Fillable Printable Sample Donation Receipts

Fillable Printable Sample Donation Receipts

Sample Donation Receipts

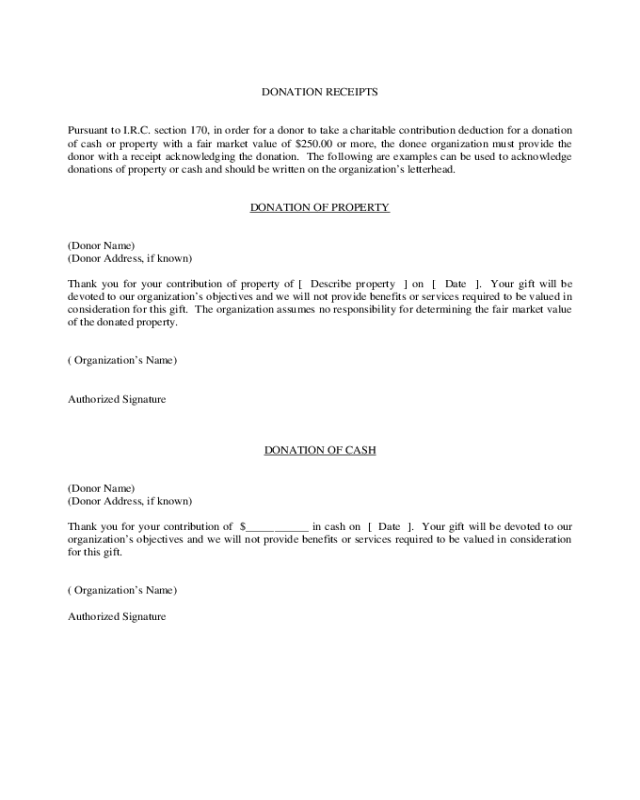

DONATION RECEIPTS

Pursuant to I.R.C. section 170, in order for a donor to take a charitable contribution deduction for a donation

of cash or property with a fair market value of $250.00 or more, the donee organization must provide the

donor with a receipt acknowledging the donation. The following are examples can be used to acknowledge

donations of property or cash and should be written on the organization’s letterhead.

DONATION OF PROPERTY

(Donor Name)

(Donor Address, if known)

Thank you for your contribution of property of [ Describe property ] on [ Date ]. Your gift will be

devoted to our organization’s objectives and we will not provide benefits or services required to be valued in

consideration for this gift. The organization assumes no responsibility for determining the fair market value

of the donated property.

( Organization’s Name)

Authorized Signature

DONATION OF CASH

(Donor Name)

(Donor Address, if known)

Thank you for your contribution of $___________ in cash on [ Date ]. Your gift will be devoted to our

organization’s objectives and we will not provide benefits or services required to be valued in consideration

for this gift.

( Organization’s Name)

Authorized Signature

For donations of property, (non-cash), it is the donor’s responsibility to determine fair market value of the

property donated. The organization is not required to estimate or to make any determination of fair market

value of the property donated. The organization is only responsible for acknowledging the receipt of the

donated property. For donations of property with a fair market value of $5,000.00 or more the organization

is required to acknowledge receipt of the donation by signing Part IV of Form 8283, Non-cash Charitable

Contributions (copy attached). This acknowledgement does not represent any acquiesce as to the fair market

value of the donated property, only an acknowledgement of its receipt from the donor.

In general, if with two years of receiving donated property with a fair market value of more than $5000, an

organization sells, exchanges or otherwise disposes of the donated property, the organization is required to

file Form 8282, Donee Information Return, with the Internal Revenue Service. Since the organization is not

responsible for determining the fair market value of donated property when received from the donor, for the

purposes of determining whether to file Form 8282, a reasonable valuation of the donated property is

advised. If the organization anticipates selling or disposing of the donated property within two years, it is

advisable to obtain the donor’s taxpayer identification number at the time the property is received in order to

complete Form 8282.

For the purposes of acknowledging the receipt of property donations, the term “property” does

not include

services (I.R.C. section 1.170A-1(g)). As a general rule, for a “donation” to be considered a charitable

contribution, the donated property must have some cost basis in the hands of the donor. Donations such as

coupons for services or discounts on services or goods have no such cost basis in the hands of the donor and

therefore do not qualify as a charitable contribution and should not be acknowledged as such (Rev. Rul. 79-

431, 1979-2 CB 108).

There may be instances where the organization may provide some benefit to the donor for a donation of cash

or property. For example, suppose the organization auctions two tickets to a football game, each with a face

value of $10, total value of $20. In this example the tickets are auctioned for $100 each, a total auction price

of $200. The charitable donation for the donor is $180 ($200 less $20). If the organization provides a

benefit to a donor as part of the receipt of more than $75 of value in cash or property from the donor, the

organization should provide a receipt letter as follows.

BENEFITS PROVIDED (PAYMENT OF $75.01 OR MORE)

(Donor Name)

(Donor Address, if known)

Thank you for your contribution of $___________ in cash and/or [ Describe Property ] on [ Date ].

We estimate the fair market value of the benefits we provided to you consideration for this donation was

$___________. We are a I.R.C. section 501(c)(3) organization and you may claim a donation deduction for

the difference between the cash and/or property given to the organization and the value of the benefits you

received. The organization assumes no responsibility for determining the fair market value of the donated

property.

( Organization’s Name)

Authorized Signature

CHARITABLE BENEFITS (TICKET PRICE $75.01 OR MORE)

(Donor Name)

(Donor Address, if known)

Thank you for your purchase of benefit tickets for $__________ in cash on [ Date]. We estimate the fair

market value of the meal and/or entertainment furnished in connection with the event was $_______ per

person (ticket). We are a 501(c)(3) organization and therefore you may claim a donation deduction for the

difference between the cash you paid and the value of the benefits or $_________.

(Organization Name)

AUCTION PURCHASE RECEIPT

(Purchaser's Name)

(Purchaser's Address, if known)

Thank you for your purchase of auction item #_______ (description) for $________ in cash on [ Date ]. We

estimate the fair market value of this item is $_________. We are a 501(c)(3) organization and therefore you

may claim a donation deduction for the difference between the cash you paid less the value of the item, or

$________.

(Organization Name)

This is a general and brief explanation of the responsibilities and requirements of an organization that

receives contributions of property or cash and is not intended to cover all the requirements of the Internal

Revenue Code and its regulations.