Fillable Printable Penalty Reference Chart (De 231Ep)

Fillable Printable Penalty Reference Chart (De 231Ep)

Penalty Reference Chart (De 231Ep)

DE 231EP (7-16) (INTERNET) Page 1 of 5 CU

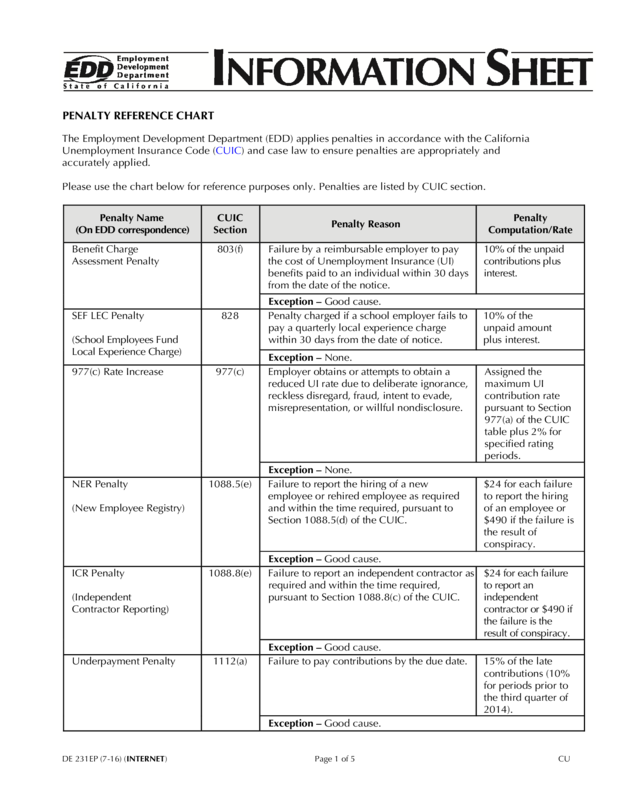

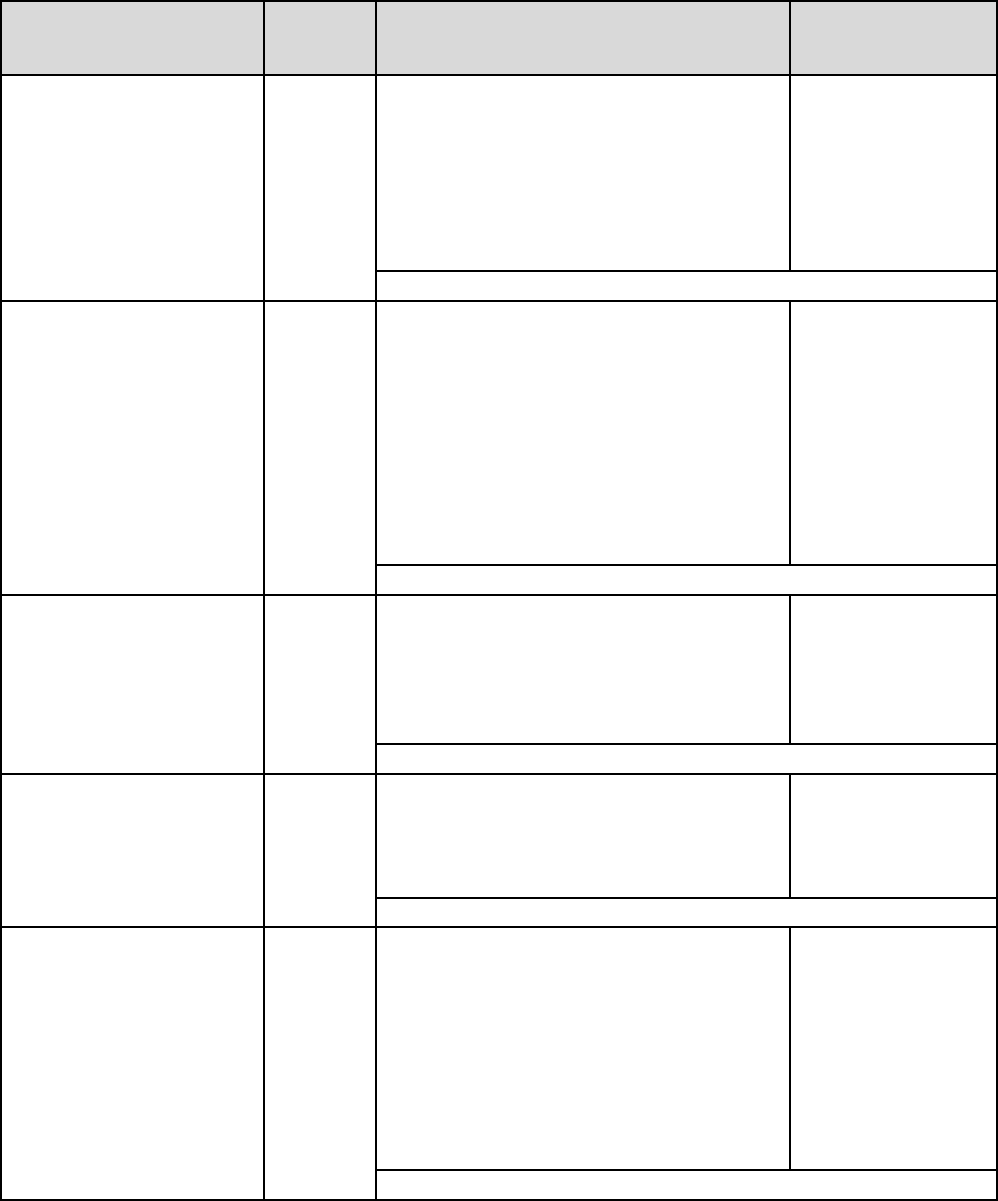

PENALTY REFERENCE CHART

The Employment Development Department (EDD) applies penalties in accordance with the California

Unemployment Insurance Code (CUIC) and case law to ensure penalties are appropriately and

accurately applied.

Please use the chart below for reference purposes only. Penalties are listed by CUIC section.

Penalty Name

(On EDD correspondence)

CUIC

Section

Penalty Reason

Penalty

Computation/Rate

Benefit Char

g

e

Assessment Penalty

803(f) Failure by a reimbursable employer to pay

the cost of Unemployment Insurance (UI)

benefits paid to an individual within 30 days

from the date of the notice.

10% o

f

the unpaid

contributions plus

interest.

Exception – Good cause.

SEF LEC Penalty

(School Employees Fund

Local Experience Charge)

828 Penalty char

g

ed if a school employer fails to

pay a quarterly local experience charge

within 30 days from the date of notice.

10% of the

unpaid amount

plus interest.

Exception – None.

977(c) Rate Increase 977(c) Employer obtains or attempts to obtain a

reduced UI rate due to deliberate ignorance,

reckless disregard, fraud, intent to evade,

misrepresentation, or willful nondisclosure.

Assi

g

ned the

maximum UI

contribution rate

pursuant to Section

977(a) of the CUIC

table plus 2% for

specified rating

periods.

Exception – None.

NER Penalty

(New Employee Registry)

1088.5(e) Failure to repor

t

the hirin

g

of a new

employee or rehired employee as required

and within the time required, pursuant to

Section 1088.5(d) of the CUIC.

$24 for each failure

to report the hiring

of an employee or

$490 if the failure is

the result of

conspiracy.

Exception – Good cause.

ICR Penalty

(Independent

Contractor Reporting)

1088.8(e) Failure to report an independent contractor as

required and within the time required,

pursuant to Section 1088.8(c) of the CUIC.

$24 for each failure

to report an

independent

contractor or $490 if

the failure is the

result of conspiracy.

Exception – Good cause.

Underpayment Penalty 1112(a) Failure to pay contributions by the due date. 15% of the late

contributions (10%

for periods prior to

the third quarter of

2014).

Exception – Good cause.

DE 231EP (7-16) (INTERNET) Page 2 of 5

Penalty Name

(On EDD correspondence)

CUIC

Section

Penalty Reason

Penalty

Computation/Rate

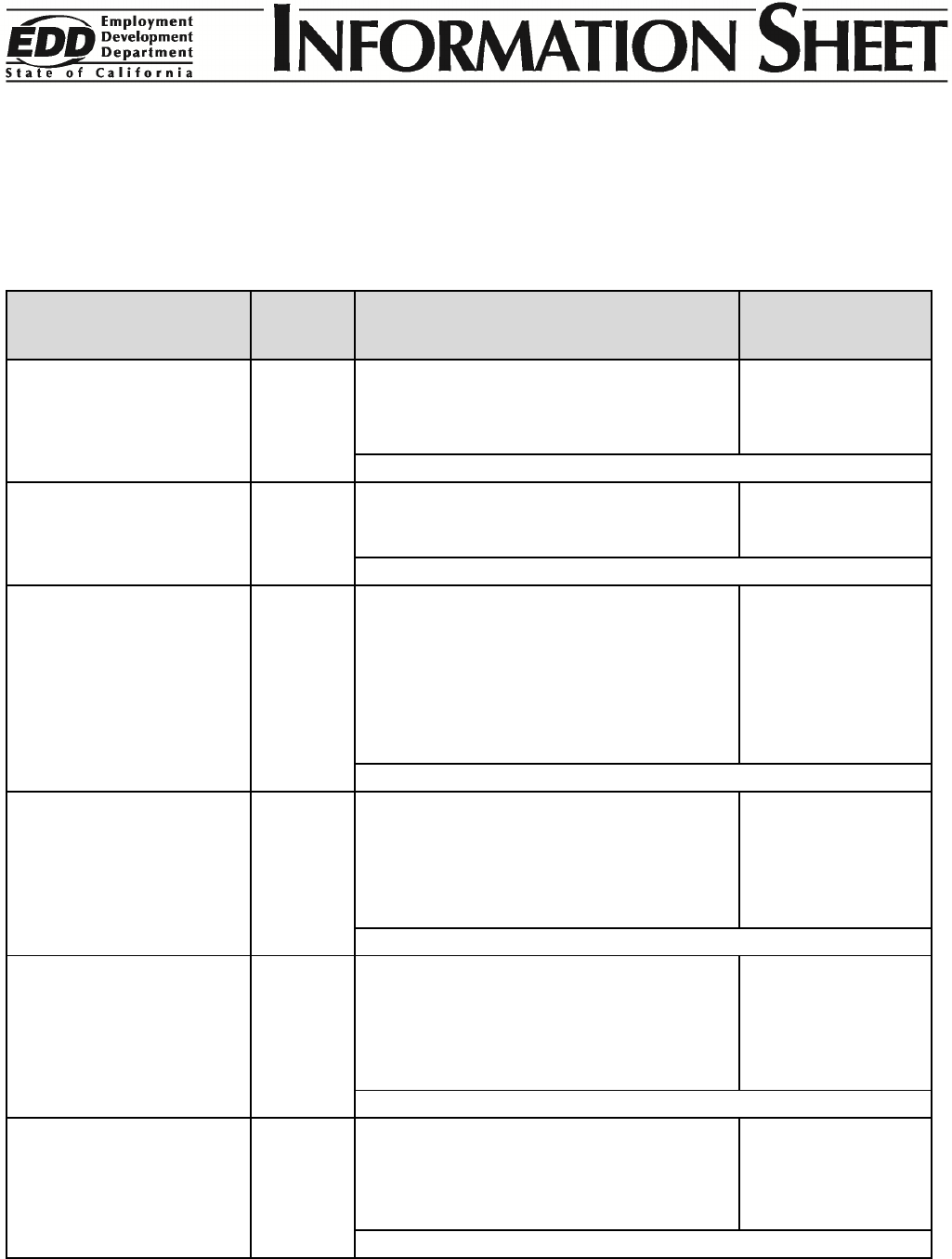

Late Payment Penalty 1112(a) Failure to submit a Pa

y

roll Tax De

p

osi

t

,

DE 88, payment within the time required.

15% of the late

contributions (10%

for periods prior to

the third quarter of

2014).

Exception – Good cause.

Quarterly Threshold

Penalty

1112(a) Personal Income Tax (PIT) reported on a

DE 88 deposit exceeded the limits for the

quarterly deposit schedule. Penalty and

interest are based on State Disability

Insurance (SDI) and PIT withholdings.

15% of the

contributions (10%

for periods prior to

the third quarter of

2014).

Exception – Good cause.

Payment

Noncompliance Penalty

1112(b) Failure to remit SDI and PIT payments by

electronic funds transfer (if required).

15% of the

contributions (10%

for periods prior to

the third quarter of

2014).

Exception – Good cause.

Late Report Penalty 1112.5(a) Failure to file reports within 60 days of the

due date. Applies only to amounts that were

not paid by the due date. This penalty is in

addition to penalties required by

Sections 1112, 1126, and 1127 of the CUIC.

15% of the late

contributions and

PIT withholdings

(10% for periods

prior to the third

quarter of 2014).

Exception – Good cause.

Wa

g

e Item Penalty 1114(a) Failure to file wa

g

e reports within 15 days of

a specific written demand.

$20 per wa

g

e item

($10 for periods

prior to the third

quarter of 2014).

Exception – Good cause.

Wa

g

e Noncompliance

Penalty

1114(b) Failure to file wa

g

e reports for each

employee on magnetic media (if required).

$20 per wa

g

e item

($10 for periods

prior to the third

quarter of 2014).

Exception – Good cause.

Annual Return Penalty 1117 Failure to file annual reconciliation return

within 30 days of written notice.

The lesser of:

$1,000 or

5% of the

contributions to be

reconciled.

Exception – Good cause.

1126 Assessment

Penalty

1126 Penalty added to an assessment for failure to

file returns or reports.

15% of the assessed

contributions (10%

for periods prior to

the third quarter of

2014).

Exception – None.

DE 231EP (7-16) (INTERNET) Page 3 of 5

Penalty Name

(On EDD correspondence)

CUIC

Section

Penalty Reason

Penalty

Computation/Rate

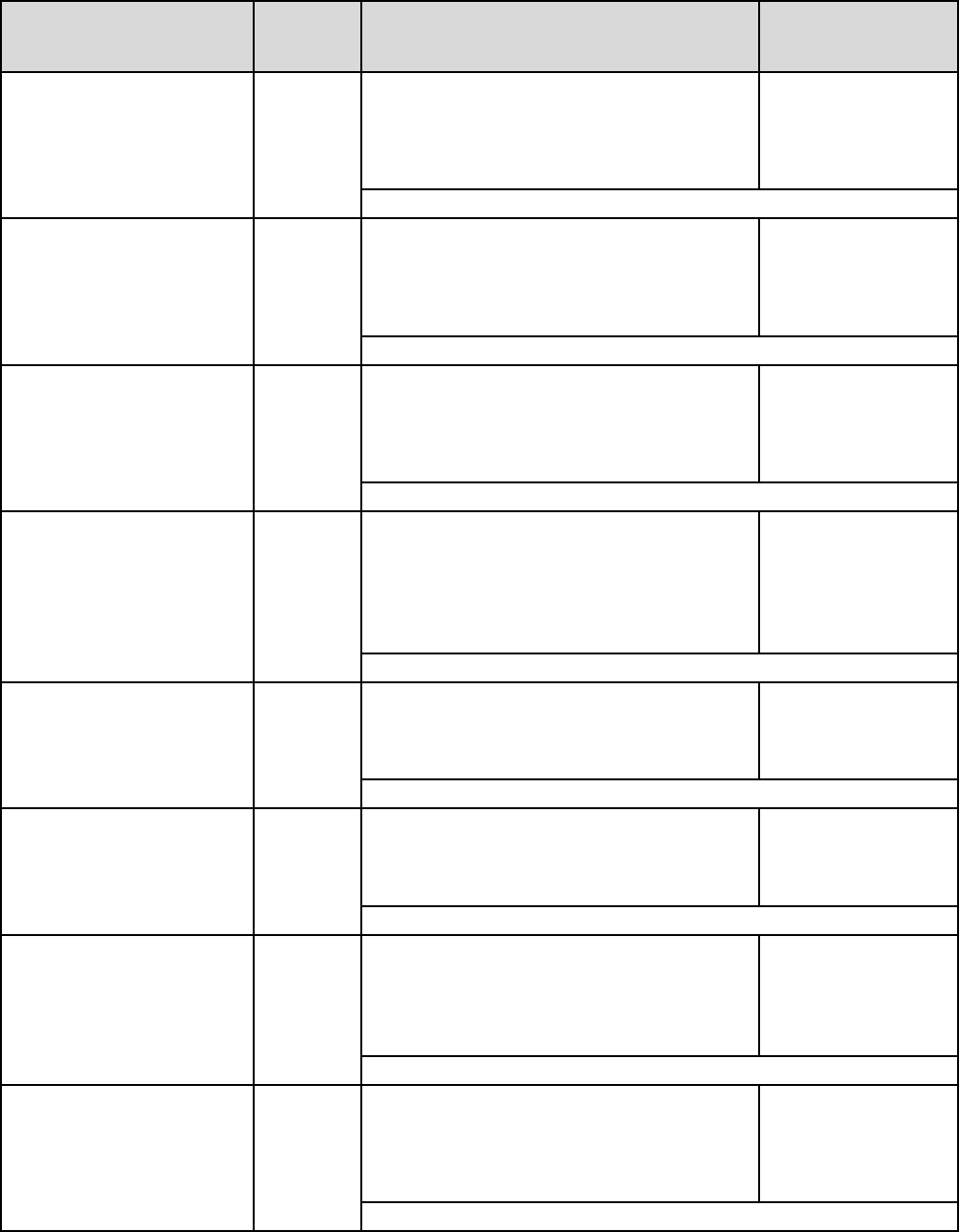

Failure to Re

g

ister

Penalty

1126.1 Failure to re

g

ister as an employer when the

failure is due to intentional disregard or intent

to evade.

$100 per unreported

employee – applied

in the assessed

quarter with the

highest number of

unreported

employees.

Exception – None.

1127 Assessment

Penalty

1127 Filin

g

of deficient returns or reports when the

employer was negligent or intentionally

disregarded the law.

15% of the assessed

contributions (10%

for periods prior to

the third quarter of

2014).

Exception – None.

Fraud or Intent to

Evade Penalty

1128(a) Failure to file returns or reports or if any part

of the deficiency for which an assessment is

made is due to fraud or intent to evade. This

is in addition to penalties assessed pursuant

to Sections 1126 and 1127 of the CUIC.

50% of the assessed

contributions.

Exception – None.

Additional Fraud or

Intent to Evade Penalty

1128(b) Failure to provide information returns to

workers as required under Section 13050 of

the CUIC or Section 6041A of the Internal

Revenue Code (IRC) when penalty is

assessed pursuant to Section 1128(a) of the

CUIC. This is in addition to penalties

assessed pursuant to Sections 1126 and

1127 of the CUIC.

50% of the

assessed

contributions.

Exception – None.

Money Exchan

g

e

Penalty

1128.1 Penalty char

g

ed to an individual or business

who knowingly participates in a money

exchange scheme with an employer in an

attempt to conceal wages.

100% of the

assessed

contributions based

on concealed

wages.

Exception – None.

Assessment Finality

Penalty

1135 Failure to pay assessments by the date the

assessment becomes final.

15% of the unpaid

contributions due

after the finality date

(10% for periods

prior to the third

quarter of 2014).

Exception – None.

False Statement Penalty 1142(a) Makin

g

a false statement or representation or

willfully failing to report a material fact

regarding the termination of an employee’s

employment. This penalty is assessed against

the employer, the employer’s agent, or both.

Not less than two (2)

or more than 10

times the claimant’s

weekly benefit

amount.

Exception – None.

DE 231EP (7-16) (INTERNET) Page 4 of 5

Penalty Name

(On EDD correspondence)

CUIC

Section

Penalty Reason

Penalty

Computation/Rate

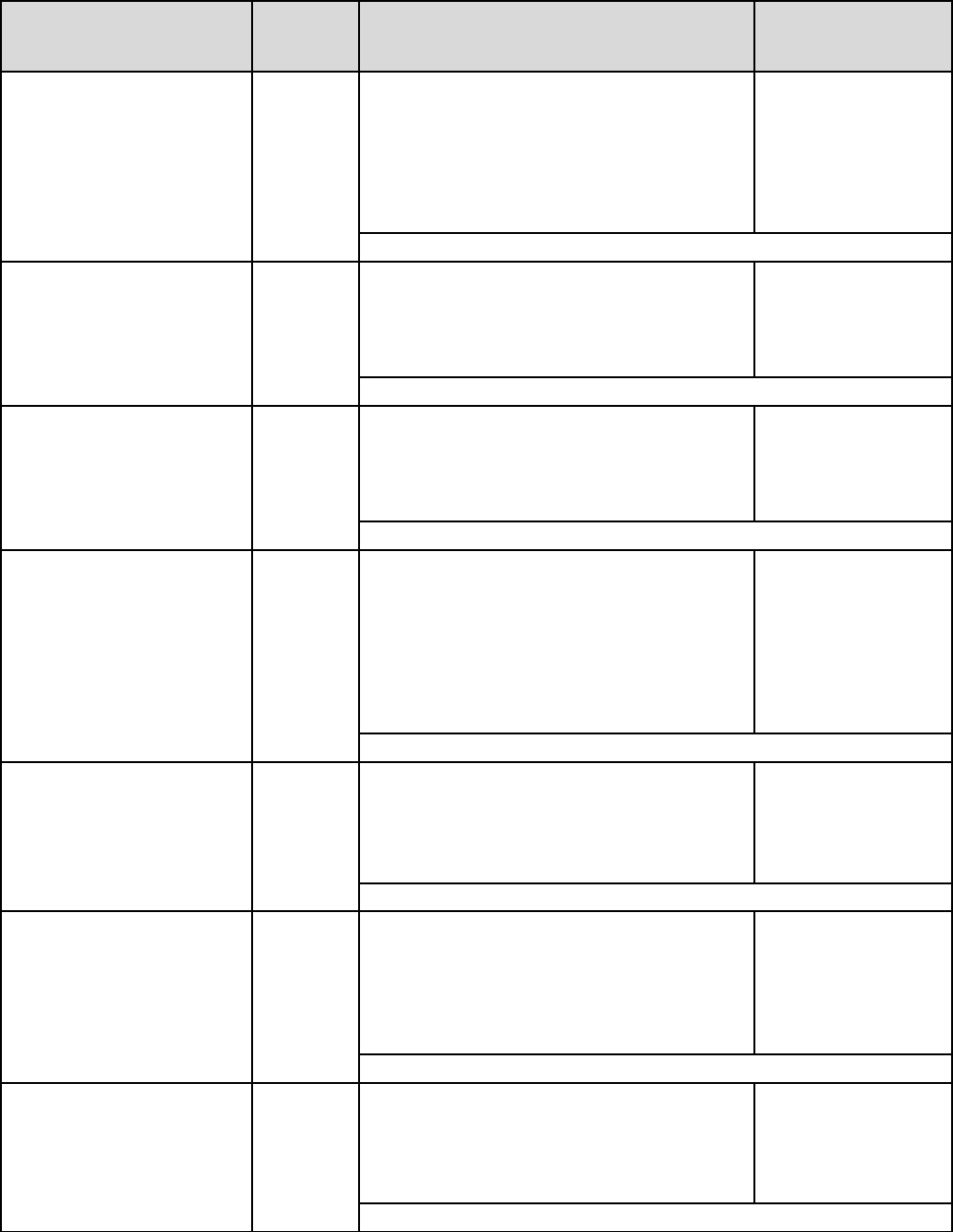

False Statement Penalty 1142(b) Submission of a written statement containin

g

a false statement or representation or

willfully failing to report a material fact

concerning the reasonable assurance of

reemployment following a break between

academic years or terms. This penalty is

assessed against the employer, the

employer’s agent, or both.

Not less than two (2)

nor more than 10

times the claimant’s

weekly benefit

amount.

Exception – None.

False Statement Penalty 1142.1 Makin

g

a false statement or representation or

willfully failing to report a material fact

regarding the termination of an employee’s

employment, regarding any week during

which the employee worked or regarding

any time granted to the employee for

professional development, when the

employee was performing services for an

educational institution as defined in

Section 1253.3 of the CUIC. This penalty is

assessed against the employer.

Not less than two (2)

nor more than 10

times the claimant’s

weekly benefit

amount.

Exception – None.

Advisor Penalty 1145 Person or business entity knowin

g

ly

advising another person or business entity

to violate any provision of Chapter 4, Part 1

of Division 1 of the CUIC. This penalty is

assessed against the advisor.

The

g

reater of:

$5,000 or 10% of

the underreported

contributions,

penalties, and

interest.

Exception – None.

Worker Information

Return Penalty

13052 Failure to furnish a statement to an

employee in the manner, at the time, and

showing the information required by

Section 13050 of the CUIC or furnishing a

false or fraudulent statement to an employee.

$50 for each

occurrence.

Exception – Reasonable cause.

Additional Worker

Information Return

Penalty

13052.5 Failure to report amounts paid as

remuneration for personal services on an

information return as required by

Section 13050 of the CUIC or

Section 6041A of the IRC on the date

prescribed. This penalty shall be assessed

against the person or entity required to file

and may be charged in lieu of, or in

addition to, the penalty under

Section 13052 of the CUIC.

The maximum

income tax rate

pursuant to

Section 17041 of

the Revenue and

Taxation Code

multiplied by the

unreported

amounts paid for

personal services.

Exception – None.

DE 231EP (7-16) (INTERNET) Page 5 of 5

ADDITIONAL INFORMATION

F

or further assistance, please contact the Taxpayer Assistance Center at 888-745-3886 or visit the nearest

Employment Tax Office listed in the Ca

lifornia Employer’s Guide, DE 44, and on the EDD website at

www.edd.ca.gov/Office_Locator/. Additional information is also available through the EDD no-fee payroll tax

seminars and online courses. View the in-person and online course offerings on the EDD website at

www.edd.ca.gov/Payroll_Tax_Seminars/.

F

or information regarding penalty waivers, refer to Information Sheet: Waiver of Penalty Policy, DE 231J.

The EDD is an equal opportunity employer/program. Auxiliary aids and services are available upon request to

individuals with disabilities. Requests for services, aids, and/or alternate formats need to be made by calling

888-745-3886 (voice) or TTY 800-547-9565.

This information sheet is provided as a public service and is intended to provide nontechnical assistance. Every attempt has been made to

provide information that is consistent with the appropriate statutes, rules, and administrative and court decisions. Any information that is

inconsistent with the law, regulations, and administrative and court decisions is not binding on either the Employment Development Department

or the taxpayer. Any information provided is not intended to be legal, accounting, tax, investment, or other professional advice.