Fillable Printable Iowa Refund Request Form Ia 843

Fillable Printable Iowa Refund Request Form Ia 843

Iowa Refund Request Form Ia 843

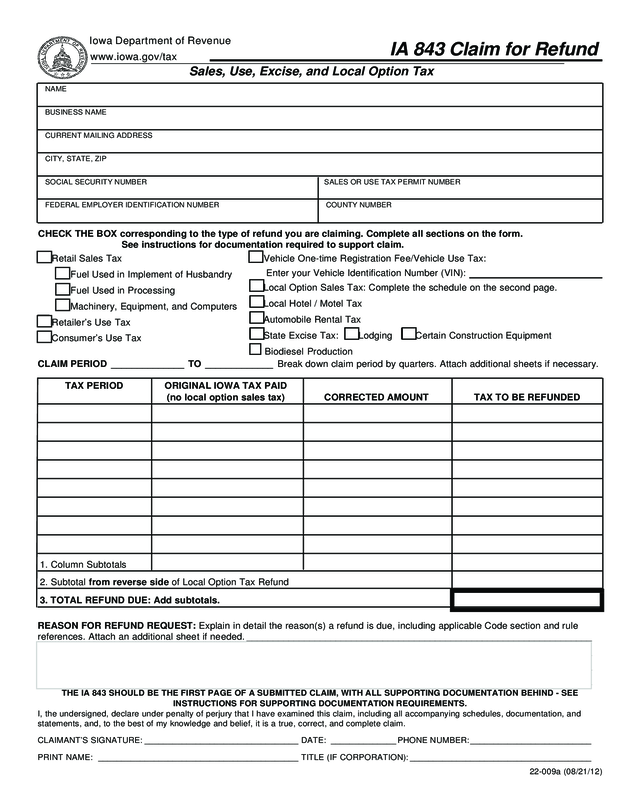

22-009a (08/21/12)

www.iowa.gov/tax

Iowa Department of Revenue

IA 843 Claim for Refund

Sales, Use, Excise, and Local Option Tax

NAME

BUSINESS NAME

CURRENT MAILING ADDRESS

CITY, STATE, ZIP

SOCIAL SECURITY NUMBER SALES OR USE TAX PERMIT NUMBER

FEDERAL EMPLOYER IDENTIFICATION NUMBER COUNTY NUMBER

CHECK THE BOX corresponding to the type of refund you are claiming. Complete all sections on the form.

See instructions for documentation required to support claim.

Retail Sales Tax

Fuel Used in Implement of Husbandry

Fuel Used in Processing

Machinery, Equipment, and Computers

Retailer’s Use Tax

Consumer’s Use Tax

Vehicle One-time Registration Fee/Vehicle Use Tax:

Enter your Vehicle Identification Number (VIN):

Local Option Sales Tax: Complete the schedule on the second page.

Local Hotel / Motel Tax

Automobile Rental Tax

State Excise Tax:

Lodging

Certain Construction Equipment

CLAIM PERIOD ______________ TO _____________ Break down claim period by quarters. Attach additional sheets if necessary.

TAX PERIOD ORIGINAL IOWA TAX PAID

(no local option sales tax) CORRECTED AMOUNT TAX TO BE REFUNDED

1. Column Subtotals

2. Subtotal from reverse side of Local Option Tax Refund

3. TOTAL REFUND DUE: Add subtotals.

REASON FOR REFUND REQUEST: Explain in detail the reason(s) a refund is due, including applicable Code section and rule

references. Attach an additional sheet if needed. __________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

THE IA 843 SHOULD BE THE FIRST PAGE OF A SUBMITTED CLAIM, WITH ALL SUPPORTING DOCUMENTATION BEHIND - SEE

INSTRUCTIONS FOR SUPPORTING DOCUMENTATION REQUIREMENTS.

I, the undersigned, declare under penalty of perjury that I have examined this claim, including all accompanying schedules, documentation, and

statements, and, to the best of my knowledge and belief, it is a true, correct, and complete claim.

CLAIMANT’S SIGNATURE: _________________________________ DATE: ______________ PHONE NUMBER: __________________________

PRINT NAME: ___________________________________________ TITLE (IF CORPORATION): _______________________________________

Biodiesel Production

Reset Form

Print Form

Who May File

Any taxpayer who believes that an overpayment of retail sales,

retailer’s use, consumer’s use, vehicle one-time registration fee/

use tax, local option, local hotel/motel, automobile rental, or

state excise tax exists may file this Claim for Refund form.

The IA 843 may not be used to claim a refund of withholding.

Employers must file an amended withholding quarterly return to

claim a withholding tax refund.

Individuals must file the IA 1040, IA 1040A, or IA 1040X, as

appropriate, to request a refund of Iowa income tax withheld.

All claims must include a sales or use tax permit number, if

applicable.

Individuals: You must provide your Social Security Number.

Sole Proprietors: You must provide a Social Security Number

and a Federal Employer Identification Number, if applicable.

Partnerships and Corporations: You must provide your

Federal Employer Identification Number.

Who Must Sign

If a claim is filed for a corporation, the claim must be signed

either by an officer or other authorized representative of the

corporation. If an attorney or agent is filing the claim on behalf

of the claimant, a power of attorney (original) authorizing the

attorney or agent to sign must be submitted with the claim. A

power of attorney should clearly identify who is to receive the

refund check and where it should be mailed.

Supporting Documentation Required - contact the

Department if you would like to submit supporting

documentation electronically.

Retail Sales/Use Tax, Consumer’s Use Tax, Local Hotel/

Motel, State Excise, and Automobile Rental Tax: Provide

copies of the invoices, exemption certificates, credit memos,

and any other supporting documentation applicable.

Fuel Used in Processing and Implements of Husbandry: A

processing vs. nonprocessing energy study to determine the

exempt percentage, copies of all invoices, and a schedule of

energy used. Explain the manufacturing process (how the

equipment using the fuel is used in this process) and describe

the tangible personal property to be sold at retail.

22-009b (09/25/12)

Farm and Industrial Machinery and Equipment: Copies of

the invoices. Explain how each item is used directly and

primarily in your agricultural production or manufacturing

process.

Computers: Copies of all invoices. Explain how they are used

in processing or storing data and describe your type of business

or occupation.

Vehicle One-time Registration Fee (on or after 7-1-08) /

Vehicle Use Tax (prior to 7-1-08): Copies of the original bill

of sale, the title, and any additional supporting information.

NOTE: The vehicle identification number (VIN) must be

entered on the first page of this claim form.

Local Option Tax: Copies of all invoices verifying that local

option tax has been paid to the State of Iowa.

Biodiesel Production: Provide the number of biodiesel

gallons produced during each quarter.

Where is My Sales/Use Refund? Call 515/242-6034.

Questions?

Phone: 515-281-3114 or 1-800-367-3388

E-mail: [email protected]

Where to File: Compliance Division

Iowa Department of Revenue

PO Box 10456

Des Moines, IA 50306-0456

Instructions for IA 843

If this is a correction to a sales tax return, you need to file an amended return.

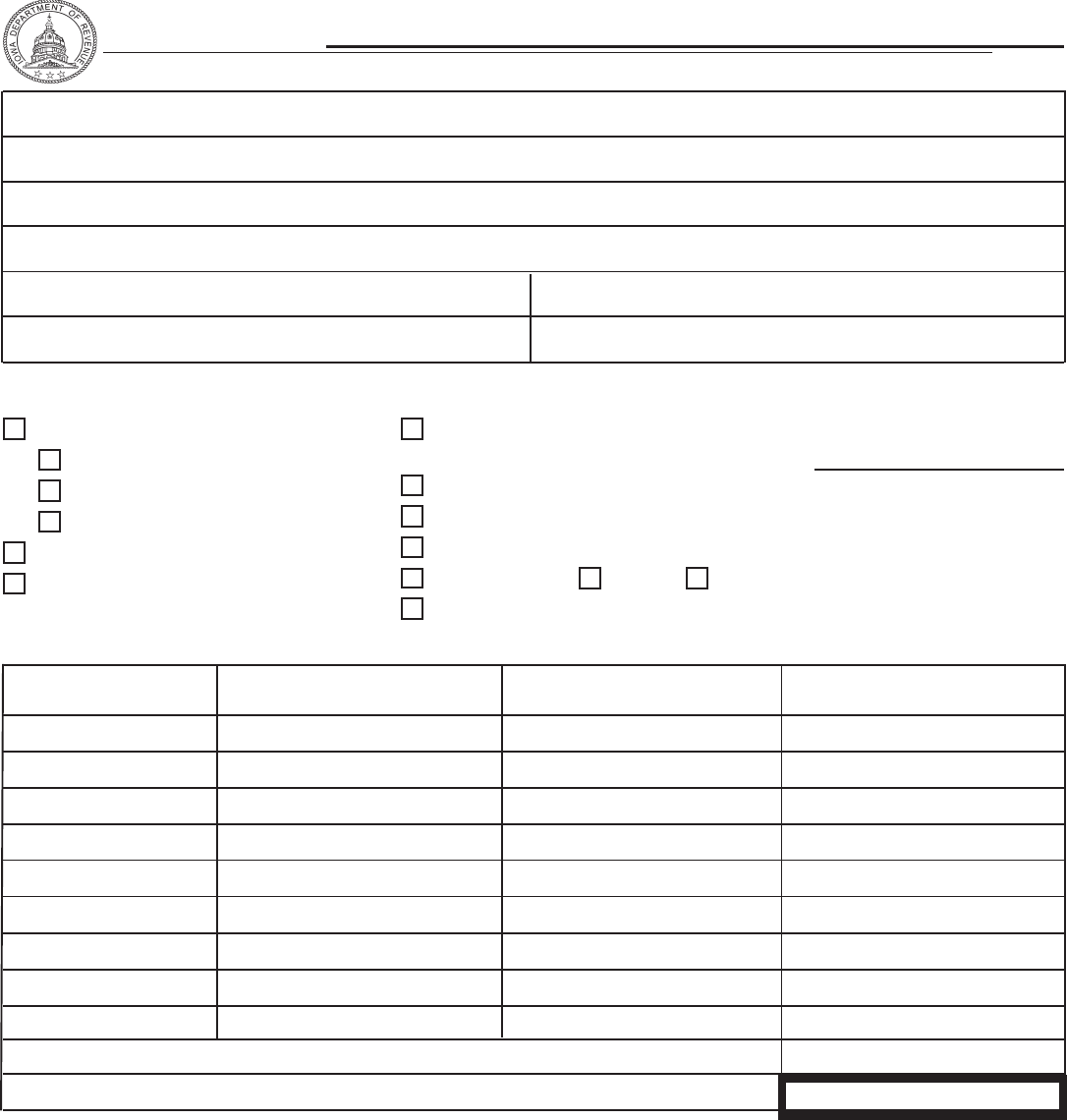

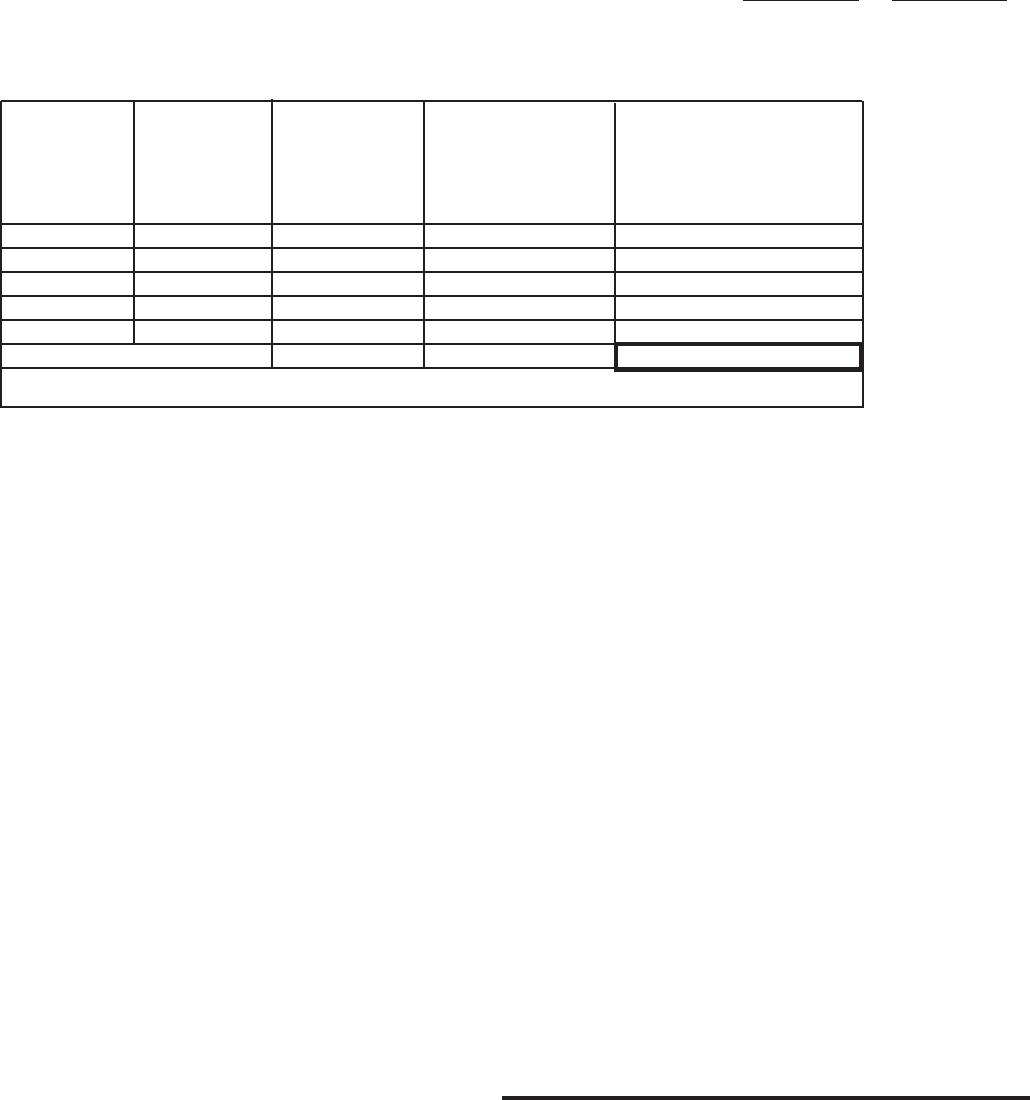

Computation of Local Option Sales Tax Claim Period to

Break down the claim period by quarters. Attach an additional sheet if needed. Break down each tax period by county. Enter the

local option tax to be refunded on the front of this claim on line 2, Subtotal Local Option Tax Refund.

76-POCAHONTAS

77-POLK

78-POTTAWATTAMIE

79-POWESHIEK

80-RINGGOLD

81-SAC

82-SCOTT

83-SHELBY

84-SIOUX

85-STORY

86-TAMA

87-TAYLOR

88-UNION

89-VAN BUREN

90-WAPELLO

91-WARREN

92-WASHINGTON

93-WAYNE

94-WEBSTER

95-WINNEBAGO

96-WINNESHIEK

97-WOODBURY

98-WORTH

99-WRIGHT

01-ADAIR

02-ADAMS

03-ALLAMAKEE

04-APPANOOSE

05-AUDUBON

06-BENTON

07-BLACK HAWK

08-BOONE

09-BREMER

10-BUCHANAN

11-BUENA VISTA

12-BUTLER

13-CALHOUN

14-CARROLL

15-CASS

16-CEDAR

17-CERRO GORDO

18-CHEROKEE

19-CHICKASAW

20-CLARKE

21-CLAY

22-CLAYTON

23-CLINTON

24-CRAWFORD

25-DALLAS

51-JEFFERSON

52-JOHNSON

53-JONES

54-KEOKUK

55-KOSSUTH

56-LEE

57-LINN

58-LOUISA

59-LUCAS

60-LYON

61-MADISON

62-MAHASKA

63-MARION

64-MARSHALL

65-MILLS

66-MITCHELL

67-MONONA

68-MONROE

69-MONTGOMERY

70-MUSCATINE

71-O’BRIEN

72-OSCEOLA

73-PAGE

74-PALO ALTO

75-PLYMOUTH

26-DAVIS

27-DECATUR

28-DELAWARE

29-DES MOINES

30-DICKINSON

31-DUBUQUE

32-EMMET

33-FAYETTE

34-FLOYD

35-FRANKLIN

36-FREMONT

37-GREENE

38-GRUNDY

39-GUTHRIE

40-HAMILTON

41-HANCOCK

42-HARDIN

43-HARRISON

44-HENRY

45-HOWARD

46-HUMBOLDT

47-IDA

48-IOWA

49-JACKSON

50-JASPER

IOWA COUNTIES AND COUNTY NUMBERS

·

·

TAX COUNTY ORIGINAL CORRECTED LOCAL OPTION TAX

PERIOD NUMBER TAX PAID AMOUNT TO BE REFUNDED

TOTALS

Enter on line 2 of page 1, Subtotal