Fillable Printable Report New Employees And Independent Contractors To The Edd (De 542B)

Fillable Printable Report New Employees And Independent Contractors To The Edd (De 542B)

Report New Employees And Independent Contractors To The Edd (De 542B)

Why do

I have

to report?

The federal New

Employee Registry

(NER) program, part

of the welfare reform

legislation, requires

employers to report newly-

hired or rehired employees to

the Employment Development

Department (EDD). The California

Legislature expanded the reporting to

require businesses and government

entities to report the independent

contractors they hire.

What’s the benefit?

The information you provide to the EDD is

cross-matched against a list of parents who are

delinquent in their child support obligations.

Child support agencies are then able to locate these

parents to establish a payment order or enforce an existing order.

The EDD is an equal opportunity employer/

program. Auxiliary aids and services are available

upon request to individuals with disabilities.

Requests for services, aids, and/or alternate

formats need to be made by calling

888-745-3886 (voice) or TTY 800-547-9565.

DE 542B Rev. 10 (8-16) (INTERNET) Page 1 of 2 CU/GA 855

State of California

Labor and Workforce

Development Agency

Employment Development

Department

Businesses and

government entities

are required to

report new employees

and independent

contractors to the

Employment

Development

Department.

REPORT NEW

EMPLOYEES AND

INDEPENDENT

CONTRACTORS

TO THE EDD

PROVIDE SUPPORT

FOR CALIFORNIA

CHILDREN

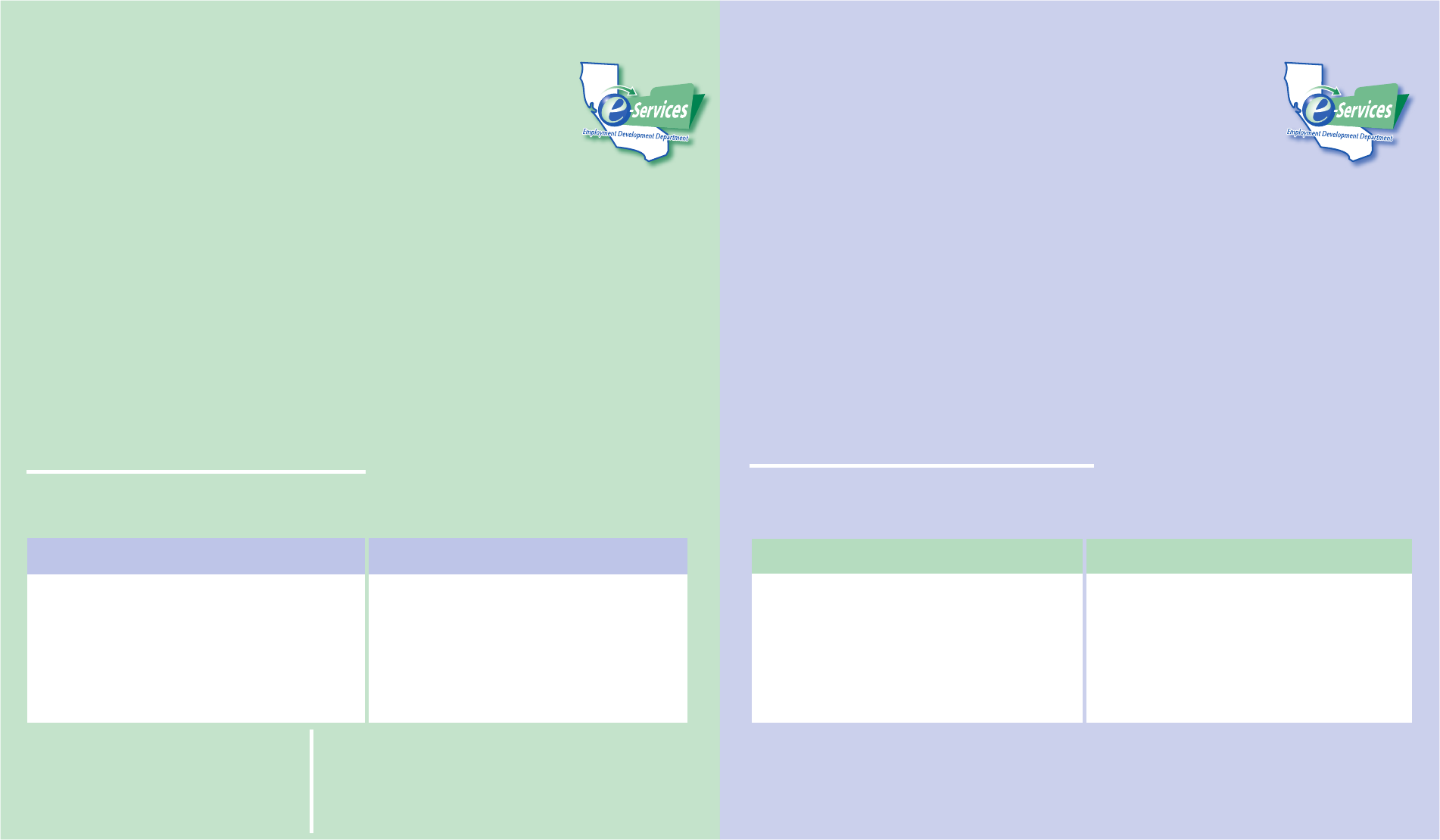

TO OBTAIN FORMS

WHO MUST REPORT

Any business or government entity required to

file a Form 1099-MISC for services performed

by an independent contractor.

WHO TO REPORT

An individual (independent contractor) who

receives compensation for work performed

or who enters into a contract for services for

which a federal Form 1099-MISC will be filed.

WHEN TO REPORT

Within 20 days of EITHER making payments

totaling $600 or more OR entering into a

contract for $600 or more with an independent

contractor in any calendar year, whichever

is earlier.

WHAT TO REPORT

You are required to provide the following information:

FOR ADDITIONAL INFORMATION

General Inquiries: 916-657-0529

WHO MUST REPORT

All employers and government entities.

Multistate employers who report new

employees electronically may select

one state to report.

WHO TO REPORT

All newly hired or rehired employees. Rehired

employees are those who left your employment

and you rehired them after a separation of at

least 60 consecutive days.

WHEN TO REPORT

Within 20 days of the newly hired or rehired

employee’s start-of-work date.

NON-REPORTING PENALTIES

A $24 penalty may be assessed for each failure

to report or $490 if the failure is intentional

between the employer and employee.

WHAT TO REPORT

You are required to provide the following

information:

HOW TO REPORT

File online using any of the

options available with the EDD

e-Services for Business. Visit our web page at

www.edd.ca.gov/e-Services_for_Business to

choose the option best for you, or

File a Report of New Employee(s), DE 34, or

File a copy of the employee’s Form W-4 (be

sure to include your employer payroll tax

account number and the date the employee

started working for you).

WHERE TO REPORT

File online at

www.edd.ca.gov/e-Services_for_Business

OR

Mail forms to:

Employment Development Department

PO Box 997016, MIC 96

West Sacramento, CA 95799-7016

OR

Fax forms to: 916-319-4400

HOW TO REPORT

File online using any of the

options available with the EDD

e-Services for Business. Visit our web page at

www.edd.ca.gov/e-Services_for_Business to

choose the option best for you, or

File a Report of Independent Contractor(s),

DE 542.

WHERE TO REPORT

File online at

www.edd.ca.gov/e-Services_for_Business

OR

Mail forms to:

Employment Development Department

PO Box 997350, MIC 96

Sacramento, CA 95899-7350

OR

Fax forms to: 916-319-4410

INDEPENDENT CONTRACTOR

First name, middle initial, and last name

Social Security number

Address

Start date of contract

Amount of contract (including cents)

Contract expiration date

Ongoing contract (check box, if applicable)

BUSINESS OR GOVERNMENT ENTITY

Federal employer identification number

(FEIN), EDD employer payroll tax account

number, and/or Social Security number

Business name

Address

Phone number

Contact person

Websites:

EDD

–

www.edd.ca.gov

EDD e-Services for Business –

www.edd.ca.gov/e-Services_for_Business

ICR

–

www.edd.ca.gov/Payroll_Taxes/Independent_Contractor_Reporting.htm

NER

– www.edd.ca.gov/Payroll_Taxes/New_Hire_Reporting.htm

FSET

–

www.edd.ca.gov/Payroll_Taxes/Bulk_Transmissions.htm

Forms are available on the EDD website at www.edd.ca.gov or call the Taxpayer

Assistance Center at 888-745-3886. For TTY (nonverbal) access, call 800-547-9565.

EMPLOYER OR GOVERNMENT ENTITY

EDD employer payroll tax account number

Federal employer identification number

(FEIN)

Business name

Address

Phone number

Contact person

NEW EMPLOYEE

First name, middle initial, and last name

Social Security number

Address

Start-of-work-date

DE 542B Rev. 10 (8-16) (INTERNET) Page 2 of 2

B

u

s

i

n

e

s

s

B

u

s

i

n

e

s

s

NEW EMPLOYEE REGISTRY

(NER)

INDEPENDENT CONTRACTOR

REPORTING (ICR)