Fillable Printable Lc-110 - Wisconsin Department Of Revenue

Fillable Printable Lc-110 - Wisconsin Department Of Revenue

Lc-110 - Wisconsin Department Of Revenue

LC-110 (R. 12-16)

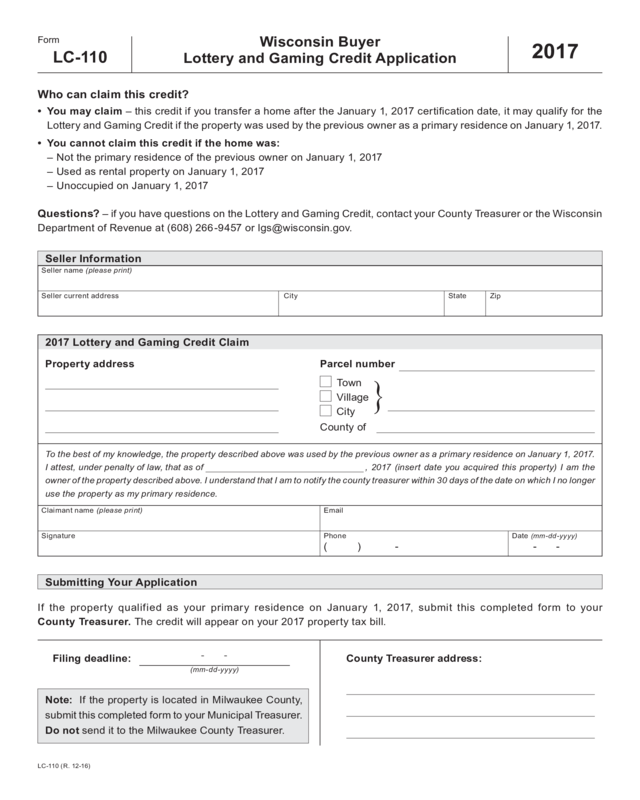

LC-110

Form

Wisconsin Buyer

Lottery and Gaming Credit Application

2017

Who can claim this credit?

• You may claim – this credit if you transfer a home after the January 1, 2017 certification date, it may qualify for the

Lottery and Gaming Credit if the property was used by the previous owner as a primary residence on January 1, 2017.

• You cannot claim this credit if the home was:

– Not the primary residence of the previous owner on January 1, 2017

– Used as rental property on January 1, 2017

– Unoccupied on January 1, 2017

Questions? – if you have questions on the Lottery and Gaming Credit, contact your County Treasurer or the Wisconsin

Department of Revenue at (608) 266-9457 or lgs@wisconsin.gov.

If the property qualified as your primary residence on January 1, 2017, submit this completed form to your

County Treasurer. The credit will appear on your 2017 property tax bill.

2017 Lottery and Gaming Credit Claim

To the best of my knowledge, the property described above was used by the previous owner as a primary residence on January 1, 2017.

I attest, under penalty of law, that as of , 2017 (insert date you acquired this property) I am the

owner of the property described above. I understand that I am to notify the county treasurer within 30 days of the date on which I no longer

use the property as my primary residence.

Town

Village

City

County of

}

Property address

Claimant name (please print) Email

( ) -

Parcel number

Signature Phone Date (mm-dd-yyyy)

- -

County Treasurer address:

Note: If the property is located in Milwaukee County,

submit this completed form to your Municipal Treasurer.

Do not send it to the Milwaukee County Treasurer.

Filing deadline:

(mm-dd-yyyy)

- -

Submitting Your Application

Seller name (please print)

Seller current address City State Zip

Seller Information

Save

Print

Clear

Important -- to ensure this form works properly,

save it to your computer before completing the form.