Fillable Printable Request for Proposal - Chicago

Fillable Printable Request for Proposal - Chicago

Request for Proposal - Chicago

Strategic Planning Request for Proposal

The National Community Tax Coalition is seeks an experienced consultant to conduct and

organizational assessment and strategic planning process to carry NCTC through the next

several years of adaptation, leadership, and impact. The consultant will work closely with a

NCTC strategic planning working group to include the President of the organization, select

members of staff and select members of the board of directors.

ORGANIZATION OVERVIEW

The National Community Tax Coalition (NCTC) started as a project in 2002, under the Center for Economic

Progress, and we transitioned to a separate independent Illinois nonprofit organization on October 1, 2013.

NCTC is comprised of a seven member board of directors and currently has 15 full‐time staff members. As an

organization, NCTC works to create a more accessible and equitable tax system for American workers. NCTC is

an organization dedicated to strengthening economies, building communities and improving lives through tax

assistance and asset building activities that produce financial security, protect families, and promote economic

justice.

Our network of organizations provides critical, on‐the‐ground financial services for working families. NCTC

represents the 57,000 community Volunteer Income Tax Assistance (VITA) sites nationwide that collectively

prepare an estimated 1.8 million tax returns for low‐ and moderate‐income workers. Community tax preparers

offer a high‐quality choice – one that’s trusted, accessible, and equipped to help families claim their full refund

and all the credits to which they are entitled.

NCTC actively seeks to broaden the reach and impact of community tax preparers and is a

leading voice in Washington, D.C. for low‐wage workers against unfair financial practices. NCTC

recognizes that together, we can strengthen economies, build communities and improve life for

all American families.

NCTC DIVISIONS

Infrastructure. This area of the organization encompasses information technology, member

services, fundraising, marketing and communications, governance, and administrative

services.

Community Building. This division covers what NCTC calls practice. Under this division the

team provides technical assistance and training opportunities to the broader community

VITA field covering a range of initiatives including tax preparation, asset building, and

college access & success.

Policy, Advocacy & Research: This division of the agency focuses on civic engagement,

mobilizing and activating members, administrative and legislative policy efforts, and original

research. Core areas of interest in this division includes preserving federal funding for the

VITA Grant; protecting tax credits for working families which includes, but is not limited to

the Earned Income Tax Credit and Child Tax Credit; consumer protections; and savings

policy.

PROJECT DESCRIPTION

The overarching objective is to assist the National Community Tax Coalition in creating a

comprehensive three‐year strategic plan that will position NCTC to confront key questions,

challenges and opportunities facing the agency. Some crucial aspects include, but are not

limited to:

Describe NCTC’s operating environment and current conditions which will require an

assessment of current initiatives policy and program initiatives available, the agency

business model, and stakeholder feedback.

Outline NCTC’s organizational objectives in all functional areas that will assist NCTC in

moving to the next phase of its organizational life cycle. Addressing what services and how

these services are employed to make the greatest impact in the most efficient manner.

Illustrate how we can adapt NCTC to a rapidly changing landscape in all areas of the

organization (community building, policy and advocacy, and infrastructure).

Clarify NCTCs strengths and how the organization can strategically apply its strengths to

achieve its objectives and desired impact.

Articulate strategies to enhance NCTC’s fiscal health and resilience.

SCOPE OF WORK

It is anticipated that the key areas of work will entail, but, may not be limited to the following:

Conduct a strategic assessment of all key area of the organization, including NCTC

infrastructure, Community Building, and Policy & Advocacy divisions.

Conduct an environmental scan, to include, but may not be limited to research, interviews

with mix of board members, staff, donors, partners, volunteers, policy makers, and

stakeholders and thought‐leaders in the community tax preparation and asset building field,

Design and implement facilitated strategic planning meetings for the board (March 2014),

staff, and key stakeholders to discuss the key questions.

In consultation with NCTC leadership, the consultant will write a three‐year strategic plan

document for NCTC, for review and approval by the Board of Directors (June 2014).

AWARD DETAILS

The maximum award amount for this contract will be $20,000.

SUBMISSION DETAILS

If interested, please submit one electronic copy of a proposal in response to this RFP. Limit

submission to 10 pages (excluding list of contacts, resumes, and budget), no less than 11pt font

size will be accepted. The proposal should include the following information:

Cover letter

Name and contact information of the name(s) of participating consultant(s) with

accompanying resumes;

Statement of qualifications to undertake this initiative;

Summary of similar work conducted, highlighting specific accomplishments;

A narrative description of the proposed process, activities and approach;

Complete timeline;

Fee and budget. Proposals involving components should provide unit costs;

Three to five business references of other local, regional, or national nonprofits with which

you have performed a similar services.

Submit proposals electronically by 5:00PM Central, Friday, January 24, 2014 to:

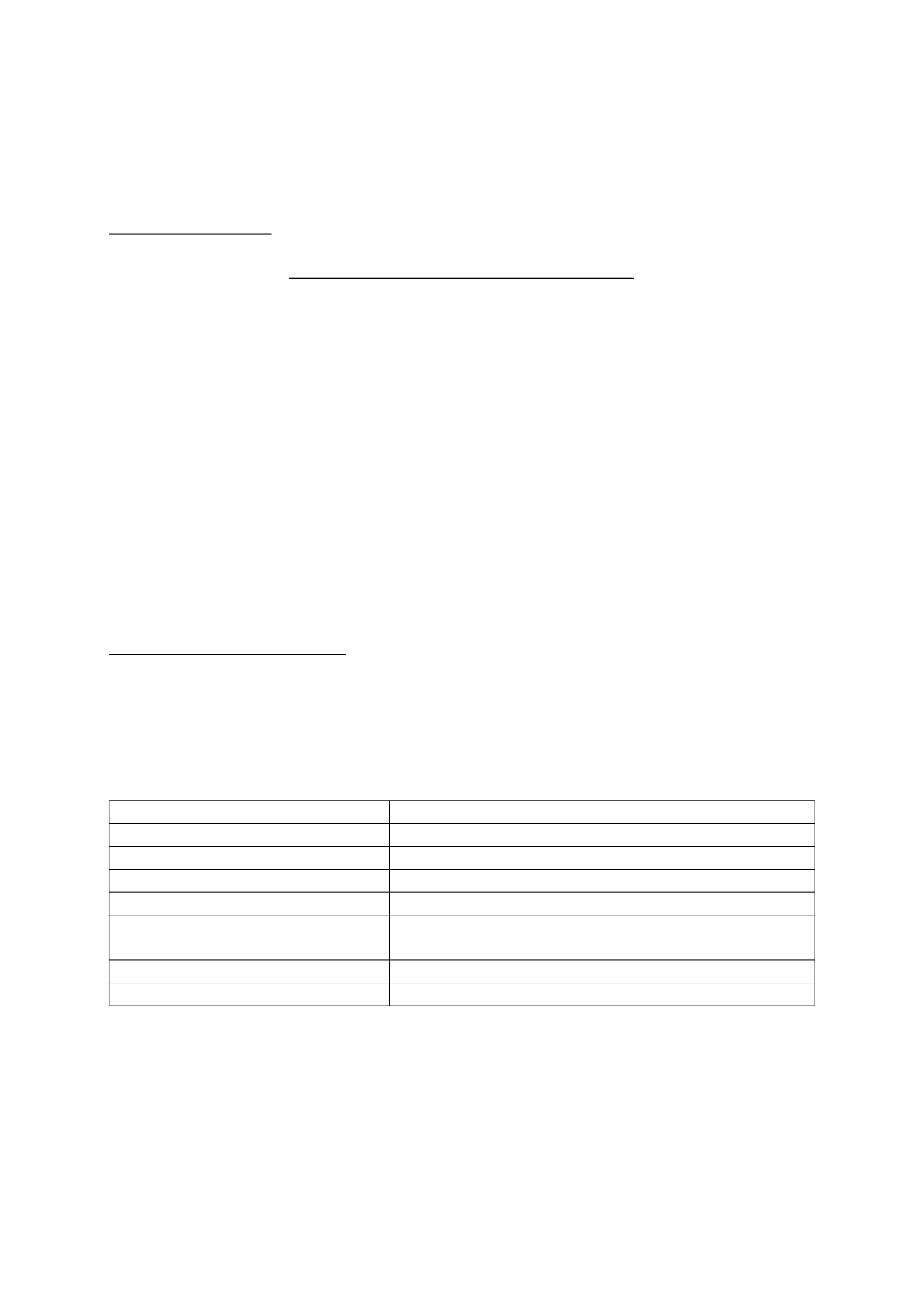

DUE DATES AND NOTIFICATION

Applications for this opportunity will be accepted until 5:00PM Central, Friday, January 24,

2014. Notification of selected consultant will be informed no later than February 14, 2014.

Notification will be submitted electronically to the selected consultant. After award, a meeting

will be scheduled to develop the final details of the contract, so that work can commence by or

before February 20, 2014.

Action Date

Proposals Due 5:00PM Central, Friday, January 24, 2014

Panelists review proposals Tuesday, January 28, 2014 – Monday, February 3, 2014

Notification to finalists Wednesday, February 5, 2014

Finalists Interviews February 10, 2014 – February 12, 2014

Final Consultant selected and

notified

Friday, February 14, 2014

Consultant contract awarded Thursday, February 20, 2014

Project Begins Thursday, February 20, 2014

Lanetta Williams, Business Support Associate at lwilliams@tax‐coalition.org