Fillable Printable Quarterly Contribution And Wage Adjustment Form (De 9Adj)

Fillable Printable Quarterly Contribution And Wage Adjustment Form (De 9Adj)

Quarterly Contribution And Wage Adjustment Form (De 9Adj)

DE 9ADJ Rev. 3 (7-13) (INTERNET) Page 1 of 2 CU

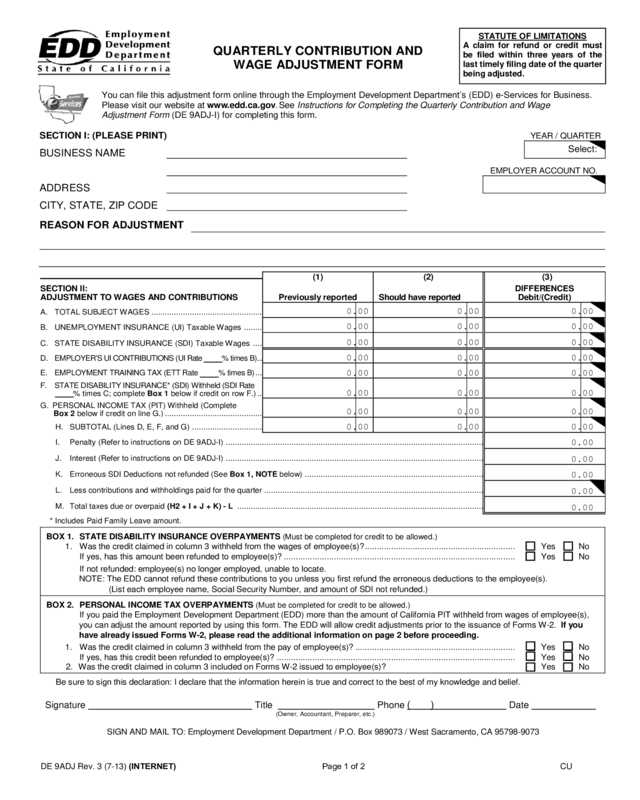

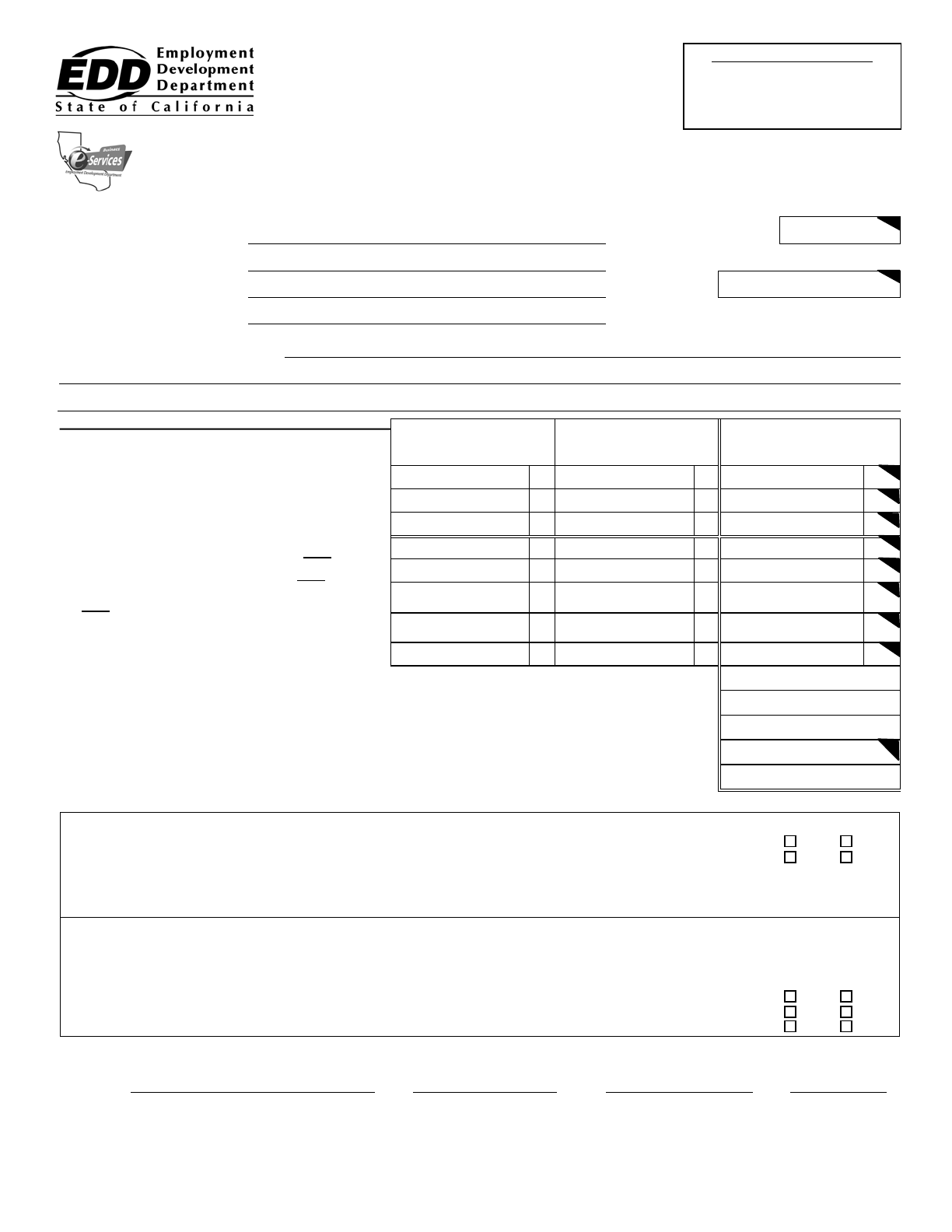

QUARTERLY CONTRIBUTION AND

WAGE ADJUS TMENT FORM

You can file this adjustment form online thr ough the Employment Development Department’s (EDD) e-Services for Busi ness.

Please visit our w ebsite at www.edd.ca.gov. See Instructions for Completing the Quar terly Contribution and W age

Adjustment Form (DE 9ADJ-I) for completing t his form.

SECTION I: (PLEASE PRINT)

YEAR / QUARTER

BUSINESS NAME

EMPLOYER ACCOUNT NO.

ADDRESS

CIT Y, ST AT E, ZIP CODE

REASON FOR ADJUSTMENT

(1)

(2)

(3)

SECTION II:

DIFFERENCES

ADJUSTME NT TO WAGES AND CONTRIBUTIONS

Previou sl y reported

Should have reported

Debit/(Credit)

A. TOTAL SUBJECT WAGES .................................................

B. UNEMPLOYM E NT INSURANCE ( UI) Taxa b l e Wages ........

C. STATE DISABILITY INSURANCE (SDI) Taxable Wages ....

D. EMPLOYER’S UI CONTRIBUTIONS (UI Rate 0.00 % times B) ...

E. EMPLOYMENT TRAINING TAX (ETT Rate 0.00 % times B) ...

F.

STATE DISABILITY INSURANCE* (SDI) Withheld (SDI Rate

0.00 % times C; compl ete Box 1 below if credit on row F.) ..

G

. PERSONAL INCOME TAX (PIT) Withheld (Complete

Box 2 below if credit on line G.) ...........................................

H. SUBTOTAL (Lines D, E, F, and G) . ..............................

I. Penalty (Refer t o instructio ns on DE 9ADJ-I) ................................................................................................

..................

J. Inte rest (R efer to i nstruc tions on DE 9ADJ-I) ................................................................................................

..................

K. Erroneous SDI Dedu c tions not refunded (See Box 1, NOTE below) ................................................................

...............

L. Less contributions and withholdings paid for the quarter ................................................................................................

.

M. Total taxes due or o verpaid

(H2 + I + J + K) - L

................................................................................................

.............

* Includes Paid F amily Leave am ount.

BOX 1. STATE DISABILITY INSURANCE OVERPAYMENTS (Must be completed for credit to be allowed.)

1. Was the credit claimed in column 3 withheld from the wages of employee(s)? ............................................................... Yes No

If yes, has this amount been refunded to employee(s)? ................................................................................................. Yes No

If not refunded: employee(s) no longer employed, unable to locate.

NOTE: The EDD cannot refund these contributions to you unless you first refund the erroneous deducti ons to the employee(s ).

(List each employee name, Social Security Number, and amount of SDI not refunded.)

BOX 2. PERSONAL INCOME TAX OVERPAYMENTS (Must be completed for credit to be allowed. )

If you paid the Employment Development Departm ent (EDD) more than the amount of California PIT withheld from wages of employee(s),

you can adjust the amount reported by using this form. The EDD will allow credit adjustments prior to the issuance of Forms W-2. I f yo u

have already issued Forms W-2, please read the additional information on page 2 before proceeding.

1. Was the credit claimed in column 3 withheld from the pay of employee(s)? ................................................................... Yes No

If yes, has this credit been refunded to employee(s)? .................................................................................................... Yes No

2. Was the credit claimed in column 3 included on Forms W-2 issued to employee(s)? Yes No

Be sure to sign this declaration: I declare that the information herein is true and correct to the best of my knowledge and belief.

Signature Title Phone ( ) Date

(Owner, Accountant, Preparer, etc.)

SIGN AND MAIL T O: Employment Development Department / P.O. Box 989073 / West Sacramento, CA 95798-9073

STATUTE OF LIMITATIONS

A claim for refund or credit must

be filed within three years of the

last tim ely filing date of th e q u arter

being adjusted.

Select:

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

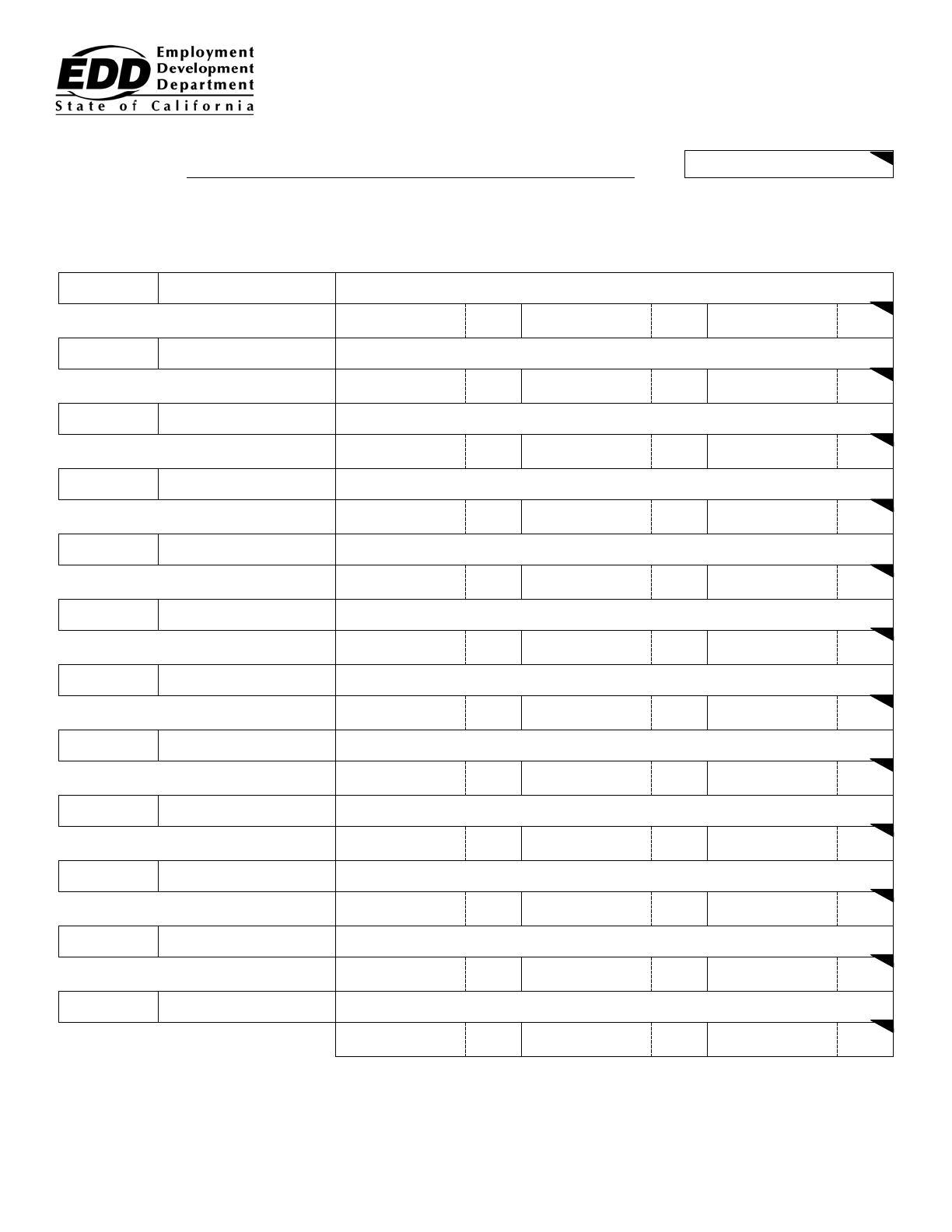

DE 9ADJ Rev. 3 (7-13) (INTERNET) Page 2 of 2

QU ARTER L Y CO NT R IBU TIO N AND WAGE ADJUSTMENT FORM

EMPLOYER ACCOUNT NO.

BUSINESS NAME

SECTION III: QUARTERLY W AGE AND WITHHOLDING ADJUSTMENTS

Enter amounts that should have been reported; if unchan ged, leave field blank. Correcting the Social Security Number o r Name

requires two entries. See Instructions for Completing the Quarterly Contribution and Wage Adjustment Form (DE 9ADJ-I),

Section III, for additional information and instructions.

YEAR / QUARTER

SOCIAL SECURITY NUMB ER

EMPLOYEE NAME (FIRST, MIDDLE INITIAL, LAST)

TOTAL SUBJECT WAGES

PIT WAGES

PIT WITHHELD

YEAR / QUARTER

SOCIAL SECURITY NUMB ER

EMPLOYEE NAME (FIRST, MIDDLE INITI AL, LAST)

TOTAL SUBJECT WAGES

PIT WAGES

PIT WITHHELD

YEAR / QUARTER

SOCIAL SECURITY NUMB ER

EMPLOYEE NAME (FIRST, MIDDLE INITIAL, LAST)

TOTAL SUBJECT WAGES

PIT WAGES

PIT WITHHELD

YEAR / QUARTER

SOCIAL SECURITY NUMB ER

EMPLOYEE NAME (FIRST, MIDDLE INITI AL, LAST)

TOTAL SUBJECT WAGES

PIT WAGES

PIT WITHHELD

YEAR / QUARTER

SOCIAL SECURITY NUMB ER

EMPLOYEE NAME (FIRST, MIDDLE INITI AL, LAST)

TOTAL SUBJECT WAGES

PIT WAGES

PIT WITHHELD

YEAR / QUARTER

SOCIAL SECURITY NUMB ER

EMPLOYEE NAME (FIRST, MIDDLE INITI AL, LAST)

TOTAL SUBJECT WAGES

PIT WAGES

PIT WITHHELD

YEAR / QUARTER

SOCIAL SECURITY NUMBER

EMPLOYEE NAME (FIRST, MIDDLE INITI AL, LAST)

TOTAL SUBJECT WAGES

PIT WAGES

PIT WITHHELD

YEAR / QUARTER

SOCIAL SECURITY NUMB ER

EMPLOYEE NAME (FIRST, MIDDLE INITI AL, LAST)

TOTAL SUBJECT WAGES

PIT WAGES

PIT WITHHELD

YEAR / QUARTER

SOCIAL SECURITY NUMBER

EMPLOYEE NAME (FIRST, MIDDLE INITI AL, LAST)

TOTAL SUBJECT WAGES

PIT WAGES

PIT WITHHELD

YEAR / QUARTER

SOCIAL SECURITY NUMB ER

EMPLOYEE NAME (FIRST, MIDDLE INITI AL, LAST)

TOTAL SUBJECT WAGES

PIT WAGES

PIT WITHHELD

YEAR / QUARTER

SOCIAL SECURITY NUMB ER

EMPLOYEE NAME (FIRST, MIDDLE INITI AL, LAST)

TOTAL SUBJECT WAGES

PIT WAGES

PIT WITHHELD

YEAR / QUARTER

SOCIAL SECURITY NUMB ER

EMPLOYEE NAME (FIRST, MIDDLE INITI AL, LAST)

TOTAL SUBJECT WAGES

PIT WAGES

PIT WITHHELD