- Certification of Payroll by Officer - New York

- Certified Payroll Form - Minnesota Department of Labor and Industry

- Certified Payroll - Michigan Department of Transportation

- Certified Payroll Report - Ohio

- Statement of Compliance - California

- Weekly Payroll Records Report and Statement of Compliance - Massachusetts

Fillable Printable Payroll Certification - New Jersey

Fillable Printable Payroll Certification - New Jersey

Payroll Certification - New Jersey

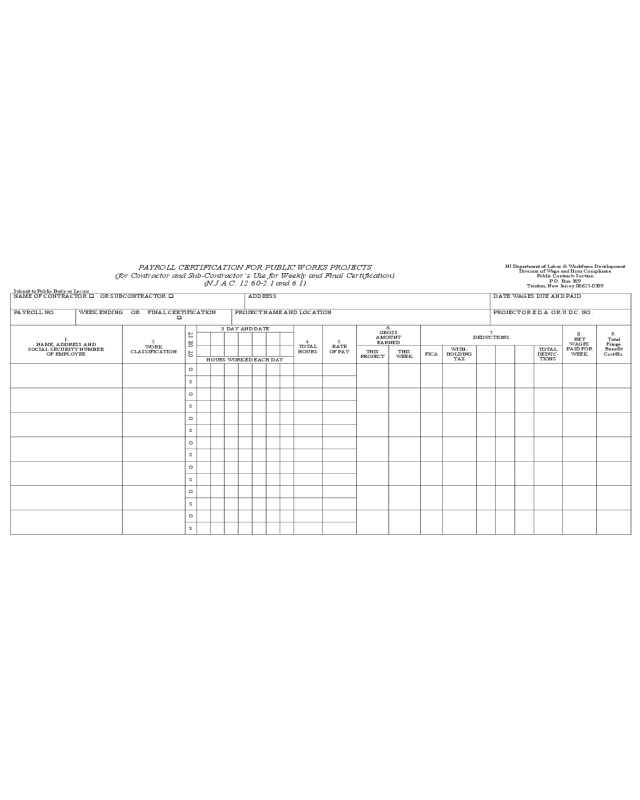

PAYROLL CERTIFICATION FOR PUBLIC WORKS PROJECTS

(for Contractor and Sub-Contractor’s Use for Weekly and Final Certification)

(N.J.A.C. 12:60-2.1 and 6.1)

NJ Department of Labor & Workforce Development

Division of Wage and Hour Compliance

Public Contracts Section

P.O. Box 389

Trenton, New Jersey 08625-0389

Submit to Public Body or Lessor

NAME OF CONTRACTOR OR SUBCONTRACTOR ADDRESS DATE WAGES DUE AND PAID

PAYROLL NO. WEEK ENDING OR FINAL CERTIFICATION

PROJECT NAME AND LOCATION PROJECT OR E.D.A. OR U.D.C. NO.

3. DAY AND DATE

6.

GROSS

AMOUNT

EARNED

7.

DEDUCTIONS

1.

NAME, ADDRESS AND

SOCIAL SECURITY NUMBER

OF EMPLOYEE

2.

WORK

CLASSIFICATION

OT. OR ST.

HOURS WORKED EACH DAY

4.

TOTAL

HOURS

5.

RATE

OF PAY

THIS

PROJECT

THIS

WEEK

FICA

WITH-

HOLDING

TAX

TOTAL

DEDUC-

TIONS

8.

NET

WAGES

PAID FOR

WEEK

9.

Total

Fringe

Benefit

Cost/Hr.

O

S

O

S

O

S

O

S

O

S

O

S

O

S

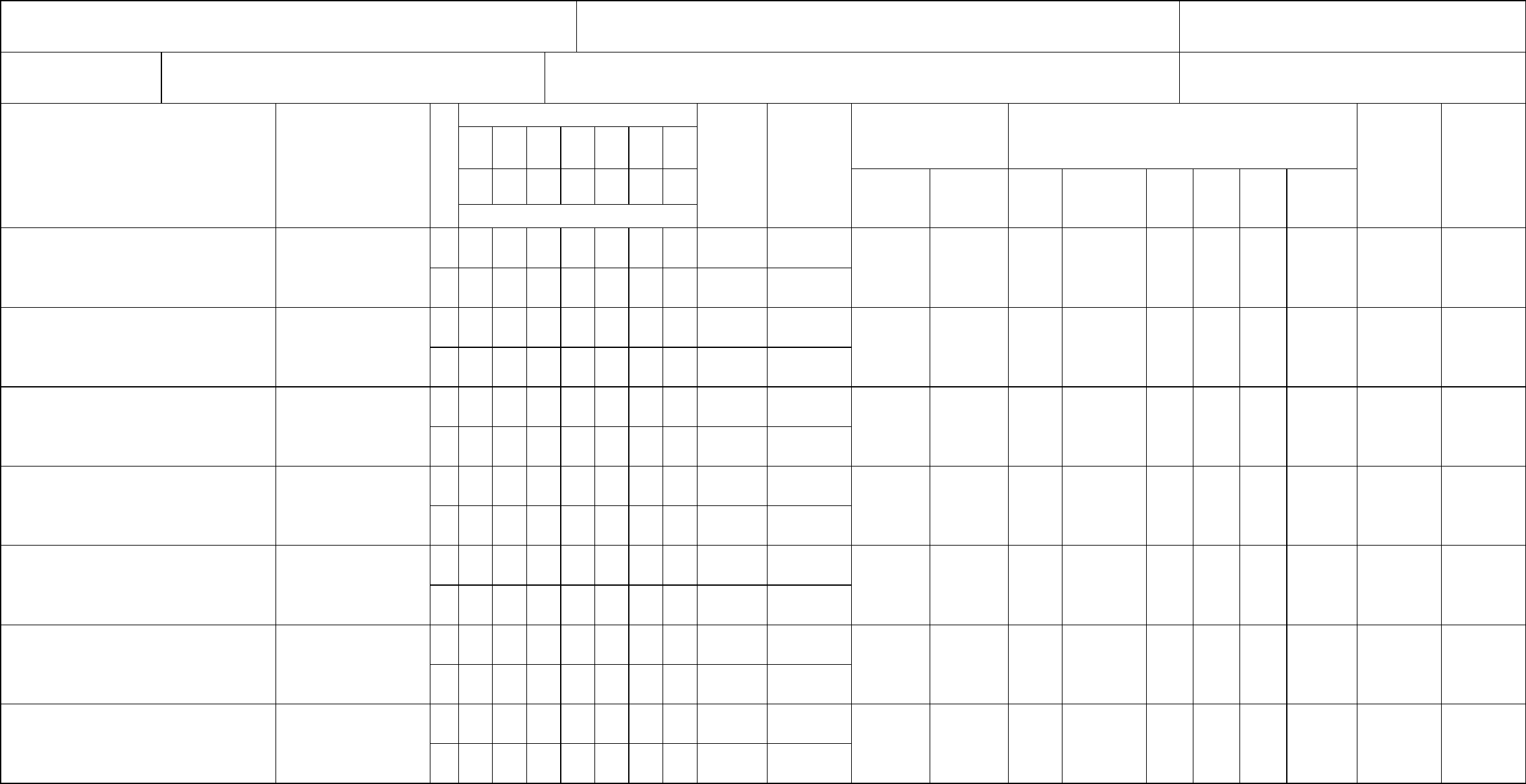

Date

I,

(Name of signatory party) (Title)

do hereby state and certify:

(1) That I pay or supervise the payment of the persons employed by

on the ;

(Contractor or Subcontractor) (Building or Work)

that during the payroll period commencing on the

day of , 20 , and ending the

day of , 20 , all persons employed on said project have been paid the full weekly

wages earned, that no rebates have been or will be made either directly or indirectly to or on behalf of said

from the full

(Contractor or Subcontractor)

weekly wages earned by any person and that no deductions have been made either directly or indirectly from the

full wages earned by any person, other than permissible deductions as defined in the New Jersey Prevailing Wage

Act, N.J.S.A. 34:11-56.25 et seq. and Regulation N.J.A.C. 12:60 et seq. and the Payment of Wages Law, N.J.S.A.

34:11-4.1 et seq.

(2) That any payrolls otherwise under this contract required to be submitted for the above period are correct

and complete; that the wage rates for laborers or mechanics contained therein are not less than the applicable wage

rates contained in any wage determination incorporated into the contract; that the classifications set forth therein for

each laborer or mechanic conform with the work he performed.

(3) That any apprentices employed in the above period are duly registered in good standing, in an

apprenticeship program approved or certified by the Division of Vocational Education in the New Jersey

Department of Education or by the Bureau of Apprenticeship Training in the United States Department of Labor.

(4) That:

(a) WHERE FRINGE BENEFITS ARE PAID TO APPROVED PLANS, FUNDS OR PROGRAMS

In addition to the basic hourly wage rates paid to each laborer or mechanic listed in the above

referenced payroll, payments of fringe benefits as listed in the contract have been or will be

made to appropriate programs for the benefit of such employees, except as noted in Section

4(c) below.

(b) WHERE FRINGE BENEFITS ARE PAID IN CASH

Each laborer or mechanic listed in the above referenced payroll has been paid as indicated on

the payroll, an amount not less than the sum of the applicable basic hourly wage rate plus the

amount of the required fringe benefits as listed in the contract, except as noted in Section 4(c)

below.

(c) FRINGE BENEFITS

EXCEPTIONS (CRAFT)

REMARKS

PLEASE SPECIFY THE TYPE OF BENEFIT PROVIDED AND NOTE THE TOTAL COST PER

HOUR IN BLOCK 9 ON THE REVERSE SIDE*

1) Medical or hospital coverage

2) Dental coverage

3) Pension or Retirement

4) Vacation, Holidays

5) Sick days

6) Life Insurance

7) Other (Explain)

* TO CALCULATE THE COST PER HOUR, DIVIDE 2,000 HOURS INTO THE BENEFIT

COST PER YEAR PER EMPLOYEE.

(5) N.J.S.A. 12:60-2.1 and 6.1 - The Public Works employers shall submit to the public body or lessor a

certified payroll record each pay period within 10 days of the payment of wages.

Contractor Registration Number

NAME AND TITLE

THE FALSIFICATION OF ANY OF THE ABOVE STATEMENTS MAY SUBJECT THE CONTRACTOR

OR SUBCONTRACTOR TO CIVIL OR CRIMINAL PROSECUTION. N.J.S.A. 34:11-56.25 ET SEQ. AND

N.J.A.C. 12:60 ET SEQ. AND N.J.S.A. 34:11-4.1 ET SEQ.