Fillable Printable Property Tax Deferral Application

Fillable Printable Property Tax Deferral Application

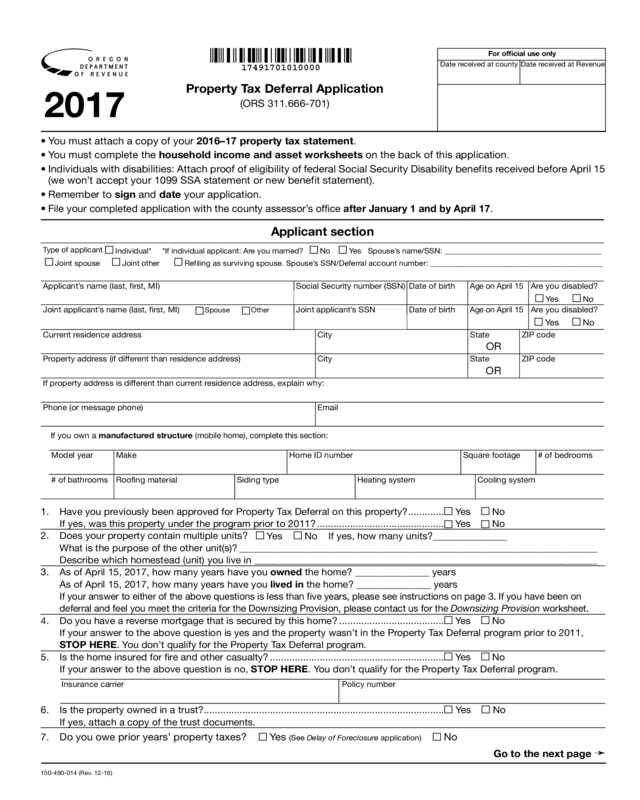

Property Tax Deferral Application

150-490-014 (Rev. 12-16)

For official use only

Date received at county Date received at Revenue

Property Tax Deferral Application

(ORS 311.666-701)

• You must attach a copy of your 2016–17 property tax statement.

• You must complete the household income and asset worksheets on the back of this application.

• Individuals with disabilities: Attach proof of eligibility of federal Social Security Disability benefits received before April 15

(we won’t accept your 1099 SSA statement or new benefit statement).

• Remember to sign and date your application.

•

File your completed application with the county assessor’s office after January 1 and by April 17.

2017

17491701010000

Applicant section

Type of applicant

Individual* *If individual applicant: Are you married? No Yes Spouse’s name/SSN: ________________________________________

Joint spouse Joint other Refiling as surviving spouse. Spouse’s SSN/Deferral account number: ____________________________________________

Applicant’s name (last, first, MI) Social Security number (SSN)

– –

Date of birth

Age on April 15

Are you disabled?

Yes No

Joint applicant’s name (last, first, MI) Spouse Other Joint applicant’s SSN

– –

Date of birth

Age on April 15

Are you disabled?

Yes No

Current residence address City State ZIP code

Property address (if different than residence address) City State ZIP code

If property address is different than current residence address, explain why:

Phone (or message phone) Email

If you own a manufactured structure

(mobile home), complete this section:

Model year Make Home ID number Square footage # of bedrooms

# of bathrooms Roofing material Siding type Heating system Cooling system

Go to the next page ➛

6. Is the property owned in a trust? ....................................................................................... Yes No

If yes, attach a copy of the trust documents.

7.

Do you owe prior years’ property taxes? Yes (See Delay of Foreclosure application) No

1. Have you previously been approved for Property Tax Deferral on this property? ............. Yes No

If yes, was this property under the program prior to 2011? ..............................................

Yes No

2. Does your property contain multiple units?

Yes No If yes, how many units?_______________

What is the purpose of the other unit(s)? ________________________________________________________________________

Describe which homestead (unit) you live in _____________________________________________________________________

3. As of April 15, 2017, how many years have you owned the home? _______________ years

As of April 15, 2017, how many years have you lived in the home? _______________ years

If your answer to either of the above questions is less than five years, please see instructions on page 3. If you have been on

deferral and feel you meet the criteria for the Downsizing Provision, please contact us for the Downsizing Provision worksheet.

4. Do you have a reverse mortgage that is secured by this home? ...................................... Yes No

If your answer to the above question is yes and the property wasn’t in the Property Tax Deferral program prior to 2011,

STOP HERE. You don’t qualify for the Property Tax Deferral program.

5. Is the home insured for fire and other casualty? ...............................................................

Yes No

If your answer to the above question is no, STOP HERE. You don’t qualify for the Property Tax Deferral program.

Insurance carrier Policy number

Clear All Pages

OR

OR

150-490-014 (Rev. 12-16)

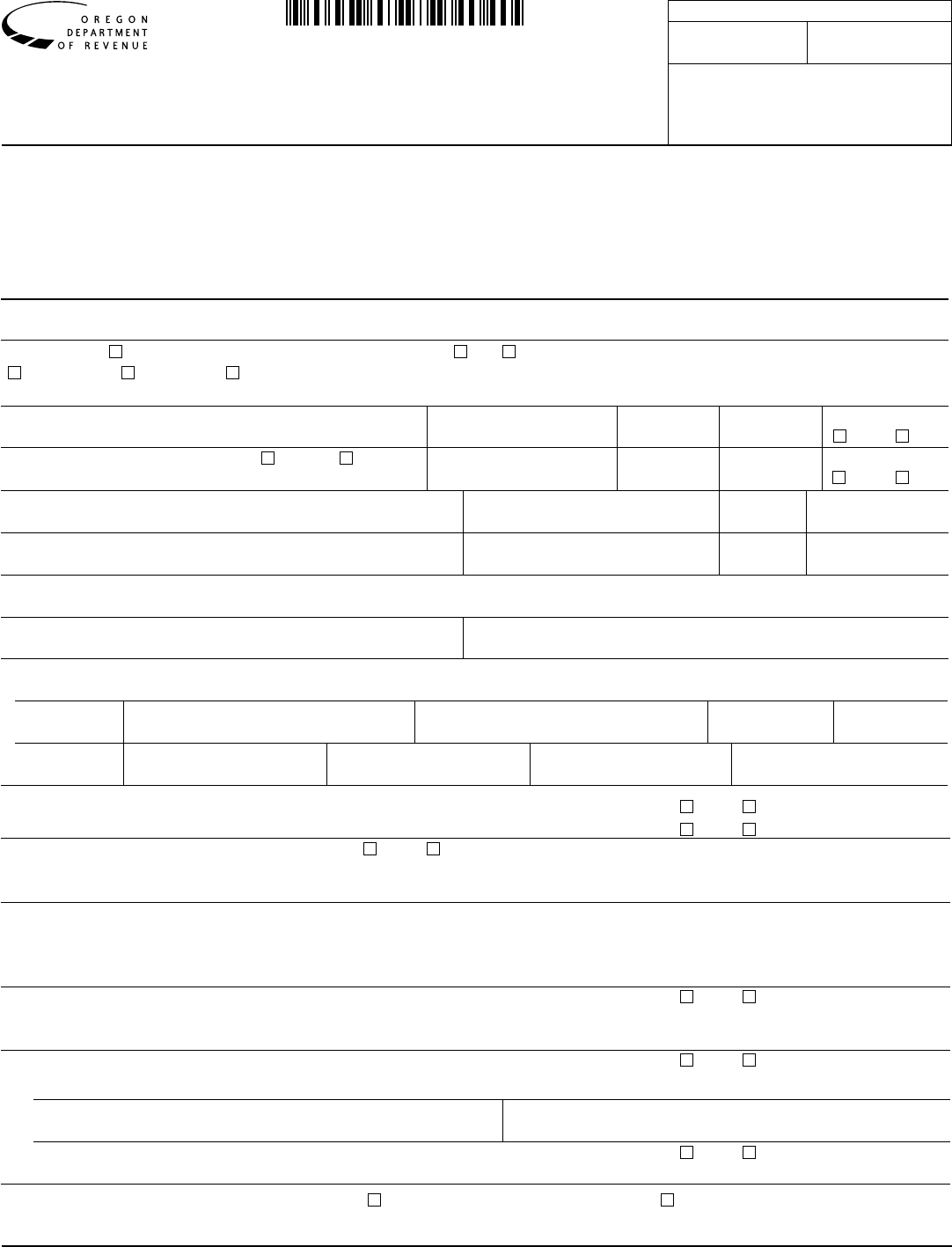

Declaration

I declare under penalties for false swearing that I have examined all documents and to the best of my knowledge, they are true, correct,

and complete (ORS 305.990). I understand a lien will be placed on this property and I will be charged lien recording and/or security

interest fees. I understand that 6 percent interest accrues on each years’ deferred tax amount (ORS 311.666-701).

Applicant’s signature

X

Date Joint applicant’s signature

X

Date

Household income worksheet

Applicant’s last name SSNFirst name and MI

This section must be completed. List your yearly household income for 2016. Household income consists of

all income of the applicant(s) and their spouse(s) that reside in the home. Include income earned in other states

or countries. Your household income must be less than $43,500 (taxable and nontaxable income) to qualify for

the 2017–2018 property tax year. We may require verification of the information you provide in this section.

Joint applicant’s last name

Joint applicant’s SSN

Joint applicant’s first name and MI

00

00

00

00

17491701020000

00

00

00

00

00

00

00

00

00

00

00

00

00

00

1. Wages, salaries, and other pay for work ..................................................... 1

2. Interest and dividends (total taxable and nontaxable) .................................

2

3. Business net income (loss limited to $1,000) .............................................. 3

4. Farm net income (loss limited to $1,000) ..................................................... 4

5. Total gain on property sales ......................................................................... 5

6. Rental net income ........................................................................................ 6

7. Other capital gains (i.e., stocks and bonds) (loss limited to $1,000) ........... 7

8. Total Social Security, Supplemental Security Income (SSI), and railroad

retirement before Medicare premium deductions

......................................... 8

9. Pensions and annuities before health insurance premium

deductions (total taxable and nontaxable) ................................................... 9

10. Unemployment benefits ............................................................................... 10

11. Child support ............................................................................................... 11

12. Veteran’s and military benefits ..................................................................... 12

13. Gambling winnings ...................................................................................... 13

14. All other sources. Identify: ______________________________________ ...... 14

15. Your total household income. Add lines 1-14 ............................................................................ • 15

If your total household income (line 15) is more than $43,500, STOP HERE. You don’t qualify for the Property Tax Deferral program.

List the total net worth of all applicants. Net worth means the sum of the current market value of all assets, includ-

ing real property, cash, savings accounts, bonds, and other investments after deducting outstanding liabilities. We

may require verification of the information you provide in this section.

Net worth doesn’t include the value of the property for which deferral is claimed, the cash value of life insurance

policies on the life of an applicant, or tangible personal property owned by an applicant (e.g., furniture, vehicles).

Net worth asset worksheet ($500,000 limit, not including your home)

1. Cash, savings, and checking account balances as of Dec. 31, 2016 .......... 1

2. Amount of investments in qualified retirement plans and

individual retirement accounts as of Dec. 31, 2016. ..................................... 2

3. Net worth of investments as of Dec. 31, 2016 .............................................

3

(Net worth means current value minus debt. Investments include real estate,

trust funds, stocks, stock options, bonds, other securities, commodities, etc.)

4. Your total assets. Add lines 1-3 .............................................................................................

•

4

If your total assets on line 4 exceed $500,000, STOP HERE. You don’t qualify for the Property Tax Deferral Program.

00

Clear All Pages

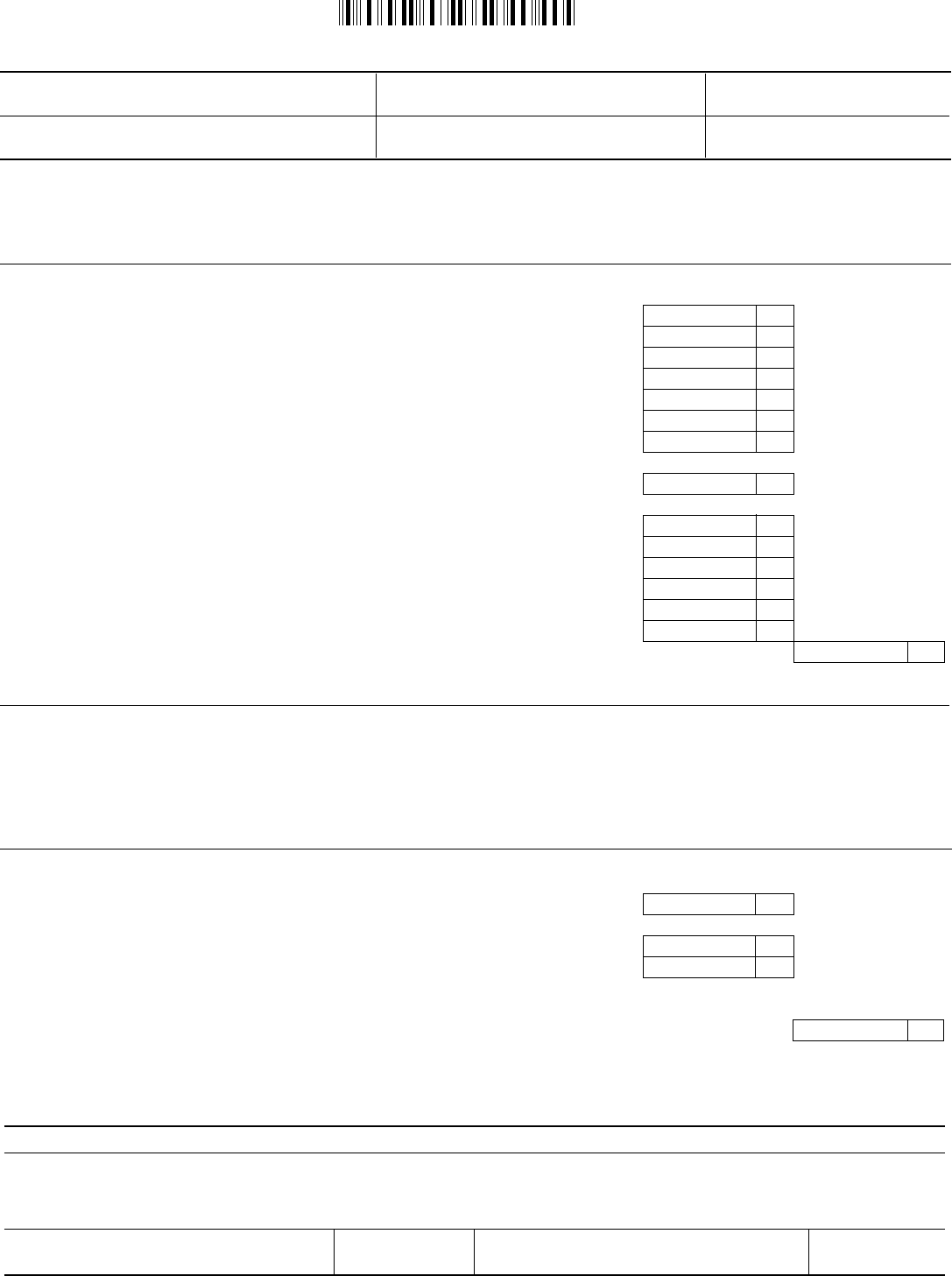

150-490-014 (Rev. 12-16)

Property

description

Unplatted

Deed

information

LOT ________________ BLK ________________ ________________________________________________ Legal desc

T ______________________ R ___________________________ SEC_____________________________

Parcel in:

As described in _____________________________________________ County Containing ________________________ acres

For all unplatted properties attach a copy of the recorded deed or contract.

County section (Don’t complete. This section will be completed by the county assessor’s office.)

Platted

•

•

Assessor’s

certification

Property described above contains

A single unit Multi-units

If the property contains multiple units, what is the percentage

of value allocated to the taxpayer’s unit (percent to be deferred)?

• ___________ %

Assessor’s (or Assessor’s designee’s) signature verifying applicant is the owner of record

X

Date

County number

•

Check

here for

split levy

code

Assessor’s account number

Levy code

Assessor’s account number

Levy code

• •

• •

Earliest deed showing

ownership by the taxpayer(s)

Recorded (date) Document/instrument number

Current deed

information

Deed recorded (date) __________________________ Contract recorded (date) ____________________________

Microfilm number Reel Book/volume Page

•

Document/instrument number

17491701030000