Fillable Printable Payroll Tax Deposit, De 88, Printing Specifications (De 88Ps)

Fillable Printable Payroll Tax Deposit, De 88, Printing Specifications (De 88Ps)

Payroll Tax Deposit, De 88, Printing Specifications (De 88Ps)

DE 88PS Rev. 3 (9-17) (INTERNET) Page 1 of 6 CU

PAYROLL TAX DEPOSIT, DE 88, PRINTING SPECIFICATIONS

COMPUTER OR LASER GENERATED ALTERNATE FORMS

The Employment Development Department (EDD) provides Payroll Tax Deposit, DE 88, forms

suitable for laser printers at no cost to our customers.

These specifications will assist you in creating an alternate (facsimile) DE 88 form that we can

image with our equipment. A sample alternate DE 88 and an original DE 88 are included with

these specifications. The sample alternate DE 88 format should not be used to align with your

new alternate format as reproduction has caused distortion.

Please use the print and line positions provided in these specifications to create your alternate

form. The DE 88 form is the correct template to use to verify that your alternate format is correct.

Place the DE 88 over or under your alternate format and visually verify that the data on your

alternate form is printing within the corresponding boxes on the DE 88. If this is the case, the

alternate format has been designed to meet our specifications.

ALL FORMS MUST BE SUBMITTED TO THE EDD FOR APPROVAL BEFORE USE.

Please submit a sample deck for testing and approval. The test deck should include 25 original

documents – no photocopies. You may use dummy data and repeat the data on all the pages.

The test deck should be mailed to the following address:

Alternate Forms Coordinator

Information Management Group II, MIC 96

Employment Development Department

PO Box 826880

Sacramento, CA 94280-0001

For express mail, make sure to include phone number 916-255-0649 on the airbill. The street

address is: 9815 C Goethe Road, Sacramento, CA 95827, Attention: Alternate Forms Coordinator,

MIC 96.

State law requires employers to electronically submit employment tax returns, wage reports,

and payroll tax deposits to the EDD. The print specifications for alternate forms are provided for

employers who have an approved e-file and e-pay mandate waiver.

You can submit, file, and pay online using e-Services for Business at

www.edd.ca.gov/e-Services_for_Business to comply with the e-file and e-pay mandate. For

more information on this mandate, visit www.edd.ca.gov/EfileMandate.

DE 88 PRINTING SPECIFICATIONS

COMPUTER OR LASER GENERATED ALTERNATE FORMS

DE 88PS Rev. 3 (9-17) (INTERNET) Page 2 of 6

TEST SAMPLES MUST MEET A 95% OR BETTER READ RATE TO BE APPROVED.

GENERAL REQUIREMENTS AND INFORMATION

Paper: Use 8 1/2 inches by 11 inches white, 20-pound bond paper. Please do not use “No Carbon

Required” (NCR) paper or recycled paper.

Form Size: The DE 88 coupon is 8 inches wide by 3 4/6 inches high. Alternate form samples

submitted to the EDD must be cut cleanly to these dimensions. If the alternate forms submitted for

testing and approval are not cut to the required dimensions with a straight edge, new test samples

will be requested.

Alignment: The top of the form is zero, the bottom line is 22, the left perforation is print position

zero, and the right perforation is print position 80. Print at six vertical lines per inch and 10

horizontal print positions per inch.

Ink: Use black ink only. If possible, use non-ferric ink.

Printer: Do not use a dot matrix printer.

Font Size: Please use 10 or 12 point Lucinda Console or Courier font to print the data to be

captured. Data to be captured is indicated by bold print. Do not print your alternate format in

bold type. All letters must be printed in UPPER CASE only.

EDD Approval Number: This number will be assigned to the forms that the EDD has tested and

approved.

Unscannable File Copies: If you provide your customers with copies that are not Optical Character

Reader (OCR) compatible, please advise them not to submit their file copies to the EDD. We have

found that the warning “DO NOT SEND THIS COPY TO THE EDD” is effective when printed on

the file copy.

User Codes: If you print code numbers or letters on your forms, please position them above the

Employer Name and Address between lines 9 and 12 and print positions 6 thru 33.

Display of Numbers: Right justify the numbers in the payment amount fields. Use decimal points or

spaces between digits as appropriate, for example: 32 417.98 or 32 417 98. Do not use commas

or dollar signs.

DE 88 PRINTING SPECIFICATIONS

COMPUTER OR LASER GENERATED ALTERNATE FORMS

DE 88PS Rev. 3 (9-17) (INTERNET) Page 3 of 6

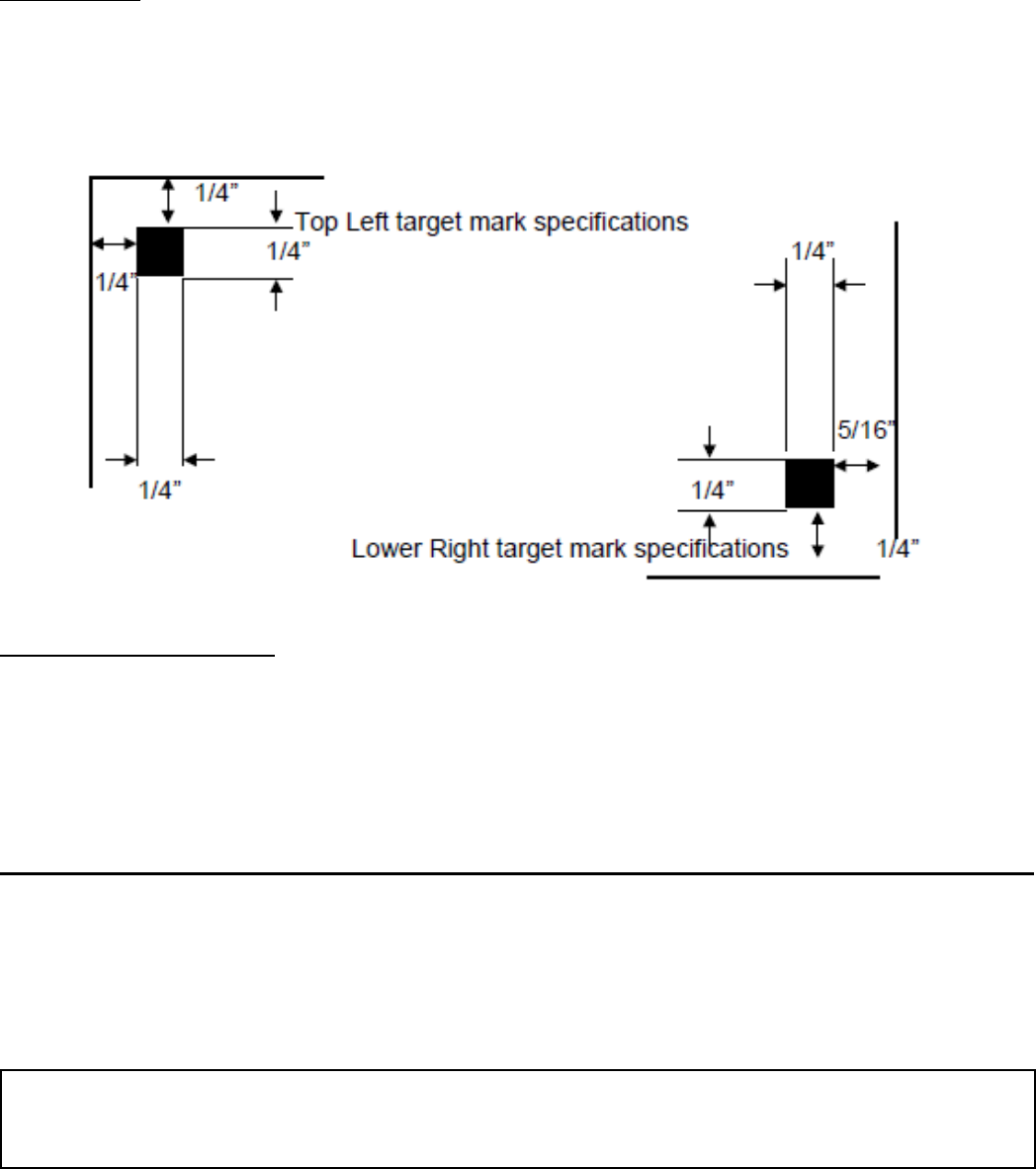

TARGET MARKS

Target Marks: Two target marks are placed at the top left and lower right corners to help the EDD

equipment properly align the scanned forms. The upper left-hand target mark is ¼ inch square and

positioned ¼ inch off the top and left paper edge. The lower right target mark is ¼ inch square and

positioned ¼ inch off the bottom and 5/16 inch off the right paper edge.

The following is a sample of the correct placement of the target marks on the alternate DE 88 form:

Account Number Scanline: If you are making a payroll tax deposit and you have your employer

payroll tax account number, submit your alternate format with the unique Account Number

Scanline. The correct format for the Account Number Scanline is “NNNNNNNN.” The N represents

the California employer payroll tax account number. Print in the OCR A, 12 point bold font (or

Courier 12 font if OCR A is unavailable). The print and line positions for the Account Number

Scanline are listed below:

PRINT

PRINT

ITEM

LINES

POSITIONS

PRINT FORMAT

Account Number Scanline

18

29 thru 36

NNNNNNNN

Note: If you do not have an employer payroll tax account number, use e-Services for Business

to register for your employer payroll tax account number. In most cases, an employer payroll

tax account number is issued within a few minutes.

DE 88 PRINTING SPECIFICATIONS

COMPUTER OR LASER GENERATED ALTERNATE FORMS

DE 88PS Rev. 3 (9-17) (INTERNET) Page 4 of 6

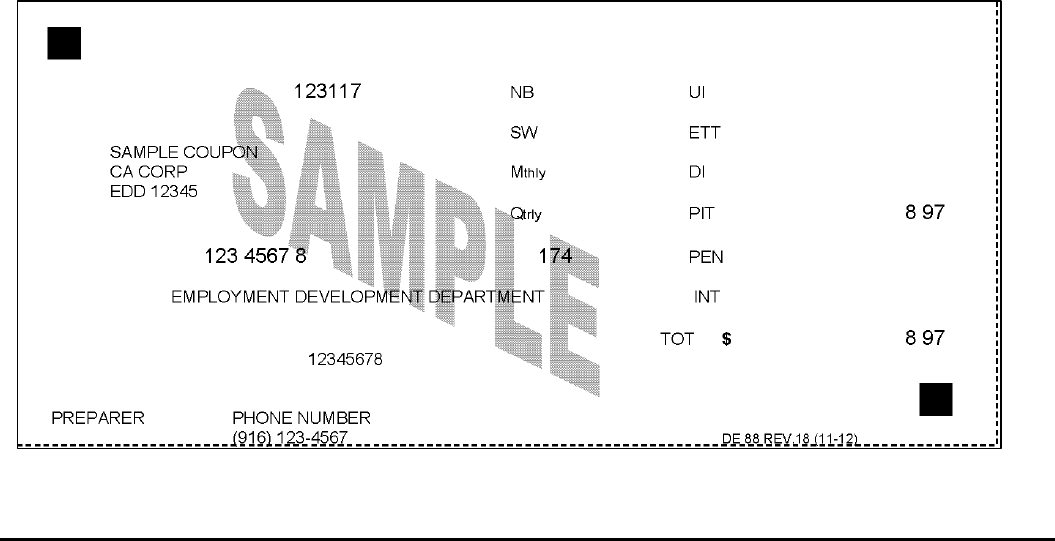

The following is a sample of the correct position for the Account Number Scanline on the alternate

DE 88 form with a California employer payroll tax account number:

PRINT PRINT

ITEM

LINES POSITIONS

PRINT FORMAT

Target Marks

See page 3.

Account Number Scanline

See page 3 and 4 above.

Payroll Date

5

21 thru 31

MMDDYY

Employer Name

8

6 thru 33

NAME

Employer DBA

9

6 thru 33

DBA

Employer Address or FEIN

10

6 thru 33

MAILING ADDRESS or

FEIN

Employer Approval Number

(Assigned by the EDD.)

11

6 thru 15

EDD 12345

Employer Payroll Tax Account

Number

13

13 thru 31

NNN NNNN N

DE 88 PRINTING SPECIFICATIONS

COMPUTER OR LASER GENERATED ALTERNATE FORMS

DE 88PS Rev. 3 (9-17) (INTERNET) Page 5 of 6

PRINT

PRINT

ITEM

LINES

POSITIONS

PRINT FORMAT

(Continued)

Year/Quarter

13

42 thru 46

YYQ

EDD (For use with the EDD

15

16 thru 49

EMPLOYMENT

supplied envelopes.)

DEVELOPMENT

DEPARTMENT

Payment Type: Print X only by payment being reported and display the titles in a small font. Do not

use bold print.

Next-Day X

5

40 thru 42

ND

(Abbreviate title to ND)

5

46

X

Semiweekly X

7

40 thru 42

SW

(Abbreviate title to SW)

7

46

X

Monthly X

9

40 thru 42

Mtly

(Abbreviate title to Mtly)

9

46

X

Quarterly X

11

40 thru 42

Qtly

(Abbreviate title to Qtly)

11

46

X

PRINT

PRINT

ITEM

LINES

POSITIONS

PRINT FORMAT

Fund Titles/Payment Amounts: Please display the fund titles in a small font. Print the fund types

even if there is no payment for that fund.

Unemployment Insurance

5

51 thru 53

UI

UI Amount

5

61 thru 77

N NNN NNN NN

Employment Training Tax

7

51 thru 53

ETT

ETT Amount

7

61 thru 77

N NNN NNN NN

State Disability Insurance

9

51 thru 53

DI

SDI Amount

9

61 thru 77

N NNN NNN NN

DE 88 PRINTING SPECIFICATIONS

COMPUTER OR LASER GENERATED ALTERNATE FORMS

DE 88PS Rev. 3 (9-17) (INTERNET) Page 6 of 6

PRINT

PRINT

ITEM

LINES

POSITIONS

PRINT FORMAT

(Continued)

California PIT

11

51 thru 53

PIT

PIT Amount

11

61 thru 77

N NNN NNN NN

Penalty

13

51 thru 53

PEN

Penalty Amount

13

61 thru 77

N NNN NNN NN

Interest

15

51 thru 53

INT

Interest Amount

15

61 thru 77

N NNN NNN NN

Total Paid

17

51 thru 53

TOT

Dollar Sign

17

57 thru 58

$ (Use OCR B 18pt)

Decimal

17

74 thru 75

(BOLD)

Total Amount

17

59 thru 77

N NNN NNN NN

Preparer and Phone Number

20

1 thru 38

Any font is acceptable,

but do not extend beyond

print position 38 to the right.

Revision Number

(Reduced font is necessary

–

there should be 2/8 inch

clearance around lower right target mark.)

21

60 thru 70

DE 88 Rev. 18 (11-12)

N=Numeric

Quarterly – This DE 88 coupon type is used only at the end of the quarter to make UI and ETT

payments and to pay any SDI and PIT not previously deposited. The correct method of completing

the quarterly DE 88 coupon is as follows:

Include the last day of the quarter in the PAYROLL DATE field.

Mark the QUARTERLY payment type.

Include the correct year and quarter in the YEAR/QUARTER field.

If you have any questions about these specifications, please contact the Alternate Forms

Coordinator at 916-255-0649.