Fillable Printable January Trs Plan 3 Contribution Rate Change Form

Fillable Printable January Trs Plan 3 Contribution Rate Change Form

January Trs Plan 3 Contribution Rate Change Form

DRS T 252 (R 07/14)

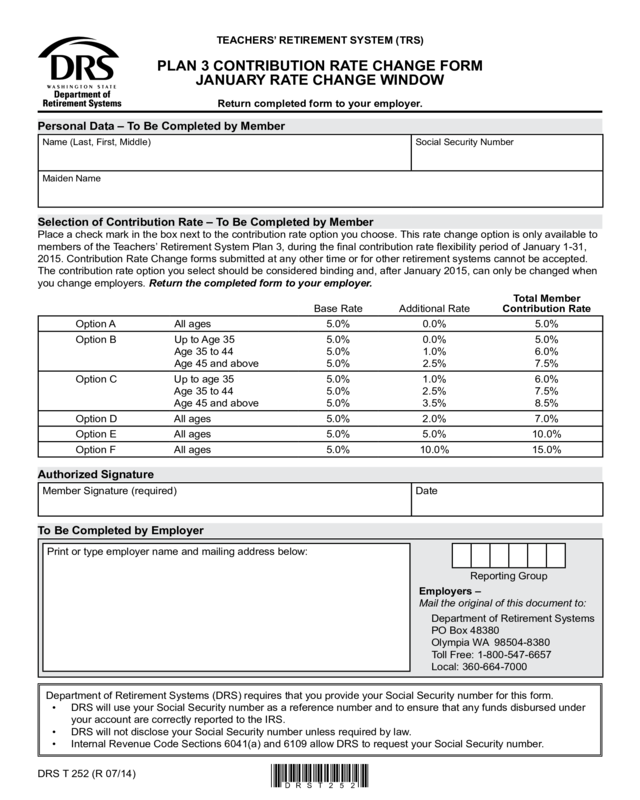

PLAN 3 CONTRIBUTION RATE CHANGE FORM

JANUARY RATE CHANGE WINDOW

TEACHERS’ RETIREMENT SYSTEM (TRS)

Return completed form to your employer.

Personal Data – To Be Completed by Member

Name (Last, First, Middle) Social Security Number

Maiden Name

Selection of Contribution Rate – To Be Completed by Member

Place a check mark in the box next to the contribution rate option you choose. This rate change option is only available to

members of the Teachers’ Retirement System Plan 3, during the nal contribution rate exibility period of January 1-31,

2015. Contribution Rate Change forms submitted at any other time or for other retirement systems cannot be accepted.

The contribution rate option you select should be considered binding and, after January 2015, can only be changed when

you change employers. Return the completed form to your employer.

Base Rate Additional Rate

Total Member

Contribution Rate

Option A All ages 5.0% 0.0% 5.0%

Option B Up to Age 35

Age 35 to 44

Age 45 and above

5.0%

5.0%

5.0%

0.0%

1.0%

2.5%

5.0%

6.0%

7.5%

Option C Up to age 35

Age 35 to 44

Age 45 and above

5.0%

5.0%

5.0%

1.0%

2.5%

3.5%

6.0%

7.5%

8.5%

Option D All ages 5.0% 2.0% 7.0%

Option E All ages 5.0% 5.0% 10.0%

Option F All ages 5.0% 10.0% 15.0%

To Be Completed by Employer

Print or type employer name and mailing address below:

Reporting Group

Employers –

Mail the original of this document to:

Department of Retirement Systems

PO Box 48380

Olympia WA 98504-8380

Toll Free: 1-800-547-6657

Local: 360-664-7000

Department of Retirement Systems (DRS) requires that you provide your Social Security number for this form.

• DRS will use your Social Security number as a reference number and to ensure that any funds disbursed under

your account are correctly reported to the IRS.

• DRS will not disclose your Social Security number unless required by law.

• Internal Revenue Code Sections 6041(a) and 6109 allow DRS to request your Social Security number.

*DRST252*

Authorized Signature

Member Signature (required) Date

Clear Form