Fillable Printable Internal Audit Plan Fy 2014

Fillable Printable Internal Audit Plan Fy 2014

Internal Audit Plan Fy 2014

Internal Audit Plan FY

Internal Audit Division

Internal Audit Plan FY 2014

1

Internal Audit

Plan FY

Internal Audit Division

Table of Contents

Introduction

2

Recommended Engagements

3

Appendix A

-

Risk Assessment Scores

5

Appendix B

-

Estimated Hours

6

Internal Audit Plan FY 2014

2

Introduction

The Texas Internal Auditing Act

1

and the International Professional Practices

Framework

2

require the Internal Audit function of an organization to develop an

annual Internal Audit Plan. The Internal Audit Plan establishes the framework for

the audit and consulting activities to be performed by the Texas Department of

Motor Vehicles (TxDMV) Internal Audit Division (IAD) during the 2014 Fiscal Year.

Scope and Objective

This Internal Audit Plan covers the period of September 1

st

, 2013 to August 31

st

,

2014.

The preparation of the Internal Audit Plan serves as the process by which the

Internal Audit Division accumulates the data necessary to identify and rank potential

engagement areas according to risk. The ultimate objective of IAD is to provide the

Board of Directors and management with information to reduce exposure to the

negative effects that may be associated with operations of the agency. The degree

or materiality (size) of exposure can be viewed as risks mitigated by establishing

sound internal control.

Responsibilities

The Internal Audit Division is responsible for preparing the Annual Audit Plan and

submitting it to the Board of Directors for review and approval. Periodic updates

relating to project status, schedules and significant interim changes will also be

communicated.

1

Texas Government Code, Section 2102.005.

2

International Professional Practices Framework (Altamonte Springs, Florida; IIA, 2011 Edition

Standard 2010)

Internal Audit Plan FY 2014

3

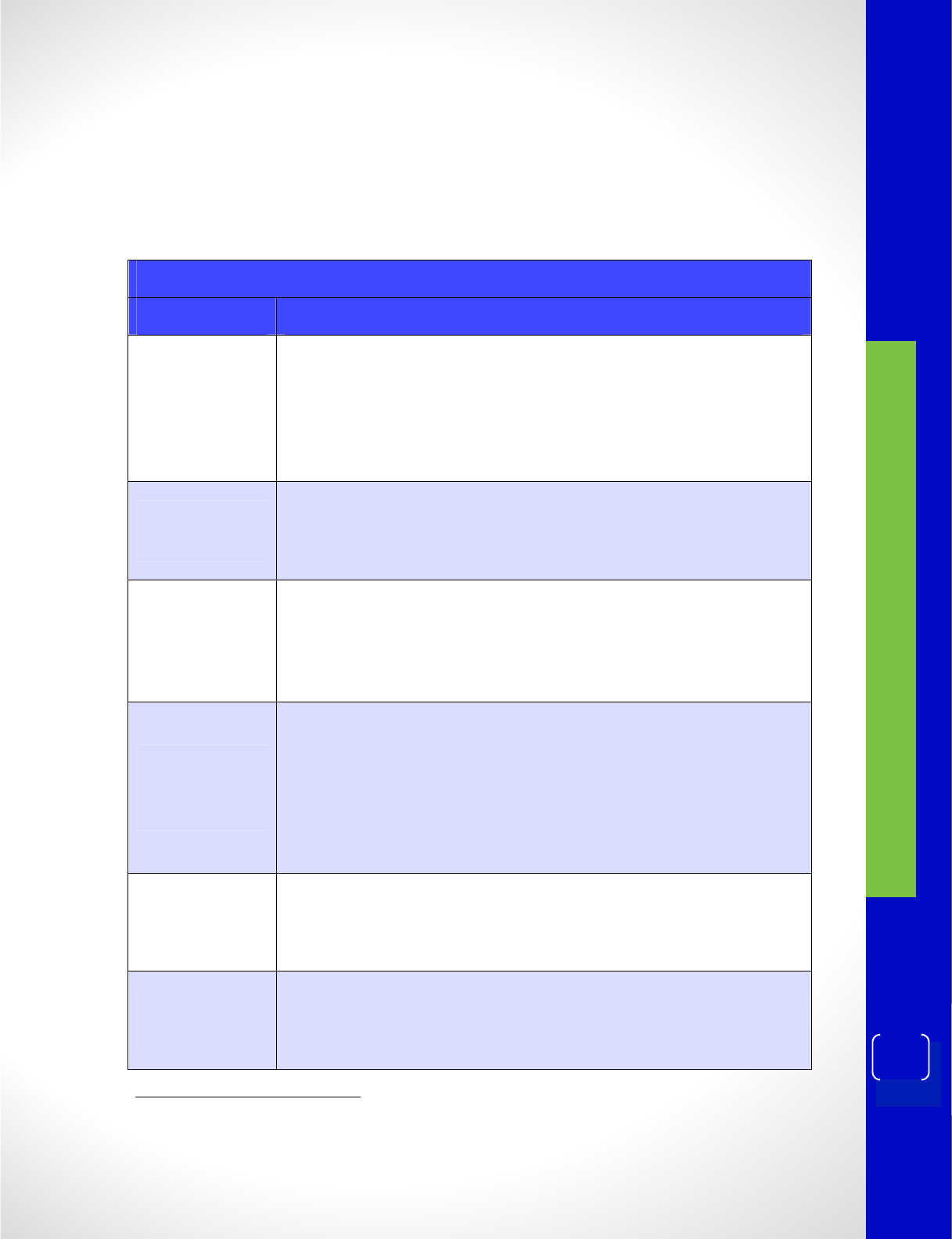

Recommended Engagements

Based on the results of the risk assessment process performed (Appendix A), IAD is

recommending the engagements detailed in Tables 1 and 2 below, to comprise the

Internal Audit Plan for the 2014 Fiscal Year.

Table 1

FY 201

4

Aud

it Engagements

with reports to the Board

Audit Area

Identified Risks and Summary of Work to be Performed

Review of Agency

Approved

Contracts

Potential Risks

–

To obtain reasonable assurance that the agency is

receiving the goods or services contracted for.

Work Plan – This audit will focus on examining executed contracts to

evaluate attributes including justification, authorization and sufficient

documentation to support the purchases.

Information

Security

Potential Risks

–

This is a statutorily

3

required engagement.

Work Plan – This audit would review the agency’s compliance with the

provisions of TAC 202 Information security requirements.

Web-enabled

Subcontractor

Renewals

(Web Sub)

Potential Risks

–

Th

is is a new program

for processing a large volume

of registration renewal transactions via the internet.

Work Plan – This engagement is a continuation of the audit previously

started and will focus on reviewing the application controls over data.

Data Integrity of

selected RTS

Information

Potential Risks

–

The potential for

corrupt or incomplete data within

the RTS system which is used by law enforcement and other external

stakeholders.

Work Plan – This project would be a follow-up to the current agency

RTS data integrity clean-up project to determine the effectiveness of

the effort to purify vehicle information and data contained within RTS.

Internal Audit

Plan (FY 2015)

Potential Risks

–

This is a statutorily

4

required engagement.

Work Plan – Propose the engagements which will comprise the FY

2015 Internal Audit Plan.

Annual Audit

Report (FY 2013)

Potential Risks

–

This is a statutorily

5

required engagement.

Work Plan – Report on the FY 2013 activities of the Internal Audit

Division to the appropriate oversight agencies by November 1

st

, 2013.

3

Statutory Mandate – Texas Administrative Code, Section 202.21 (e).

4

Statutory Mandate – Texas Government Code, Section 2102.007 (2).

5

Statutory Mandate – Texas Government Code, Section 2102.009.

Internal Audit Plan FY 2014

4

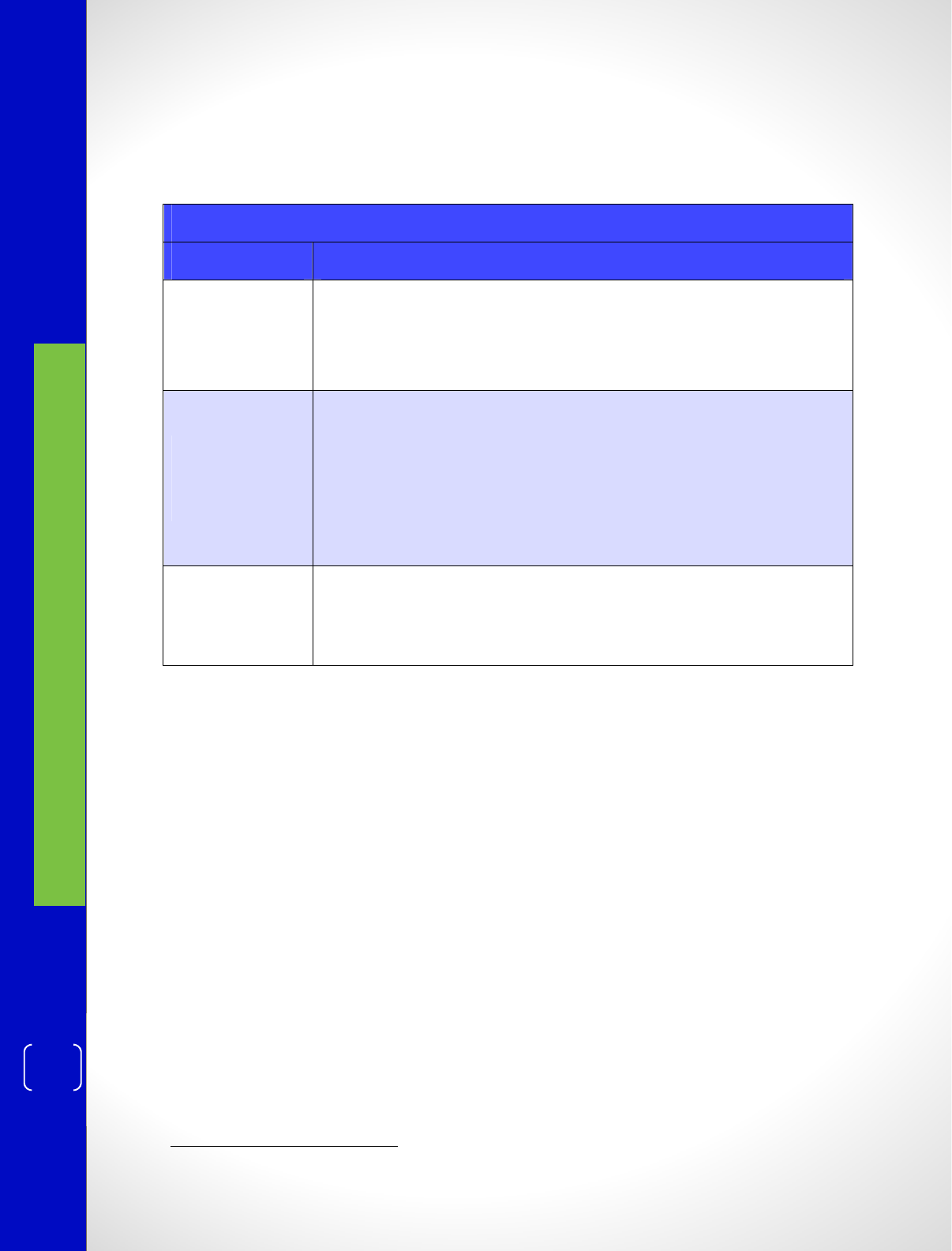

Table 2

FY 201

4

Other Activities

(Final Deliverable to be determined)

Project

Area

Summary Description

Board and

Executive

Management

Requests

Potential Risks – Varied, depending on the nature of the request.

Work Plan –In anticipation of requests during the 2014 Fiscal Year, IAD

is allocating time to assist the Board and Executive Management.

Monitoring of

RTS Refactoring

including IV&V

Potential Risks

–

The refactoring project is both highly visible and with

large financial considerations which will have a significant impact on

the various external and internal stakeholders of the agency.

Work Plan – On-going monitoring to include attending meetings,

reviewing status reports, invoice processes and providing feedback on

issues to the Executive Director and Board.

ABTPA Single

Audit Reviews

Potential Risks

–

Statutorily

6

required engagement.

Work Plan – On-going monitoring of grantee compliance with Uniform

Grant Management Standards.

6

Statutory Mandate – Texas Government Code, Section 783.010.

Internal Audit Plan FY 2014

5

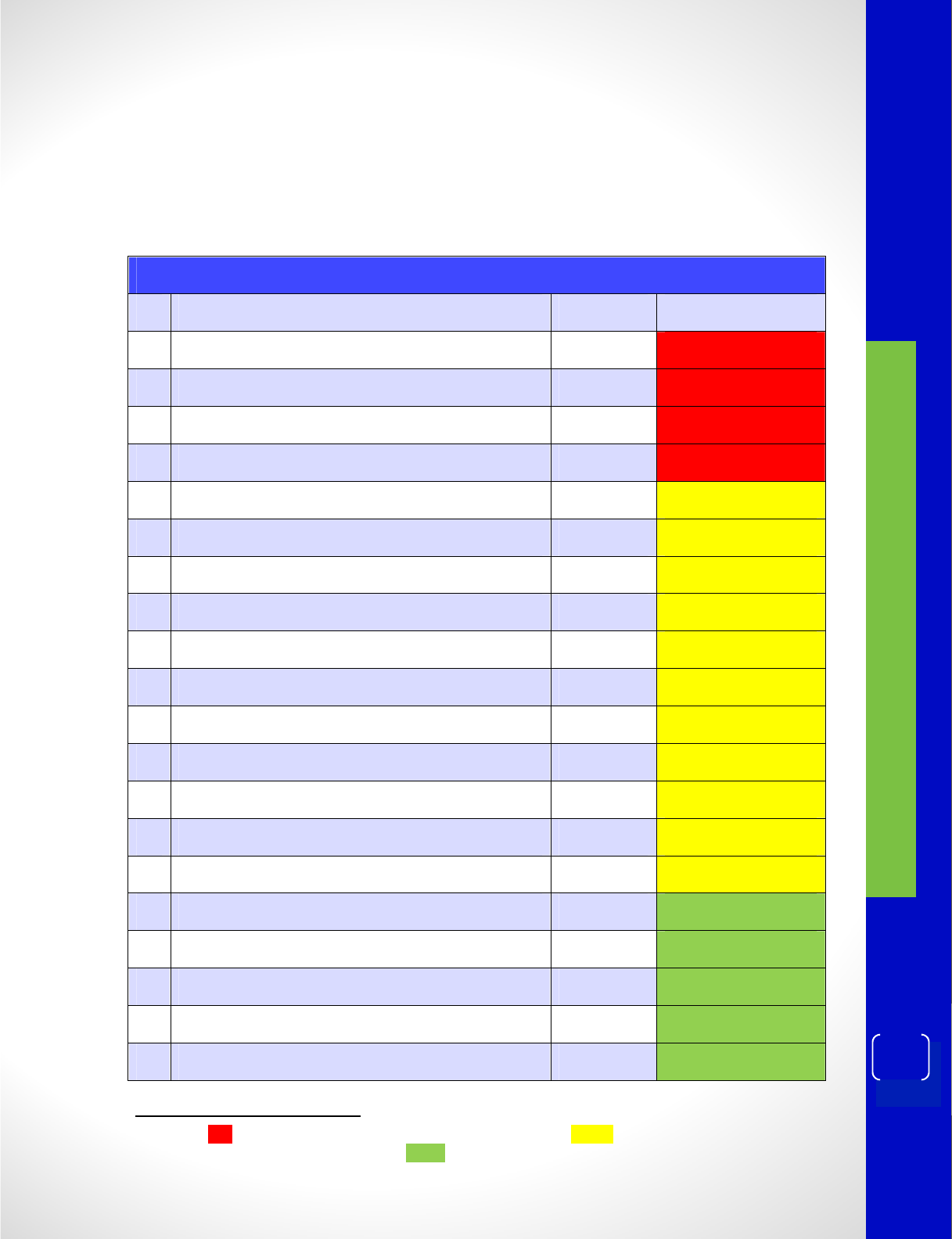

Appendix A – Risk Assessment Scores

Listed below are the results of the risk assessment scoring (RAS) process conducted

by IAD. Those engagements in red have been included in the FY 2014 Audit Plan.

Those engagements which are statutorily required were not part of the RAS process.

Table 3

Risk Assessment Scores for identified

Engagement

Audit Areas

-

FY 201

4

Engagement

Area

RAS

Score

Assessed Risk Level

7

1

Monitoring of RTS

Refactoring Project

4.84

2

Review of

Agency

Approved Contracts

4.08

3

Data Integrity of selected RTS Information

4.06

4

Web Sub

4.02

5

Review of Motor Carrier Division

3.96

6

Review of RTS Refactoring Contract Process

3.94

7

Dealer Licensing

3.90

8

Review of Agency Performance Scorecard

3.

71

9

Vehicle Registration

3.61

10

TxPros

3.5

9

11

Permits

3.51

12

Review of HR Processes

3.47

13

Vehicle Titling

3.35

14

Revenue Processing Controls

3.33

15

Regional Operations

3.27

16

Vendor

Payment Processing Controls

2.96

17

Customer Service Process Review

2.84

18

Vehicle Consumer Complaints

2.33

19

Speciality Plate Testing and Implementation

2.27

20

Investigations

2.12

7

Legend – Red represents Risk Scores > 4.0 (Highest Assessed Risk), Yellow represents Risk Score

between 3.0 and 3.99 (Intermediate Risk), Green represents Risk Scores < 3.0 (Lowest Assessed Risk)

Internal Audit Plan FY 2014

6

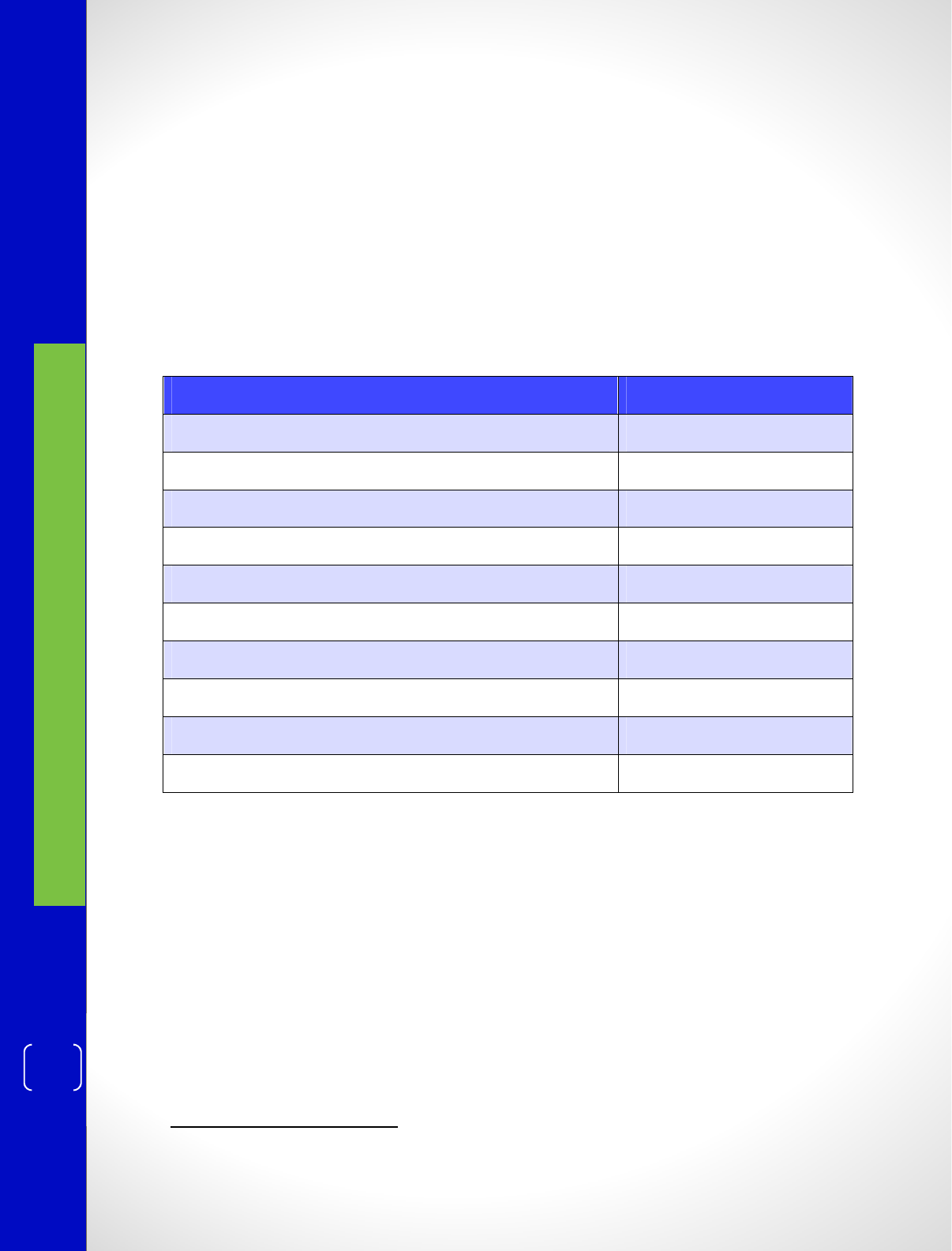

Appendix B – Estimated Hours

For each of the potential engagements noted above in Tables 1 and 2, IAD has

developed an estimate of the number of hours needed for each project. These

estimates are based both on the time needed for each engagement as well as the

amount of direct audit hours (3,600)

8

available for the year.

IAD will track and monitor the status of engagements as well as the availability of

audit resources on an ongoing basis. As circumstances occur which necessitate

adjustments, IAD will include these changes in the FY 2015 Internal Audit plan.

Table 4

Engagement

Estimated Hours

Monitoring of RTS Refactoring Project

600

Review of

Agency

Approved Contracts

600

Data

Integrity of selected RTS Information

500

Web Sub

400

ABTPA Single Audit Reviews

350

Internal Audit Plan

(FY 201

5

)

150

Annual Audit Report (FY 201

3

)

150

Board and Executive Management Requests

500

Information Security Review

350

Total

3,

60

0

8

This amount is calculated based on approximately 33% direct audit hours for the Division Director

and 67% direct audit hours for division staff.