Fillable Printable Offer In Compromise Application (De 999A)

Fillable Printable Offer In Compromise Application (De 999A)

Offer In Compromise Application (De 999A)

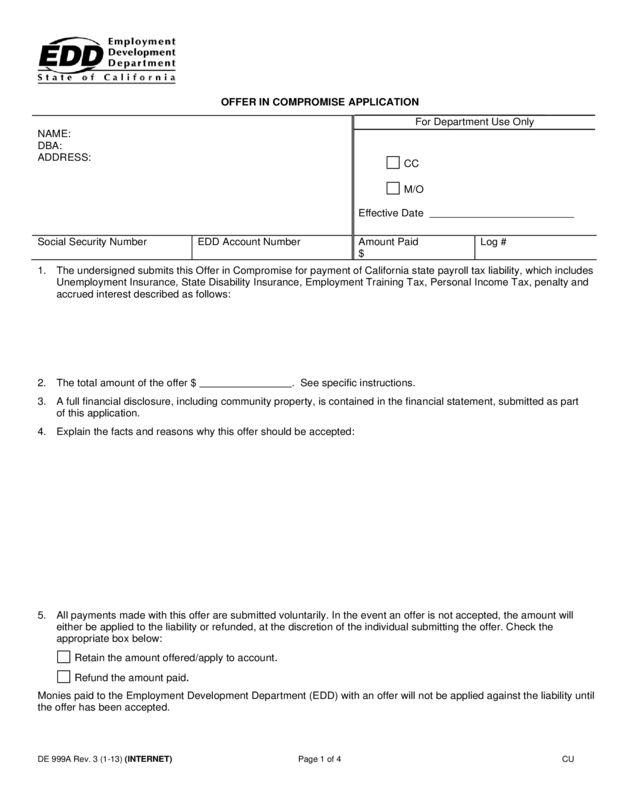

DE 999A Rev. 3 (1-13) (INTERNET) Page 1 of 4 CU

OF

FER IN COMPROMISE APPLICATION

NAME:

DBA:

ADDRESS:

For Department Use Only

CC

M/O

Effective Date

Social Security Number

EDD Account Num ber

Amount Paid

$

Log #

1. The undersigned submits this Offer in Compromise for payment of California state payroll tax liability, which includes

Unemployment Insurance, State Disability Insurance, Employment Training Tax, Personal Income Tax, penalty and

accrued interest described as follows:

2. The total amount of the offer $ . See specific instructions.

3. A full financial disclosure, including community property, is contained in the financial statement, submitted as part

of this application.

4. Explain the facts and reasons why this offer should be accepted:

5. All payments made with this offer are submitted voluntarily. In the event an offer is not accepted, the amount will

either be applied to the liability or refunded, at the discretion of the individual submitting the offer. Check the

appropriate box below:

Retain the amount offered/apply to account.

Refund the amount paid.

Monies paid to the Employment Devel op ment Department (EDD) with an offer will not be applied against the liability until

the offer has been accepted.

DE 999A Rev. 3 (1-13) (INTERNET) Page 2 of 4 CU

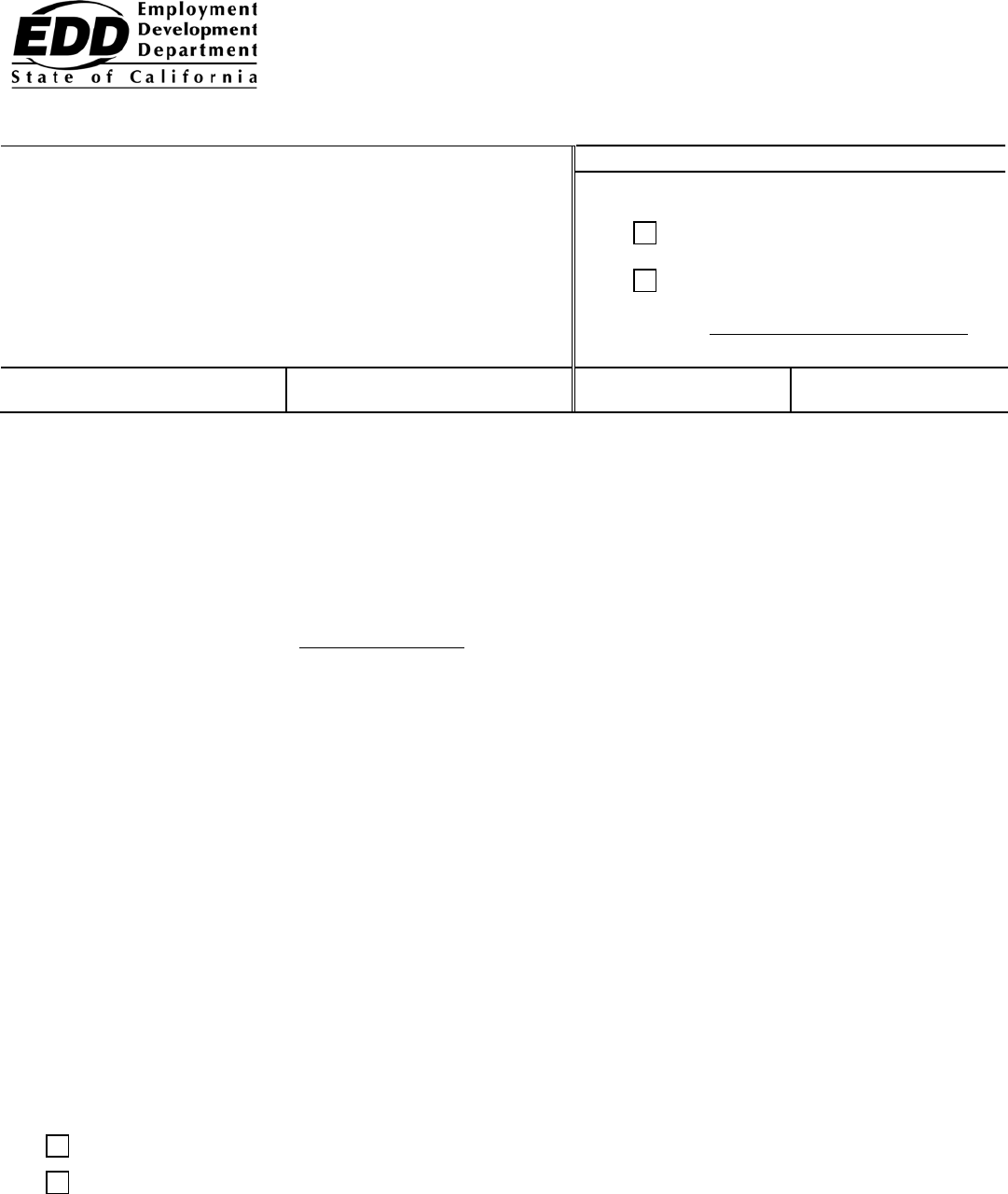

ELIGIBILITY REQUIREMENTS

• Any person assessed under Section 1735 of the California Unemployment Insurance Code (CUIC), a partner or an

individual owner with inactive, out-of-business accounts.

• Any person assessed under Section 1735 of the CUIC, a partner or an individual of an active business, only if you no

longer have a controlling interest or association with the business.

• Any person assessed under Section 1735 of the CUIC, a partner or an individual owner who does not have access to

current income sufficient to pay more than the accumulating interest and 6.7 percent of the liability on an annual

basis.

• Any person assessed under Section 1735 of the CUIC, a partner or an individual owner who does not have as sets ,

whether or not subjected to lien by the EDD, that if sold, would satisfy the liability.

• The amount offered by the individual must be more than the EDD could expect to collect through involuntary means

within four years of the time the offer is made.

• Only non-disputed, final tax liabilities will be considered for compromise. Liabil ities under pet iti on or bankrup t cy will

not be considered.

• Liabilities, as a result of fraud (Section 1128 of the CUIC) or actions resulting in a conviction for a violation of the

CUIC, will not be compromised.

Acknowledgment of Facts

A determination by the Director that it would not be in the best interest of the state to accept partial payment in satisfaction

of a tax liability will not be subject to administrative appeal or judicial review.

When in the Director’s judgment it serves the best interest of the state, the Director may permit the agreed upon amount

to be paid in installments under a payment agreement not to exceed five years in length.

It is understood that this offer will be considered and acted upon in due course and that it does not relieve the individual

from the liability sought to be compromised unless and until the offer is accepted in writing by the Director or a

delegated representative and there has been a full compliance with the terms of the offer.

All liens will remain in effect until the terms of the compromise agreement are fulfilled, including payment of the amount

offered.

Under penalties of perjury, I declare that I have examined this offer, including accompanying documents, and to the best

of my knowledge and belief, it is true, correct, and complete.

Signature of Applicant

Date

Signature of Applicant

Date

Signature of Authorized

EDD Representative

Title

Date

Part 1 (EDD Copy)

DE 999A Rev. 3 (1-13) (INTERNET) Page 3 of 4 CU

Background

The Offers in Compromise program is governed by

Article 8, Sections 1870-1875 of the CUIC. This

program enables a qualified applicant to potentially

eliminate a state tax liability at less than full value. The

term “tax liability” includes EDD taxes, contributions,

penalty, and interest.

Reason for Compromise

When it is in the best interest of the state, the Director

of the EDD may enter into an agreement for partial

payment in satisfaction of the full liability.

Practical Consideration

The following requirements must be met for

consideration:

1. Applicant must not have access to income

sufficient to pay more than the accumulating

interest and 6.7 percent of the outstanding liability

annually.

2. Must not have prospects of increased income or

assets, which allow payment within a reasonable

period.

3. Must not have assets, which if sold, would satisfy

the lia bi lity .

4. The amount offered must be more than the EDD

could expect to collect through involuntary means

within four years of the time the offer is made.

Acceptance of Offer in Compromise

Once the terms of the compromise agreement are

fulfilled, including payment of the amount offered, the

following wi ll occ ur:

1. The liability will be considered satisfied in full.

2. All tax liens filed or recorded, or both, will be

released.

3. A statement will be placed on file with the EDD

containing the following information:

a. The individual’s name and Offer in

Compromise identification number.

b. The year(s) and quarter(s) involved.

c. The reason(s) the liability was reduced by an

Offer in Compromise.

d. The total amount of unpaid tax, interest,

additions to tax, and penalties at issue in the

compromise.

e. The terms of the Offer in Compromise.

f. The total amount paid under the Offer in

Compromise.

All records of compromise are kept by the EDD and

may be reviewed as part of the annual single audit of

the EDD.

Full Compliance of Terms

The EDD will:

1. Notify the individual(s) submitting the offer, in

writing, that the terms of the compromise

agreement have been fulfilled and all liens filed or

recorded, or both, against the individual’s interests

have been released.

2. Furnish the individual(s) submitting the offer with a

copy of the statement on file. The statement will

be retained for one year from the date of the

issuance.

Denial of Offer in Compromise

You will receive a written notification if your offer is

denied. A denia l is final. Se ction 187 2 of the CUIC

states a denial of an Offer in Compromise “shall not

be subject to administrative appeal or judicial review.”

You may reapply in six months if a substantial and

permanent change to your financial situation occurs.

DE 999A Rev. 3 (1-13) (INTERNET) Page 4 of 4 CU

Terms of Rescission

The acceptance of the offer will be rescinded and all

compromised liabilities will be reestablished without

regard to any statute of limitations if it is subsequently

determined that any individual(s) willfully:

1. Concealed from any officer or employee of the

state any property belonging to the estate of the

individual liable with respect to the tax.

2. Received, withheld, destroyed, mutilated, or

falsified any book(s), document(s), or record(s).

3. Made any false statement relating to the estate or

financial conditions of the individual liable with

respect to the tax.

4. Failed to pay any tax liability owed the EDD for

any subsequent, active business in which the

individual who previously submitted the Offer in

Compromise has a controlling interest or

association.

Upon any rescission, the EDD, at its discretion, may

file a Notice of State Tax Lien against the individual or

entity responsible for the previously compromised

liability.

The EDD will notify the individual who previously

submitted the Offer in Compromise in writing of the

following:

1. The rescission of any offer and reasons therefore.

2. The amount of liability that is due and payable.

Collecti on Actio n

Submission of an offer does not automatically

suspend collection action on a liability. Should there

be any indication that filing the offer is solely for the

purpose of delaying collection or will negatively impact

our ability to collect the tax, collection efforts will

continue. If the EDD has previously agreed to an

installment plan, t hose payments must continue.

Should collection action occur after an acceptance of

an Offer in Compromise, you may receive a refund or

have the funds applied to the agreed amount.

Specific Instructions

1. The offer must be submitted on an Offer in

Compromis e Application (DE 999A). A separate

application must be submitted for each account to

be compromised.

2. The application must be completed in full. If the

full amount cannot be paid at the time of offer, the

individual may be permitted to pay the agreed

amount in insta llment s, not t o exceed a five-year

period. The EDD will negotiate terms of the

installment plan during the review process.

3. This is a legal and binding agreement and must be

read in its entirety. The application cannot be

processed without signature in all applicable

areas.

4. Send original application to:

Employment Development Department

P.O. Box 826880, MIC 92S

Sacramento, CA 94280-0001

5. Retain a copy for your records.

Other Facts to Know

The Offer in Compromise package must be

completed. You will be expected to provide

reasonable documentation to verify your inability to

pay the full liability. The offer will only be successful if

a legitimate proposal is submitted in the state’s best

interests.

Should you have any questions, please contact the

EDD at 916-464-2739.