Fillable Printable Medicare Cost Sharing For Members

Fillable Printable Medicare Cost Sharing For Members

Medicare Cost Sharing For Members

AHCCCS CONTRACTOR OPERATIONS MANUAL

CHAPTER 200 - CLAIMS

201 - Page 1 of 8

201 - MEDICARE COST SHARING FOR MEMBERS COVERED BY MEDICARE AND

MEDICAID

EFFECTIVE DATES: 10/01/97, 02/01/13, 07/01/13, 12/01/14, 07/01/16, 09/20/17

REVISION DATES: 06/01/01, 03/11/10, 01/03/13, 06/06/13, 07/18/13, 11/20/14, 05/19/16,

09/07/17

I. PURPOSE

This Policy applies to Acute, ALTCS/EPD, CRS, DCS/CMDP (CMDP), DES/DDD (DDD),

and RBHA Contractors. The purpose of this Policy is to define Contractor cost sharing

responsibilities for members that are Dual-Eligible Medicare Beneficiaries (Duals) receiving

Medicare Parts A and/or B through Original Fee-For-Service (FFS) Medicare or a Medicare

Advantage Plan. The purpose of this Policy is also to maximize cost avoidance efforts by

Managed Care Contractors and to provide a consistent reimbursement methodology for

Medicare cost sharing as outlined in section 1905(p)(3) of the Social Security Act.

II. DEFINITIONS

COST SHARING

The Contractors’ obligation for payment of applicable Medicare

coinsurance, deductible, and copayment amounts for Medicare

Parts A and B covered services.

DUAL ELIGIBLE

MEDICARE

BENEFICIARIES (DUALS)

An AHCCCS member who is eligible for both Medicaid and

Medicare services. There are two types of Dual Eligible

members: QMB Duals and Non-QMB Duals (FBDE, SLMB+,

QMB+)

FULL BENEFIT DUAL

ELIGIBLE (FBDE)

An AHCCCS Member who does not meet the income or

resources criteria for a QMB or an SLMB. Eligible for

Medicaid either categorically or through optional coverage

groups, such as Medically Needy or special income levels for

institutionalized or home and community-based waivers.

IN-NETWORK

PROVIDER

A provider that is contracted with the Contractor to provide

services.

MEDICARE ADVANTAGE

PLAN

A private health insurance plan that has a contract with the

Centers for Medicare and Medicaid Services (CMS) to provide

all Medicare benefits covered under Parts A and B to Medicare

beneficiaries who choose to enroll in their plan. Most plans

include prescription drug coverage and may also provide

additional benefits. Types of Medicare Advantage plans

include Local Health Maintenance Organizations (HMOs),

Special Needs Plans (SNPs), and Local and Regional Preferred

Provider Organizations (RPPOs).

AHCCCS CONTRACTOR OPERATIONS MANUAL

CHAPTER 200 - CLAIMS

201 - Page 2 of 8

MEDICARE PART A

Hospital insurance that provides coverage for inpatient care in

hospitals, skilled nursing facilities, and hospice.

MEDICARE PART B

Coverage for medically-necessary services like doctors'

services, outpatient care, home health services, and other

medical services.

MEDICARE PART D

Medicare prescription drug coverage.

NON-QUALIFIED

MEDICARE BENEFICIARY

(NON-QMB) DUAL

A person who qualifies to receive both Medicare and Medicaid

services, but does not qualify for the QMB program as outlined

in A.A.C. R9-29-101.

OUT OF NETWORK

PROVIDER

A provider that is neither contracted with nor authorized by the

Contractor to provide services to its members.

QUALIFIED MEDICARE

BENEFICIARY DUAL

(QMB DUAL)

A person determined eligible under A.A.C. R9-29-101 et seq.

for QMB and eligible for acute care services provided for in

A.A.C. R9-22-201 et seq. or ALTCS services provided for in

A.A.C. R9-28-201 et seq. A QMB dual person receiving both

Medicare and Medicaid services and cost sharing assistance.

QUALIFIED MEDICARE

BENEFICIARY ONLY

(QMB ONLY)

A person who qualifies to receive Medicare services only and

cost-sharing assistance known as QMB.

SPECIFIED LOW-INCOME

MEDICARE BENEFICIARY

(SLMB)

Persons entitled to Medicare Part A whose incomes are between

100-120 per cent of the National Poverty Level. Medicaid also

covers the beneficiary’s Part B premium costs.

SUPPLEMENTAL

BENEFITS

Benefits which may be offered by Medicare Advantage plans

which are not traditionally covered under Medicare Parts A and

B. These benefits may include, but are not limited to,

preventative dental and standard vision benefits.

III. POLICY

For QMB Duals and Non-QMB Duals, the Contractor’s cost sharing payment

responsibilities are dependent upon various factors:

Whether the service is covered by Medicare only, by Medicaid only or by both

Medicare and Medicaid,

Whether the services are received in or out of network (the Contractor only has

responsibility to make payments to AHCCCS registered providers),

Whether the services are emergency services, and/or

Whether the Contractor refers the member out of network.

Refer to sections A-B of this policy and. to A.A.C. Title 9, Chapter 29, Article 3.

AHCCCS CONTRACTOR OPERATIONS MANUAL

CHAPTER 200 - CLAIMS

201 - Page 3 of 8

An exception to the Contractor’s cost sharing payment responsibility described below

applies to days in a Skilled Nursing Facility. For stays in a Skilled Nursing Facility, the

Contractor shall pay 100% of the member cost sharing amount for any Medicare Part A

Skilled Nursing Facility (SNF) days (21 through 100) even if the Contractor has a Medicaid

Nursing Facility rate less than the amount paid by Medicare for a Part A SNF day.

For Contractor responsibilities regarding coordination of benefits activities for members

who have third-party coverage other than Medicare, refer to ACOM Policy 434.

A. QMB DUALS

QMB Duals are entitled to all Medicaid and Medicare Part A and B covered services.

These members are identified by a Medicare Part C entry in their AHCCCS Medicare

record and typically by a two in the third digit of the rate code. A QMB Dual eligible

member who receives services under A.A.C.R9-22-2 or A.A.C. R9-28-2

from a

registered provider is not liable for any Medicare copayment, coinsurance or deductible

associated with those services and is not liable for any balance of billed charges. (A.A.C.

R9-29-302)

CONTRACTOR PAYMENT RESPONSIBILITIES

1. The Contractor is responsible for payment of Medicare cost sharing (deductible,

coinsurance, and copayment) amounts for all Medicare Part A and B covered

services, including services not covered by AHCCCS, subject to the limits outlined in

this Policy. See also AMPM Chapter 300, Section 310. These services include:

a. Chiropractic services for adults,

b. Outpatient occupational and speech therapy coverage for adults,

c. Orthotic devices for adults,

d. Cochlear implants for adults,

e. Services by a podiatrist, and

f. Any services covered by or added to the Medicare program not covered by

Medicaid.

2. The Contractor is prohibited from using the 09 coverage code to deny payment for

medically necessary services to members who are both Medicare and Medicaid

eligible. The 09 coverage code is used by AHCCCS to resolve coding discrepancies

between Medicare and Medicaid, and shall not be used to deny payment of claims.

3. The Contractor only has responsibility to make payments to AHCCCS registered

providers.

4. The payment of Medicare cost sharing for QMB Duals must be provided regardless

of whether the provider is in the Contractor's network or prior authorization has been

obtained.

5. The Contractor shall have no cost sharing obligation if the Medicare payment exceeds

the Contractor’s contracted rate for the services. The Contractor’s liability for cost

sharing plus the amount of Medicare’s payment shall not exceed the Contractor’s

AHCCCS CONTRACTOR OPERATIONS MANUAL

CHAPTER 200 - CLAIMS

201 - Page 4 of 8

contracted rate for the service. There is no cost sharing obligation if the Contractor

has a contract with the provider, and the provider’s contracted rate includes Medicare

cost sharing. The exception to these limits on payments as noted above is that the

Contractor shall pay 100% of the member copayment amount for any Medicare Part

A SNF days (21 through 100) even if the Contractor has a Medicaid Nursing Facility

rate less than the amount paid by Medicare for a Part A SNF day.

6. In accordance with A.A.C. R9-29-302, unless the subcontract with the provider sets

forth different terms, when the enrolled member (QMB Dual) receives services from

an AHCCCS registered provider in or out of network the following applies (Table 1

and Figure 1):

TABLE 1: QMB DUALS

QMB DUALS

WHEN THE SERVICE IS

COVERED BY:

THE CONTRACTOR SHALL PAY

(Subject to the limits outlined in this Policy)

Medicare Only

Medicare copayments, coinsurance and deductible

Medicaid Only

The provider in accordance with the contract

By both Medicare and

Medicaid

(See Examples Below)

The lesser of:

a. The Medicare copay, coinsurance or deductible, or

b. The difference between the Contractor’s contracted

rate and the Medicare paid amount.

FIGURE 1 – QMB DUAL COST SHARING - EXAMPLES

SERVICES ARE COVERED BY BOTH MEDICARE AND MEDICAID

Subject to the limits outlined in this Policy

EXAMPLE 1

(b. In Table 1 above)

EXAMPLE 2

(b. In Tab le 1 above)

EXAMPLE 3

(b. In Table 1 above)

Provider charges

$125

$125

$125

Medicare rate for service

$100

$100

$100

Medicaid rate for Medicare

service (Contractor’s

contracted rate)

$100

$90

$90

Medicare deductible

$0

$0

$40

Medicare paid amount (80%

of Medicare rate less

deductible)

$80

$80

$40

AHCCCS CONTRACTOR OPERATIONS MANUAL

CHAPTER 200 - CLAIMS

201 - Page 5 of 8

Medicare coinsurance (20%

of Medicare rate)

$20

$20

$20

CONTRACTOR PAYS

$20

$10

$50

B. NON-QMB DUALS

A Non-QMB Dual eligible member who receives covered services under 9 A.A.C. 22,

Article 2 or 9, 9 A.A.C. 28, Article 2 from a provider within the Contractor's network is

not liable for any Medicare copay, coinsurance or deductible associated with those

services and is not liable for any balance of billed charges unless services have reached

the limitations described within A.A.C. R9-22, Article 2. When the Non-QMB Dual

Member elects to receive services out of network that are covered by both Medicare and

Medicaid, the member is responsible for any Medicare copay, coinsurance or deductible

unless the service is emergent, or, for non-emergency services, the provider has obtained

the member’s approval for payment as required in A.A.C. R9-22-702.

CONTRACTOR PAYMENT RESPONSIBILITIES (IN NETWORK)

1. In accordance with A.A.C. R9-29-303, when an enrolled member (Non-QMB Dual)

receives services within the network of contracted providers and the service is

covered up to the limitations described within A.A.C. R9-22-2, the member is not

liable for any balance of billed charges and the following applies (Table 2):

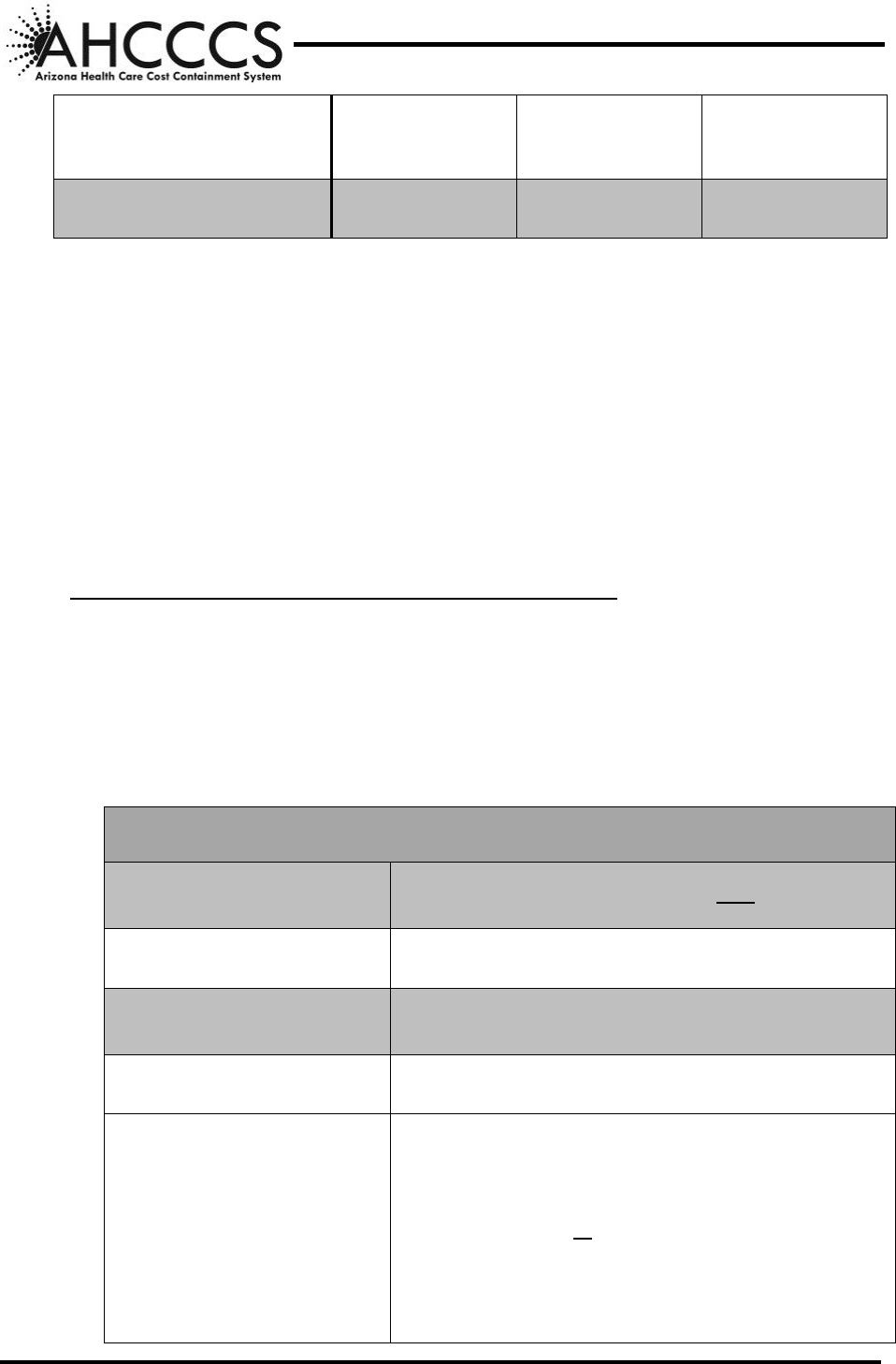

TABLE 2: NON-QMB DUALS (IN NETWORK)

NON-QMB DUALS (IN NETWORK)

WHEN THE SERVICE IS

COVERED BY:

THE CONTRACTOR SHALL NOT PAY:

Medicare Only

Medicare copay, coinsurance or deductible

WHEN THE SERVICE IS

COVERED BY:

THE CONTRACTOR SHALL PAY:

(SUBJECT TO THE LIMITS OUTLINED IN THIS POLICY)

Medicaid Only

The provider in accordance with the contract

By both Medicare and

Medicaid

The lesser of the following (unless the subcontract with

the provider sets forth different terms):

a. The Medicare copay, coinsurance or deductible,

or

b. Any amount remaining after the Medicare paid

amount is deducted from the subcontracted rate

(Contractor’s contracted rate).

AHCCCS CONTRACTOR OPERATIONS MANUAL

CHAPTER 200 - CLAIMS

201 - Page 6 of 8

CONTRACTOR PAYMENT RESPONSIBILITIES (OUT OF NETWORK)

2. In accordance with A.A.C. R9-29-303, when an enrolled member (Non-QMB Dual)

receives services from a non-contracting provider the following applies (Table 3):

TABLE 3: NON-QMB DUALS (OUT OF NETWORK)

NON-QMB DUALS (OUT OF NETWORK)

WHEN THE SERVICE IS

COVERED BY:

THE CONTRACTOR

Subject to the limits outlined in this Policy

Medicare Only

Has no responsibility for payment.

Medicaid only and the

Contractor has not referred the

member to the provider or has

not authorized the provider to

render services and the services

are not emergent

Has no responsibility for payment.

Medicaid only and the

Contractor has referred the

member to the provider or has

authorized the provider to

render services or the services

are emergent

Shall pay in accordance with A.A.C. R9-22-705.

By both Medicare and Medicaid

and the Contractor has not

referred the member to the

provider or has not authorized

the provider to render services

and the services are not

emergent

Has no responsibility for payment.

By both Medicare and Medicaid

and the Contractor has referred

the member to the provider or

has authorized the provider to

render services or the services

are emergent

Shall pay the lesser of:

a. The Medicare copay, coinsurance or

deductible, or

b. Any amount remaining after the Medicare

paid amount is deducted from the amount

otherwise payable under A.A.C. R9-22-705.

AHCCCS CONTRACTOR OPERATIONS MANUAL

CHAPTER 200 - CLAIMS

201 - Page 7 of 8

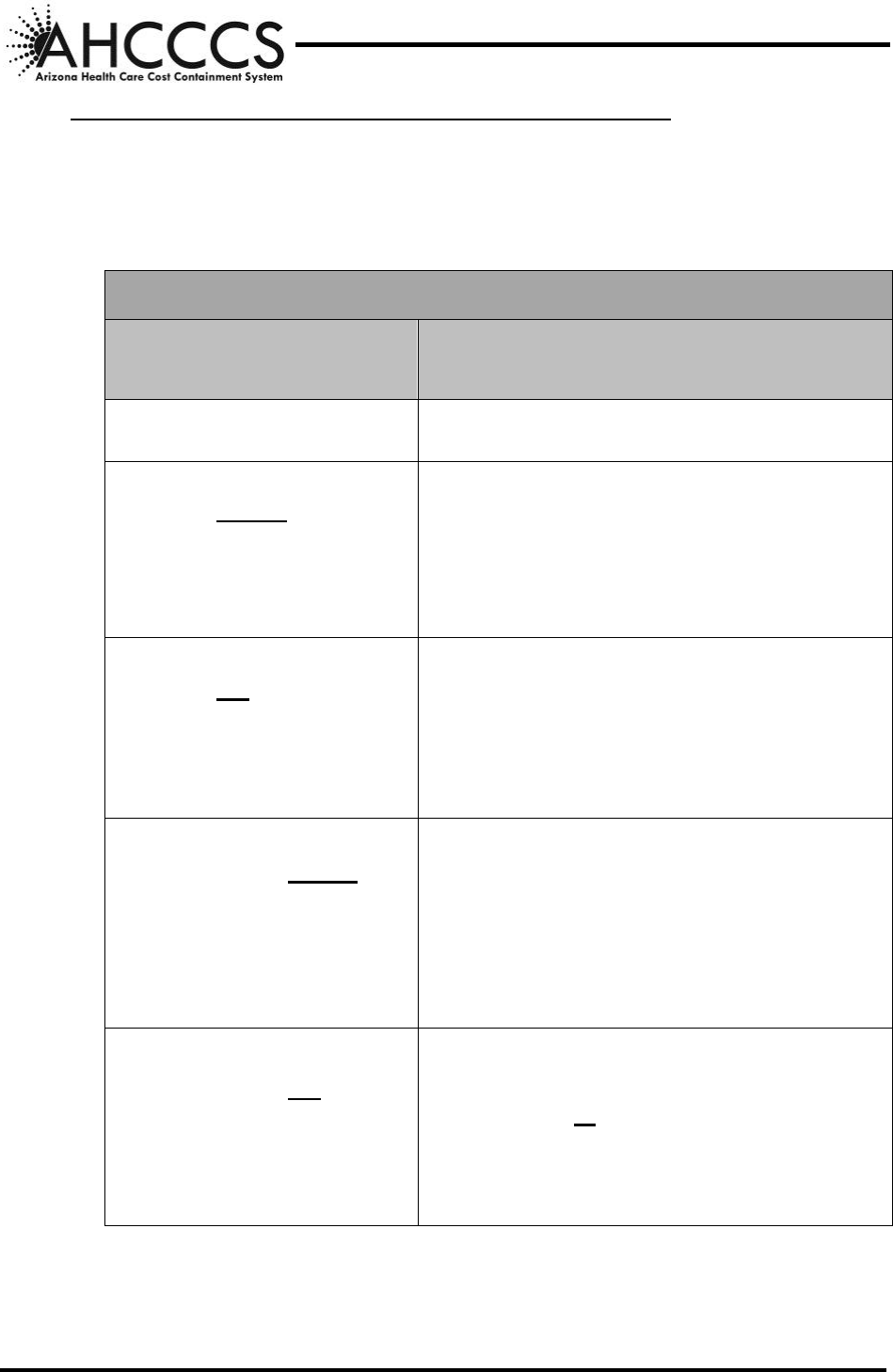

C. PRIOR AUTHORIZATION

The Contractor can require prior authorization. If the Medicare provider determines that

a service is medically necessary, the Contractor is responsible for Medicare cost sharing

if the member is a QMB dual, even if the Contractor determines the service is not

medically necessary. If Medicare denies a service for lack of medical necessity, the

Contractor must apply its own criteria to determine medical necessity. If criteria support

medical necessity, then the Contractor shall cover the cost of the service for QMB Duals.

D. PART D COVERED DRUGS

For QMB and Non-QMB Duals, Federal and State laws prohibit the use of AHCCCS

monies to pay for cost sharing of Medicare Part D medications.

RBHAs must utilize available Non-Title XIX/XXI funds to cover Medicare Part D

copayments for Title XIX/XXI and Non-Title XIX/XXI persons determined to have SMI,

with the following limitations:

Coverage of co-payments are to be used for medications on the AHCCCS

Behavioral Health Drug List,

Co-payments are to be covered for medications prescribed by RBHA in-network

providers,

RBHAs shall utilize Non-Title XIX/XXI funds for coverage of medications

during the Medicare Part D coverage gap, and

If a request for an exception has been submitted and denied by the Medicare Part

D plan and the coverage determination appeals process has been completed, the

RBHA may utilize Non-Title XIX/XXI funds to cover the cost of the non-covered

Part D medication for persons determined SMI, regardless of Title XIX/XXI

eligibility.

E. INSTITUTIONAL STATUS REPORTING – PART D COPAYS

1. Acute, RBHA, CMDP and CRS -- When a dual eligible member is inpatient in a

medical institution or nursing facility and that stay is funded by Medicaid for a full

calendar month, the dual eligible person is not required to pay copayments for their

Medicare covered prescription medications for the remainder of the calendar year.

(See Chapter 16b, Section 80.4.3 of the Medicare Managed Care Manual and

Medicare Prescription Drug Benefit Manual, Chapter 13, Section 60).

To ensure appropriate information is communicated for these members to CMS, the

Contractor must notify the AHCCCS, Member Database Management Administration

(MDMA), using the form provided in Attachment A of this Policy, as soon as it

determines that a dual eligible person is expected to be in a medical institution that is

funded by Medicaid for a full calendar month, regardless of the status of the dual

eligible person’s Medicare lifetime or annual benefits. Notification is to be submitted

as specified in Contract

. This includes:

a. Members who have Medicare Part “D” only,

b. Members who have Medicare Part “B” only,

c. Members who have used their Medicare Part “A” life time inpatient benefit, and

AHCCCS CONTRACTOR OPERATIONS MANUAL

CHAPTER 200 - CLAIMS

201 - Page 8 of 8

d. Members who are in a continuous placement in a single medical institution or any

combination of continuous placements in a medical institution.

2. Types of Medical Institutions -- For purposes of the medical institution notification,

medical institutions are defined as:

a. Acute hospitals,

b. Psychiatric hospital – Non IMD,

c. Psychiatric hospital – IMD,

d. Residential treatment center – Non IMD,

e. Residential treatment center – IMD,

f. Skilled nursing facilities, and

g. Intermediate Care Facilities for the Intellectually Disabled.

ALTCS/EPD and DDD are not required to provide this information as the State is

already aware of the institutional status of these members and provides this

information to CMS.