Fillable Printable Info Sheet: Restaurant & Hotel Industries (De 231E)

Fillable Printable Info Sheet: Restaurant & Hotel Industries (De 231E)

Info Sheet: Restaurant & Hotel Industries (De 231E)

RESTAURANT AND HOTEL INDUSTRIES

DE 231E Rev. 33 (12-16) (INTERNET) Page 1 of 2 CU

The restaurant and hotel industries consist of

establishments that are open to the public or are operated

by membership organizations that furnish meals or

lodging.

The restaurant industry is composed of establishments

that prepare and serve meals and beverages. This

includes, but is not limited to, restaurants, cafeterias,

caterers, cocktail lounges, diners, fast food places, mobile

food services, and takeout or delivery businesses.

Establishments in the hotel industry provide lodging to

their customers or members and include, but are not

limited to, hotels, motels, hostels, inns, rooming and

boarding houses, fraternity or sorority residential houses,

and residential clubs.

WHO IS AN EMPLOYEE?

A worker is a common law employee when the employer

has the right to control the manner and means of

accomplishing the work. Refer to Information Sheet:

Employment, DE 231, for additional information.

Types of employees that are typical in the restaurant and

hotel industries are:

• Chefs • Cooks

• Dishwashers • Kitchen helpers

• Bus persons • Waiters and waitresses

• Maitre d’s • Hosts and hostesses

• Cashiers • Managers

• Delivery persons • Bartenders

• Valets • Clerical and office staff

• Maids • Switchboard operators

• Laundry persons • Repair and maintenance

• Desk clerks

persons

• Bellhops

Other services that may be performed by an employee

under common law rules include, but are not limited to,

bookkeepers, janitors, and entertainers.

WHAT ARE WAGES?

Wages are payments made to an employee for services

performed during employment. The payment may be

made in cash or some medium other than cash. Types of

payments typically considered to be wages are:

• Cash • Lodging

• Meals and beverages • Tips

Employer-provided meals and lodging are subject to

Unemployment Insurance (UI), Employment Training Tax

(ETT), and State Disability Insurance* (SDI). For additional

information, refer to Information Sheet: Personal Income

Tax Wages Reported on the Quarterly Contribution Return

and Report of Wages (Continuation) (DE 9C), DE 231PIT

.

Meals are subject to California Personal Income Tax (PIT)

withholding and reportable as PIT wages unless furnished

for the employer’s convenience and on the employer’s

premises.

If more than half of the employees receive meals that

are for the convenience of the employer, then all meals

furnished by the employer are considered furnished for the

employer’s convenience and are therefore not subject to PIT

withholding or reportable as PIT wages. If fewer than half of

the employees receive meals which are for the convenience

of the employer, then only those meals actually provided for

the employer’s convenience would be exempt from the PIT

withholding and wage reporting requirements.

Lodging is also subject to PIT unless furnished on the

employer’s premises, for the employer’s convenience, and

as a condition of employment.

*Includes Paid Family Leave (PFL).

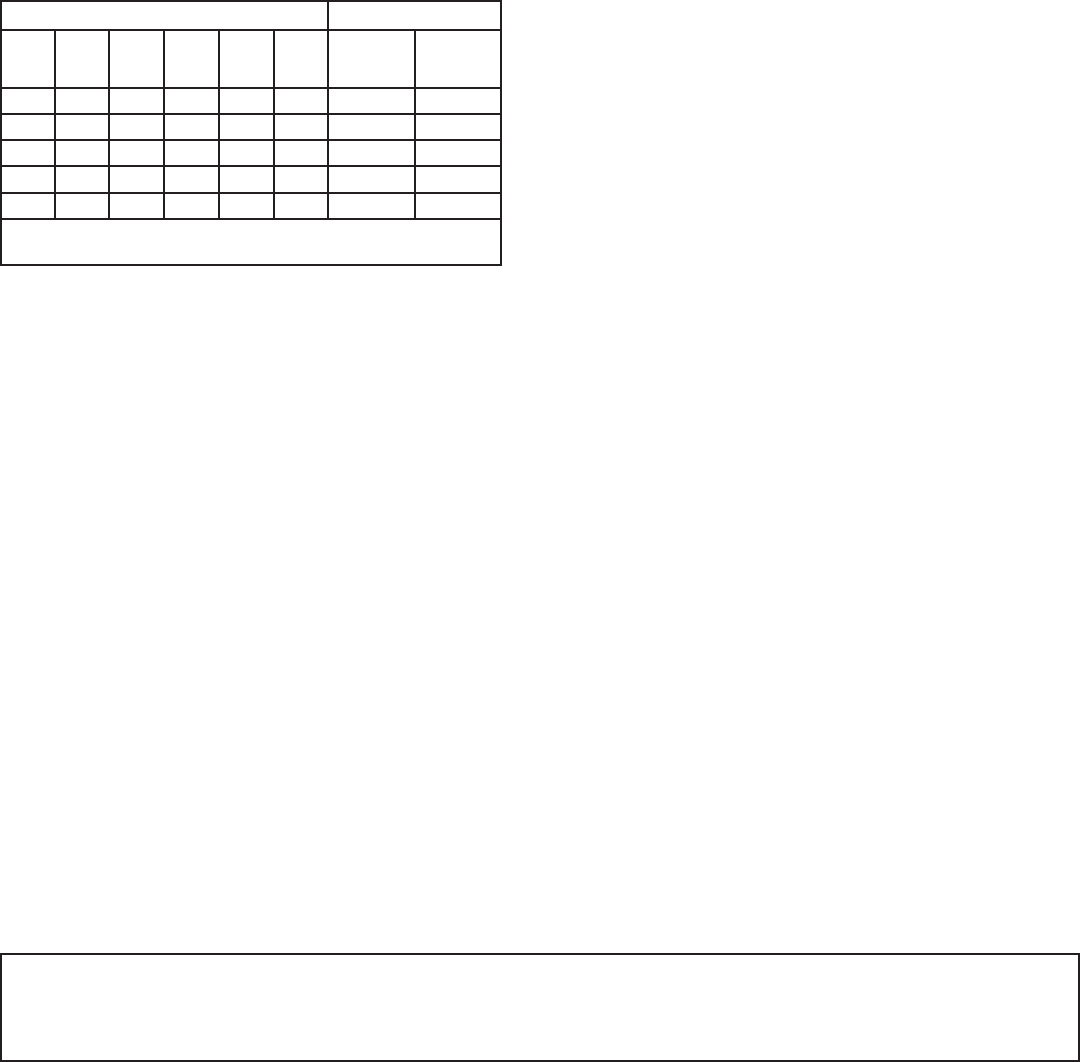

What Are the Values of Meals and Lodging?

The taxable values of meals and lodging should not be

less than the reasonable estimated values stipulated by

the contract of employment or in a union agreement.

If the cash values are not stipulated in the hiring or

union agreement, the taxable values are established

by regulation. The taxable value of lodging is 66 2/3

percent of the ordinary rental value to the public up to a

maximum per month and not less than a minimum value

per week. The taxable values of meals and lodging are

listed below:

VALUE OF MEALS VALUE OF LODGING

YEAR DAY BR. LU. DI. UNID MAX PER

MONTH

MIN PER

WEEK

2017 $11.50 $2.35 $3.55 $5.60 $4.15 $1,387 $45.00

2016 $11.40 $2.35 $3.50 $5.55 $4.10 $1,332 $43.20

2015 $11.05 $2.25 $3.40 $5.40 $3.95 $1,287 $41.75

2014 $10.90 $2.25 $3.35 $5.30 $3.90 $1,255 $40.70

2013 $10.85 $2.35 $3.30 $5.20 $3.80 $1,224 $39.90

NOTE: These values apply to non-maritime employees only.

Lodging: 66 2/3 percent of ordinary rental value.

The cash values of meals and lodging are subject to change

each calendar year. This information is found under Rates,

Withholding Schedules, and Meals and Lodging Values on

the EDD website at

www.edd.ca.gov/Payroll_Taxes/Rates_and_Withholding.

htm#MealsandLodging.

Wages Includes Tips

Employees who receive more than $20 in tips in a

calendar month must report all tips in one or more written

statements to the employer on or before the 10

th

day of

the month following the month in which they are received

from the customers. Tips are taxable when the employee’s

statement is furnished to the employer. Banquet tips and

tips controlled by the employer are treated as regular

wages, and their taxability is not contingent upon

employees reporting them to the employer.

Tips received by the employee fro

m the customer in

the form of cash, check, or any other monetary item of

e

xchange are wages subject to UI, ETT, SDI*, and PIT if

they total $20 or more in a month, provided the employee

reports the amount in a written statement furnished to the

employer. Tips should be combined with regular wages

when reported to the EDD. Refer to Information Sheet: Tips,

DE 231T, for more detailed information on reporting tips.

ADDITIONAL INFORMATION

For further assistance, please contact the Taxpayer

Assistance Center at 888-745-3886 or visit the nearest

Employment Tax Office listed in the California Employer’s

Guide, DE 44, and on the EDD website at

www.edd.ca.gov/Office_Locator/. Additional information

is also available through the EDD no-fee payroll tax

seminars. View the in-person course offerings on the EDD

website at www.edd.ca.gov/Payroll_Tax_Seminars/.

The EDD is an equal opportunity employer/program.

Auxiliary aids and services are available upon request to

individuals with disabilities. Requests for services, aids,

and/or alternate formats need to be made by calling

888-745-3886 (voice) or TTY 800-547-9565.

*Includes Paid Family Leave (PFL).

This information sheet is provided as a public service and is intended to provide non-technical assistance. Every attempt has been made

to provide information that is consistent with the appropriate statutes, rules, and administrative and court decisions. Any information that

is inconsistent with the law, regulations, and administrative and court decisions is not binding on either the Employment Development

Department or the taxpayer. Any information provided is not intended to be legal, accounting, tax, investment, or other professional advice.

DE 231E Rev. 33 (12-16) (INTERNET)

Page 2 of 2