Fillable Printable Reporting Wage Plan Codes On Electronic Quarterly Wage Reports (De 231Wpc)

Fillable Printable Reporting Wage Plan Codes On Electronic Quarterly Wage Reports (De 231Wpc)

Reporting Wage Plan Codes On Electronic Quarterly Wage Reports (De 231Wpc)

REPORTING WAGE PLAN CODES ON ELECTRONIC QUARTERLY WAGE REPORTS

DE 231WPC Rev. 1 (2-17) (INTERNET) Page 1 of 3 CU

Wage plan codes are letter indicators used by the Employment

Development Department (EDD) automated data systems to

determine whether the total subject wages reported for an

employee can be used for Unemployment Insurance (UI) and/

or Disability Insurance (DI)* benefit claims.

Employers are required to include a wage plan code along with

the Social Security number (SSN), last name, first name, middle

initial, total subject wages, Personal Income Tax (PIT) wages,

and PIT withholdings for each employee when submitting one

of the following EDD forms electronically:

• Quarterly Contribution Return and Report of Wages

(Continuation), DE 9C.

• Employer of Household Worker(s) Quarterly Report of

Wages and Withholdings, DE 3BHW.

• Quarterly Wage and Withholding Report, DE 6 (2010 4th

quarter and prior).

HOW TO DETERMINE THE WAGE PLAN CODES FOR

YOUR ACCOUNT

The valid wage plan codes for each employment payroll tax

account are correlated to the UI, DI, and/or PIT reporting on

the account. Employers can use the Employer Account and

Wage Plan Code Correlation Table on page 2 to determine

which wage plan codes are valid for their account/employees.

The Plan Code Descriptions Table on page 3 includes a

description of each of the individual plan codes.

WAGE PLAN CODES ON WAGE REPORTS SUBMITTED

THROUGH E-SERVICES FOR BUSINESS

The valid wage plan code(s) for each employment payroll

tax account are available when you complete a wage report

directly on your account through e-Services for Business. If

multiple wage plan codes are valid for the account, the wage

plan code field will include a drop-down box to allow you to

select the appropriate wage plan code for the employee.

PAPER WAGE REPORTS

Employers do not report wage plan codes when filing a paper

DE 9C, DE 3BHW, or DE 6. The EDD determines the correct

wage plan code for the employees based on:

• The subject funds for the account.

• Whether the wage report is marked as “Sole Shareholder/

Religious/Third-Party Sick Pay.”

• Whether Box B of the wage report is marked (for Voluntary

Plan for Disability Insurance employers).

CORRECTING WAGE PLAN CODES

Reporting the incorrect wage plan code could cause employee

benefits to be delayed or denied. However, it may not be

necessary to submit a Quarterly Contribution and Wage

Adjustment Form, DE 9ADJ, or a Quarterly Contribution Form

for Voluntary Plan Disability Employers, DE 938, if a wage plan

code was reported incorrectly on a previously filed wage report.

*Includes Paid Family Leave (PFL)

Please refer to the Employer Account and Wage Plan Code

Correlation Table on page 2 for scenarios that require a wage

plan code correction.

In general, the following rules apply regarding wage plan codes:

• If there is only one valid wage plan code for the account,

the EDD will change any invalid wage plan code to the

correct plan code for the account. You do not need to

submit an adjustment form to correct wage plan codes on

previously filed wage reports. However, please ensure that

the wage plan code is reported correctly on future wage

reports.

• If there are multiple valid wage plan codes for the

account (refer to the scenarios on the Employer Account

and Wage Plan Code Correlation Table on page 2),

complete an adjustment form as follows:

On a Paper DE 9ADJ or DE 938:

○ Section I: Complete all fields in this section. Include

a detailed reason in the “Reason for Adjustment” field

that includes the original and corrected wage plan

codes and the number of wage lines that need to be

corrected. If all wage plan codes need to be corrected,

indicate that you are correcting wage plan codes for

all employees from [the original wage plan code]

to [the corrected wage plan code]. You do not need

to complete Section III if all employees need to be

corrected.

○ Section II: Complete fields only if a correction is

needed to the tax return.

○ Section III: If not all wage plan codes need to be

corrected, enter the wage lines for employees

who need a wage plan code correction separately

from other adjustments. Write or type “Adjust Plan

Codes from [the original wage plan code] to [the

corrected wage plan code]” at the top of the page(s).

If additional adjustments are needed, report them on

separate page(s).

Through the e-Services for Business Website:

○ Access the wage report online.

○ Select the “Adjust” hyperlink to access the

adjustment form.

○ Select the “Edit Wages” hyperlink and enter the

employee wage lines that need to be corrected. Be

sure to select the correct wage plan code. Do not

report any adjustments other than wage plan code

corrections on the request (remove wage lines that

do not need a wage plan code correction).

○ Enter the Amended Grand Totals for the quarter.

○ Enter a detailed note indicating the reason for the

adjustment and that the wage plan code on the

reported wage line needs to be corrected from [the

original wage plan code] to [the corrected wage

plan code].

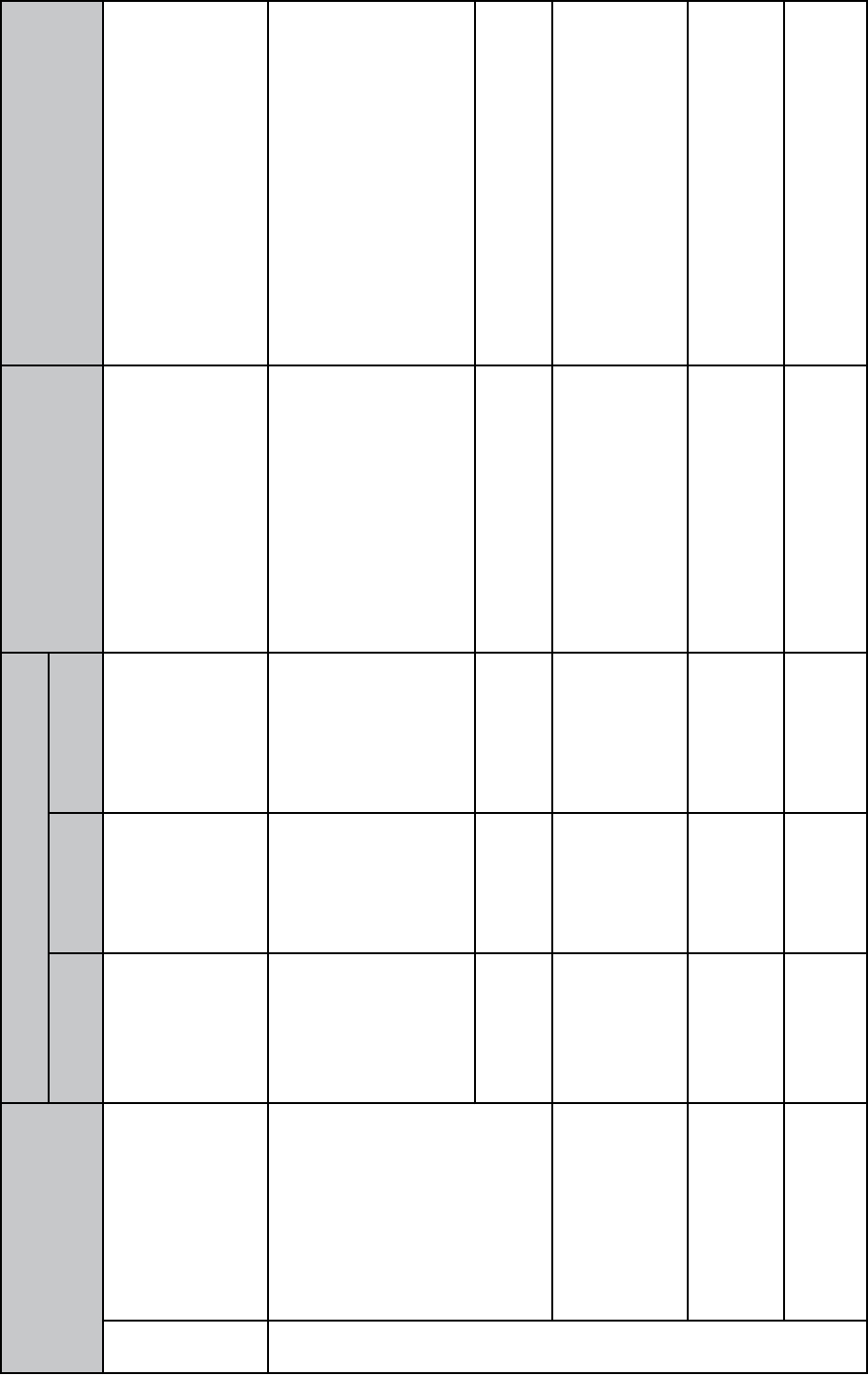

EMPLOYER ACCOUNT AND WAGE PLAN CODE CORRELATION TABLE

Use the table below to determine which wage plan codes are valid for the account. The Plan Code Descriptions Table on page 3 includes a description of each of the individual

plan codes.

Type

Employment Account Is Subject to the Following:

Valid Wage Plan Code(s)

for Account

When Plan Code Corrections

Are Needed (Scenarios)

Unemployment

Insurance (UI)

Disability

Insurance (DI)

Personal Income

Tax (PIT)

Most Employers

Accounts Subject

to UI and SDI

Tax-Rated

or

Reimbursable

State Disability

Insurance (SDI)

Subject,

Not Subject, or

PIT Optional

Use:

• R for employee(s) with a valid

SDI exclusion.

• S for employee(s) subject to UI

and SDI.

• S for employee(s) only subject

to PIT.

Submit a DE 9ADJ to correct the wage plan

code(s) only if:

• You reported R and it should be S.

• You reported S and it should be R.

• You reported A, J, L, P, or U and it should

be R.

Other Employer Types

Accounts Covered

Under a Voluntary Plan

for Disability Insurance

(VPDI)

(VPDI employers can have

employees covered under

VPDI and some covered

under SDI)

Tax-Rated

or

Reimbursable

VPDI

and

SDI

Subject,

Not Subject, or

PIT Optional

Use:

• R for employee(s) with a valid DI

exclusion.

• S for employee(s) covered under

UI and SDI.

• S for employee(s) only subject

to PIT.

• U for employees covered by UI

and VPDI.

Submit a DE 938 to correct the wage plan

code(s) only if:

• You reported U or R and it should be S.

• You reported R or S and it should be U.

• You reported A, J, L, or P and it should be

R.

Not Subject VPDI

Subject or

Not Subject

Use L for all employees

Do not file corrections to wage plan codes for

prior quarters. Be sure to report correct wage

plan codes on future quarters.

Accounts Not

Subject to UI

(Applies to domestic

employers who have

reported $750 to $999 and

some public entities)

Not Subject SDI

Subject,

Not Subject, or

PIT Optional

Use J for all employees

Do not file corrections to wage plan codes for

prior quarters. Be sure to report correct wage

plan codes on future quarters.

Accounts Not

Subject to DI

(Applies to some

public entities)

Tax-Rated

or

Reimbursable

Not Subject

Subject,

Not Subject, or

PIT Optional

Use A for all employees

Do not file corrections to wage plan codes for

prior quarters. Be sure to report correct wage

plan codes on future quarters.

Accounts Only

Subject to PIT

Not Subject Not Subject

Subject or

PIT Optional

Use P for all wage lines

Do not file corrections to wage plan codes for

prior quarters. Be sure to report correct wage

plan codes on future quarters.

DE 231WPC Rev. 1 (2-17) (INTERNET) Page 2 of 3 CU

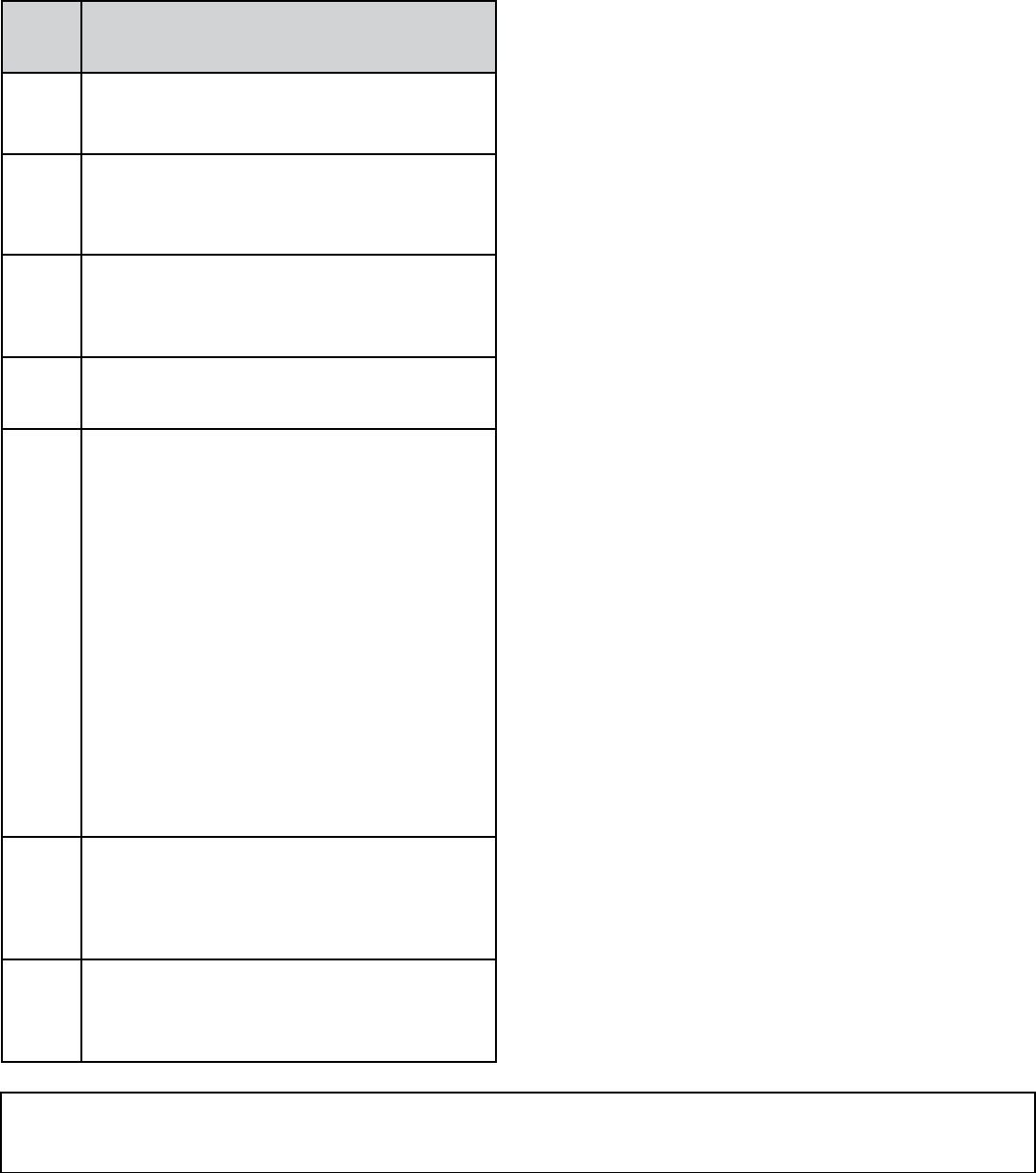

PLAN CODE DESCRIPTIONS TABLE

The table below includes the description of the individual wage

plan codes. Keep in mind that the wage plan code is correlated

to the subject funds on the employer’s EDD account. Refer to

the Employer Account and Wage Plan Code Correlation Table

on page 2 to determine if the wage plan code is valid for the

account.

Wage

Plan

Code

Description of Employee Benefit Coverage

and Use of Wage Plan Code

A

The employee’s total subject wages can only be used

for UI benefit purposes.

Used on accounts not covered by SDI or VPDI.

J

The employee’s total subject wages can only be used

for SDI benefit purposes.

Used on accounts not covered by a state Tax-Rated or

Reimbursable UI plan.

L

The employee’s total subject wages can only be used

for VPDI benefit purposes.

Used on VPDI accounts not covered by a state

Tax-Rated or Reimbursable UI plan.

P

The employee wages and/or withholdings are

reported under an account that is only subject for PIT

withholding purposes.

R

The employee’s total subject wages can only be used

for UI benefit purposes.

This wage plan code is only valid for employees with

one of the following DI exclusions when reported on

an account subject to UI and SDI or VPDI:

• Sole Shareholders who have filed a Sole

Shareholder/Corporate Officer Exclusion

Statement, DE 459, and have been approved

for a DI exclusion under Section 637.1 of the

California Unemployment Insurance Code

(CUIC).

• Third-Party Sick Pay recipients who claim an

exclusion under Section 931.5 of the CUIC.

• Religious employees who have filed a Religious

Exemption Certificate, DE 5067, and have been

approved for a Religious DI exclusion under

Section 2902 of the CUIC.

S

The employee’s total subject wages can be used for

SDI and UI benefit purposes.

Note: S can also be used for employees who are

only subject to PIT and are being reported under an

account that is subject to UI and SDI.

U

The employee’s total subject wages can be used for

VPDI and UI benefit purposes.

Used on VPDI accounts covered by a state Tax-Rated

or Reimbursable UI plan.

ADDITIONAL INFORMATION

Please refer to the Electronic Filing Guide for the Quarterly

Wage and Withholding Program, DE 8300, for additional

information regarding the reporting of employee wage

information on electronic wage reports.

If you need help determining the correct wage plan code

for your employee(s), please contact the Taxpayer Assistance

Center at 888-745-3886 or call the Tax and Wage Correction

Group at 916-654-9018.

The EDD is an equal opportunity employer/program. Auxiliary

aids and services are available upon request to individuals

with disabilities. Requests for services, aids, and/or alternate

formats need to be made by calling 888-745-3886 (voice) or

TTY 800-547-9565.

This information sheet is provided as a public service and is intended to provide nontechnical assistance. Every attempt has been made to provide

information that is consistent with the appropriate statutes, rules, and administrative and court decisions. Any information that is inconsistent with

the law, regulations, and administrative and court decisions is not binding on either the Employment Development Department or the taxpayer.

Any information provided is not intended to be legal, accounting, tax, investment, or other professional advice.

DE 231WPC Rev. 1 (2-17) (INTERNET) Page 3 of 3 CU