Fillable Printable Sample Foreign Banks and Financial Accounts Report Form

Fillable Printable Sample Foreign Banks and Financial Accounts Report Form

Sample Foreign Banks and Financial Accounts Report Form

JUDA KALLUS, EA 80 EIGHTH AVE #900 • NEW YORK, NY 10011-5126 • TEL 212.727.9811 • FAX 212.727.9812 ©05.2013 JUDA KALLUS/MARYANN NICHOLS

Foreign Banks and Financial Accounts

Until recently, the IRS was lax in enforcing the foreign bank account reporting (FBAR) requirement.

However, in recent years the IRS has increased its publicity and enforcement of these rules while

gradually increasing ling and reporting requirements.

Currently all tax lers must indicate on their tax returns if they have a foreign bank or nancial account, no

matter how small it is. If you own or have an interest in or signatory authority over foreign nancial

accounts, then you should be aware of the FBAR [Foreign Bank Account Report] requirements.

FBAR Form TD F 90-22.1 must be led by U.S. Persons (citizens, residents and certain other persons)

if the person has an interest in, or signatory authority over a foreign nancial account, and the

aggregate value of these accounts exceeds $10,000, at any time, during the calendar year. This report

MUST BE RECEIVED BY THE US TREASURY BY JUNE 30TH EACH YEAR AND THERE ARE NO EXTENSIONS!

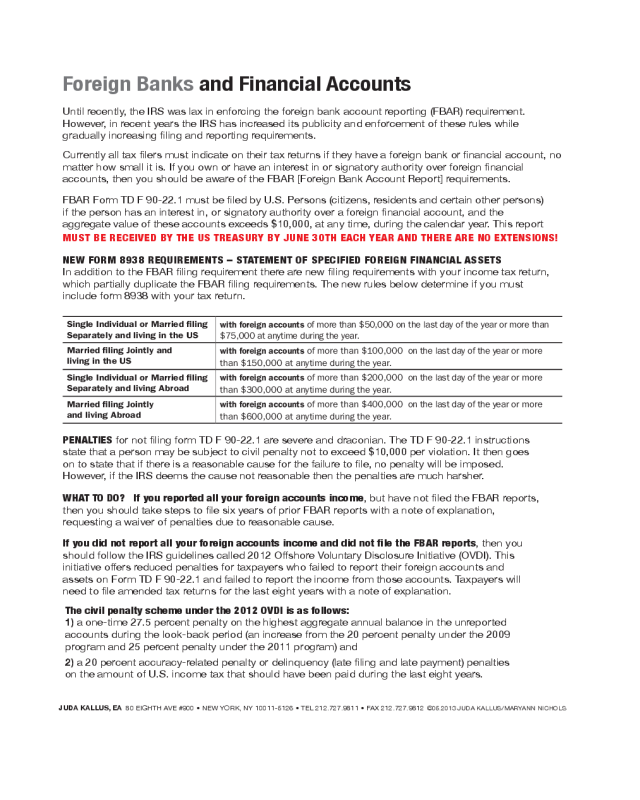

NEW FORM 8938 REQUIREMENTS – STATEMENT OF SPECIFIED FOREIGN FINANCIAL ASSETS

In addition to the FBAR ling requirement there are new ling requirements with your income tax return,

which partially duplicate the FBAR ling requirements. The new rules below determine if you must

include form 8938 with your tax return.

PENALTIES

for not ling form TD F 90-22.1 are severe and draconian. The TD F 90-22.1 instructions

state that a person may be subject to civil penalty not to exceed $10,000 per violation. It then goes

on to state that if there is a reasonable cause for the failure to le, no penalty will be imposed.

However, if the IRS deems the cause not reasonable then the penalties are much harsher.

WHAT TO DO? If you reported all your foreign accounts income

, but have not led the FBAR reports,

then you should take steps to le six years of prior FBAR reports with a note of explanation,

requesting a waiver of penalties due to reasonable cause.

If you did not report all your foreign accounts income and did not le the FBAR reports

, then you

should follow the IRS guidelines called 2012 Offshore Voluntary Disclosure Initiative (OVDI). This

initiative offers reduced penalties for taxpayers who failed to report their foreign accounts and

assets on Form TD F 90-22.1 and failed to report the income from those accounts. Taxpayers will

need to le amended tax returns for the last eight years with a note of explanation.

The civil penalty scheme under the 2012 OVDI is as follows:

1) a one-time 27.5 percent penalty on the highest aggregate annual balance in the unreported

accounts during the look-back period (an increase from the 20 percent penalty under the 2009

program and 25 percent penalty under the 2011 program) and

2) a 20 percent accuracy-related penalty or delinquency (late ling and late payment) penalties

on the amount of U.S. income tax that should have been paid during the last eight years.

Single Individual or Married filing

Separately and living in the US

with foreign accounts

of more than $50,000 on the last day of the year or more than

$75,000 at anytime during the year.

Married filing Jointly and

living in the US

with foreign accounts

of more than $100,000 on the last day of the year or more

than $150,000 at anytime during the year.

Single Individual or Married filing

Separately and living Abroad

with foreign accounts

of more than $200,000 on the last day of the year or more

than $300,000 at anytime during the year.

Married filing Jointly

and living Abroad

with foreign accounts

of more than $400,000 on the last day of the year or more

than $600,000 at anytime during the year.