Fillable Printable Power Purchase Agreement Checklist for State and Local Governments

Fillable Printable Power Purchase Agreement Checklist for State and Local Governments

Power Purchase Agreement Checklist for State and Local Governments

This fact sheet provides information and guidance on the

solar photovoltaic (PV) power purchase agreement (PPA),

which is a nancing mechanism that state and local govern-

ment entities can use to acquire clean, renewable energy. We

address the nancial, logistical, and legal questions relevant

to implementing a PPA, but we do not examine the technical

details—those can be discussed later with the developer/con-

tractor. This fact sheet is written to support decision makers

in U.S. state and local governments who are aware of solar

PPAs and may have a cursory knowledge of their structure

but they still require further information before committing

to a particular project.

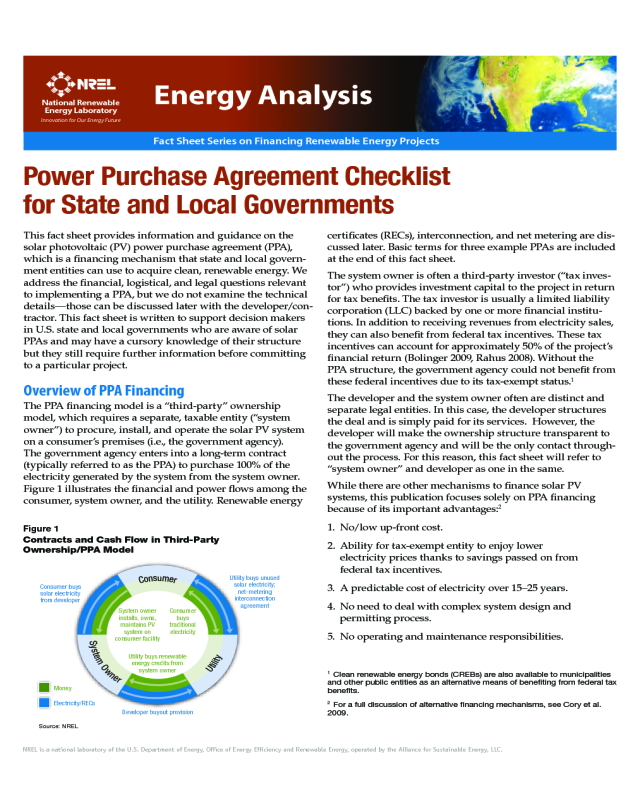

Overview of PPA Financing

The PPA nancing model is a “third-party” ownership

model, which requires a separate, taxable entity (“system

owner”) to procure, install, and operate the solar PV system

on a consumer’s premises (i.e., the government agency).

The government agency enters into a long-term contract

(typically referred to as the PPA) to purchase 100% of the

electricity generated by the system from the system owner.

Figure 1 illustrates the nancial and power ows among the

consumer, system owner, and the utility. Renewable energy

certicates (RECs), interconnection, and net metering are dis-

cussed later. Basic terms for three example PPAs are included

at the end of this fact sheet.

The system owner is often a third-party investor (“tax inves-

tor”) who provides investment capital to the project in return

for tax benets. The tax investor is usually a limited liability

corporation (LLC) backed by one or more nancial institu-

tions. In addition to receiving revenues from electricity sales,

they can also benet from federal tax incentives. These tax

incentives can account for approximately 50% of the project’s

nancial return (Bolinger 2009, Rahus 2008). Without the

PPA structure, the government agency could not benet from

these federal incentives due to its tax-exempt status.

1

The developer and the system owner often are distinct and

separate legal entities. In this case, the developer structures

the deal and is simply paid for its services. However, the

developer will make the ownership structure transparent to

the government agency and will be the only contact through-

out the process. For this reason, this fact sheet will refer to

“system owner” and developer as one in the same.

While there are other mechanisms to nance solar PV

systems, this publication focuses solely on PPA nancing

because of its important advantages:

2

1. No/low up-front cost.

2. Ability for tax-exempt entity to enjoy lower

electricity prices thanks to savings passed on from

federal tax incentives.

3. A predictable cost of electricity over 15–25 years.

4. No need to deal with complex system design and

permitting process.

5. No operating and maintenance responsibilities.

1

Clean renewable energy bonds (CREBs) are also available to municipalities

and other public entities as an alternative means of beneting from federal tax

benets.

2

For a full discussion of alternative nancing mechanisms, see Cory et al.

2009.

Figure 1

Contracts and Cash Flow in Third-Party

Ownership/PPA Model

Fact Sheet Series on Financing Renewable Energy Projects

Energy Analysis

NREL is a national laboratory of the U.S. Department of Energy, Office of Energy Efficiency and Renewable Energy, operated by the Alliance for Sustainable Energy, LLC.

Power Purchase Agreement Checklist

for State and Local Governments

Utility buys unused

solar electricity;

net-metering

interconnection

agreement

Developer buyout provision

Money

Electricity/RECs

Consumer buys

solar electricity

from developer

C

o

n

s

u

m

e

r

U

t

i

l

i

t

y

S

y

s

t

e

m

O

w

n

e

r

Utility buys renewable

energy credits from

system owner

Consumer

buys

traditional

electricity

System owner

installs, owns,

maintains PV

system on

consumer facility

Source: NREL

National Renewable

Energy Laboratory

Innovation for Our Energy Future

Sponsorship Format Reversed

Horizontal Format-B Reversed

Color: White

Vertical Format Reversed-A

Vertical Format Reversed-B

National Renewable

Energy Laboratory

National Renewable

Energy Laboratory

Innovation for Our Energy Future

National Renewable Energy Laboratory

Innovation for Our Energy Future

Horizontal Format-A Reversed

National Renewable Energy Laboratory

Innovation for Our Energy Future

Power Purchase Agreement Checklist

High-Level Project Plan for Solar PV with

PPA Financing

Implementing power purchase agreements involves many

facets of an organization: decision maker, energy manager,

facilities manager, contracting ofcer, attorney, budget of-

cial, real estate manager, environmental and safety experts,

and potentially others (Shah 2009). While it is understood

that some employees may hold several of these roles, it is

important that all skill sets are engaged early in the process.

Execution of a PPA requires the following project coordina-

tion efforts, although some may be concurrent:

3

Step 1. Identify Potential Locations

Identify approximate area available for PV installation

including any potential shading. The areas may be either

on rooftops or on the ground. A general guideline for solar

installations is 5–10 watts (W) per square foot of usable

rooftop or other space.

4

In the planning stages, it is useful to

create a CD that contains site plans and to use Google Earth

software to capture photos of the proposed sites (Pechman

2008). In addition, it is helpful to identify current electricity

costs. Estimating System Size (this page) discusses the online

tools used to evaluate system performance for U.S. buildings.

Step 2. Issue a Request for Proposal (RFP) to Competitively

Select a Developer

If the aggregated sites are 500 kW or more in electricity

demand, then the request for proposal (RFP) process will

likely be the best way to proceed. If the aggregate demand is

signicantly less, then it may not receive sufcient response

rates from developers or it may receive responses with

expensive electricity pricing. For smaller sites, government

entities should either 1) seek to aggregate multiple sites into

a single RFP or 2) contact developers directly to receive bids

without a formal RFP process (if legally permissible within

the jurisdiction).

Links to sample RFP documents (and other useful docu-

ments) can be found at the end of this fact sheet. The materi-

als generated in Step 1 should be included in the RFP along

with any language or requirements for the contract. In

addition, the logistical information that bidders may require

to create their proposals (described later) should be included.

It is also worthwhile to create a process for site visits.

3

Adapted from a report by GreenTech Media (Guice 2008) and from conver-

sations with Bob Westby, NREL technology manager for the Federal Energy

Management Program (FEMP).

4

This range represents both lower efciency thin-lm and higher efciency

crystalline solar installations. The location of the array (rooftop or ground) can

also affect the power density. Source: http://www.solarbuzz.com/Consumer/

FastFacts.htm

Renewable industry associations can help identify Web sites

that accept RFPs. Each bidder will respond with an initial

proposal including a term sheet specifying estimated output,

pricing terms, ownership of environmental attributes (i.e.,

RECs) and any perceived engineering issues.

Step 3. Contract Development

After a winning bid is selected, the contracts must be negoti-

ated—this is a time-sensitive process. In addition to the PPA

between the government agency and the system owner, there

will be a lease or easement specifying terms for access to the

property (both for construction and maintenance). REC sales

may be included in the PPA or as an annex to it (see Page 6

for details on RECs). Insurance and potential municipal law

issues that may be pertinent to contract development are on

Page 8.

Step 4. Permitting and Rebate Processing

The system owner (developer) will usually be responsible

for ling permits and rebates in a timely manner. However,

the government agency should note ling deadlines for

state-level incentives because there may be limited windows

or auction processes. The Database of State Incentives for

Renewables and Efciency (http://www.dsireusa.org/) is a

useful resource to help understand the process for your state.

Step 5. Project Design, Procurement, Construction, and

Commissioning

The developer will complete a detailed design based on

the term sheet and more precise measurements; it will then

procure, install, and commission the solar PV equipment. The

commissioning step certies interconnection with the utility

and permits system startup. Once again, this needs to be done

within the timing determined by the state incentives. Failure

to meet the deadlines may result in forfeiture of benets,

which will likely change the electricity price to the govern-

ment agency in the contract. The PPA should rmly establish

realistic developer responsibilities along with a process for

determining monetary damages for failure to perform.

Financial and Contractual Considerations

The developer’s proposal should include detailed projections

of all nancial considerations. This section helps the govern-

ment agency become a more informed purchaser by explain-

ing key components that are needed for a complete proposal.

Estimating System Size

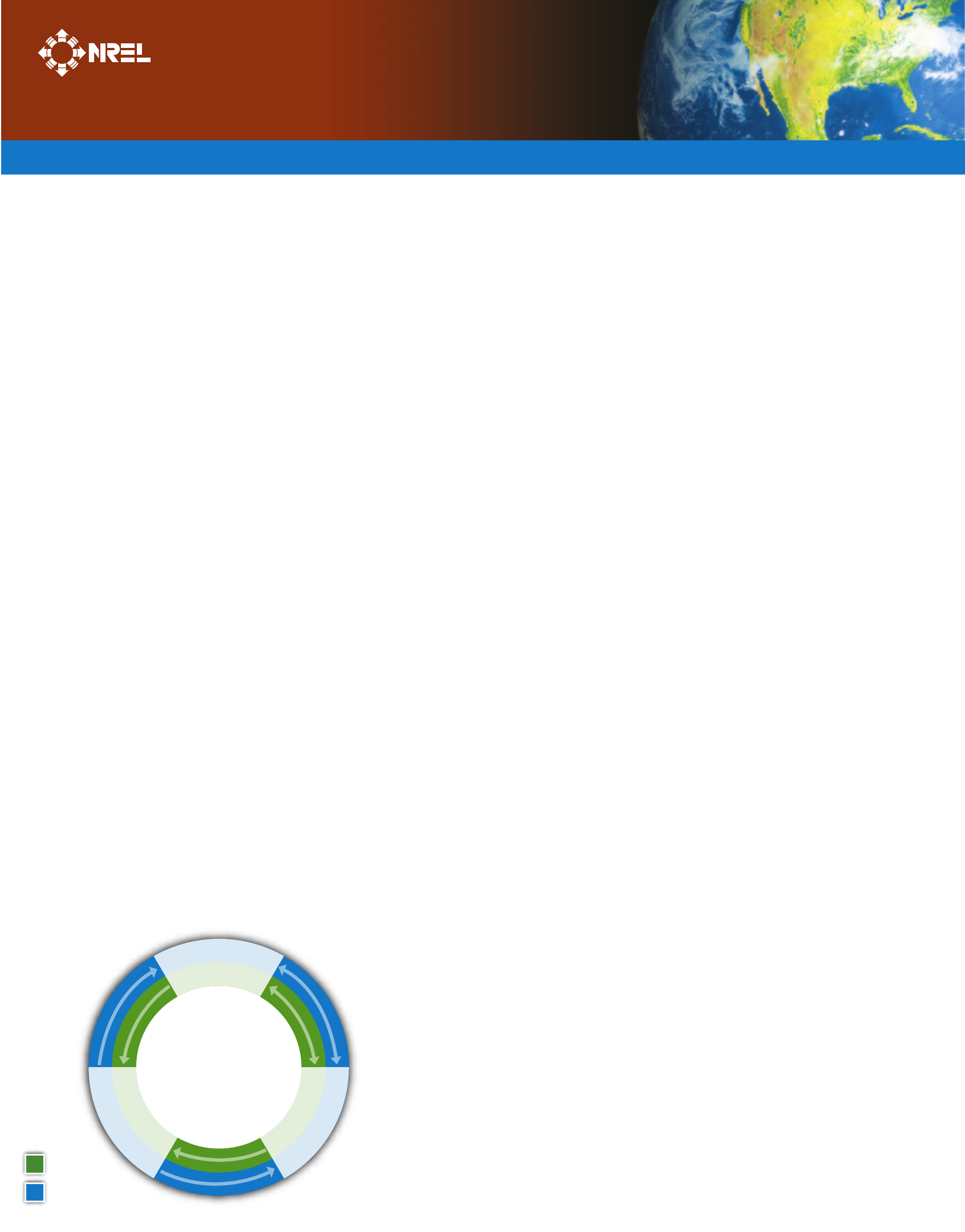

One of the rst steps for determining the nancial feasibility

of a PPA is to estimate the available roof and ground space,

and to approximate the size of the PV system or systems.

NREL provides a free online tool called In My Backyard

(IMBY) to make this assessment—the program can be found

at http://www.nrel.gov/eis/imby/

Page 2

The IMBY tool, which uses a Google Maps interface, allows

users to zoom-in on a particular building or location and

trace the approximate perimeter of the potential solar array.

From this information, IMBY simulates nancial and tech-

nical aspects of the system; the results provide a rst-level

estimate and might not capture the exact situation (system

performance, system cost, or utility bills) at a particular loca-

tion (an example is shown in Figure 2). IMBY estimates the

system size and annual electricity production as well as the

monetary value of the electricity generated by the photovol-

taic system. Users can adjust primary technical and nancial

inputs to simulate more specic conditions. The amount of

electricity generated by the solar system can be compared to

the facility’s monthly utility electric bills to estimate potential

offset capacity of the PV system.

5

PPA Pricing

A key advantage of power purchase agreements is the

predictable cost of electricity over the life of a 15- to 25-year

contract. This avoids unpredictable price uctuations from

utility rates, which are typically dependent on fossil fuel

prices in most of the United States. The approval of climate

change legislation also may cause utility electricity rates to

5

It is important to be cognizant of any planned or potential changes to the

facility that could affect the electrical demand (and, therefore, electricity

offset) such as the additions to the facility.

increase signicantly; thus, the projected savings may

be further accentuated. In a PPA, the electricity rates are

predetermined, explicitly spelled out in the contract, and

legally binding with no dependency on fossil fuel or climate

change legislation.

The most common PPA pricing scenarios are xed price

and xed escalator. In a xed-price scheme, electricity

produced by the PV system is sold to the government agency

at a xed rate over the life of the contract (see Figure 3 for

an example of this scenario). Note that it is possible for the

PPA price to be higher than the utility rate at the beginning.

However, over time, the utility rate is expected to overtake

the PPA price such that the PPA generates positive savings

over the life of the contract. This structure is most favorable

when there is concern that the utility rates will increase

signicantly.

In a xed-escalator scheme, electricity produced by the sys-

tem is sold to the government agency at a price that increases

at a predetermined rate, usually 2–5% (see Figure 4 for an

example of this scenario). Some system owners will offer a

rate structure that escalates for a time period (e.g., 10 years)

and then remains xed for the remainder of the contract.

Page 3

Electricity

(¢/kWh)

0

10

20

30

20-Year PPA

PPA Rate

Utility Rate

PPA Rate

Utility Rate

Electricity

(¢/kWh)

0

10

20

30

20-Year PPA

Figure 3

Fixed-Price PPA

Figure 4

PPA Price Escalator

Figure 2

IMBY Example

Source: NREL

Power Purchase Agreement Checklist

A less common PPA pricing model involves the PPA price

based on the utility rate with a predetermined discount.

While this ensures that the PPA price is always lower than

utility rates, it is complicated to structure and it undermines

the price-predictability advantage of a PPA.

A recently emerging PPA structure has consumers either 1)

prepay for a portion of the power to be generated by the PV

system or 2) make certain investments at the site to lower

the installed cost of the system. Either method can reduce

the cost of electricity agreed to in the PPA itself. This struc-

ture takes advantage of a governmental entity’s ability to

issue tax-exempt debt or to tap other sources of funding to

buy-down the cost of the project. Prepayments can improve

economics for both parties and provide greater price stability

over the life of the contract. Boulder County exercised this

option by making investments to lower the project costs (see

the table on Page 10, which provides examples of PPA pricing

and structures from state and local government projects in

California and Colorado).

Interconnection and Net Metering

Interconnection to the existing electrical grid and net meter-

ing are important policies to consider.

6

Interconnection

standards vary according to state-mandated rules (and

sometimes by utility), which regulate the process by which

renewable energy systems are connected to the electrical

grid. Federal policy mandates that utilities accept intercon-

nection from solar power stations, but each utility’s process

varies. The system owner and utility develop an interconnec-

tion agreement, which spells out the conditions, equipment,

and processes. Such conditions may include standby charges,

which are fees that utilities impose on solar system owners to

account for the cost of maintaining resources in case the solar

system is not generating. Additionally, the project host and

developer should consider utility tariff charges applicable to

electricity purchased in backup mode—contact your local

utility to fully comprehend the process of interconnection in

the early stages of RFP development. The Interstate Renew-

able Energy Council has a report on state-specic intercon-

nection standards, which is available at http://www.irecusa.

org/index.php?id=86.

6

The 2008 Edition of Freeing the Grid, issued by the Network for New Energy

Choices, provides a listing of the best and worst practices in state net-meter-

ing policies and interconnection standards. Much of the report discusses

the technical aspects, which your developer should be able to address.

http://www.newenergychoices.org/uploads/FreeingTheGrid2008_report.pdf

Page 4

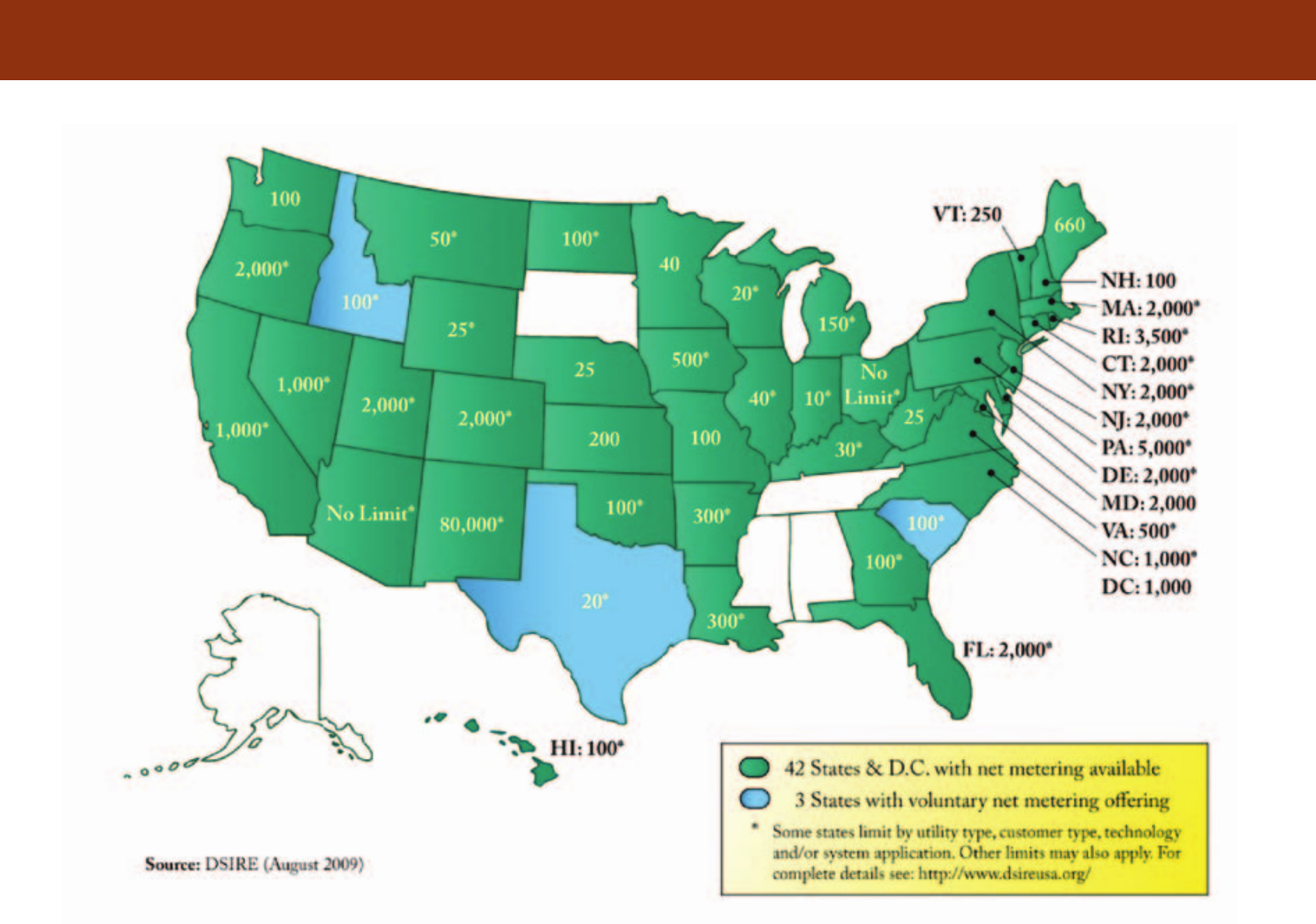

Figure 5

Net Metering

Net metering is a policy that allows a solar-system owner

to receive credit on his/her electricity bill for surplus solar

electricity sent back to the utility. The electricity meter

“spins backward,” accurately tracking the excess electricity.

Net-metering regulations vary by state but typically include

specications for the amount of excess electricity that the

utility can count, the rate at which the utility can produce the

credit, and the duration of the agreement (Rahus Institute

2008). States that do not have net-metering guidelines may

require the system owner to install a second meter.

States differ on their net-metering pricing scheme, but they

fall into three basic categories: (1) retail rate (the rate consum-

ers pay), (2) the wholesale rate (market rate), or (3) the utili-

ties’ avoided-generation rate. Time of use (TOU) net metering

is a system of indexing net-metering credits to the value of

the power sold on the market during that time period. This

is advantageous to solar power because it is strongest during

electricity peak demand times (Rahus Institute 2008). Figure

5 shows the states with net-metering policies in place.

Sizing PV systems for specic locations/applications depends

highly on energy demand schedules as well as net-metering

laws. When sizing a PV system, it is important to avoid

the potential for overproduction. If there are unanticipated

changes in demand, or if electricity production is not coinci-

dent with electricity consumption at the site, the PV system

may generate more electricity than the utility can credit the

customer for—some net-metering laws cap this amount.

The risk is overproducing and sending electricity to the

grid without compensation. A facility can produce a

disproportionate amount of energy during peak periods

and may not make up for this discrepancy during off-peak

periods (Pechman 2008).

Federal Tax Incentives for the System Owner

An important aspect of the PPA structure is that a system

owner can take advantage of federal tax incentives that a tax-

exempt entity cannot. The two most signicant tax benets

are the investment tax credit (ITC) and accelerated deprecia-

tion. The ITC offers tax-paying entities a 30% tax credit on the

total cost of their solar system.

7

Accelerated depreciation is an

accounting practice used to allocate the cost of wear and tear

on a piece of equipment over time – in this case, more quickly

than the expected system life. The Internal Revenue Service

(IRS) allows a ve-year modied accelerated cost recovery sys-

tem (MACRS) for commercial PV systems. Although a solar

array may produce power during the entirety of a 20-year

PPA, the system owner can take advantage of the entire tax

benet within the rst ve years. Both of these incentives

7

Under the American Recovery and Reinvestment Act (Recovery Act),

tax-paying entities can elect to recover the ITC using a Department of

Treasury grant, once project construction is complete. This is expected

to improve the nancial benets of the incentive.

alleviate a great deal of nancial risk for system owners,

encourage project development, and help make renewable

energy an affordable alternative to fossil fuel energy sources.

The Value of Renewable Energy Certificates

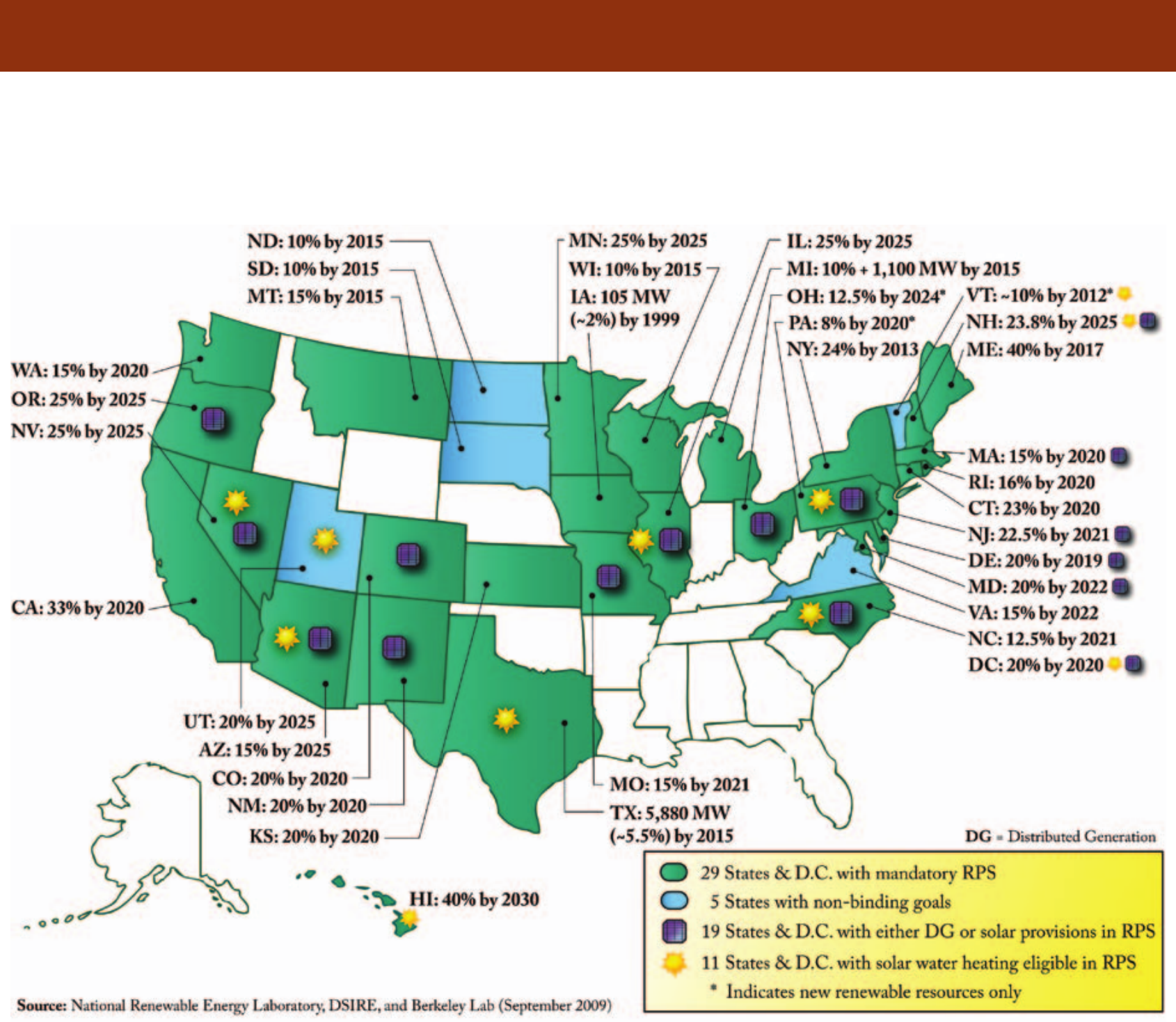

Twenty-nine states and the District of Columbia have imple-

mented renewable portfolio standard (RPS) policies. An RPS

requires utilities to provide their customers with a minimum

percentage of renewable generation by statutory target dates.

Failure to meet these requirements usually results in compli-

ance penalties. Figure 6 shows these RPS policies by state.

Utilities typically prove RPS compliance using renewable

energy certicates (RECs), which represent 1 megawatt-hour

(MWh) of electricity produced from a renewable source. In

many states, RECs can be traded separately from the electric-

ity. In these cases, the RECs represent the environmental

attributes of renewable energy. In addition, some states offer

carve-outs for solar renewable energy certicates (SRECs) or

distributed generation (DG) (see Figure 6). These states create

separate markets for these RECs (usually at higher prices) or

offer multiple credits for each megawatt-hour. For example,

a 3x multiplier allows the utility to count each REC from

solar electricity as 3 MWh for compliance purposes.

8

States with RPS policies are known as “compliance markets.”

In these markets, utilities can include purchased RECs in

demonstration of compliance with state energy mandates.

This can provide an important source of cash ow to PV

system owners. In addition, states with carve-outs for solar

or DG can realize even higher prices for SRECs.

“Voluntary markets” also exist in which residential, commer-

cial, and industrial consumers can buy SRECs from system

owners to claim their energy is produced from renewable

technologies. The advantage is that consumers do not have

to develop renewable projects but still can claim the environ-

mental benets (Cory 2008).

In general, PPAs are structured so that the RECs remain with

the system owner. However, the host can negotiate to buy the

RECs along with the electricity. This will drive up the price

per kilowatt-hour in the PPA to compensate the system owner

for the RECs. If the host does not buy the RECs, it is important

to manage the claims made regarding the PV system. The

government agency can say it is hosting a renewable energy

project but it cannot say that it is powered by renewable

energy. One option is an SREC swap. In this case, the host

would decide against buying the solar RECs from the PPA

provider and instead buy cheaper replacement RECs (wind

or biomass, for example) in the voluntary market (Coughlin

2009). REC prices in the voluntary markets are substantially

8

Under the Waxman-Markey bill (as of July 2009), Congress is considering

a federal solar multiplier of 3x for all distributed generation projects.

Page 5

Power Purchase Agreement Checklist

lower than in the compliance market. This REC swap would

allow the host to claim green power benets (but not solar

power because the replacement RECs were not SRECs).

State and Utility Cash Incentives

Other important state-level programs are those that provide

cash incentives for system installation. These programs

(often called “buy-down” or “rebate” programs) come in

two varieties. The capacity-based incentive (CBI) provides a

dollar amount per installed watt of PV. Incentives can also be

structured as performance-based incentives (PBI). They do

not provide up-front payments, but rather provide ongoing

payments for each kilowatt-hour of electricity produced over

a time period (e.g., ve years). Consumers will normally pre-

fer CBIs because of the up-front cash. However, some states

prefer PBIs because they encourage better performance.

The downside of these more recent programs is that the

government agency must nance a large part of system

costs (if not under a solar PPA) and incur performance risk

(Bolinger 2009).

Approximately 20 states and 100 utilities offer nancial

incentives for solar photovoltaic projects. Depending on the

state and local programs, these incentives can cover 20-50%

of a project’s cost (DSIRE 2009). Specics for individual state

programs can be found on the Database of State Incentives

for Renewables and Efciency (http://www.dsireusa.org/).

Additional government incentives include state tax credits,

sales tax exemptions, and property tax exemptions, which

can be important under the solar PPA model.

Page 6

Figure 6

States with Renewable Portfolio Standards (indicating solar/DG set-asides)

System Purchase Options

If the host prefers, the solar PPA can include provisions for a

consumer to buy the PV system. This can occur at any point

during the life of the contract but almost always after the

sixth year because of tax recapture issues related to the ITC.

The buyout clause is phrased as the greater of fair market

value (FMV) or some “termination” value (that is higher than

the FMV). This termination value often includes the pres-

ent value of the electricity that would have been generated

under the remaining life of the PPA. Buyout options are more

readily available in third-party PPAs in which the investors

are motivated by the tax incentives rather than long-term

electricity revenues. A different set of investors may have

a longer-term investment horizon and may be less likely to

favor early system-purchase options.

When issuing RFPs and evaluating bids, it is important to

understand the project goals of the potential developers

and decide which most closely align with those of your

organization. From the government agency’s point of view,

there are both benets and responsibilities that come with

owning the system. The obvious benet is that the electric-

ity generated by the PV system can now be consumed by

the host at no cost (nancing charges notwithstanding); the

costs and responsibilities revolve around the need to operate

and maintain the PV system. Owner’s costs include physical

maintenance (including inverter replacement, which can be

costly) and monitoring, as well as nancial aspects such as

insurance.

Although PPAs are inherently structured as a contract by

which a government agency can buy electricity, system own-

ership may be a viable option at some point. If the buyout

option is not available or not exercised by the end of the

contract life, the government agency can purchase the system

at “fair market value,” extend the PPA, or request the system

owner remove the system (Rahus 2008). Government hosts

may want to consider requiring (in the RPF and the PPA) that

the system owner pay for the cost of equipment removal at

contract maturity.

Logistical Considerations

Appropriate roof or land areas must be identied, and there

are also important logistical requirements to consider. The

issues discussed in this section should be included in the

RFP because they will allow the developer to provide a

rmer bid with less assumptions and contingencies.

Rooftop Mounted Arrays

After the RFP, the winning bidder will conduct a structural

analysis to determine whether the roof can sustain the load.

By documenting the condition in the RFP, you may avoid

potential adjustments. It is important to assess the following

information:

•Roof structure and type (at, angled, metal, wood, etc.) –

determines the attachment methods that may be used.

•Orientation of the roof – especially important if it is

a sloped roof. Southern facing roofs are ideal but not

necessarily mandatory.

•Roof manufacturer’s warranty – usually lasts a minimum

of 10 years but can extend over 20 years. Before installing

solar panels, it is important to ensure that the solar installa-

tion will not void the warranty. Systems that do not pen-

etrate the roof surface or membrane are usually acceptable,

but it is important to obtain this allowance in writing prior

to moving forward with the solar project.

•Planned roof replacement – if it is to be scheduled within

a few years, it a good idea to combine projects, which will

cut costs and minimize facility disturbance.

•Potential leak concern – if this exists, you may opt for a

formal roof survey to assess and document the condition of

the roof prior to the solar installation.

•Obstructions on the roof – items such as roof vents and

HVAC equipment can hinder the project.

•Shade from adjacent trees or buildings – can reduce

solar potential.

Ground-Mounted Systems

Ground-mounted photovoltaic systems are advantageous in

some situations because they can be cheaper and easier to

install and can be scaled-up more easily. This reduces the

cost per kilowatt-hour and translates into cheaper energy

costs for the consumer. Additionally, ground systems offer

exibility in the type of technology that can be used. For

example, the project may have tracking technologies, which

can result in higher energy output and better project eco-

nomics. One of the key logistical issues for ground-mounted

systems is the wind speed the system is designed to with-

stand, which depends primarily on the location of the project

site (e.g., hurricane risks); the soil type and strength charac-

teristics are also important. To obtain more accurate bids,

consumers often will have a third-party conduct soil sample

tests prior to issuing an RFP. Wind and soil conditions can

greatly inuence the design and cost of a project. Perimeter

fencing and site monitoring should be specied in the RFP to

ensure security, safety, and compliance with local codes.

Page 7

Power Purchase Agreement Checklist

General Logistical Considerations

Electrical upgrades or changes may affect the system design

and potential interconnection to the electrical grid. Any

planned changes should be documented within the RFP.

For proper maintenance, accessibility to the inverter and

solar array will be important to the system owners through-

out the life of the project.

Fire departments will have building accessibility require-

ments, particularly for roof-mounted systems. Some jurisdic-

tions formally specify these standards and will conrm that

the system meets the requirements during the permitting

phase and nal approval process. In states that do not have

such requirements, it is important for the government agency

and the system owner to gain re department approval early

in the process.

Contractually, operation and ongoing maintenance of the

solar system is typically the responsibility of the system

owner unless otherwise specied.

Insurance

9

While many governmental entities may be able to self-insure,

it is important to investigate the minimum insurance required

by your utility’s interconnection rules. The requirements may

necessitate additional coverage through private insurance.

Unfortunately, insurance underwriters charge fairly high

premiums for PV installations. These premiums can repre-

sent approximately 25% of the annual operating budget and

may be as large as 0.25% to 0.50% of the project installed

costs. According to discussions with developers, the cost of

insurance can increase energy pricing by 5–10%. The high

premiums are due to two underlying reasons: 1) Insurance

underwriters still view PV as a risky technology due to

its lack of long operating history, and 2) the relatively low

number of projects do not allow underwriters to average risk

across a large number of installations (i.e., “the law of large

numbers”). Until recently, Lloyds of London was the only

underwriter for PV in the United States; however, Munich Re,

AIG, Zurich Insurance Group, ACE Ltd., and Chubb are also

actively pursuing renewable energy policies. Reportedly, a

fth underwriter is developing a PV product, but no public

announcements have been made (Kollins et al., forthcoming).

9

Much of this section is adopted from a forthcoming NREL paper:

“Insuring Solar Photovoltaics: Challenges and Possible Solutions”;

Speer, B.; Mendelsohn, M.; and Cory, K.

In general, insurance is the responsibility of the system

owner (developer). At a minimum, the system owner should

be expected to carry both general liability and property

insurance. Additional considerations may be given to sepa-

rate policies for location-specic risks (e.g., hurricane cover-

age in Florida), property-equivalent policies (which cover

engineering), and environmental risk (inclusive of pre-exist-

ing conditions). If covered by the system owner, the cost of

insurance will be factored into the PPA cost of electricity and

not passed through separately. Thus, a fairly recent realiza-

tion is that it may be cheaper for the government agency to

insure the system directly, although they don’t actually own

the system. Then, the system owner is named as an addi-

tional insured party on the policy and agrees to reimburse

the government agency for the premiums. Insurance com-

panies have agreed to this in previous PPAs (Boylston 2008).

Because this can reduce overall project costs, this arrange-

ment deserves further investigation with a provider.

One nal note concerns indemnication for bad-acts and

pre-existing structural or environmental risks. Whether

contractual or not, the government agency may want to

acquire its own insurance to protect itself from the potential

of future liabilities.

Potential Deal Constraints Embedded in

Municipal Laws

10

Municipal laws were written before PV installations were

even a remote consideration. While each jurisdiction operates

under its own unique statutes, this section lists some common

constraints that may be encountered. Listed below are the

categories that may require investigation. More detail on the

following specic issues is provided at the end of this fact sheet:

1. Debt limitations in city codes, state statutes,

and constitutions

2. Restrictions on contracting power in city codes and

state statutes

3. Budgeting, public purpose, and credit-lending issues

4. Public utility rules

5. Authority to grant site interests and buy electricity

10

Much of this section is adapted from the transcript of a June 12, 2008,

NREL conference call led by Patrick Boylston of Stoel Rives LLP.

Page 8

Page 9

Conclusions

Financing solar PV through a power purchase agreement

allows state and local governments to benet from clean

renewable energy while minimizing up-front expenditures

and outsourcing O&M responsibilities. Also important, a

PPA provides a predictable electricity cost over the length of

the contract.

This fact sheet is a concise guide that will help states and

municipalities with the solar PPA process. The following ve

steps are recommended to formally launch a project (and are

described in this brief):

Step 1: Identify Potential Locations

Step 2: Issue a Request for Proposal (RFP) to Competitively

Select a Developer

Step 3: Contract Development

Step 4: Permitting and Rebate Processing

Step 5: Project Design, Procurement, Construction, and

Commissioning

The U.S. Department of Energy (DOE) can help facilitate the

process by providing quick, short-term access to expertise on

renewable energy and energy efciency programs. This is

coordinated through the Technical Assistance Project (TAP)

for state and local ofcials.

11

More information on the program

can be found at http://apps1.eere.energy.gov/wip/tap.cfm.

References

Bolinger, M. (January 2009). “Financing Non-Residential

Photovoltaic Projects: Options and Implications.” Published

by Lawrence Berkeley National Laboratory (LBNL-1410E).

http://eetd.lbl.gov/EA/EMP/reports/lbnl-1410e.pdf.

Boylston, P. (June 13, 2008). Transcript from conference call

presentation “Navigating the Legal, Tax and Finance Issues

Associated with Installation of Municipal PV Systems”

hosted by Stoel Rives LLP and the National Renewable

Energy Laboratory (NREL).

Cory, K.; Coggeshall, C.; Coughlin, J.; Kreycik, C. (2009).

“Solar Photovoltaic Financing: Deployment by Federal Gov-

ernment Agencies.” National Renewable Energy Laboratory

(NREL), http://www.nrel.gov/docs/fy09osti/46397.pdf

11

TAP currently has a focus on assisting programs that are related to

Recovery Act funds.

Cory, K.; Coggeshall, C.; Coughlin, J. (May 2008) “Solar

Photovoltaic Financing: Deployment on Public Property

by State and Local Governments.” NREL Technical Report

TP-670-43115 http://www.nrel.gov/docs/fy08osti/43115.pdf

Coughlin, J. (May 27, 2009). Presentation at TAP Webcast

“Financing Public Sector PV Projects.” National Renewable

Energy Laboratory (NREL).

Guice, J.; King, J. (February 14, 2008). “Solar Power Services:

How PPAs are changing the PV Value Chain.” Greentech

Media Inc.

James, R. (October 2008). “Freeing the Grid: Best and

Worst Practices in State Net Metering Policies and

Interconnection Standards”. Network for New Energy

Choices. http://www.newenergychoices.org/uploads/

FreeingTheGrid2008_report.pdf

Kollins, K.; Speers, B.; Cory, K. “Insuring Photovoltaics:

Challenges and Possible Solutions.” National Renewable

Energy Laboratory (NREL); Forthcoming Release.

Pechman, C.; Brown, P. (April 2008). “Investing in Solar Pho-

tovoltaics: A School District’s Story.” The Electricity Journal;

Vol. 21:3. http://www.sciencedirect.com/science/article/

B6VSS-4S9FH5F-1/2/0c4658faa0cfea7ac8d5c3a0df77a40e

Rahus Institute. (October 2008). “The Consumer’s Guide

to Solar Power Purchase Agreements.” http://www.califor-

niasolarcenter.org/pdfs/ppa/Rahus_SPPACustomersGuide_

v20081005HR.pdf

Shah, C. (June 10, 2009). Presentation at Federal Energy Man-

agement Program Webinar “Consumer Sited Power Purchase

Agreements.” National Renewable Energy Laboratory (NREL).

Stoel Rives LLP. (2008). “Lex Helius: The Law of Solar

Energy, A Guide to Business and Legal Issues.” First Edition.

http://www.stoel.com/webles/lawofsolarenergy.pdf

Power Purchase Agreement Checklist

Page 10

Sample Terms of Executed Power Purchase Agreements (PPAs)

Government Level State County City

Name

Caltrans District 10 Solar Project Boulder County Solar Project Denver Airport Solar Project

Location

Stockton, California Boulder County Denver, Colorado

Customer

California Department of

Transportation

Boulder County Denver International Airport

Utility

Pacic Gas & Electric Xcel Energy Xcel Energy

Size (DC)

248 kW 615 kW 2,000 kW

Annual Production

347,407 kWh 869,100 kWh 3,000,000 kWh

Type

123 kW rooftop, 125 kW carport 570 kW rooftop, 45 kW ground Ground-mount, single-axis tracking

Location

Maintenance Warehouse

Maintenance Shop

Parking Lot Canopy

Recycling Center

Courthouse

Clerk and Recorder

Addiction Recovery Center

Justice Center

Walden Ponds (ground-mount)

Sundquist

Ground of the Denver International

Airport

Area

22,200 sq ft 8 county buildings 7.5 acres

Developer

Sun Edison, LLC Bella Energy World Water & Solar Technologies

Owner

Sun Edison, LLC Rockwell Financial MMA Renewable Ventures

PPA Terms

20 years, 5.5% discount from

utility rates

20 years, xed-price 6.5 ¢/kWh

for rst 7 years, renegotiate price

and buyout option at beginning

of year 8

25 years, xed-price 6 ¢/kWh for rst 5

years, buyout option at beginning of year

6 or price increases to 10.5 ¢/kWh

Status

Completed September 2007 Completed January 2009 Completed August 2008

Contact

Patrick McCoy

(916) 375-5988

patrick.mc[email protected]

Ann Livington

(303) 441-3517

alivingston@bouldercounty.org

Woods Allee

(303) 342-2632

woods.allee@ydenver.com

Source: NREL

Potential Deal Constraints Embedded in Municipal Laws

This table lists potential constraints posed by municipal laws. Not all issues will pertain to your jurisdiction; however, this

table can serve as a short checklist for use in your investigation. The request for proposal (RFP) issue column is meant to

qualify each issue as to whether it needs to be highlighted in the RFP.

Category

RFP

Issue?

Issue Implication General Findings and Next Steps

1. Debt Limitations

in City Codes,

State Statutes,

and Constitutions

No Is PPA debt or

contingent liability?

Debt would require public vote

for approval.

Contingent liability is allowed

under purchasing authority

without a vote.

Most states see as purchasing only what is

consumed. Thus, a vote not is required.

PPA agreements usually called “energy services

agreement” to avoid any appearance of debt.

Must be wary of “take or pay provisions” in PPA

requiring payments regardless of use.

Also, be careful to size so as to not over-

produce based on net-metering rules

No Is system purchase

option debt?

A vote will be required to

approve debt for system

purchase.

It is important that the PPA deems the purchase

as optional at fair market value so that a vote is

not needed until the option is exercised.

2. Restrictions

on Contracting

Power in City

Codes and State

Statutes

Yes Contract Tenor

statutes (e.g.,

limited to 10 yrs

or 15 yrs)

May limit choice of developers

based on investment goals.

Research of local rules and precedents may be

required.

Yes Ability to buy/sell

RECs

When codes and statutes

were created, RECs were

not envisioned.

May determine where

benecial REC ownership is

assigned in PPA.

Each jurisdiction will be different. Research of

local rules and precedents is required.

Is there enough general authority under

electricity purchases (or other) to justify REC

trading?

Yes Public bidding

laws

May preclude RFP process

unless there is an applicable

exemption to public bidding

laws.

Research of local rules and precedents may

be required.

Developer will ask for representation and

warranty that the contract is exempt from public

bidding rules.

3. Public Purpose

and Lending of

Credit Issues

Yes Pre-paying for

electricity

Is this a grant to a for-prot

LLC that owns the PV system?

In most states, authority exists (such as

in the opinion of attorneys general) that it

is permissible if the entities are fullling a

government purpose.

Research may be required if pre-payment

is envisioned.

4. Public Utility

Rules

Yes How many entities

will be buying

electricity (i.e.,

city, county, and/or

other government

entities occupy

site)?

Most state laws and/or rules

clarify that if you are selling

electricity to a certain number of

consumers, then you are a utility

and subject to Public Utility

Commission (PUC) regulation.

12

This can be prohibitively

expensive for the developer.

Developers will generally want to contract

only with a single entity that owns the meter.

The costs can then be divided among various

entities.

If the entities are all behind the meter, then they

would not be subject to PUC regulations.

5. Authority to Grant

Site Interests

and Purchase

Electricity

No Lease or

easement?

A lease can have problems

with disposal and interest in

public property, which may

require a public-bidding or

offering process.

Framing the document as an “easement”

instead of a “lease” has worked well. Works

much like a lease except without ability

to transfer it—except in accordance with

agreement (usually restricted).

Source: Boylston 2008

12

The threshold is set differently by each state. Most are in the two-ve range.

Page 11