Fillable Printable Op-236

Fillable Printable Op-236

Op-236

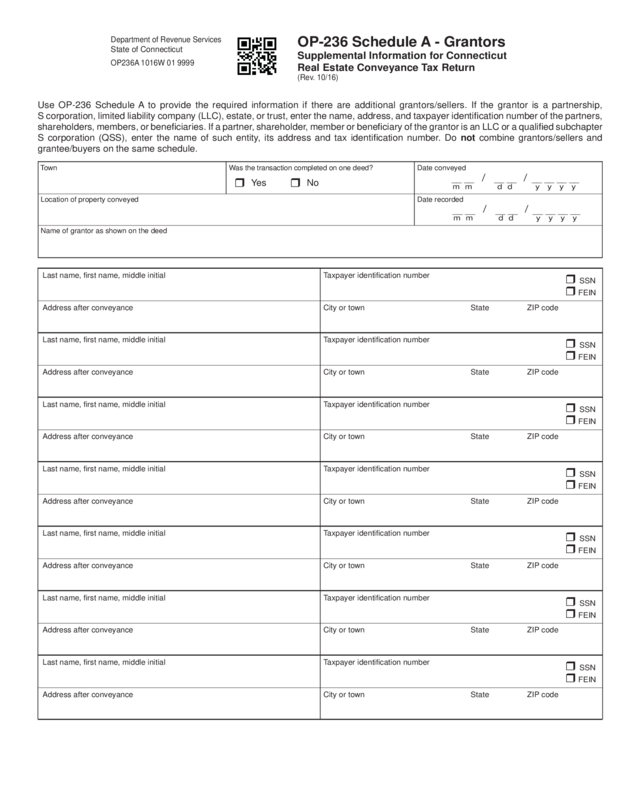

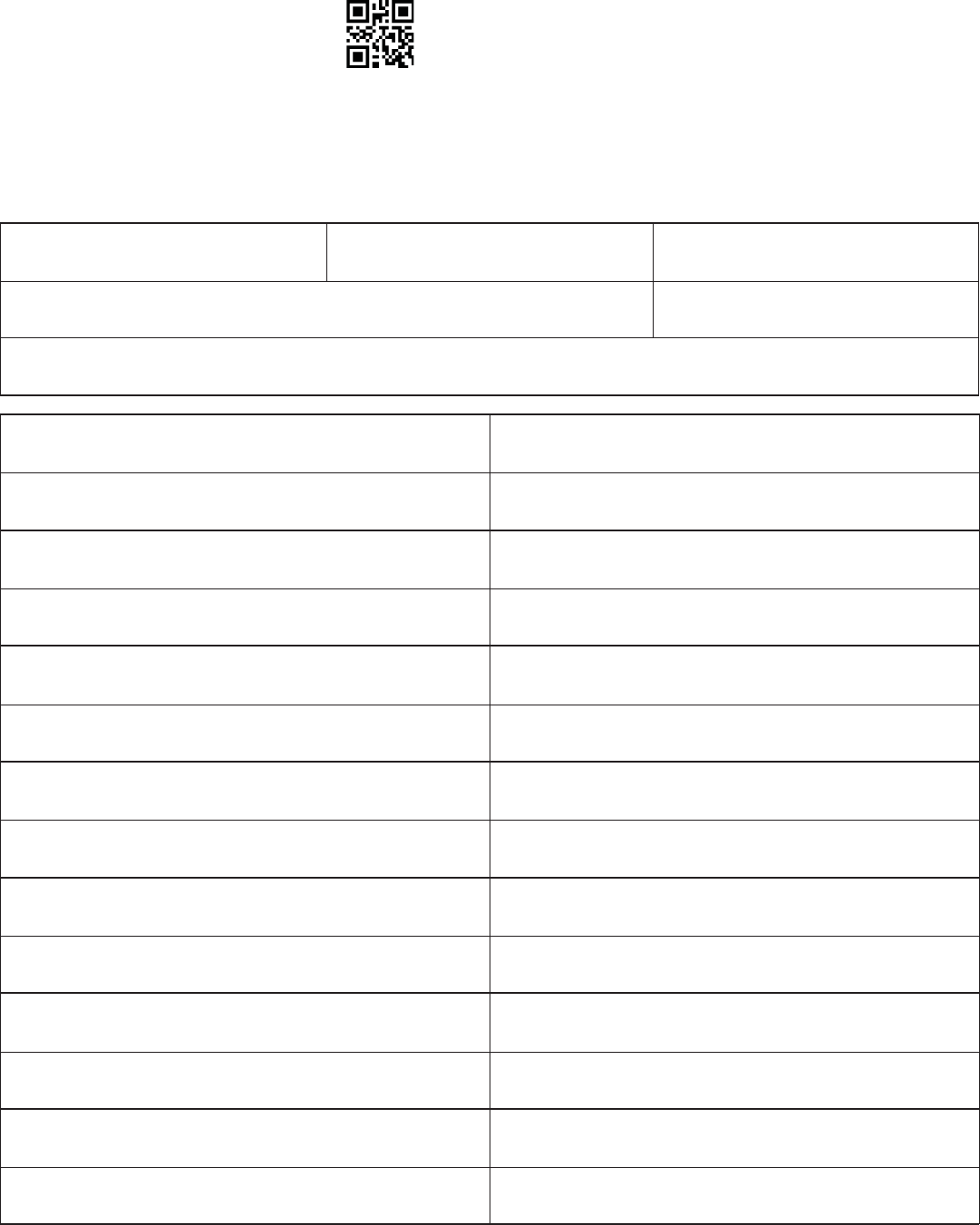

Last name, fi rst name, middle initial Taxpayer identifi cation number

Address after conveyance City or town State ZIP code

Last name, fi rst name, middle initial Taxpayer identifi cation number

Address after conveyance City or town State ZIP code

Last name, fi rst name, middle initial Taxpayer identifi cation number

Address after conveyance City or town State ZIP code

Last name, fi rst name, middle initial Taxpayer identifi cation number

Address after conveyance City or town State ZIP code

Last name, fi rst name, middle initial Taxpayer identifi cation number

Address after conveyance City or town State ZIP code

Last name, fi rst name, middle initial Taxpayer identifi cation number

Address after conveyance City or town State ZIP code

Last name, fi rst name, middle initial Taxpayer identifi cation number

Address after conveyance City or town State ZIP code

SSN

FEIN

SSN

FEIN

SSN

FEIN

SSN

FEIN

SSN

FEIN

SSN

FEIN

Use OP-236 Schedule A to provide the required information if there are additional grantors/sellers. If the grantor is a partnership,

S corporation, limited liability company (LLC), estate, or trust, enter the name, address, and taxpayer identifi cation number of the partners,

shareholders, members, or benefi ciaries. If a partner , shareholder, member or benefi ciary of the grantor is an LLC or a qualifi ed subchapter

S corporation (QSS), enter the name of such entity, its address and tax identifi cation number. Do not combine grantors/sellers and

grantee/buyers on the same schedule.

Town W as the transaction completed on one deed? Date conveyed

Yes

No

Location of property conveyed Date recorded

Name of grantor as shown on the deed

__ __ __ __ __ __ __ __

m m d d y y y y

/ /

__ __ __ __ __ __ __ __

m m d d y y y y

/ /

SSN

FEIN

Department of Revenue Services

State of Connecticut

OP236A 1016W 01 9999

OP-236 Schedule A - Grantors

Supplemental Information for Connecticut

Real Estate Conveyance Tax Return

(Rev. 10/16)