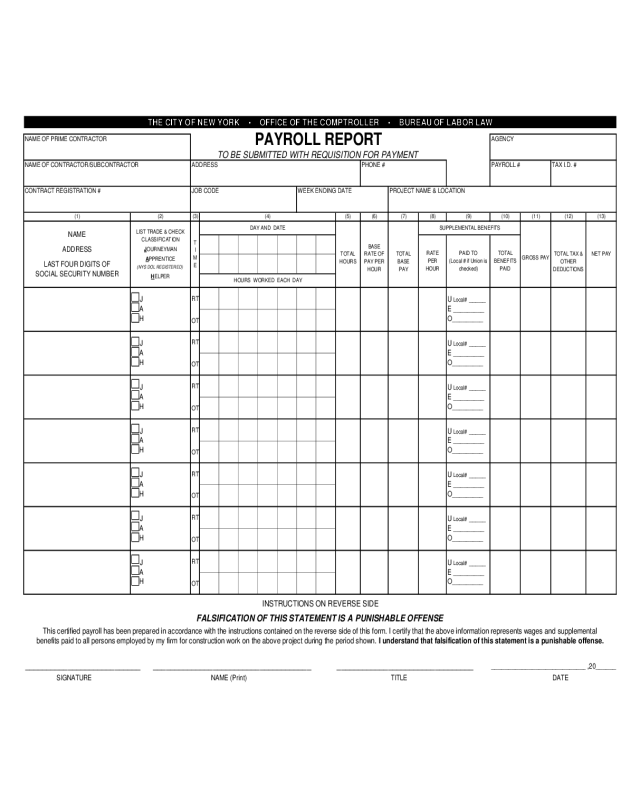

Fillable Printable Payroll Report - New York

Fillable Printable Payroll Report - New York

Payroll Report - New York

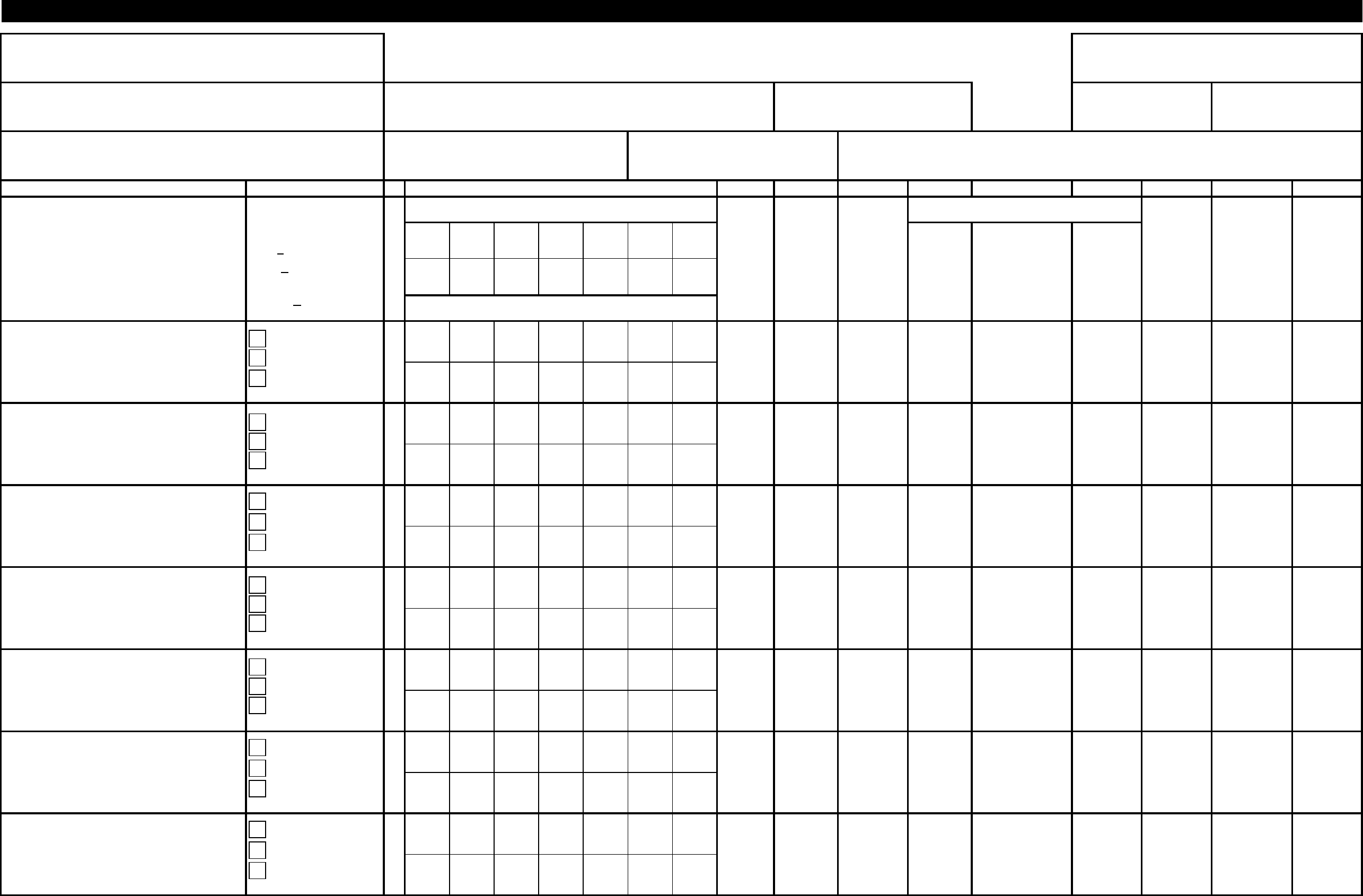

(1) (2) (3) (5) (6) (7) (8) (9) (10) (11) (12) (13)

RT

OT

RT

OT

RT

OT

RT

OT

RT

OT

RT

OT

RT

OT

___________________________ _____________________________________ ________________________________

____________________________

,20______

SI G NA TURE NAME (Print) TITL E DATE

AGENCY

WEEK ENDING DATE PROJECT NAME & LOCATI ON

INSTRUCTIONS ON REVERSE SIDE

J

A

H

FALSIFICATION OF THIS STATEMENT IS A PUNISHABLE OFFENSE

T his certified payroll has been prepared in accordance with the instructions contained on the reverse side of this form. I certify that the abov e information represents wages and supplemental

benefits paid to all persons employed by my firm for construction work on the above project during the period shown. I und erstand t hat falsification of this statement is a punishable offense.

U Local# _____

E _________

O_________

U

Local # _____

E _________

O_________

J

A

H

J

A

H

U

Local # _____

E _________

O_________

U

Local # _____

E _________

O_________

U

Local # _____

E _________

O_________

J

A

H

J

A

H

U

Local # _____

E _________

O_________

U

Local # _____

E _________

O_________

J

A

H

NET PAY

RATE

PER

HOUR

PAI D TO

(Local # if Union i s

checked)

TOTAL

BENEFITS

PAID

J

A

H

TOTAL

HOURS

BASE

RATE OF

PAY PER

HOUR

TOTAL

BASE

PAY

SUPPLEMENT AL BENEFITS

GROSS PAY

TOTAL TAX &

OTHER

DEDUCTIONS

(4)

NAME

ADDRESS

LAS T FO UR DIGITS OF

SOCIAL SECURITY NUMBER

LIST TRADE & CHECK

CLASSIFICATION

JOURNEYMAN

APPRENTICE

(NYS DOL REGISTER ED )

HELPER

T

I

M

E

DAY AND DATE

HOURS WORK E D E A CH DA Y

CONTRACT REGISTRAT ION # JOB CODE

NAME OF CONTRACT OR/SUBCONT RACTOR

THE CITY OF NEW YORK • OFFICE OF THE COMPTROLLER • BUREAU OF LABOR LAW

NAME OF PRI ME CONTRACTOR

PAYROLL REPORT

TO BE SUBMITTED WITH REQUISITION FOR PAYMENT

PAYROLL # TAX I.D. #ADDRESS PHONE #

1. All persons who performed any on-site construction activity, during the period of the requisition, shall be listed on the Payroll Report.

2. Separate Payroll Reports shall be submitted by the prime contractor and each subcontractor who performed any on-site construction activity during the period of the requisition.

3. Failure to provide the required Payroll Report may result in the requisition for payment being returned unpaid or the payment being reduced.

4. PAYROLL REPORT HEADING: The Payroll Report Heading shall require the following information:

Instructions for the Preparation and Submission of a Payroll Report

NAME OF PRIME CONTRACTOR: Enter the name of the firm that has entered into the contract with the New York City government agency.

NAME OF CONTRACTOR / SUBCONTRACTOR: The legal name of the firm submitting the Payroll Report shall be placed immediately below this designation.

Circle either the word CONTRACTOR or SUBCONTRACTOR as applicable.

ADDRESS: Insert the current address (i.e., street, city, state and zip code) of the firm submitting the Payroll Report.

PHONE NO.: Enter the telephone number of the firm submitting the Payroll Report in the space provided.

AGENCY: Enter the name of the New York City government agency that has the contract with the Prime Contractor.

PAYROLL NO.: In the space provided, enter the Payroll Number of the Contractor or Subcontractor.

CONTRACT REG. NO.: Enter the Contract Registration Number here. This may be obtained from the "Notice of Award" and / or the "Order to Commence Work" letters.

JOB CODE: In the space provided, enter the Contractor/ Subcontractor's in-house labor distribution code or job number where applicable.

WEEK ENDING DATE: In the space provided, enter the last date of the pay-week (i.e., month, day, year).

PROJECT NAME & LOCATION: In this space, enter the Project Name and Location where contract work is being performed.

TAX I.D. NO.: Enter in this space the Federal Tax Identification Number of the firm submitting the Payroll Report.

5. For every employee who performed any on-site construction activity during the period of the Payroll Report, the following information shall be provided:

1) NAME, ADDRESS, LAST FOUR DIGITS OF THE SOCIAL SECURITY NO.: The legal name, current address and the last four digits of the social security

number of each employee. (Employers must keep the full social security number on file for each of their covered workers.) If the employee has no social

security number, please list his/her IRS Individual Taxpayer Identification Number and mark it “ITIN”.

2) LIST TRADE & CHECK WORK CLASSIFICATION: Specify and insert the Trade applicable to the work performed by each employee. The Trade identified

must be one listed on the Prevailing Wage & Supplemental Benefits Schedule of the Comptroller, i.e., Electrician, Laborer, etc. Check next to the letter J if the

individual is a Journeyperson. Check next to the letter A if the person is a Registered Apprentice with the Department of Labor of the State of New York. Check

next to the letter H only if the person is a Helper in a trade classification that has Helper rates listed in the Comptroller's Schedule of Prevailing Wages.

3) TIME: RT indicates Regular Time, and OT indicates Overtime.

4) DAY AND DATE: Below this heading, in the first row, enter the appropriate sequence of the contractor's pay records. MTWTFSS, for example, is the sequence

to use if the workweek ends on a Sunday, and SSMTWTF is the sequence if the workweek ends on a Friday. In the second row, below each letter representing

the day of the workweek, insert the corresponding date. Below the heading HOURS WORKED EACH DAY, at the intersection of the column of the particular day

and date and the horizontal row of the employee's name, insert the hours worked each day in the appropriate box either for RT (Regular Time) and / or OT (Overtime).

If an employee worked Shift Time, the RT (Regular Time) row shall be used and adjusted accordingly.

5) TOTAL HOURS: Add the hours worked for Regular and / or Shift Time with the hours worked for Overtime, and enter separate totals in this column.

6) BASE RATE OF PAY PER HOUR: Specify the actual base rate of pay per hour paid to the employee. Do not include supplemental benefits in this amount.

7) TOTAL BASE PAY: Total amount earned by the employee, not including benefits.

8) RATE PER HOUR: Amount of supplemental benefits paid / provided per hour.

9) PAID TO: Place a check mark in the appropriate box: U for Union if benefits paid to a Union, E for Employee if benefits paid in cash (or check) directly to the

Employee, or O for Other, if benefits are otherwise paid / provided to the employee. If U is checked, you must insert the "Local" number of the union in that box.

10) TOTAL BENEFITS PAID: Total amount of supplemental benefits paid / provided for the workweek to the employee.

11) GROSS PAY: Total amount earned for workweek: This amount comprises the Total Base Pay plus any benefit paid in cash (or check) directly to the employee

[i.e., column (7) + column (9) E if Box E is checked and payment made directly to employee]. No other type of benefit should be included in this column's total.

12) TOTAL TAX AND OTHER DEDUCTIONS: Enter the sum total of all deductions in this column (including FICA, Federal, State and City Taxes, etc.). This does

not absolve you from maintaining appropriate tax and other records required by law).

13) NET PAY: Total amount of pay after all deductions (i.e., the actual Take-Home Pay).

SUPPLEMENTAL BENEFITS: