Fillable Printable Icb-1 Request For Informal Conference Board Review

Fillable Printable Icb-1 Request For Informal Conference Board Review

Icb-1 Request For Informal Conference Board Review

ICB-1 (R-07/14) Page 1 of 3

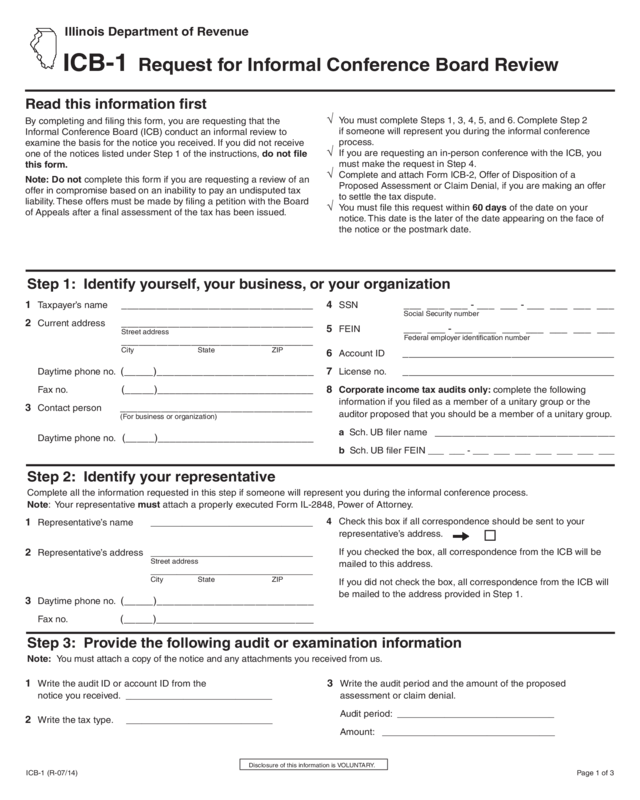

Illinois Department of Revenue

ICB-1 Request for Informal Conference Board Review

Read this information first

By completing and filing this form, you are requesting that the

Informal Conference Board (ICB) conduct an informal review to

examine the basis for the notice you received. If you did not receive

one of the notices listed under Step 1 of the instructions, do not file

this form.

Note: Do not complete this form if you are requesting a review of an

offer in compromise based on an inability to pay an undisputed tax

liability. These offers must be made by filing a petition with the Board

of Appeals after a final assessment of the tax has been issued.

√ You must complete Steps 1, 3, 4, 5, and 6. Complete Step 2

if someone will represent you during the informal conference

process.

√ If you are requesting an in-person conference with the ICB, you

must make the request in Step 4.

√

Complete and attach Form ICB-2, Offer of Disposition of a

Proposed Assessment or Claim Denial, if you are making an offer

to settle the tax dispute.

√ You must file this request within 60 days of the date on your

notice. This date is the later of the date appearing on the face of

the notice or the postmark date.

Disclosure of this information is VOLUNTARY.

Step 1: Identify yourself, your business, or your organization

1 Taxpayer’s name _________________________________

2 Current address _________________________________

Street address

_________________________________

City State ZIP

Daytime phone no. (_____)___________________________

Fax no. (_____)

__________________________

3 Contact person _________________________________

(For business or organization)

Daytime phone no. (_____)

__________________________

4 SSN ___ ___ ___ - ___ ___ - ___ ___ ___ ___

Social Security number

5 FEIN

___ ___ - ___ ___ ___ ___ ___ ___ ___

Federal employer identification number

6 Account ID

___________________________________

7 License no.

___________________________________

8 Corporate income tax audits only: complete the following

information if you filed as a member of a unitary group or the

auditor proposed that you should be a member of a unitary group.

a Sch. UB filer name _______________________________

b Sch. UB filer FEIN ___ ___ - ___ ___ ___ ___ ___ ___ ___

Step 2: Identify your representative

Complete all the information requested in this step if someone will represent you during the informal conference process.

Note: Your representative must attach a properly executed Form IL-2848, Power of Attorney.

1 Representative’s name _______________________________

2 Representative’s address _______________________________

Street address

_______________________________

City State ZIP

3 Daytime phone no. (_____)___________________________

Fax no. (_____)

__________________________

4 Check this box if all correspondence should be sent to your

representative’s address.

If you checked the box, all correspondence from the ICB will be

mailed to this address.

If you did not check the box, all correspondence from the ICB will

be mailed to the address provided in Step 1.

Step 3: Provide the following audit or examination information

Note:

You must attach a copy of the notice and any attachments you received from

us.

1 Write the audit ID or account ID from the

notice you received. ____________________________

2 Write the tax type. ____________________________

3 Write the audit period and the amount of the proposed

assessment or claim denial.

Audit period: ______________________________

Amount: _________________________________

Use your 'Mouse' or the 'Tab' key to move through the fields, except for the "Check Boxes", then you must use the 'Mouse'.

ICB-1 (R-07/14)Page 2 of 3

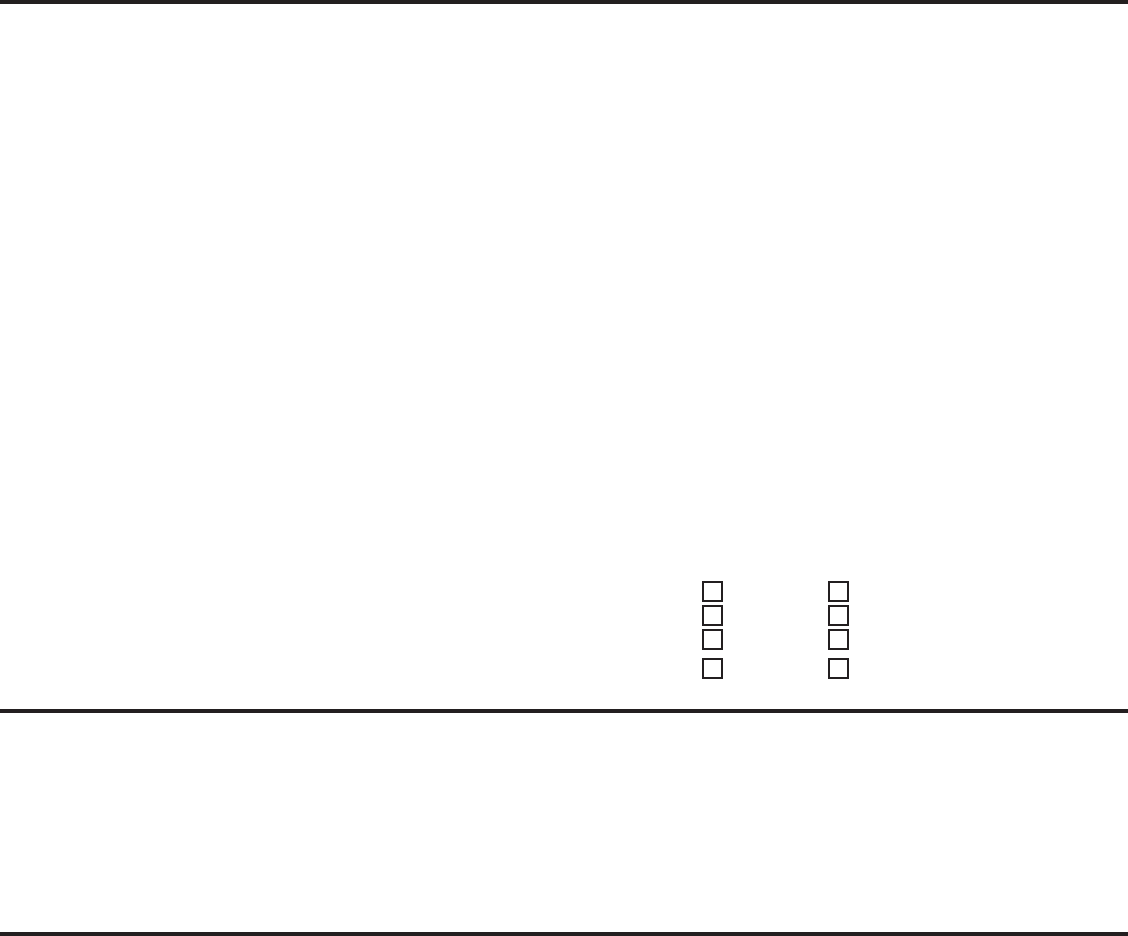

Step 4: Provide the grounds for your request

1 Please state below the specific reasons for your objection to the proposed assessment or denial of claim for refund (additional sheets

may be attached, if necessary). Please describe the specific issue(s) in the audit with which you disagree and provide in detail the legal

authority which supports your position. If you are disputing the calculation of a tax proposed to be assessed, you also must show why this

calculation is incorrect. Attach any additional information or documentation in support of your position.

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

2 The ICB will decide your case based on your written request and supporting documentation. The ICB also will grant you a conference to

discuss your case if you so desire.

Are you requesting an in-person conference with the ICB? yes no

If you answered “yes,” indicate where you are requesting the conference be held. Chicago Springfield

Are you requesting a telephone conference? yes no

3 Are you submitting an offer to settle the tax dispute? yes no

If you answered “yes,” you must complete and attach Form ICB-2, Offer of Disposition of a Proposed Assessment or Claim Denial.

Step 5: Taxpayer or taxpayer’s representative must sign below

If signing as a corporate officer, partner, fiduciary, or individual on behalf of the taxpayer, I certify that I have the authority to execute this

request on behalf of the taxpayer.

____________________________________________ _____/_____/_____ ______________________________________________

Taxpayer’s signature Title, if applicable Date Print taxpayer’s name (if corporation, print duly authorized officer’s name)

____________________________________________ _____/_____/_____

Taxpayer’s representative’s signature* Title, if applicable Date

* Representative must be duly authorized under a valid power of attorney. (Form IL-2848, Power of Attorney, must be attached.)

Step 6: Sign the waiver of statute of limitations

The following waiver of statute of limitations must be signed by the taxpayer, a duly authorized corporate officer, partner, or fiduciary of the

taxpayer, or by the taxpayer’s representative under a valid power of attorney.

In order to allow the ICB time to review this proposed assessment or claim denial, the undersigned expressly agrees to extend the running of

any and all statutes of limitations regarding the assessment of any tax, penalty, or interest or claims for refund for the tax periods at issue to

which the request is directed. This waiver shall run from the date this request for review is received and accepted by the ICB through 180 days

after the ICB issues its action decision or memorandum in the matter. This waiver applies only to the tax periods at issue and has no effect on

closed tax periods or tax periods for which assessments have been issued and for which the liability is final.

____________________________________________ ____________________ _____/_____/_____

Taxpayer’s signature Title, if applicable Date

____________________________________________ ____________________ _____/_____/_____

Taxpayer’s representative’s signature* Title, if applicable Date

____________________________________________ _____/_____/_____

Director of Revenue Date

* Representative must be duly authorized under a valid power of attorney.

Please send this form and all supporting documentation (including Form IL-2848, Power of Attorney, and Form ICB-2, Offer of Disposition of a

Proposed Assessment or Claim Denial, if applicable) to:

Informal Conference Board

Illinois Department of Revenue

100 W. Randolph, #7-286

Chicago, IL 60601

Reset

Print

ICB-1 (R-07/14) Page 3 of 3

Form ICB-1 Instructions

Step 1: Identify yourself, your business, or your

organization

Line 1 — Write your name as it appears on your Notice of

Proposed Deficiency, Notice of Proposed Liability, Notice

of Proposed Claim Denial, Notice of Proposed Liability and

Claim Denial, Notice of Proposed Deficiency and Claim Denial

or Notice of Proposed Audit Liability.

Line 2 — Write your current address. Unless you designate

otherwise in Step 2, Line 4, all correspondence from the ICB

will be mailed to this address.

Line 3 — If you are a business or an organization, please

write the name of the contact person and a daytime phone

number.

Lines 4 through 7 — Write all identification numbers

applicable to you.

Line 8 — If you are a corporation and you filed as a member

of a unitary group, or you did not file as a member of a unitary

group but in the audit it was determined that you should,

write the name and FEIN of the Schedule UB filer on the

appropriate lines.

Step 2: Identify your representative

Lines 1 through 3 — Complete all the information

requested if someone will represent you during the informal

conference process. You may be represented by any person

of your choice during the informal conference process. Your

representative need not be an attorney.

Note: Your representative must attach a properly executed

Form IL-2848, Power of Attorney.

Line 4 — Check the box if you would like all correspondence

to be directed to your representative’s address. If you do not

check the box, all correspondence from the ICB will be mailed

to the address provided in Step 1, Line 2.

Step 3: Provide the following audit or

examination information

Line 1 — Write the audit ID or account ID that appears on the

face of your notice.

Line 2 — Write the type of tax that is the subject of the audit

or examination, e.g., Retailers’ Occupation Tax, Income Tax,

Withholding.

Line 3 — Write the audit period and the amount of the

assessment or claim denial being proposed as shown on your

notice.

Note: You must attach a copy of the notice and any

attachments you received from us.

Step 4: Provide the grounds for your request

Line 1 — Use this space to write the specific reasons for

your disagreement with the proposed assessment or claim

denial. Identify and set out each of the specific issues in

the proposal with which you disagree and provide, in detail,

your arguments and legal authority to support your position

that the Department is wrong on each of the issues you

have identified. If you disagree with the calculation of the tax

proposed to be assessed, you must also use this space to

show why the calculation is incorrect. If the space provided

is inadequate, you may attach additional sheets of paper.

Any additional information or documentation supporting your

position may be included with this request and should be

referenced in your explanation.

Line 2 — The ICB will decide your case based on your

written request and supporting documentation. An in-person

conference is not mandatory, but upon your request the ICB

will provide you with an in-person conference. Check “yes”

if you wish to request an in-person conference with the ICB

to review and discuss your issues related to the proposed

assessment or claim denial. Check “Chicago” or “Springfield”

to indicate where you wish to have your conference. If you

have indicated you wish an in-person conference, the ICB

will mail a written notice of the time, date, and location of the

in-person conference to you or your representative.

Line 3 — If you will be submitting with your Form ICB-1 a

formal request to settle your tax dispute with the Department,

check “yes.” You must then complete and attach Form ICB-2,

Offer of Disposition of a Proposed Assessment or Claim

Denial. Please refer to Form ICB-2 and instructions for a

further explanation.

Steps 5 and 6: Taxpayer or taxpayer’s

representative

must sign

Form ICB-1 must be properly signed and dated by you or

your representative in both Steps 5 and 6. The ICB will not

commence the informal review process without a properly

signed Form ICB-1.

If you need additional assistance or information

If you need assistance in completing this form or have any

questions, you may call the ICB at 312 814-1722.

For additional information about the ICB, please refer to 86

Ill. Adm. Code Part 215, Informal Conference Board. A copy

of these regulations may be found by visiting our website at

tax.illinois.gov.