Fillable Printable Sample Sales Tax Receipt Instructions - Colorado

Fillable Printable Sample Sales Tax Receipt Instructions - Colorado

Sample Sales Tax Receipt Instructions - Colorado

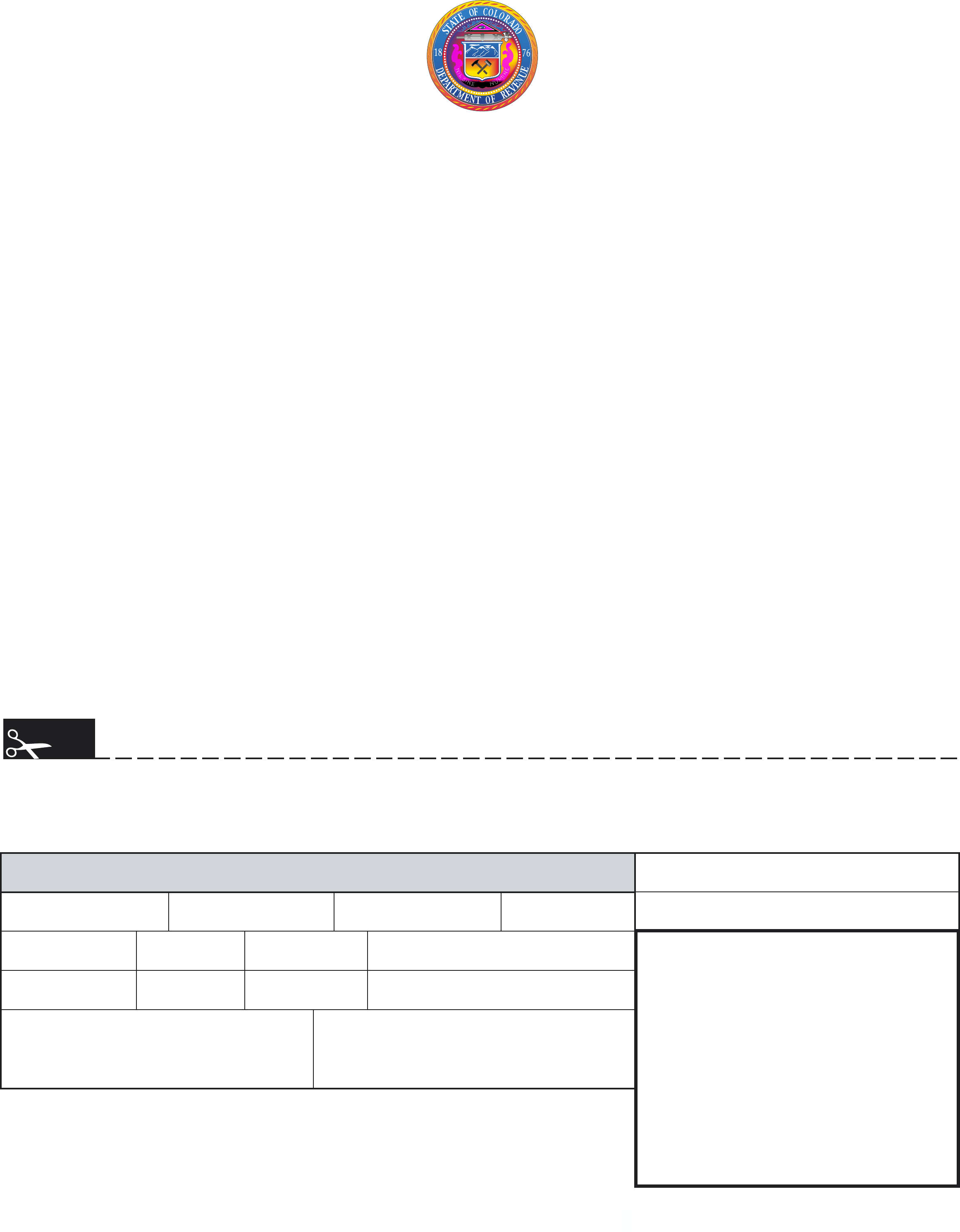

STANDARD SALES TAX RECEIPT

Gross Selling Price

Gross Amount of Trade-in (if any) Net Selling Price Date of Sale

$ $ $

Model (year) Make Body Type Identification Number

Trade-In Model (year) Trade-In Make Trade-In Body Type Trade-In Identification Number

Name of Purchaser Address

This receipt is issued pursuant to the provisions of Article 26, Title 39, CRS as amended, and regulations promulgated by

the Executive Director of the Department of Revenue.

This is to certify that the undersigned dealer (holding the sales tax account number listed at the right) has sold the following

described vehicle to the hereinafter named purchaser and has collected and will remit the applicable Sales Tax on said sale.

THIS RECEIPT MUST BE PRESENTED TO THE COUNTY CLERK

BEFORE TITLE AND/OR REGISTRATION CAN BE ISSUED.

Dealer ___________________________________________________________ By _______________________

Address _____________________________________________________________________________________

Dealer # _____________________________________ Dealer Invoice # __________________________________

For motor vehicles, trailers, semi-trailers, mobile homes,

movable structures, mobile machinery, self-propelled construction equipment or salvage vehicles.

DR 0024WEB (03/14/05)

COLORADO DEPARTMENT OF REVENUE

DENVER CO 80261-0013

(303) 238-SERV (7378)

Colorado Tax Account #

City Tax Account # (if applicable)

Sales Tax Collected by Dealer

State 2.9 %$_____________________

RTD/CD/FD

or Special District _____

%$_____________________

City of ______________________________________________

______ % $ _____________________

County of ____________________________________________

______ % $ _____________________

Total Tax Collected $ __________________________________

(Amount to be remitted to state on DR 0100)

You must retain a copy of this receipt for your records.

STANDARD SALES TAX RECEIPT

INSTRUCTIONS

This form is to be completed and used by Motor

Vehicle Dealers, Mobile Home Dealers,

Manufac-

tured Housing Dealers, and SMM Dealers ONLY

.

This form is not to be used by the general

public. After the dealer completes the form, it is

sent along with the paperwork to the county clerk

for registration and titling of property.

SPECIAL DISTRICT TAXES

Special district taxes include the Regional Trans-

portation District (RTD), the Scientific and Cultural

Facilities District (CD), and the Metropolitan Foot-

ball Stadium District (FD). For a complete listing of

city and county sales taxes and all special district

taxes and tax rates see the DRP 1002 "Colorado

Sales/Use Tax Rates" or visit our Sales Tax Infor-

mation site. For additional information on local sales

tax, please refer to FYI, Sales 62 "Guidelines for

Determining When to Collect State-Collected Local

Sales Tax". If local use tax is due, send it directly to

the Motor Vehicle Department along with documents

to initiate titling and/or registration of the property.

NOTE TO DEALER

Statute 39-26-113 states that no registration or

certificate of title will be issued for the vehicle or

mobile home until any tax due on the transaction

has been paid. To be more in line with registration

and titling requirements and in order to perfect the

lien more quickly, please collect the local use tax.

DETACH FORM

ON THIS LINE