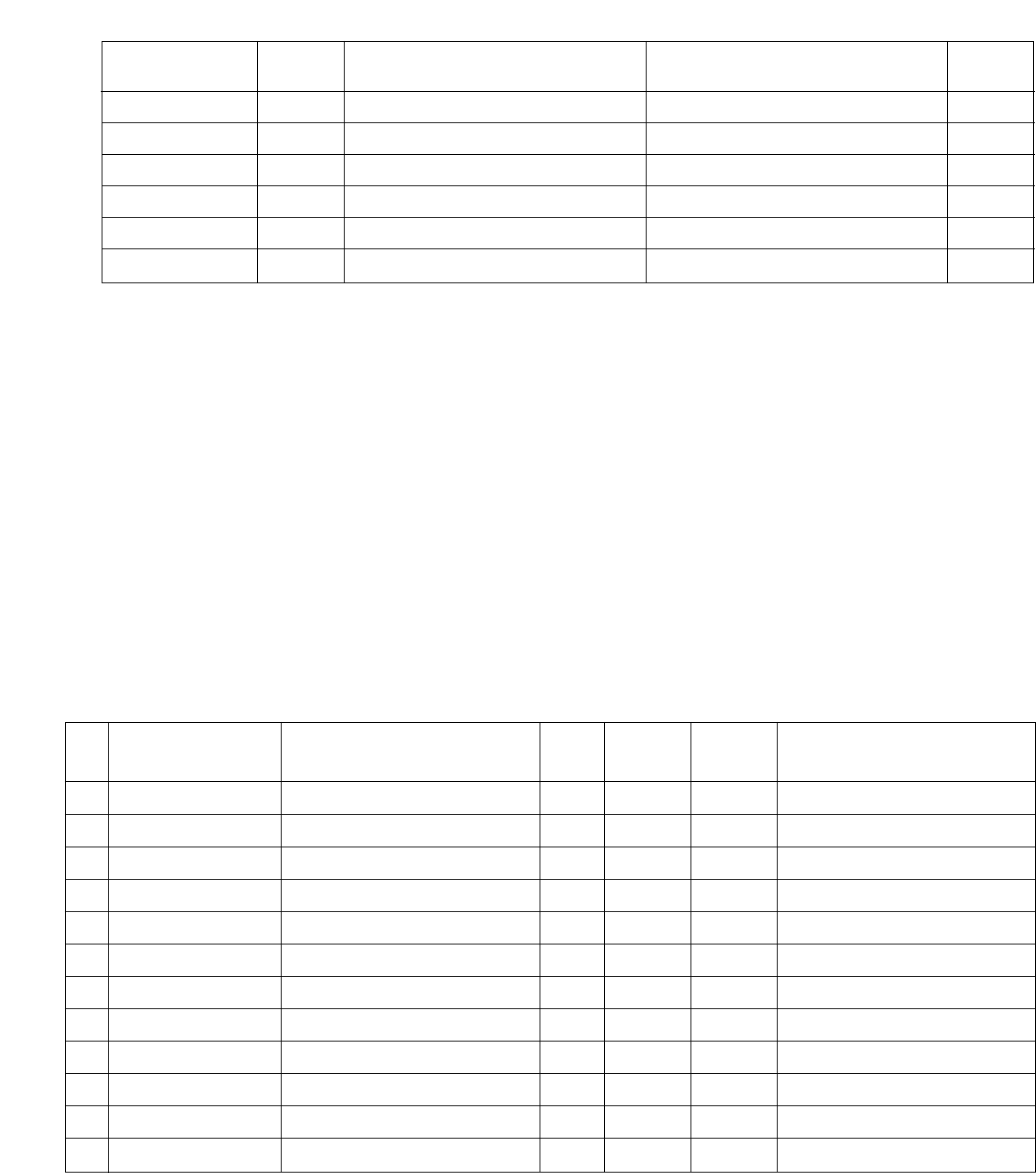

First Name, Middle Relationship to Birth

Initial and Last Name SSN No. Proposed Insured Date Age Sex Ht. Wt.

16 Spouse’s Occupation: __________________________________ Birthplace (state): _________________________________

Income: $_________________ If self-employed, income after expenses and before taxes: $_________________

Driver’s License Number: ________________________________ State of Issue: ____________________________________

17 Is spouse a U.S. citizen? ■ Yes ■ No If “No,” date of arrival in the U.S. ______________________________________

Does spouse have an alien registration receipt “Permanent Visa”? ■ Yes ■ No

If “Yes,” Permanent Visa Number: ____________________________________

18 Does spouse use tobacco in any form? ■ Yes. What form? _______________________________ No. per day: _________

■ No. ■ Never Used. ■ Stopped on _____/_____/_____

4929L-1197 (Series 0798) -3- LA4929-CA_1102

19 Do all family members proposed for insurance live with the Proposed Insured? ■ Yes ■ No If “No,” explain and give

name and phone number where family member can be contacted _______________________________________________

20 Plan Information

a. Plan of Insurance: _____________________________________________________

Premium

Amount: ________________ $ __________________

b. ■ Addition to Existing Policy No.: ________________________________________

Amount: ________________ $ __________________

c. Death Benefit Option:

■ Option 1: Accumulation Value included in Specified Amount

■ Option 2: Accumulation Value in addition to Specified Amount

d. I elect the Automatic Premium Deduction Option.

(Not available with all plans) ■ Yes ■ No

Amount or No.

e. Riders: of Units (if applicable)

(Please Note: Not all riders are available with all plans)

■ Waiver of Premium or Disability _______________ $___________________

■ Accidental Death Benefit _______________ $___________________

■ Guaranteed Issue Benefit _______________ $___________________

■ Children’s Rider _______________ $___________________

■ Spouse (indicate type of coverage) _______________ $___________________

■ Additional Insured Rider (Self, Spouse) _______________ $___________________

■ Other Insured Rider _______________ $___________________

■ Other _______________ $___________________

f. Amount Collected Explanation of Amount Collected Mode Total Premium

(Cash with App):

$ $

21 List all Life Insurance now in force or pending on any Proposed Insured(s). If none, write “None.” Have you had or do you

intend to have any life insurance policy replaced, converted, reduced, reissued, subjected to borrowing, or otherwise

discontinued because of this application? If “Yes,” so indicate below.

Policy Face ADB To Be 1035

Company Number Amount Pending Amount Replaced, etc. Exchange?

_________________________________________________________________________ ■ Yes ■ No ■ Yes ■ No

_________________________________________________________________________ ■ Yes ■ No ■ Yes ■ No

_________________________________________________________________________ ■ Yes ■ No ■ Yes ■ No

_________________________________________________________________________ ■ Yes ■ No ■ Yes ■ No

_________________________________________________________________________ ■ Yes ■ No ■ Yes ■ No

22 Life Insurance Beneficiary (Give full names and relationship).

Note: Unless you specify otherwise, payments will be shared equally by all primary beneficiaries who survive the Insured

or, if none, by all contingent beneficiaries who survive the Insured. The right to change the beneficiary is reserved unless

otherwise stated.

■ See Attached Beneficiary Designation

Primary Beneficiary(ies)

Name _________________________________________ Relationship _____________________ SSN No. _______________

Name _________________________________________ Relationship _____________________ SSN No. _______________

Contingent Beneficiary(ies):

Name _________________________________________ Relationship _____________________ SSN No. _______________

Name _________________________________________ Relationship _____________________ SSN No. _______________

23 Complete only for PRD or Association Group or Franchise Coverage:

Full Name of Group/Organization _______________________________________ Date Joined _____________________

Group/Membership No.: _________________ Relationship to above: ■ Shareholding Member

■ Dues-paying Member ■ Other _______________________________________________________

THIS BOX FOR ADMINISTRATIVE PURPOSES ONLY

4929L-1197 (Series 0798) -4- LA4929-CA_1102

Part II of Application for Life Insurance — Nonmedical Supplement

Please Print. All Questions Relate to Anyone Proposed for Insurance.

Wisconsin Residents: AIDS (HIV) test results received at an anonymous counseling and testing site need not be disclosed.

1 Name, address and telephone number of personal physician of each person proposed for insurance:

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

(a) Date last seen: _______________________________________________________________________________________

(b) State reason, findings and treatment: ____________________________________________________________________

____________________________________________________________________________________________________

____________________________________________________________________________________________________

2 Name and address of physician most recently consulted by each person proposed for insurance: _____________________

_______________________________________________________________________________________________________

(a) Date:___________ (b) State reason, findings and treatment _______________________________________________

3 Have you, or any person proposed for insurance, ever been told that you had, or have you consulted or been

treated by a physician or licensed practitioner for any of the following:

YES NO

(a) Any disease or abnormal condition of the heart, circulatory system or blood vessels, high

blood pressure, rapid pulse, rheumatic fever, murmur, coronary artery disease, chest pain,

angina or stroke? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ■ ■

(b) Any disease of the lungs or respiratory system, including tuberculosis, asthma, bronchitis,

emphysema or shortness of breath? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ■ ■

(c) Any digestive system disease, including stomach or duodenal ulcer, indigestion, stomach

pain, liver or gallbladder disease, colon or rectal disorder? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ■ ■

(d) Any genitourinary system disease including albumin, blood or sugar in urine, kidney

infection or stones, tumor or disease of the prostate, testis, breasts, uterus or ovaries? . . . . . . . . . . . . . . . . ■ ■

(e) Any nervous, brain or mental disorder, convulsions, dizziness, headaches, epilepsy, nervous

breakdown or paralysis? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ■ ■

(f) Any bone or joint disorder, arthritis or rheumatism, bodily deformity, back or spinal disorder? . . . . . . . . . . . ■ ■

(g) Any disease or impairment of vision or hearing?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ■ ■

(h) Gout, diabetes, thyroid or other glandular disorder, cancer, tumor or blood disorder other

than AIDS or AIDS Related Complex (ARC). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ■ ■

4 Have you, or any person proposed for insurance, ever been diagnosed as having Acquired Immune

Deficiency Syndrome (AIDS) or AIDS Related Complex (ARC), caused by the HIV infection, or

been treated for AIDS or ARC by a physician or licensed practitioner? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ■ ■

5 During the past 10 years, have you, or any person proposed for insurance:

(a) had any illness, injury, surgery, hospitalization, medical examination or care not listed above? . . . . . . . . . . ■ ■

(b) had or received treatment for any unexplained fever, fatigue or chronic cough? . . . . . . . . . . . . . . . . . . . . . . . ■ ■

(c) had any X-rays, electrocardiograms, blood or other studies, except for an HIV test?. . . . . . . . . . . . . . . . . . . . ■ ■

(d) been advised by a physician to have a surgical operation? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ■ ■

(e) been advised by a physician to limit your use of alcohol? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ■ ■

6 Are you, or any person proposed for insurance, now taking any medication prescribed

by a physician? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ■ ■

7 During the last 10 years, have you, or any person proposed for insurance:

(a) used alcohol or other drugs to a degree that required treatment or advice from a physician or

other licensed practitioner? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ■ ■

If “Yes,” has use been discontinued? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ■ ■

(b) been or are currently a member of Alcoholics Anonymous or Narcotics Anonymous? . . . . . . . . . . . . . . . . . . . ■ ■

8 If pregnant, enter approximate delivery date:___________________________________________

9 Height: _______________ft. ______________ins. Weight: ______________________lbs.

Weight change during last 12 months: Lbs. Gained: ___________ Lost: __________

4929L-1197 (Series 0798) -5- LA4929-CA_1102

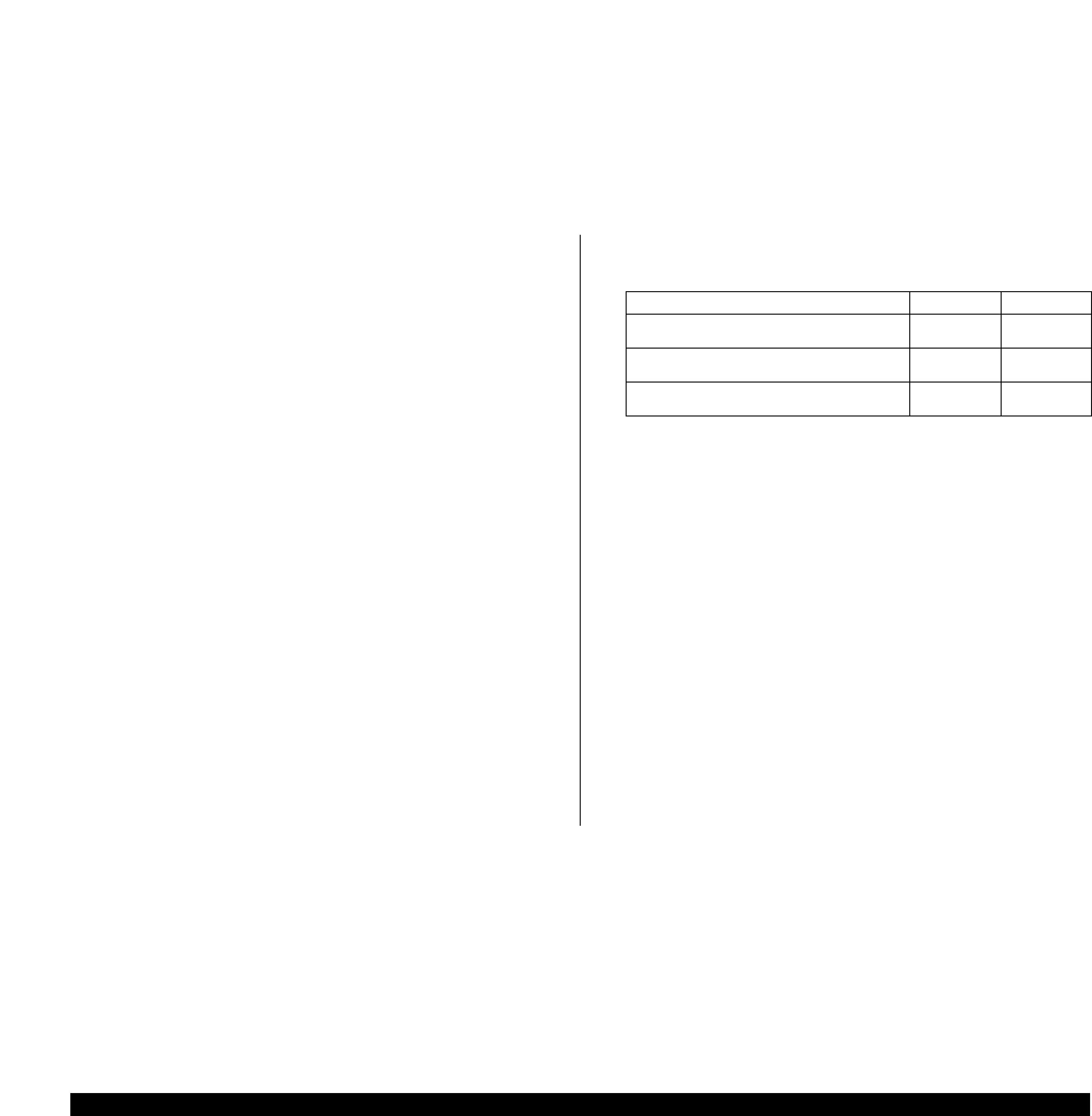

10 Family Age if If Living, If Deceased, Age at

History Living Present Health Cause of Death Death

Father

Mother

Sibling

Sibling

Sibling

Sibling

11 Have you, or any person proposed for insurance: YES NO

(a) ever been declined, postponed, limited, denied reinstatement or asked to pay an extra

premium by any insurance company? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ■ ■

(b) engaged in any hazardous sports or activities such as motor vehicle racing, boat racing,

parachuting, hang gliding, skydiving, skin diving or scuba diving within the last three years,

or plan such activity in the next six months?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ■ ■

(c) any intention of traveling or living outside the USA or Canada in the next two years? . . . . . . . . . . . . . . . . . . . ■ ■

(If “Yes,” complete foreign travel questionnaire.)

(d) flown as a civilian pilot, student pilot or crew member within the last three years, or plan

such activity in the next 12 months? (If “Yes,” complete Aviation Supplement).. . . . . . . . . . . . . . . . . . . . . . . ■ ■

(e) within the last 5 years: (1) been convicted of two or more moving violations or driving

under the influence of alcohol or drugs or (2) had a driver’s license suspended or revoked? . . . . . . . . . . . . . ■ ■

(f) been convicted of a felony within the last 10 years?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ■ ■

If any of the above questions are answered “Yes,” give complete details in Part III

Part III of Application for Life Insurance —

Additional Details and Explanations

(Use for any explanation where space is insufficient)

Ques. Condition, Injury, Symptom of Ill Health Mo. Degree of Name, Address, Zip of Hospital

No. Name or Findings of Examination and Duration Recovery and Attending Physician

(If Operation Performed, State Type) Yr.

4929L-1197 (Series 0798) -6- LA4929-CA_1102

Acknowledgement. I received a Notice of Exchange of Information, a Fair Credit Reporting Act Notice, a Notice of Information

Practices, a Summary of Rights Under the Fair Credit Reporting Act, and a Life Insurance Buyer’s Guide before completing this

application.

Agreements. I, the undersigned, and the undersigned Agent(s)/Broker(s) certify that we have read the completed application

or have had it read to us and agree to the following:

1 (This statement is only applicable to Variable Universal Life products.) I understand that the policy’s accumulation

value in the Variable Account is based on the investment experience in that account and will increase or decrease

daily. I understand that the amount of the death benefit may be fixed or variable, depending on the investment

experience of the Variable Account.

2 All answers in this application: (a) are true and complete to the best of my knowledge and belief, (b) will be relied on

to determine insurability and (c) which are incorrect or misleading, may void the application effective the issue date.

3 If the full initial premium is paid on the date of the completed life insurance application and I am eligible for the

policy applied for in accordance with the underwriting standards of United of Omaha in effect on the date of the

application, the life policy will be in effect from the date of the application.

4 If any Proposed Insured for insurance is not eligible for the insurance applied for, or if there has been any change in

either my health or habits or the answers to any of the questions in the application prior to policy delivery, I agree

that no policy of any kind will be in effect, except for coverage provided by the Temporary Life Insurance Agreement

and Receipt.

5 In no event will any benefits be paid for the same loss under both the Temporary Life Insurance Agreement and

Receipt and any policy issued from this application.

6 If the Applicant is other than the Proposed Insured, the policy will be owned by the Applicant.

7 No Agent/Broker can: (a) waive or change any receipt or policy provision or (b) agree to issue a policy.

I have: (a) read the Agreements section and the receipt(s) and (b) read and approved the answers as recorded.

Signed at _______________________________________ Date___________________________________________

City State

________________________________________________ ______________________________________________

Signature of Proposed Insured (Age 15 and Over) Signature of Spouse (if a Proposed Insured)

________________________________________________ ______________________________________________

Signature of Parent or Guardian (if insured under age 15) Signature of Applicant/Owner/Trustee (if other than Proposed Insured)

___________________________________________ ________________ __________________________________________

Signature of Agent/Broker Date Print or Stamp Agent/Broker Name

___________________________________________ ________________ __________________________________________

Signature of Agent/Broker Date Print or Stamp Agent/Broker Name

Agent/Broker Statement:

1 Do you have any reason to believe the policy applied for has replaced or will replace any

life insurance policy? (If “Yes,” fulfill all state requirements.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ■ Yes ■ No

2 In the presence of the Proposed Insured/Spouse have you asked each question exactly as

written and recorded the answers completely and accurately? (If “No,” explain.) __________________ ■ Yes ■ No

_______________________________________________________________________________________________________

___________________________________________ ________________

Signature of Agent/Broker Date

___________________________________________ ________________

Signature of Agent/Broker Date

4929L-1197 (Series 0798) -7- LA4929-CA_1102

Agent’s/Broker’s Report

(Must be completed by the agent/broker who obtained the application on the Proposed Insured named below.)

1 Is Proposed Insured self-supporting? ■ Yes ■ No If “No,” provide the following information about the person on whom

Proposed Insured is dependent:

Full Name _______________________________ Address ____________________________ Birth Date __________________

Amount of insurance carried with all companies $ ____________ If none, state why _________________________________

2 If Proposed Insured used different name in past, give

previous full name ________________________________

3 (a) Are you related to Proposed Insured or Owner?

■ Yes ■ No

If “Yes,” state relationship ______________________

(b) How long have you known Proposed Insured?______

(c) How long have you known Proposed Owner?_______

4 When did you last see Proposed Insured?_____________

5 Did you ask Proposed Insured or Owner every question

as printed (if “No,” explain below)?

■ Yes ■ No

6 Do you have any information not presented in this

application which might in any way affect this risk (if

“Yes,” explain below)? ■ Yes ■ No

7 Proposed Insured’s Annual Income $_________________

■ Exact ■ Estimated

8 What is the purpose of this insurance? Give details

including financial information (for amounts of $500,000

or more, financial statements may be requested)

________________________________________________

9 (a) Is a medical exam to be completed? ■ Yes ■ No

(b) Name of examiner or paramedical facility _________

________________________________________________

10 Previous residence and business addresses of Proposed

Insured for past five years.

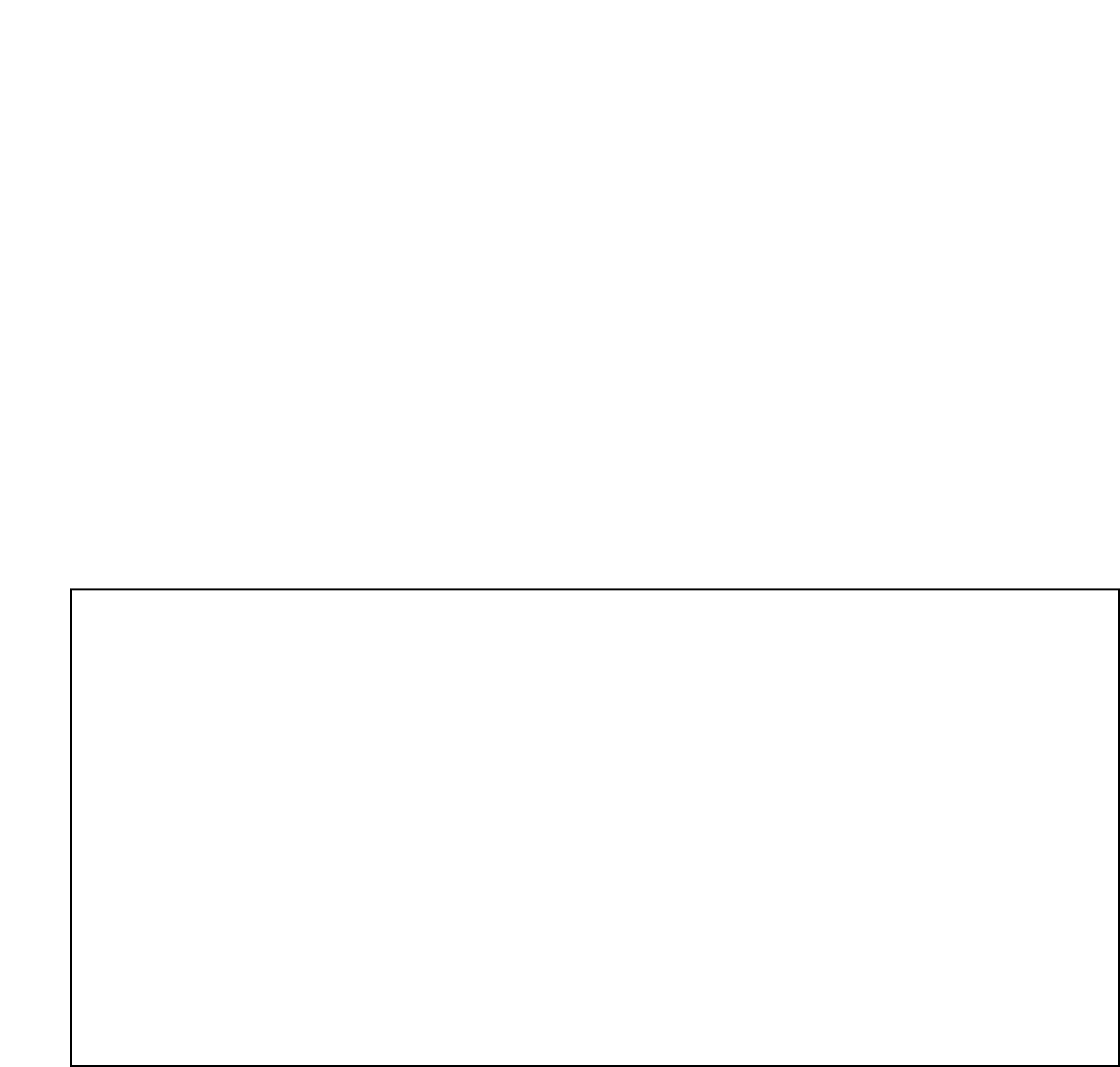

Address From To

11 Is another policy requested based on this application?

■ Additional policy Plan _____________________

■ Alternate policy Amount $ ________________

Owner (if different) ________________________________

Beneficiary (if different) ____________________________

12 Is Proposed Insured applying for insurance with any

other company (if “Yes,” give details)? ■ Yes ■ No

________________________________________________

________________________________________________

13 To the best of your knowledge will this policy replace any

existing life insurance or annuity (if “Yes,” give details

and fulfill all state requirements)? ■ Yes ■ No

________________________________________________

________________________________________________

Details:

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

Agent(s)/Broker(s) to Receive Commission and Volume Credit for This Application

Agent’s/Broker’s Full Name Agent’s/Broker’s Production No. % Credit

1 _______________________________________________________________________________________________________

2 _______________________________________________________________________________________________________

I hereby certify that I have truly and accurately recorded the information furnished by the Owner and/or Proposed Insured.

___________________________________________________________________________________________________________

Date Signature of Agent(s)/Broker(s) Agent(’s)/Broker(’s) Name (Please Print)

___________________________________________________________________________________________________________

Name of Division Office/Wholesaler Name of Assistant Wholesaler (Brokerage Only)

Authorization To Disclose Personal Information

Meanings of Terms

“Medical Persons and Entities” means: all physicians, medical or dental practitioners, hospitals, clinics, pharmacies,

pharmacy benefit managers, other medical care facilities, health maintenance organizations and all other providers of

medical or dental services.

“Personal Information” means: all health information, such as medical history, mental and physical condition, prescription

drug records, drug and alcohol use and other information such as finances, occupation, general reputation and insurance

claims information about me and, if my children are proposed insureds, my children also. Personal Information does not

include Psychotherapy Notes.

“Psychotherapy Notes” means: notes recorded by a health care provider who is a mental health professional documenting or

analyzing the contents of conversation during a counseling session, which notes are separated from the rest of the person’s

medical record. Certain information, such as that relating to prescriptions, diagnosis and functional status, is not included in

the term Psychotherapy Notes.

“Specified Companies” means:

• The group of companies which presently includes Mutual of Omaha Insurance Company, United of Omaha

Life Insurance Company, United World Life Insurance Company, Companion Life Insurance Company,

Exclusive Healthcare, Inc., additional companies which may become part of this group of companies and

their successors.

• Other persons and entities which act on behalf of those companies to provide services to them.

Authorization to Disclose

I authorize the Medical Persons and Entities, the Specified Companies, employers, consumer reporting agencies and other

insurance companies to disclose Personal Information about me and, if my children are proposed insureds, about my children

to United of Omaha Life Insurance Company.

Purposes

The Personal Information will be used to determine my or my children’s eligibility for insurance and to resolve or contest any

issues of incomplete, incorrect or misrepresented information on this application which may arise during the processing of my

application or in connection with claims for insurance benefits.

Potential For Redisclosure

If the person or entity to whom Personal Information is disclosed is not a health care provider or health plan subject to federal

privacy regulations, the Personal Information may then be subject to further disclosure by that person or entity without the

protections of the federal privacy regulations. We have contracts with persons and entities which act on our behalf which

require them to maintain the confidentiality of the Personal Information.

Failure to Sign

I understand that I may refuse to sign this authorization. I realize that if I refuse to sign, the insurance for which I am applying

will not be issued.

Inspection and Copying

I have the right to inspect or copy Personal Information disclosed under this authorization.

MLU23202 -8-

Authorization To Disclose Personal Information (continued)

Expiration and Revocation

Unless revoked earlier, this authorization will remain in effect for 24 months from the date I sign it. I understand that I may

revoke this authorization at any time, by written notice to:

ATTN: Individual Underwriting

Mutual of Omaha

Mutual of Omaha Plaza

Omaha, NE 68175-0001

I realize that my right to revoke this authorization is limited to the extent that any of the Specified Companies has taken

action in reliance on the authorization or the law allows any of the Specified Companies to contest the issuance of the policy

or a claim under the policy.

Copy

I understand that I, or my authorized representative, will receive a copy of the signed authorization. A copy of this

authorization is as effective as the original.

Names and Signatures

Name(s) used for medical records (if different than the name(s) below): ______________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

_____________________________________________________ ______________________________________________

Printed Name If children are to be insured, their printed names

_____________________________________________________ ______________________________________________

Signature of Proposed Insured Date

_____________________________________________________

Spouse’s Printed Name (If Proposed Insured)

_____________________________________________________ ______________________________________________

Signature of Spouse (If Proposed Insured) Date

_____________________________________________________ ______________________________________________

Signature of Parent or Guardian Date

(If Proposed Insured is a Minor)

-9-

4929L-1197 (Series 0798) -10- LA4929-CA_1102

Bank Service Plan Request Form

Bank Service Plan Authorization

As a convenience to me, I authorize Mutual of Omaha Insurance Company and/or its affiliated companies* to

withdraw funds from my account.

I also authorize you, my financial institution, to pay from my account any checks, drafts or preauthorized

electronic fund transfers from my account to the appropriate company(ies) below. Your rights with each such

charge will be the same as if personally paid by me. This authorization will be effective until I give you at

least three business days’ notice to cancel it. If notice is given verbally, you may require written confirmation

from me within 14 days after my verbal notice.

Date ___________________________ ______________________________________________________

Authorized Signature as Shown on Account

______________________________________________________

Joint Account or Other Authorized Signature

*Mutual of Omaha Insurance Company United of Omaha Life Insurance Company

United World Life Insurance Company Mutual of Omaha Plaza Omaha, Nebraska 68175

Complete the following information:

Insured’s Name ___________________________________

Address __________________________________________

City______________________________________________

State ________________________ ZIP ________________

Coverage ID Number(s):

_________________________ _____________________

_________________________ _____________________

Specify Preferred Date of Withdrawals

Please indicate when you prefer the monthly premiums to

be withdrawn from your checking account:

Withdraw on the ________________ (1st through 28th) of

the month

8213L-1001 -11- LA4929-CA_1102

Receipt (Agent/Producer — See Premium Acceptance Guidelines — Page 1)

All checks must be made payable to United of Omaha. Do not make checks payable to the agent/producer or leave the payee

blank. We will not accept cash premiums.

Temporary Life Insurance Agreement and Receipt (“Agreement”)

United of Omaha Life Insurance Company (“United,” “We,” “Our,” “Us”), Mutual of Omaha Plaza, Omaha, NE 68175

The following questions must be answered either “Yes” or “No.” YES NO

1. Within the past 90 days, has any Proposed Insured been admitted to a hospital or other medical facility, been

advised to be admitted, had surgery performed or recommended, or been advised to have a diagnostic test other

than an HIV test?.............................................................................................................................................................................. ■ ■

2. Within the past 10 years, has any Proposed Insured been treated for heart trouble, stroke, cancer, drug or alcohol

use, or had such treatment recommended by a physician or other licensed medical professional?........................................... ■ ■

3. Has any person proposed for insurance been diagnosed or treated by a member of the medical profession as having

Acquired Immune Deficiency Syndrome (AIDS), AIDS Related Complex (ARC)? ....................................................................■ ■

California law prohibits an HIV test from being required or used by health insurance companies as a condition of

obtaining health insurance coverage.

4. Is any Proposed Insured under 15 days old or over 70 years of age?............................................................................................ ■ ■

If any of the above questions are answered “Yes” or not answered, no Agent/Broker of United is authorized to accept money with

the application and no coverage will take effect under this Agreement.

In consideration of the application and payment of $ _______________ by the Applicant, receipt of which is hereby acknowledged,

United agrees to provide temporary life insurance for the Proposed Insured(s) effective on the date of the application, for a limited

period of time, subject to the following conditions and limitations.

A. If the answer to any of the above questions is “No” and the answer is incorrect or misleading, or if any of the answers to the

questions on the application are incorrect or misleading, then this Agreement is void and never went into effect.

B. Temporary life insurance under this Agreement will automatically terminate on the earliest of the following dates:

(1) 90 days from the date of this Agreement, except in Connecticut; or

(2) the date that insurance takes effect under the policy applied for; or

(3) the date of the letter offering to the Applicant a policy, other than applied for; or

(4) the date a policy, other than as applied for, is offered by an Agent/Broker to the Applicant; or

(5) the date the premium refund is mailed; or

(6) the date any check or draft submitted as payment is not honored by the bank on which it is drawn; or

(7) the date United mails notice of termination of coverage.

C. If the policy applied for is either (a) pursuant to a conversion privilege in (an) existing United life policy(ies), or (b) to replace

(an) existing United life policy(ies) with another United life policy, then in the event of the death of the Proposed Insured before

the termination of this Agreement, United will pay only the greater of:

(1) the benefits due under the terms of the existing policy(ies) which is/are being converted or replaced, or

(2) the benefits due under the terms of the policy for which application is being made (subject to the further limitation on the

maximum amount of benefits payable under this Agreement which is set forth below); and Applicant acknowledges and agrees

that benefits shall not be payable under both.

D. The temporary life insurance provided by this Agreement is subject to the provisions of the policy form applied for; however, no

benefits will be paid for:

(1) disability; or

(2) death from suicide while sane or insane; or

(3) the same loss under both this Agreement and any life policy issued from the application.

This Agreement does not limit United in applying its underwriting standards to the application nor does this Agreement limit or

waive any rights under any life insurance policy issued. If the application is rejected by United, the amount paid with the application

will be refunded to the Applicant regardless of whether a claim has been filed or benefits have been paid under this Agreement.

No change may be made to the terms and conditions of this Agreement by anyone, including the Agent/Broker.

If any Proposed Insured dies prior to the termination of this Agreement, United will pay the beneficiary the face amount applied

for (unless otherwise required by C above), not to exceed $500,000.

I have read and received a copy of this Agreement and understand and agree to all of its terms. I verify the above answers are true.

Signed this ____________ day of _________________, _____, at ________________________________________________________

City State ZIP Code

_____________________________________________________ ____________________________________________________

Signature of Proposed Insured Printed Name of Proposed Insured

_____________________________________________________ ____________________________________________________

Signature of Applicant (if other than Proposed Insured) Printed Name of Applicant

_____________________________________________________ ____________________________________________________

Signature of Spouse (if a Proposed Insured) Printed Name of Spouse

_____________________________________________________ ____________________________________________________

Signature of Agent(s)/Broker(s) Printed Name of Agent(s)/Broker(s)

SUBMIT THIS COPY TO THE COMPANY