Fillable Printable Release Of Buyer Request Form (De 2220R)

Fillable Printable Release Of Buyer Request Form (De 2220R)

Release Of Buyer Request Form (De 2220R)

DE 2220R Rev. 7 (6-17) (INTERNET) Page 1 of 3 CU

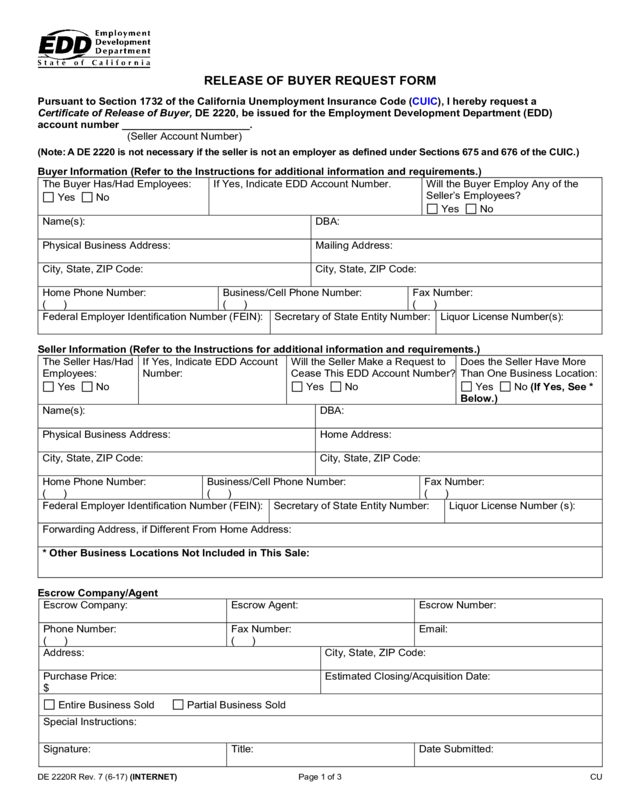

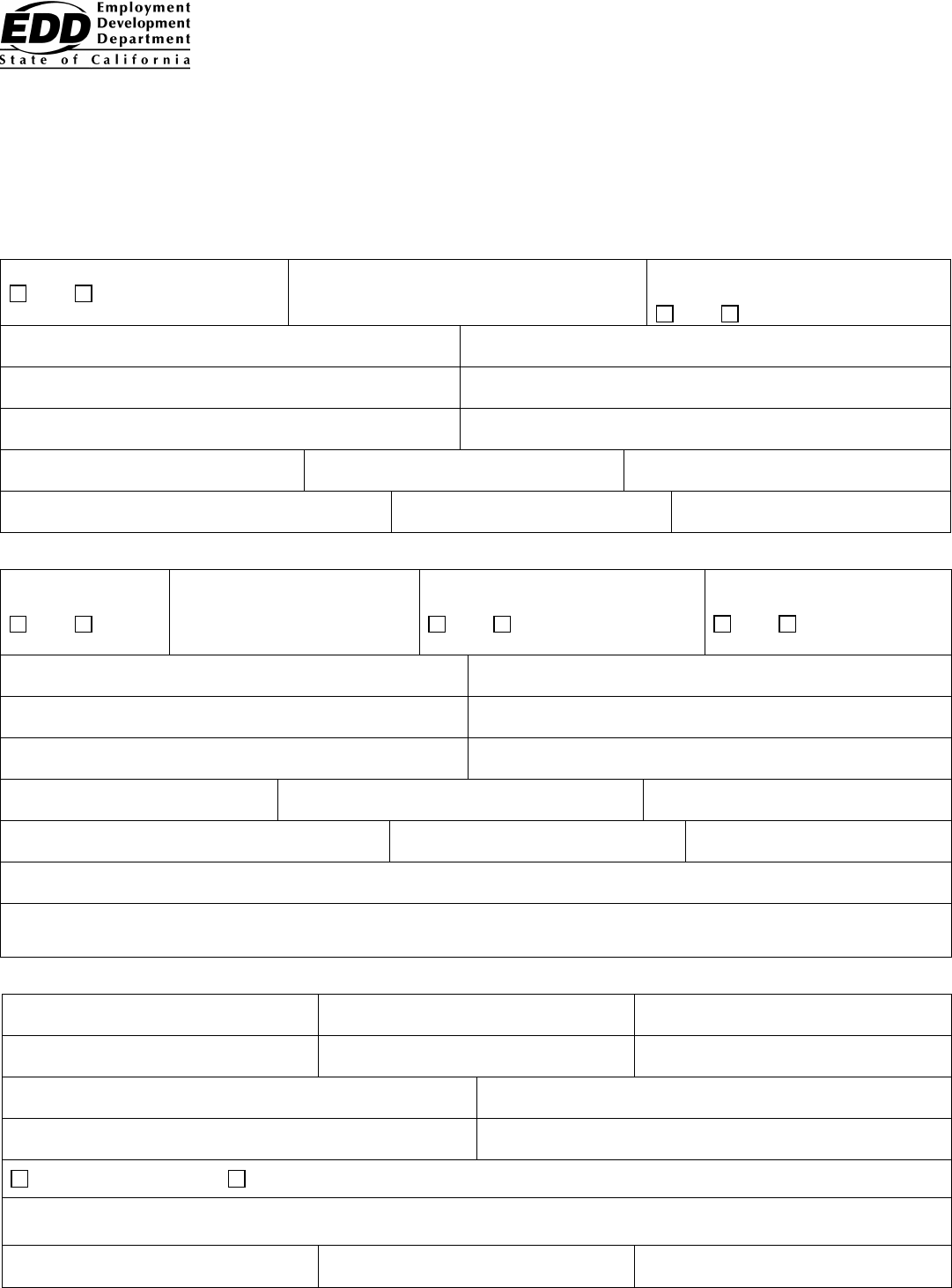

RELEASE OF BUYER REQUEST FORM

Pursuant to Section 1732 of the California Unemployment Insurance Code (CUIC), I hereby request a

Certificate of Release of Buyer, DE 2220, be issued for the Employment Development Department (EDD)

account number ______________________.

(

Seller Account Number)

(Note: A DE 2220 is not necessary if the seller is not an employer as defined under Sections 675 and 676 of the CUIC.)

Buyer Information (Refer to the Instructions for additional information and requirements.)

The Buyer Has/Had Employees:

Yes No

If Yes, Indicate EDD Account Number.

Will the Buyer Employ Any of the

Seller’s Employees?

Yes No

Name(s):

DBA:

Physical Business Address:

Mailing Address:

City, State, ZIP Code:

City, State, ZIP Code:

Home Phone Number:

( )

Business/Cell Phone Number:

( )

Fax Number:

( )

Federal Employer Identification Number (FEIN):

Secretary of State Entity Number:

Liquor License Number(s):

Seller Information (Refer to the Instructions for additional information and requirements.)

The Seller Has/Had

Employees:

Yes No

If Yes, Indicate EDD Account

Number:

Will the Seller Make a Request to

Cease This EDD Account Number?

Yes No

Does the Seller Have More

Than One Business Location:

Yes No (If Yes, See *

Below.)

Name(s):

DBA:

Physical Business Address:

Home Address:

City, State, ZIP Code:

City, State, ZIP Code:

Home Phone Number:

( )

Business/Cell Phone Number:

( )

Fax Number:

( )

Federal Employer Identification Number (FEIN):

Secretary of State Entity Number:

Liquor License Number (s):

Forwarding Address, if Different From Home Address:

* Other Business Locations Not Included in This Sale:

Escrow Company/Agent

Escrow Company:

Escrow Agent:

Escrow Number:

Phone Number:

( )

Fax Number:

( )

Email:

Address:

City, State, ZIP Code:

Purchase Price:

$

Estimated Closing/Acquisition Date:

Entire Business Sold Partial Business Sold

Special Instructions:

Signature:

Title:

Date Submitted:

DE 2220R Rev. 7 (6-17) (INTERNET) Page 2 of 3

INSTRUCTIONS FOR COMPLETING THE RELEASE OF BUYER REQUEST FORM, DE 2220R

PURPOSE: To provide information required to process a Certificate of Release of Buyer, DE 2220, request pursuant to

Sections 1731 and 1732 of the California Unemployment Insurance Code (CUIC).

Buyer Information:

•

Indicate if the buyer currently has or previously had an Employment Development Department (EDD) account number and

if the buyer will employ any

of the former owner’s employees. The buyer is required to complete the Commercial Employer

Account Registration and Update Form, DE 1, to either register as an employer and obtain an EDD employer account

number or report the purchase of the business. You may also access the online application by going to the e-Services for

Business website: www.edd.ca.gov/e-Services_for_Business.

• N

ame: Enter buyer(s) name.

• Doing Business As (DBA): Current business name of buyer (if applicable).

• Addresses: Where buyer can be reached.

• Phone and Fax Numbers: Numbers to contact buyer for additional information.

• FEIN: Federal Employer Identification Number.

• Entity Number Issued by the Secretary of State: Corporations/Limited Liability Companies/Limited Partnerships must

be

authorized to do business in the State of California by the Secretary of State.

• Liquor License Number(s) issued by Alcoholic Beverage Control (ABC).

Seller Information:

•

Indicate if the seller currently has or previously

had an EDD account number. If "Yes" is indicated, then indicate if a request

to cease the account will be made. The seller is required to complete the Commercial Employer Account Registration and

Update Form, DE 1, form to report the sale of the business. You may also access the online application and make any

changes to an existing EDD employer account number by going to the e-Services for Business website at

www.edd.ca.gov/e-Services_for_Business. If the EDD employer account number will no longer be used, the seller should

request to close the account. The seller is required to file all final returns and pay amounts owed to the EDD within 10 days

of quitting business.

• I

ndicate if the seller has more than one business location. If yes, list other business names and locations not included in t

he

s

ale under “Other Business Locations.”

• Name: Enter seller(s) name.

• Doing Business As (DBA): Name of business being sold.

• Addresses: Physical location of business in escrow and mailing address of seller.

• Phone and Fax Numbers: Numbers to contact seller for additional information.

• FEIN: Federal Employer Identification Number.

• Entity Number Issued by the Secretary of State: Corporations/Limited Liability Companies/Limited Partnerships must

be

aut

horized to do business in the State of California by the Secretary of State.

•

Liquor License Number: Available on the Alcoholic Beverage Control website at www.abc.ca.gov.

• For

warding Address: Where to contact seller after sale of business (if different from current home address).

• Other Business Locations: Provide a complete list of businesses operated by this seller, including DBA’s.

(Attach additional sheets if needed.)

Escrow Company/Agent:

Self-explanatory

Section 1731 o

f the CUIC states:

“Any person or employing unit that acquires the organization, trade or business, or substantially all the assets thereof, of an

employer shall withhold in trust money or other property sufficient in amount or value to cover the amount of any contributions,

interest and penalties due or unpaid from such employer until such employer produces a certificate from the department stating

that no contributions, interest or penalties are due. If such employer does not produce such certificate, the acquiring person or

employing unit shall pay the amount or the value of the property so withheld to the department at the time of such acquisition.”

Section 1732(a) of the CUIC states:

“Upon request of either of the parties to an acquisition as described in Section 1731, the department shall within 30 days issue a

certificate, or a statement showing the amount of any contributions, interest and penalties claimed to be due. The failure to issue

a certificate or a statement within the period of 30 days shall be deemed equivalent to the issuance of a certificate stating that no

contributions, interest or penalties are due.”

Section 1732(b) of the CUIC states:

“If the department issues a statement showing the amount of contributions, interest and penalties claimed to be due, the amount

stated therein shall be withheld and paid to the department such amount, however, not to exceed the purchase price. The

issuance of any certificate stating that no contributions, interest and penalties are due, or the failure to issue such certificate or

statement within the period of 30 days shall not release the employer from liability on account of any contributions, interest and

penalties then or thereafter determined to be due from him, but shall release the acquiring person or employing unit from any

further liability on account of any such contributions, interest and penalties.”

DE 2220R Rev. 7 (6-17) (INTERNET) Page 3 of 3

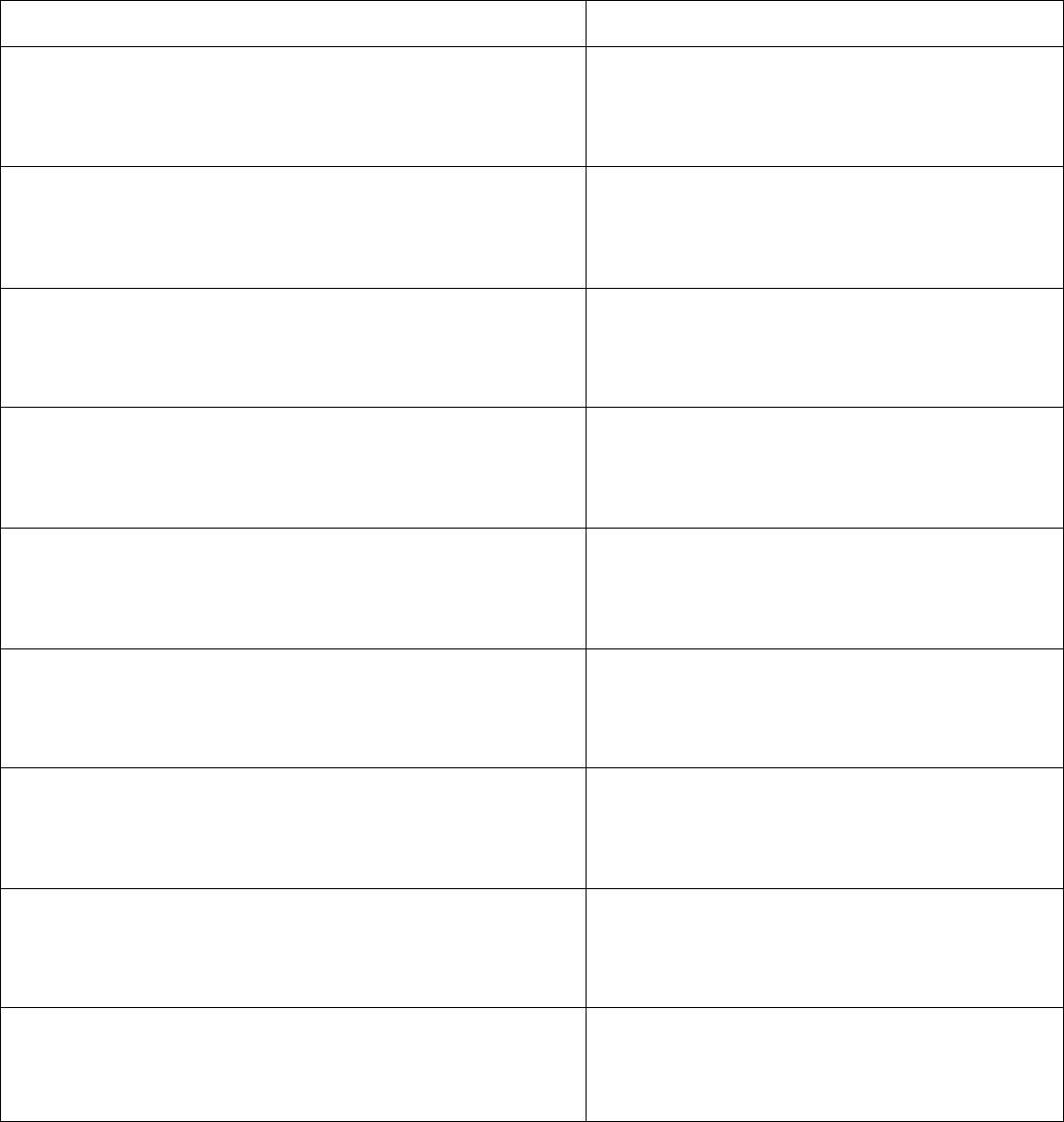

FAILURE TO PROVIDE COMPLETE INFORMATION MAY RESULT IN DELAYED PROCESSING TIME.

Fax the completed Release of Buyer Request Form, DE 2220R, to the EDD Employment Tax Office

based on the county in which the business being sold is located.

County in Which Business Being Sold Is Located

Fax Completed DE 2220R to:

Orange

City of Long Beach

Anaheim Employment Tax Office

2099 S. State College Blvd., Ste. 401

Anaheim, CA 92806

714-935-2920

Fax: 714-935-2930

Calaveras, Fresno, Inyo, Kern, Kings, Madera, Mariposa, Mono,

Merced, San Joaquin, Stanislaus, Tulare, and Tuolumne

Bakersfield Employment Tax Office

1800 30

th

St., Ste. 240

Bakersfield, CA 93301

661-335-7308

Fax: 661-395-2647

Alameda, Contra Costa, Lake, Marin, Napa, San Francisco,

San Mateo, Solano, and Sonoma

Oakland Employment Tax Office

7677 Oakport St., Ste. 400

Oakland, CA 94621

510-877-4851

Fax: 916-319-1910

Alpine, Amador, Butte, Colusa, Del Norte, El Dorado, Glenn,

Humboldt, Lake, Lassen, Mendocino, Modoc, Nevada, Placer,

Plumas, Sacramento, Shasta, Sierra, Siskiyou, Solano, Sonoma,

Sutter, Tehama, Trinity, Yolo, and Yuba

Redding Employment Tax Office

1325 Pine St.

Redding, CA 96001

530-225-2208

Fax: 530-225-2209

Riverside, San Bernardino

San Bernardino Employment Tax Office

658 E. Brier Dr., Ste. 300

San Bernardino, CA 92408

909-708-8899

Fax: 909-890-0536

Imperial, San Diego

San Diego Employment Tax Office

10636 Scripps Summit Ct., Ste. 202

San Diego, CA 92131

858-880-2500

Fax: 858-635-3751

Monterey, San Benito, Santa Clara, and Santa Cruz

San Jose Employment Tax Office

906 Ruff Dr.

San Jose, CA 95110

408-277-9435

Fax: 408-277-9453

Los Angeles

Santa Fe Springs Employment Tax Office

10330 Pioneer Blvd., Ste.150

Santa Fe Springs, CA 90670

562-903-4017

Fax: 562-903-4095

San Fernando Valley, San Luis Obispo, Santa Barbara, and

Ventura

Van Nuys Employment Tax Office

6150 Van Nuys Blvd., Rm. 210

Van Nuys, CA 91401-3384

818-901-5160

Fax: 818-901-5605