Fillable Printable HP 12C Loan Amortizations

Fillable Printable HP 12C Loan Amortizations

HP 12C Loan Amortizations

hp calculators

HP 12C Loan Amortizations

Amortization

The HP12C amortization approach

Practice amortizing loans

hp calculators

HP 12C Loan Amortizations

hp calculators - 2 - HP 12C Loan Amortizations - Version 1.0

Amortization

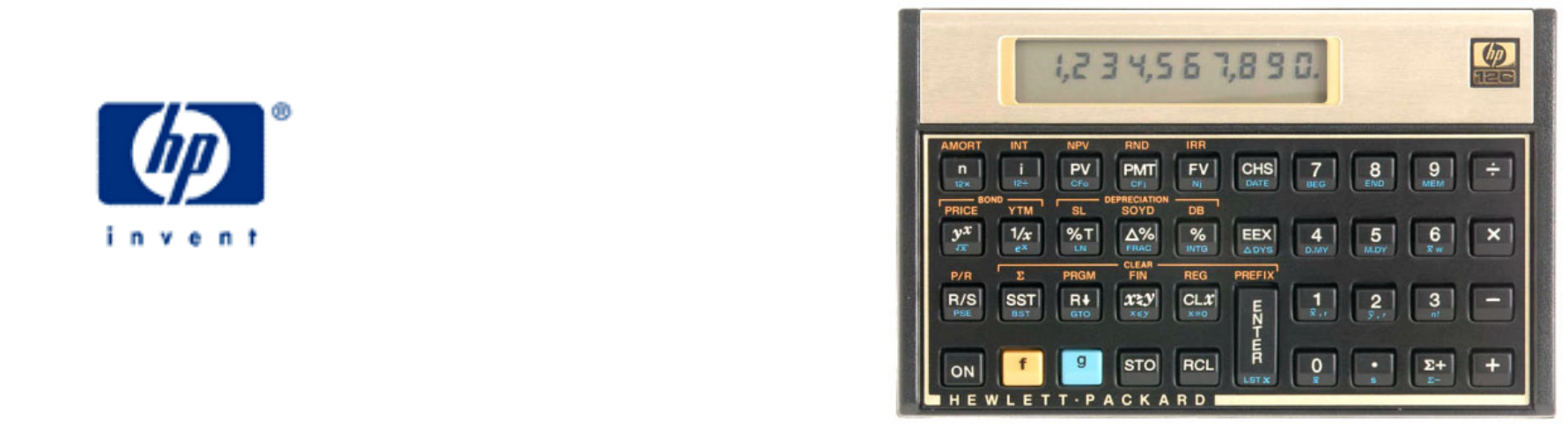

The word 'amortization' comes from a Latin word meaning "about to die". When a loan earning interest has regular, fixed

payments, it is said that the loan is being paid off or amortized. Although the debt is reduced by the same periodic

payments, different parts of each payment are applied against the principal and against the interest. The interest is

deduced from each payment and the remaining amount is used to reduce the debt. Figure 1 illustrates this process.

Figure 1

The HP12C amortization approach

In the HP12C, amortization uses the contents of the following Time Value of Money (TVM) registers:

n - used as a reference and contains the number of payments amortized

¼ - periodic interest rate

P - periodic payment

$ - remaining balance

The display must contain the number of payments to be amortized before executing f!. It is important to keep in

mind that on the HP12C, amortization is a sequenced calculation. This means that once a number of payments is

amortized, all subsequent balances refer to the next amortized payments. If it is necessary to go back and review

previous balance, some values must be restored to their default values. This is because every time f! is pressed,

the following registers have their contents updated:

$ - contents updated to remaining balance

n - contents updated to current number of payments amortized

The following examples illustrate the HP12C amortization approach.

Practice amortizing loans

Example 1: Calculate the first year of the annual amortization schedule for a 30-year, $180,000 mortgage at 7.75%,

compounded monthly.

1 2 3 . . . . . . . . . . . . . . . . . . . n

Number of

p

a

y

ments

Periodic Payment

(fixed value)

Part of each

payment related

to interest

Part of each

payment related

to the principal

hp calculators

HP 12C Loan Amortizations

hp calculators - 3 - HP 12C Loan Amortizations - Version 1.0

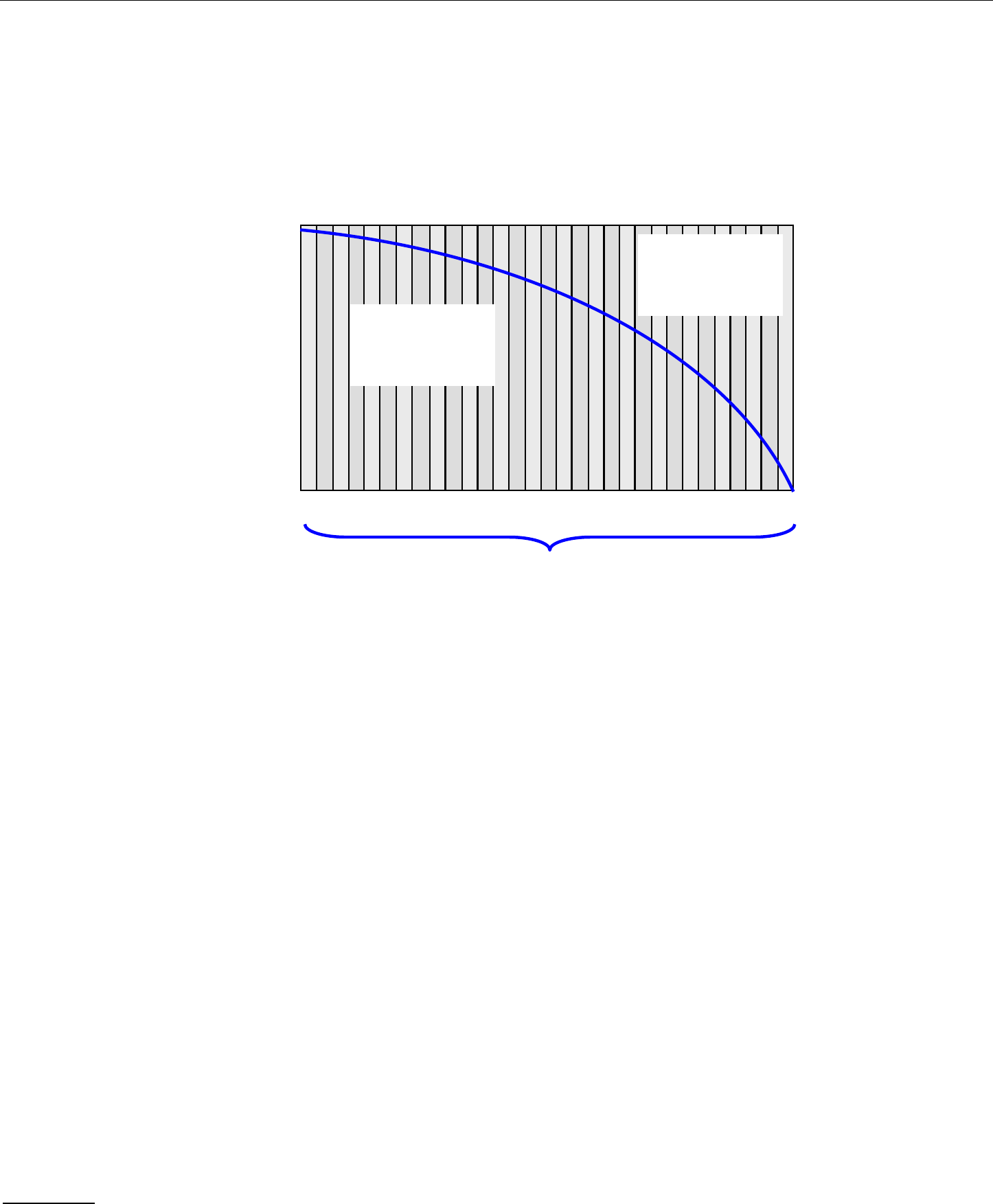

Solution: Clear the TVM registers contents to zero and set END mode:

fG gÂ

Set the relevant TVM values and calculate the PMT:

7.75 gC 30 gA 180000 $ 0 M P

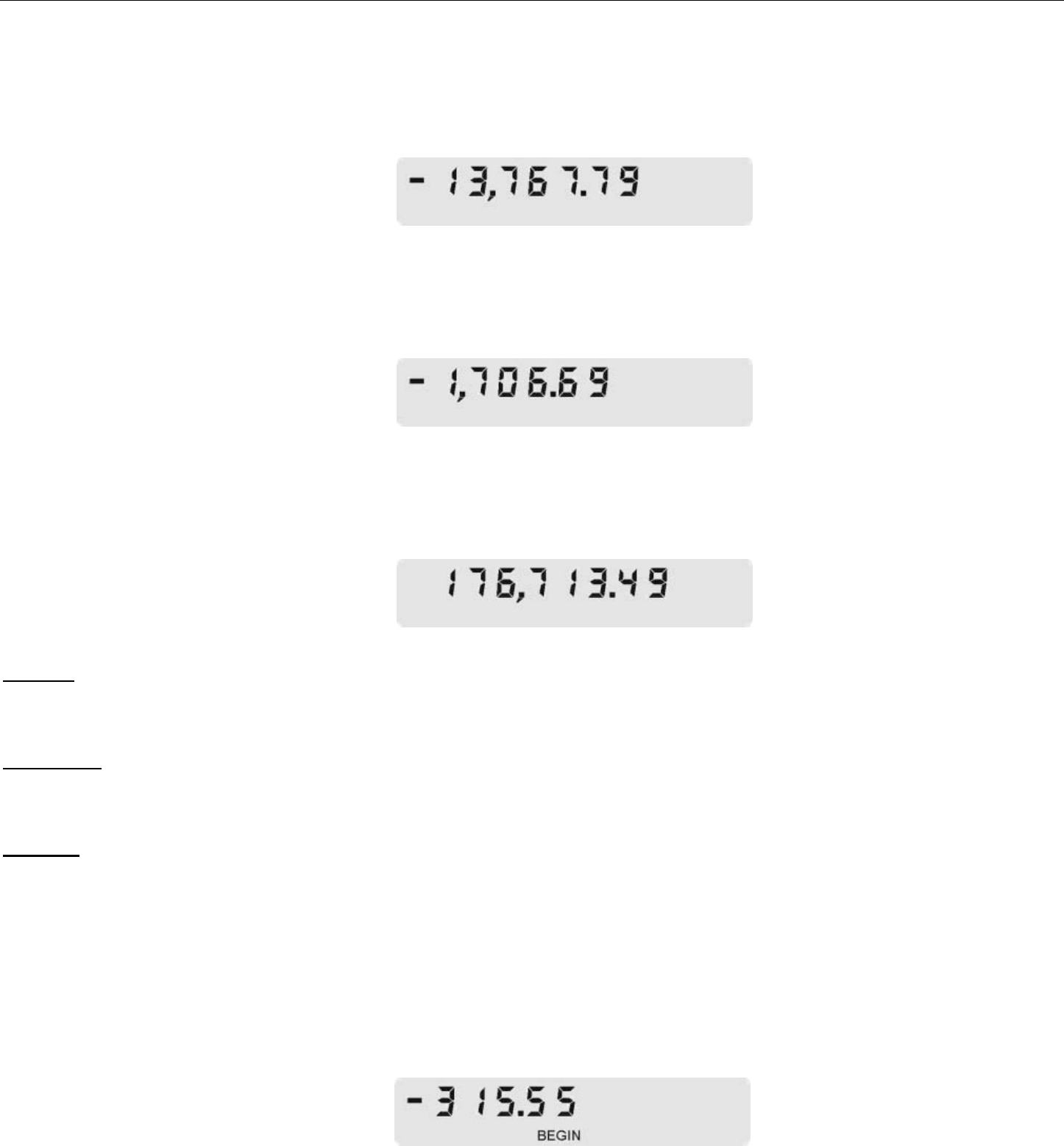

Figure 2

To calculate the first year it is necessary to set n to zero and amortize twelve payments:

0 n 12 f!

Figure 3

This is the total interest paid after one year. To see the part of the principal that is paid, press:

~

Figure 4

To check the loan balance after one year:

:$

Figure 5

Answer: After one year, the loan balance is $178,420.18. The amount of principal paid so far is $1,579.82 and

$13,894.66 interest has been paid.

Example 2: With all data from the previous example still available in the calculator's memory, calculate the second year

of the annual amortization of the same mortgage.

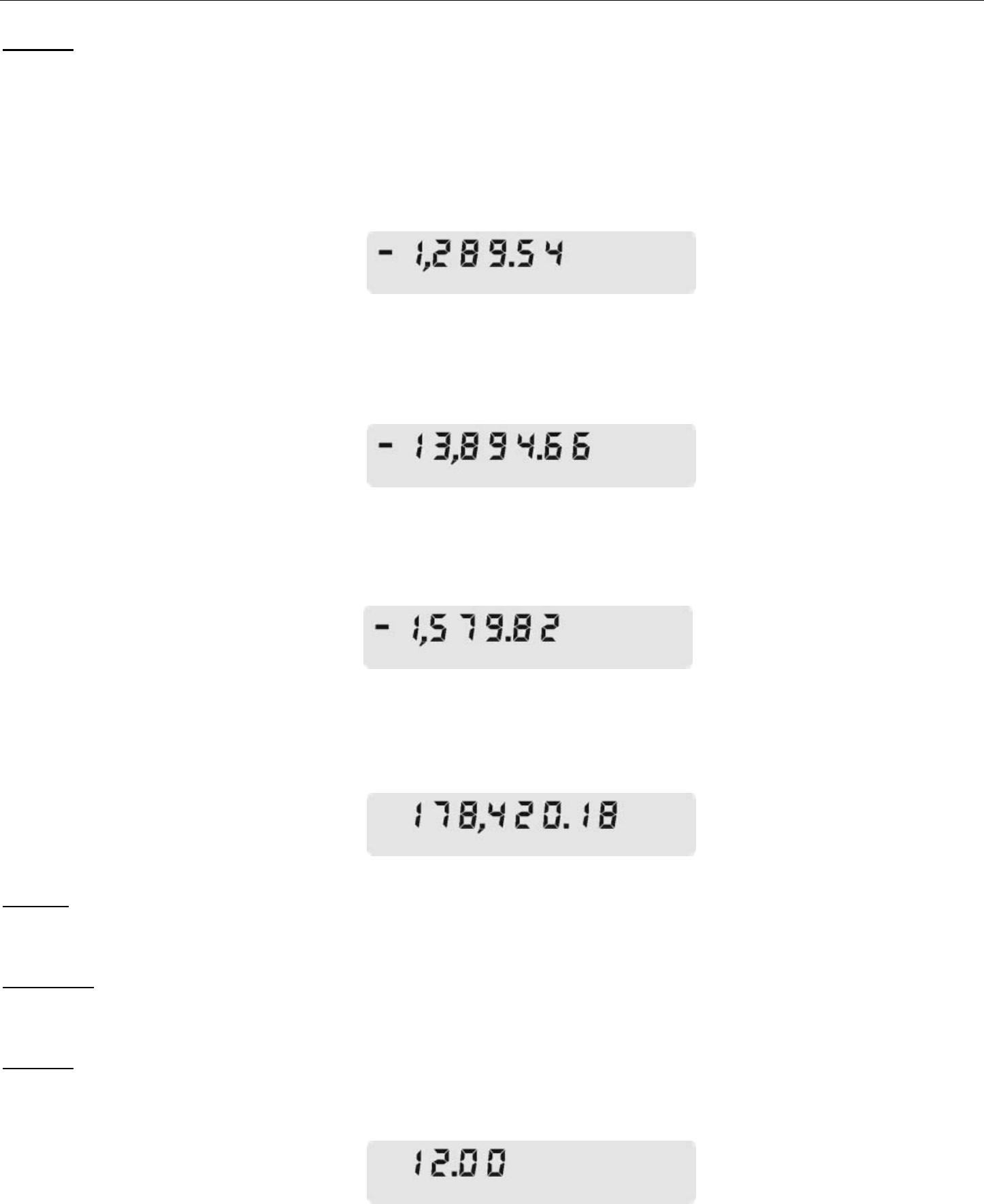

Solution: Just to make sure the calculator is at the proper point in the loan, recall the contents of n to the display:

:n

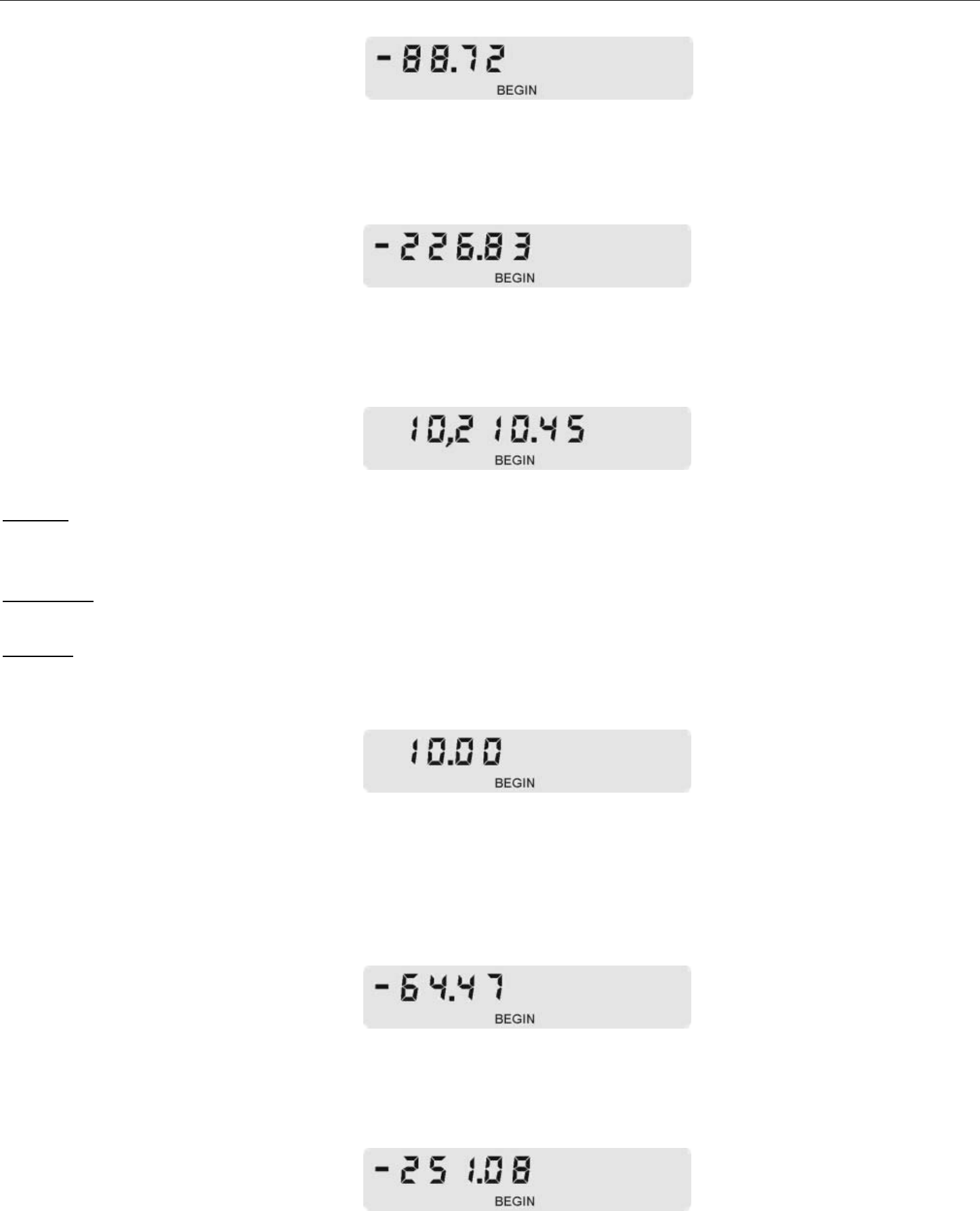

Figure 6

hp calculators

HP 12C Loan Amortizations

hp calculators - 4 - HP 12C Loan Amortizations - Version 1.0

Now it is necessary to input the number of payments to be amortized. In this example, twelve more

payments must be amortized to calculate the second year:

12 f!

Figure 7

This is the total interest paid after two years. To see the part of the principal that is paid, press:

~

Figure 8

To check the loan balance after one year, press:

:$

Figure 9

Answer: After two years, the loan balance is $176,713.49. The amount of principal repaid is $1,706.69 and the

amount of interest paid is $13,767.79.

Example 3: Amortize the 10

th

payment of a 4-year car loan. The loan amount is $12,500 and the interest rate is 10.2%,

compounded monthly. Assume monthly payments starting immediately.

Solution: Clear the TVM registers contents to zero and set BEGIN mode:

fG g×

Set the relevant TVM values and calculate PMT:

10.2 gC 4 gA 12500 $ 0 M P

Figure 10

To amortize the 10

th

payment it is necessary to amortize the first nine payments and then amortize the 10

th

separately:

0 n 9 f! 1 f!

hp calculators

HP 12C Loan Amortizations

hp calculators - 5 - HP 12C Loan Amortizations - Version 1.0

Figure 11

This is the interest paid with the 10

th

payment. To see the part of the principal that is paid:

~

Figure 12

To check the loan balance after ten payments:

:$

Figure 13

Answer: After ten payments, the loan balance is $10,210.45. With the 10

th

payment, the amount of principal that has

been paid is $226.83 and $88.72 interest has been paid.

Example 4: With all data from the previous example still available in the calculator memory, amortize the 22

nd

payment.

Solution: Just to verify the calculator is still in the proper state, recall the contents of n to the display:

:n

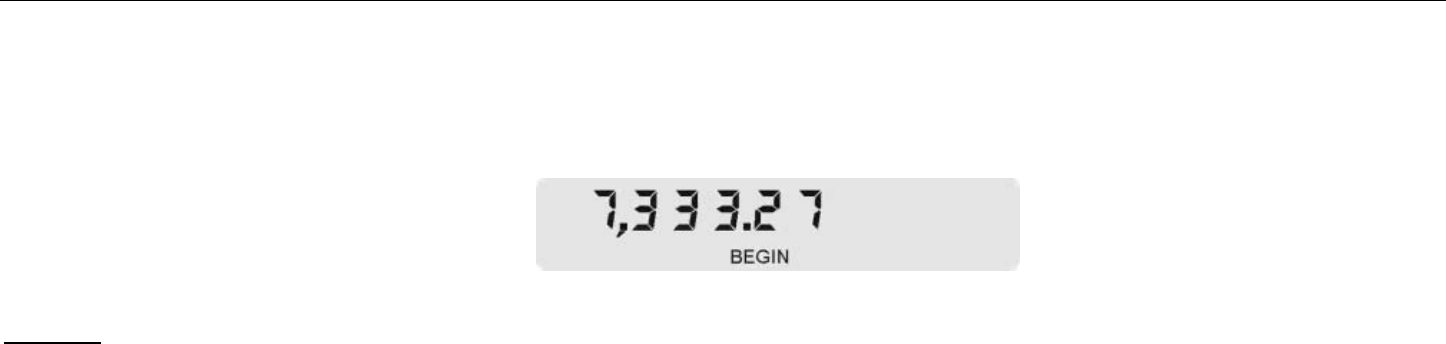

Figure 14

To amortize the 22

nd

payment it is necessary to amortize the next eleven payments and then amortize the

22

nd

separately:

11 f! 1 f!

Figure 15

This is the interest paid with the 22

nd

payment. To see the part of the principal that is paid:

~

Figure 16

hp calculators

HP 12C Loan Amortizations

hp calculators - 6 - HP 12C Loan Amortizations - Version 1.0

To check the loan balance after ten payments, press:

:$

Figure 17

Answer: After twenty-two payments, the loan balance is $7,333.27. With the 22

nd

payment, the amount paid toward

principal is $251.08 and $64.47 interest has been paid.