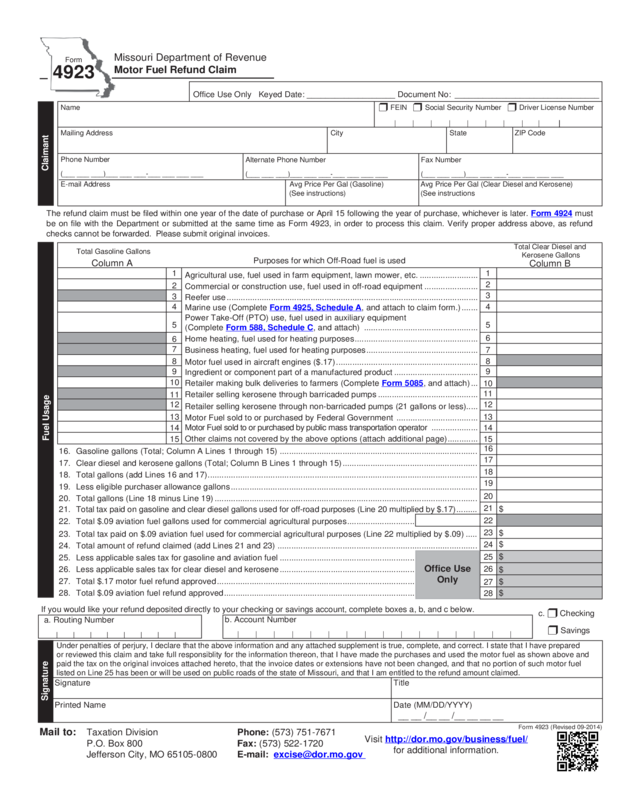

Fillable Printable Motor Fuel Refund Claim Form 4923

Fillable Printable Motor Fuel Refund Claim Form 4923

Motor Fuel Refund Claim Form 4923

The refund claim must be filed within one year of the date of purchase or April 15 following the year of purchase, whichever is later. Form 4924 must

be on file with the Department or submitted at the same time as Form 4923, in order to process this claim. Verify proper address above, as refund

checks cannot be forwarded. Please submit original invoices.

Form

4923

Missouri Department of Revenue

Motor Fuel Refund Claim

Signature Title

Printed Name Date (MM/DD/YYYY)

Signature

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct. I state that I have prepared

or reviewed this claim and take full responsiblity for the information thereon, that I have made the purchases and used the motor fuel as shown above and

paid the tax on the original invoices attached hereto, that the invoice dates or extensions have not been changed, and that no portion of such motor fuel

listed on Line 25 has been or will be used on public roads of the state of Missouri, and that I am entitled to the refund amount claimed.

__ __ /__ __ /__ __ __ __

Mail to: Taxation Division Phone: (573) 751-7671

P.O. Box 800 Fax: (573) 522-1720

Visit http://dor.mo.gov/business/fuel/

for additional information.

Form 4923 (Revised 09-2014)

If you would like your refund deposited directly to your checking or savings account, complete boxes a, b, and c below.

c. r Checking

r Savings

b. Account Number

| | | | | | | | | | | | | | | |

a. Routing Number

| | | | | | | |

Office Use Only Keyed Date: ___________________ Document No: _______________________________

Name r FEIN r Social Security Number r Driver License Number

Mailing Address City State ZIP Code

E-mail Address Avg Price Per Gal (Gasoline) Avg Price Per Gal (Clear Diesel and Kerosene)

(See instructions) (See instructions

Fax Number

(___ ___ ___)___ ___ ___-___ ___ ___ ___

Claimant

Alternate Phone Number

(___ ___ ___)___ ___ ___-___ ___ ___ ___

Phone Number

(___ ___ ___)___ ___ ___-___ ___ ___ ___

| | | | | | | | |

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

Agricultural use, fuel used in farm equipment, lawn mower, etc. .........................

Commercial or construction use, fuel used in off-road equipment .......................

Reefer use ............................................................................................................

Marine use (Complete Form 4925, Schedule A, and attach to claim form.) .......

Power Take-Off (PTO) use, fuel used in auxiliary equipment

(Complete Form 588, Schedule C, and attach) .................................................

Home heating, fuel used for heating purposes .....................................................

Business heating, fuel used for heating purposes ................................................

Motor fuel used in aircraft engines ($.17) .............................................................

Ingredient or component part of a manufactured product ....................................

Retailer making bulk deliveries to farmers (Complete Form 5085, and attach) ...

Retailer selling kerosene through barricaded pumps ...........................................

Retailer selling kerosene through non-barricaded pumps (21 gallons or less).....

Motor Fuel sold to or purchased by Federal Government ...................................

Motor Fuel sold to or purchased by public mass transportation operator ....................

Other claims not covered by the above options (attach additional page) .............

Purposes for which Off-Road fuel is used

Total Gasoline Gallons

Column A

Total Clear Diesel and

Kerosene Gallons

Column B

16. Gasoline gallons (Total; Column A Lines 1 through 15) .....................................................................................

17. Clear diesel and kerosene gallons (Total; Column B Lines 1 through 15) ..........................................................

18. Total gallons (add Lines 16 and 17) ....................................................................................................................

19. Less eligible purchaser allowance gallons ..........................................................................................................

20. Total gallons (Line 18 minus Line 19) .................................................................................................................

21. Total tax paid on gasoline and clear diesel gallons used for off-road purposes (Line 20 multiplied by $.17) .........

22. Total $.09 aviation fuel gallons used for commercial agricultural purposes .............................

23. Total tax paid on $.09 aviation fuel used for commercial agricultural purposes (Line 22 multiplied by $.09) .....

24. Total amount of refund claimed (add Lines 21 and 23) ......................................................................................

25. Less applicable sales tax for gasoline and aviation fuel ..........................................................

26. Less applicable sales tax for clear diesel and kerosene ..........................................................

27. Total $.17 motor fuel refund approved .....................................................................................

28. Total $.09 aviation fuel refund approved ..................................................................................

Office Use

Only

$

$

$

$

$

$

$

Fuel Usage

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

ROUND ALL GALLONS TO NEAREST GALLON

Reset Form

Print Form

Section 142.824 — (Motor Fuel Tax Law)

Provides the following requirements

To claim a refund, the ultimate consumer or retailer must file the claim within one year of the date of purchase or April 15th following the year

of purchase, whichever is later. The claim form must be supported by “original” invoices, sales slips, or other documentation if pre-approved

by the Department. The invoices must be marked paid by the seller and contain the date of sale, name and address of the purchaser and

seller, number of gallons purchased and price per gallon, Missouri fuel tax and sales tax, if applicable, as separate items. Form 4924, Motor

Fuel Tax Refund Application, must be on file with the Department in order to process this claim. Form 4924 can be submitted at the same time

as Form 4923.

Instructions for completing form

Group together all invoices by product type (gas, diesel, kerosene, etc). Attach calculator tapes of the total quantity and the total dollar amount

paid for each product type. Claims received without attached original invoices, sales slips or pre-approved printouts will be returned.

Average price per gallon: Enter the average price per gallon paid for Gasoline, Clear Diesel, and Kerosene. Important: Subtract the federal

and state taxes before calculating the average price paid, in order to deduct the appropriate state sales tax from your refund claim.

Round all gallons to nearest gallon

Line 1: Enter total gallons of fuel used in farm equipment for agricultural purposes, or fuel used in residential or personal off-road equipment

(residential lawn mowers, ATV’s, chain saws, weed eaters, etc.) under Column A (gasoline) and Column B (clear diesel or kerosene).

Line 2: Enter total gallons of fuel used in off-road equipment under Column A (gasoline) and Column B (diesel).

Line 3: Enter total gallons of fuel used in reefer units under Column B.

Line 4:

Enter total gallons of fuel used in watercraft under Column A (gasoline) and Column B (diesel). Attach a completed

Form 4925, Schedule A.

Line 5: Enter total gallons of fuel used in the operation of PTO equipment under Column B. Attach a completed Form 588, Schedule C.

Line 6: Enter total gallons of fuel used for home heating purposes under Column B.

Line 7: Enter total gallons of fuel used for business heating purposes under Column B.

Line 8: Enter total gallons of gasoline used in aircraft under Column A.

Line 9: Enter total gallons of fuel used as an ingredient or component part of the finished product under Column B.

Line 10:

Retailers, enter the bulk sales of one hundred gallons or more of gasoline delivered to farmers under Column A. Attach a completed

Form 5085, Bulk Deliveries of Agricultural Gasoline.

Line 11: Retailers, enter the total gallons of kerosene sold through barricaded pumps under Column B.

Line 12:

Retailers, under Column B, enter the total number of gallons of kerosene sold in quantities of 21 gallons or less through

non-barricaded pumps.

Line 13: Enter the total number of gallons of fuel sold to or purchased by the Federal Government under Columns A and B.

Line 14: Enter the total number of gallons of fuel sold to or purchased by the public mass transportation operator under Columns A and B.

Line 15:

Enter total gallons of fuel used for other off-road purposes under appropriate columns. Explain how the fuel is used for off-road

purposes.

Line 16: Enter total gasoline gallons (Column A Lines 1 through 15).

Line 17: Enter total clear diesel and kerosene gallons (Column B Lines 1 through 15).

Line 18: Enter total gallons subject to a refund (Add Lines 16 and 17).

Line 19: Enter gallons of eligible purchaser allowance. Motor fuel distributor claimants only.

Line 20: Enter total gallons (Line 18 minus Line 19).

Line 21: Enter total motor fuel tax paid on gallons used for off-road purposes (Line 20 multiplied by $.17).

Line 22: Enter total $.09 aviation fuel gallons used for commercial agricultural purposes.

Line 23: Enter total $.09 aviation fuel tax paid on gallons used for commercial agricultural purposes (Line 22 multiplied by $.09).

Line 24: Enter total amount of motor fuel tax refund claimed (Add Lines 21 and 23).

Lines 25 through 28: For office use only. The Department will calculate, if applicable.

Remember to sign and date form.

Claims received unsigned will be returned.

If you have questions or need assistance in completing this form, please call this office at (573) 751-7671 (TTY (800) 735-2966) or e-mail this

office at: [email protected]. You may also access a copy of this form on the Department’s website: http://dor.mo.gov/forms.

Form 4923 (Revised 09-2014)