Fillable Printable Schedule Or-Asc

Fillable Printable Schedule Or-Asc

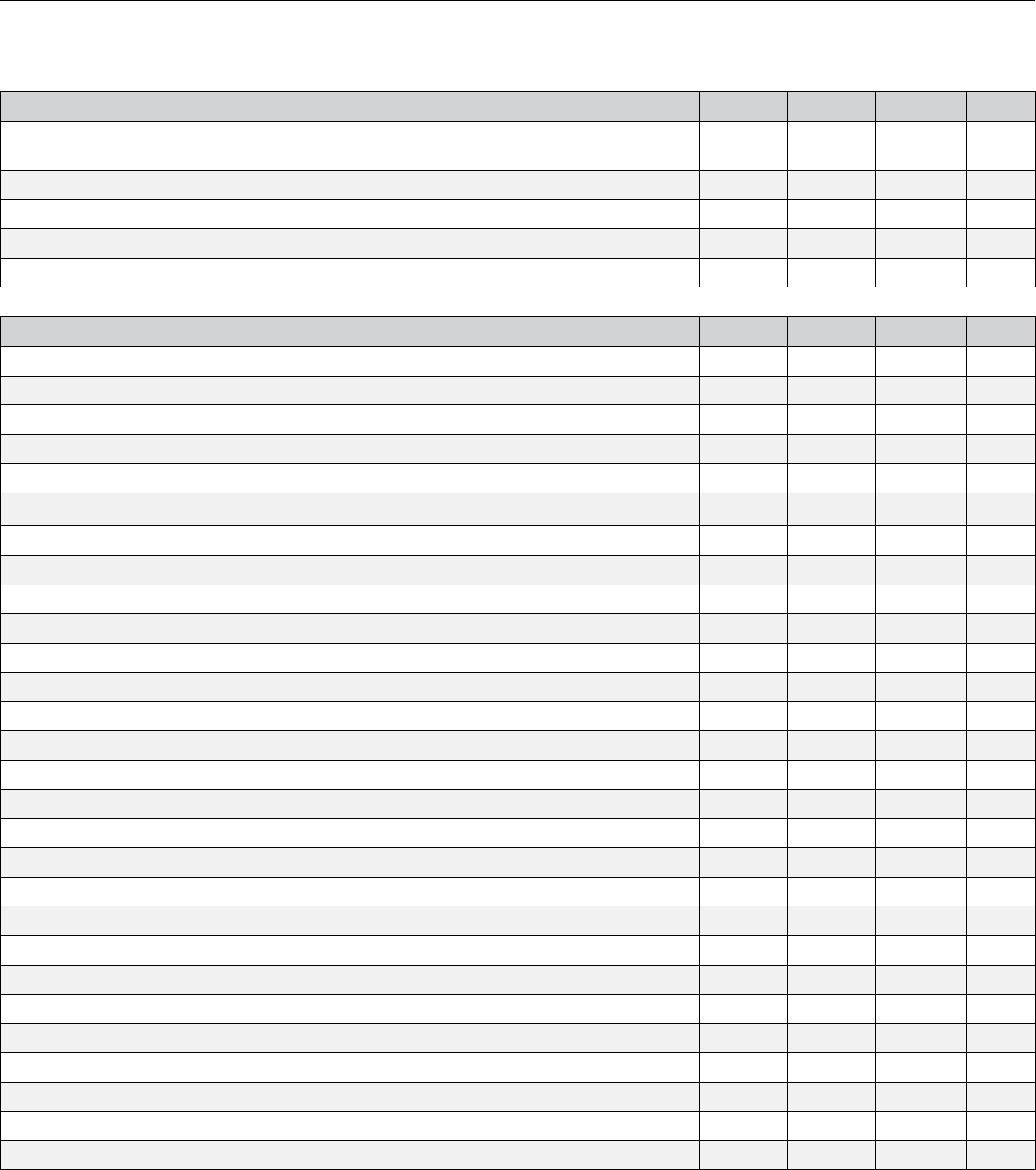

Schedule Or-Asc

First name and initial

Spouse’s first name and initial

Social Security number (SSN)

Spouse’s SSN

Last name

Spouse’s last name

Use Schedule OR-ASC to claim any of the following that aren’t included on Form OR-40:

• Additions. • Carryforward credits.

• Subtractions. • Refundable credits.

• Standard credits.

Identify the code you’re claiming and enter the information requested in the corresponding section.

For more information, refer to the instructions beginning on page 2.

Oregon Department of Revenue

15601601010000

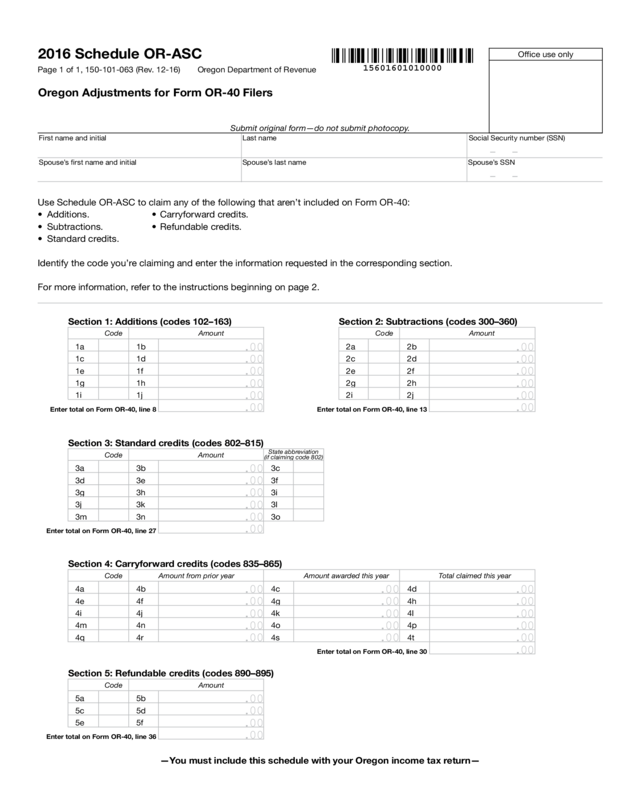

2016 Schedule OR-ASC

Oregon Adjustments for Form OR-40 Filers

Submit original form—do not submit photocopy.

Office use only

Page 1 of 1, 150-101-063 (Rev. 12-16)

—You must include this schedule with your Oregon income tax return—

Section 1: Additions (codes 102–163)

Section 5: Refundable credits (codes 890–895)

Section 2: Subtractions (codes 300–360)

Section 3: Standard credits (codes 802–815)

1a

5a

2a

3a

1c

5c

2c

3d

1e

5e

2e

3g

1g

1i

2g

2i

3j

3m

1b

5b

2b

3b 3c

3f

3i

3l

3o

1d

5d

2d

3e

1f

5f

2f

3h

1h

1j

2h

2j

3k

3n

Amount

Amount

Amount

Amount

State abbreviation

(if claiming code 802)

Code

Code

Code

Code

Enter total on Form OR-40, line 13

Enter total on Form OR-40, line 27

Enter total on Form OR-40, line 30

Enter total on Form OR-40, line 8

Enter total on Form OR-40, line 36

Section 4: Carryforward credits (codes 835–865)

4a

4e

4i

4m

4q

4b

4f

4j

4n

4r

4c 4d

4g 4h

4k 4l

4o

4s

4p

4t

Amount from prior year Amount awarded this year Total claimed this yearCode

–

–

–

–

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00 .00 .00

.00 .00 .00

.00 .00 .00

.00

.00

.00

.00

.00

.00

.00

Clear form

2

150-101-063 (Rev. 12-16)

New information

Forms and schedules. We have changed many of our forms

and schedules to provide a more consistent format and to

include a shorthand name so they’re easier to find. Please

read each form and publication carefully as other items

may have changed. For more information, visit us at www.

oregon.gov/dor.

Subtractions

• ABLE (Achieving a Better Life Experience) accounts.

Oregon now has a subtraction for contributions made to

an ABLE account for the benefit of a person with a dis-

ability. For more information about this subtraction, see

page 5.

• Marijuana business expenses. There is a new subtrac-

tion for certain business expenses incurred by licensed

sellers, distributors, and growers of marijuana in Oregon.

See Publication OR-17 for more information.

• Special Oregon medical subtraction. For tax year 2016,

you or your spouse must be age 64 or older on December

31, 2016 to qualify for the subtraction.

Credits

• Expired credits. The following credits expired as of Jan-

uary 1, 2016 and can’t be claimed on the 2016 tax return:

working family child care (WFC) credit; credit for the

elderly or disabled; the Individual Development Account

withdrawal credit; the credit for employer dependent

care assistance (carryforward still allowed); loss of use of

limbs; and the credit for low-income caregivers. The wolf

depredation credit is no longer available as the wolf was

taken off of the Endangered Species List in 2016.

• Working family household and dependent care

(WFHDC) credit. This refundable credit replaces the

child and dependent care credit and the working family

credit. For more information about the WFHDC credit,

see Schedule OR-WFHDC.

• Residential energy credit. The credit for installing resi-

dential alternative fuel devices has increased to 50 per-

cent of the cost or $750, whichever is smaller. See Publica-

t io n OR-17.

• Rural health practitioners credit. The rural medi-

cal credit qualifications have changed. See Publication

OR-17.

• Biomass production/collection credit. The amount

allowed for animal manure decreased per wet ton.

Contact the Oregon Department of Energy for more

information.

• University Venture Development Fund (UVDF). Begin-

ning with tax year 2016, the credit is 60 percent of the

contribution, limited to $600,000. The credit is claimed in

one year, with a three year carryforward.

• Individual Development Account contribution credit.

This credit is limited to $500,000 per year.

Form instructions

If you have more items than will fit on a single schedule,

provide the codes and amounts on additional schedules

and add the total to your tax return. Include all the sched-

ules with your Form OR-40.

If you are claiming multiple items (additions, subtractions,

or credits) with the same code, report the items together.

Enter the code only once and add the claimed amounts

together.

Round all cents to the nearest dollar. For example, $99.49

becomes $99.00, and $99.50 becomes $100.00.

Section 1: Additions (codes 102–163)

Additions are items the federal government doesn’t tax but

Oregon does. For detailed information regarding additions,

refer to Publication OR-17, at www.oregon.gov/dor/forms.

Did you limit itemized deductions on your federal return

because your federal adjusted gross income exceeded the

threshold amount? If so, you may need to complete a work-

sheet to determine the correct addition amount for item-

ized deduction add backs for Oregon credits. The itemized

deduction limit worksheet is available in Publication OR-17.

Step 1: Complete the table in Section 1 with the code and

amount reported for each addition. Each code

should only be listed once.

Step 2: Fill in the total of all additions. Enter this amount

on Form OR-40, line 8.

Section 2: Subtractions (codes 300–360)

Subtractions are items the federal government taxes but

Oregon doesn’t. See below for information regarding com-

monly claimed subtractions. For detailed information

regarding these and other subtractions, refer to Publication

OR-17.

Step 1: Complete the table in Section 2 with the code and

amount reported for each subtraction that isn’t

listed on the return. Each code should only be

listed once.

Step 2: Fill in the total of all subtractions. Enter this

amount on Form OR-40, line 13.

Federal pension income [code 307]. You may be able to sub-

tract some or all of your taxable federal pension included

in 2016 federal income. This includes benefits paid to the

retiree or the beneficiary. It does not include disability pay-

ments if you have not reached the minimum retirement age.

The subtraction amount is based on the number of months

Instructions for Schedule OR-ASC

2016

3

150-101-063 (Rev. 12-16)

of federal service or points earned before and after October

1, 1991:

• If all your months of federal service or points were

before October 1, 1991, subtract 100 percent of the tax-

able amount of federal pension income you reported on

your federal return.

• If you have no months of service or points before Octo-

ber 1, 1991, you cannot subtract any federal pension.

• If your service or points occur both before and after

October 1, 1991, subtract a percentage of the taxable

federal pension income you reported on your federal

return. To determine your percentage, divide the months

of service or points earned before October 1, 1991, by the

total months of service or points earned before Octo-

ber 1, 1991, by the total number of months of service or

points earned. Round to three places (example: 0.4576 =

45.8 percent). Once you determine the percentage, it will

remain the same year to year.

For more than one pension, figure the percentage and sub-

traction amount separately for each pension. Add the sepa-

rate amounts together to be reported on one line of Sched-

ule OR-ASC.

Federal pension subtraction formula:

Months of service or

points before 10/1/91

x

Federal pension

amount included in

federal income

=

Oregon

subtraction

Total months of

service or points

Federal education credits (tuition and fees deduction)

[code 308]. Did you claim the American Opportunity or

Lifetime Learning credit on your federal return? If so,

you were not allowed a federal tuition and fees deduction

because you claimed the federal credit. Because Oregon

does not have credits similar to the American Oppor-

tunity or Lifetime Learning credits, you can subtract the

federal tuition and fees deduction on your Oregon return

up to the amount you would have been allowed on your

federal return. You can claim the lesser of the federal limit

($4,000 or $2,000, depending on your income) or your actual

expenses. You can’t claim the deduction if:

• You file married filing separately;

• You can be claimed as a dependent by another person; or

• Your federal modified AGI is more than $80,000 ($160,000

if filing married filing jointly).

Oregon 529 College Savings Plan deposits [code 324].

You can subtract deposits made to an Oregon 529 College

Savings Plan. The combined total claimed under the

ABLE account deposits subtraction and the Oregon 529

College Savings Plan deposit subtraction cannot exceed

$4,620 for joint returns ($2,310 for all other returns). If you

contribute more than your limit, you can carry forward the

remaining contribution not subtracted over the next four

years. Rollovers from other 529 plans into an Oregon 529

plan are considered new contributions and qualify for the

subtraction as long as they were not previously included

in the subtraction. Keep a copy of your account statement

with your tax records. For more information, go to www.

oregoncollegesavings.com or call 1 (866) 772-8464.

Special Oregon medical subtraction [code 351]. If you or

your spouse were age 64 or older on December 31, 2016 and

have qualifying medical and/or dental expenses, you may

qualify for the special Oregon medical subtraction. See the

2016 IRS Publication 502 for types of qualifying medical

and dental expenses. You cannot subtract medical and den-

tal expenses:

• For anyone under age 64;

• For dependents, regardless of their age; or

• That have already been deducted on your return.

You may not claim a subtraction if your federal adjusted

gross income exceeds $200,000 ($100,000 for those who file

single or married filing separately). Use the worksheet on

page 4 to determine the amount of your subtraction.

Shared expenses. Did you have medical expenses or dental

expenses for more than one person? If so, you must deter-

mine which expenses belong to each qualifying taxpayer.

Start by totaling all expenses for each qualifying taxpayer.

If you have expenses that are for more than one person,

such as insurance premiums, split the expense by the most

reasonable method. For example, two qualifying taxpayers

filing jointly who paid $4,000 in insurance premiums dur-

ing the year would split the expenses in half, or $2,000 each.

For more information and examples on how to split shared

expenses, refer to Publication OR-17.

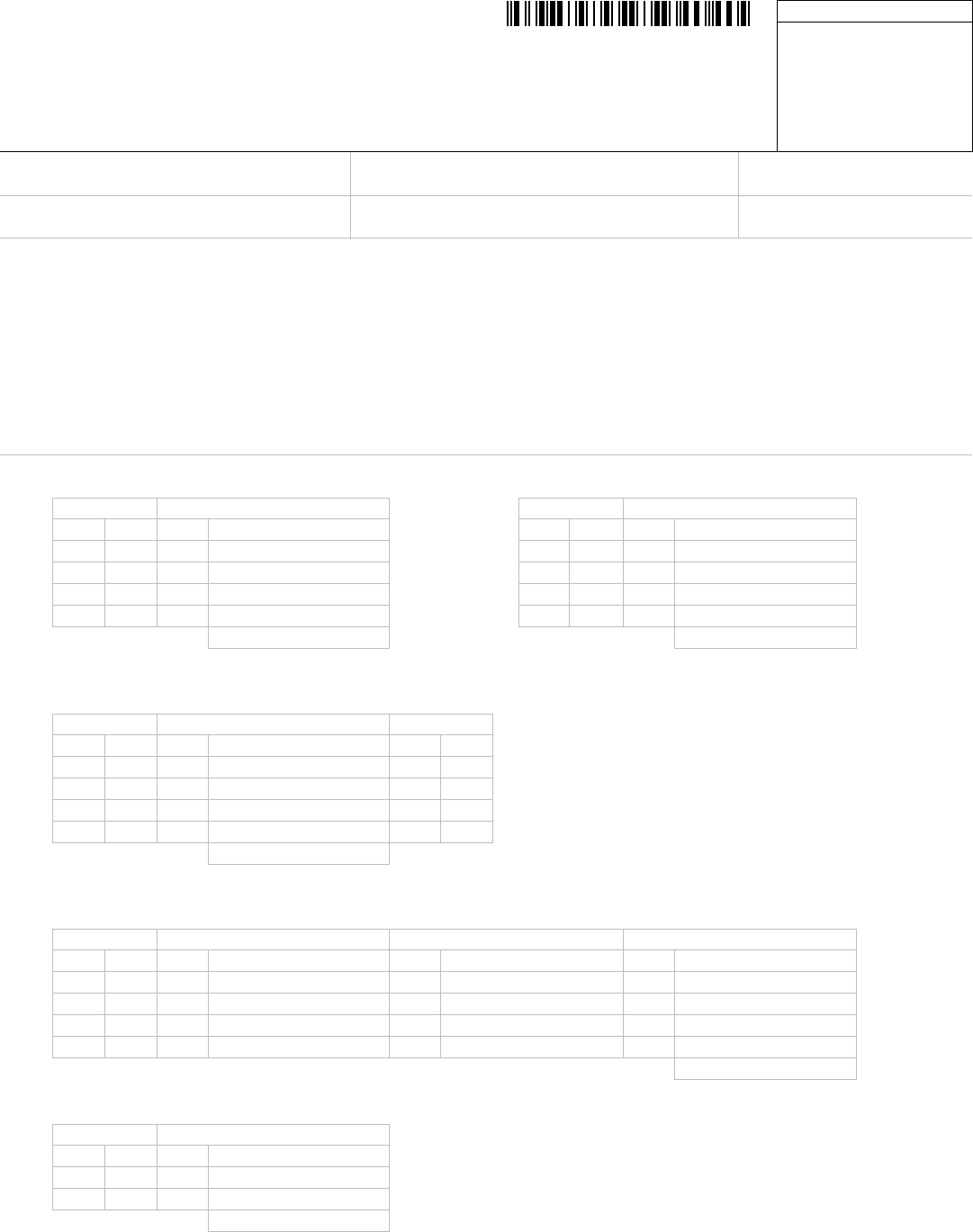

Special Oregon medical subtraction worksheet instructions

For worksheet lines 1 through 7, complete column A for

yourself first and then complete column B for your spouse

using the following instructions.

Line 1: Medical and dental expenses for each taxpayer—If

you were age 64 or older on December 31, 2016, enter your

total qualifying medical and dental expenses. See “Shared

expenses” above for information about splitting expenses,

such as insurance premiums. If your medical expenses

were not included in your itemized deductions (federal

Schedule A, line 1) or you didn’t itemize your deductions,

skip lines 2–4, enter the amount from line 1 on line 5, and

go to line 6. If you don’t have qualifying expenses or were

not age 64 or older on December 31, 2016—stop. You don’t

qualify for the subtraction based on your expenses or age.

Complete column B for your spouse to see if you can still

qualify for the subtraction based on their expenses or age.

Line 2: Total medical and dental expenses—Enter the

total medical and dental expenses claimed as an itemized

deduction (Schedule A, line 1).

Line 3: Divide line 1 by line 2 and round to three decimal

places. For example, 0.7308 is rounded to 0.731.

Line 4: Enter the lesser of the medical and dental expenses

claimed on line 1 of your Schedule A or the amount claimed

on line 3 of your Schedule A.

Line 5: Multiply line 3 and line 4 and round to whole dol-

lars. For example, $101.49 is rounded to $101.

4

150-101-063 (Rev. 12-16)

Line 6: Enter the maximum allowable medical subtraction

for your filing status and federal adjusted gross income

from the table. Don’t enter more than $1,800.

Line 7: Enter the lesser of line 5 or line 6.

Line 8: Add the amounts from line 7 column (A) and col-

umn (B). This is your special Oregon medical subtraction.

Enter this amount on the Schedule OR-ASC, section 2, using

code 351.

Special Oregon medical subtraction worksheet

Column (A)

You

Column (B)

Spouse

1. Medical and dental

expenses for each

qualifying taxpayer.

1. 1.

2. Total medical and

dental expenses

(Schedule A, line 1).

2. 2.

3. Divide line 1 by line

2 and round to three

decimal places.

3. 3.

4. Enter the lesser of

the expenses claimed

on line 1 of your

Schedule A, or the

amount on line 3 of

your Schedule A.

4. 4.

5. Multiply line 3 by

line 4 and round to

whole dollars.

5. 5.

6. Maximum allowable

medical subtraction

from the table.

6. 6.

7. Enter the lesser of

line 5 or line 6.

7. 7.

8. Add line 7, columns

(A) and (B), and enter

the total. This is

your special Oregon

medical subtraction.

8.

If your filing

status is:

And your

federal adjusted

gross income from

Form OR-40, line 7 is:

Then your

maximum

allowable

medical

subtraction

per taxpayer

meeting

the age

requirement

is:At least—

But less

than—

Married filing

jointly; or

Head of

household; or

Qualifying

widow(er)

-0- $50,000 $1,800

$50,000 $100,000 $1,400

$100,000 $200,001 $1,000

$200,001 or more -0-

Single; or

Married

filing separately

-0- $25,000 $1,800

$25,000 $50,000 $1,400

$50,000 $100,001 $1,000

$100,001 or more -0-

Example 1: Brennan and Maggie were ages 65 and 64 on

December 31, 2016. They are filing a joint return with a

federal adjusted gross income of $55,000 and are itemizing

deductions for Oregon. In 2016, they paid $5,700 in medical

expenses that they claimed on Schedule A. Of that, $3,500

was for Brennan’s expenses, $1,000 for Maggie’s expenses,

and $1,200 for Maggie’s mother who they claim as a depen-

dent. Both Brennan’s and Maggie’s expenses qualify for the

special Oregon medical subtraction. Since Maggie’s mother

is a dependent, her expenses don’t qualify for the subtrac-

tion. Brennan and Maggie would determine their subtrac-

tion as follows.

Special Oregon medical subtraction worksheet

Column (A)

Brennan

Column (B)

Maggie

1. Medical and dental

expenses for each

qualifying taxpayer.

1. $3,500 1. $1,000

2. Total medical and

dental expenses

(Schedule A, line 1).

2. $5,700 2. $5,700

3. Divide line 1 by line

2 and round to three

decimal places.

3. 0.614 3. 0.175

4. Enter the lesser of

the expenses claimed

on line 1 of your

Schedule A, or the

amount on line 3 of

your Schedule A.

4. $5,500 4. $5,500

5. Multiply line 3 by

line 4 and round to

whole dollars.

5. $3,377 5. $963

5

150-101-063 (Rev. 12-16)

6. Maximum allowable

medical subtraction

from the table.

6. $1,400 6. $1,400

7. Enter the lesser of

line 5 or line 6.

7. $1,4 0 0 7. $96 3

8. Add line 7, columns

(A) and (B), and enter

the total. This is

your special Oregon

medical subtraction.

8. $2,363

ABLE account deposits [code 360]. You can subtract con-

tributions made to an Oregon or contracting state’s ABLE

account. The combined total claimed under the Oregon

529 College Savings Plan deposit subtraction and the ABLE

account deposits subtraction cannot exceed $4,620 if you

file a joint return ($2,310 for all others). If you contribute

more than your limit, you can carry forward the remaining

contribution not subtracted over the next four years.

To qualify for the Oregon subtraction, contributions must

be made before the designated beneficiary turns 21 years

old. Rollovers qualify as a new contribution for purposes

of the subtraction; however, you can’t subtract any amount

rolled over from an Individual Development Account. If

you contribute more than your limit, you can carryforward

the remaining contribution not subtracted over the next

four years. Keep a copy of your account statement with your

tax records. For more information, visit the ABLE National

Resource Center’s website at www.ablenrc.org.

Section 3: Standard credits (codes 802–815)

Standard credits are nonrefundable credits that can only be

claimed on the current year’s tax return. Credit amounts

awarded and not used in the current tax year will be lost.

If you have both standard credits and carryforward cred-

its, standard credits are used first. For detailed information

regarding standard credits, refer to Publication OR-17.

Step 1: Complete the table in Section 3 with credits you’re

claiming that have a code between 802–815. Fill in

the code and the amount being claimed for each

standard credit. Each code should only be listed

once (unless you are claiming code 802 for credit

for taxes paid to another state, for multiple states.

These can be listed on separate lines).

Step 2: If you’re claiming a credit for income taxes paid

to another state on income that was also taxed by

Oregon, use code 802 and enter that state’s abbre-

viation in the corresponding box. If you aren’t

claiming this credit, leave this box blank.

Step 3: Fill in the total of all standard credits. Enter this

amount on Form OR-40, line 27.

Section 4: Carryforward credits (codes 835–865)

Carryforward credits are nonrefundable credits for which

any unused portion in the current tax year may be carried

forward to the following tax year. The number of years

that a credit can be carried forward varies according to the

carryforward rules of that credit. For detailed information

regarding carryforward credits, refer to Publication OR-17.

Step 1: Complete the table in section 4 for credits you’re

claiming that have a code between 835–865. Fill

in the carryforward codes in the order that you

would like to claim the credits (usually this will

be by listing the credits with earlier carryforward

expirations first).

If you received the same credit in back to back

years, or more than once in the same year, don’t

list the same code twice within the table. Instead,

report these credits on the same line (see example

3). Each code should only be listed once.

List credits that are available to you even if you

are not able to claim them this year (see example

4).

Step 2: Fill in the total amount of the credit that could

not be claimed in 2015 that was carried forward

to the current year (2016). Enter this amount into

the “Amount from prior year” column, if any (see

example 3).

Step 3: Fill in the credit amount you earned in 2016, and

enter it in the “Amount awarded this year” col-

umn, if any. Enter this amount even if this is more

than the amount that can be claimed this year.

If the total awarded amount of your credit can

be claimed in one year, list the entire amount

awarded in the “Amount awarded this year” col-

umn (see example 2).

If the total awarded amount of your credit must

be claimed over multiple years, list only the por-

tion that is allowed to be claimed in tax year 2016

(see example 5).

Step 4: Fill in the credit amount you’re claiming this year.

The “Total claimed this year” box can’t be more

than the combined total of the “Amount from

prior year” and the “Amount awarded this year”

boxes. This amount also can’t be more than any

credit limitation for that credit. Any excess credit

not claimed in 2016 may be carried forward to the

following tax year, if it doesn’t expire according to

the carryforward rules of the credit (see example

6).

Step 5: Fill in the total of all carryforward credits being

claimed. Enter this number on Form OR-40, line

30. The total of all carryforward credits can’t be

more than your tax reported on Form OR-40, line

29. If your carryforward credits are more than

the tax reported on line 29, you must reduce how

much you are claiming on one or more of your

carryforward credits. If you have more than

one carryforward credit, consider claiming the

6

150-101-063 (Rev. 12-16)

maximum allowed on credits with earlier expira-

tions first (see example 6).

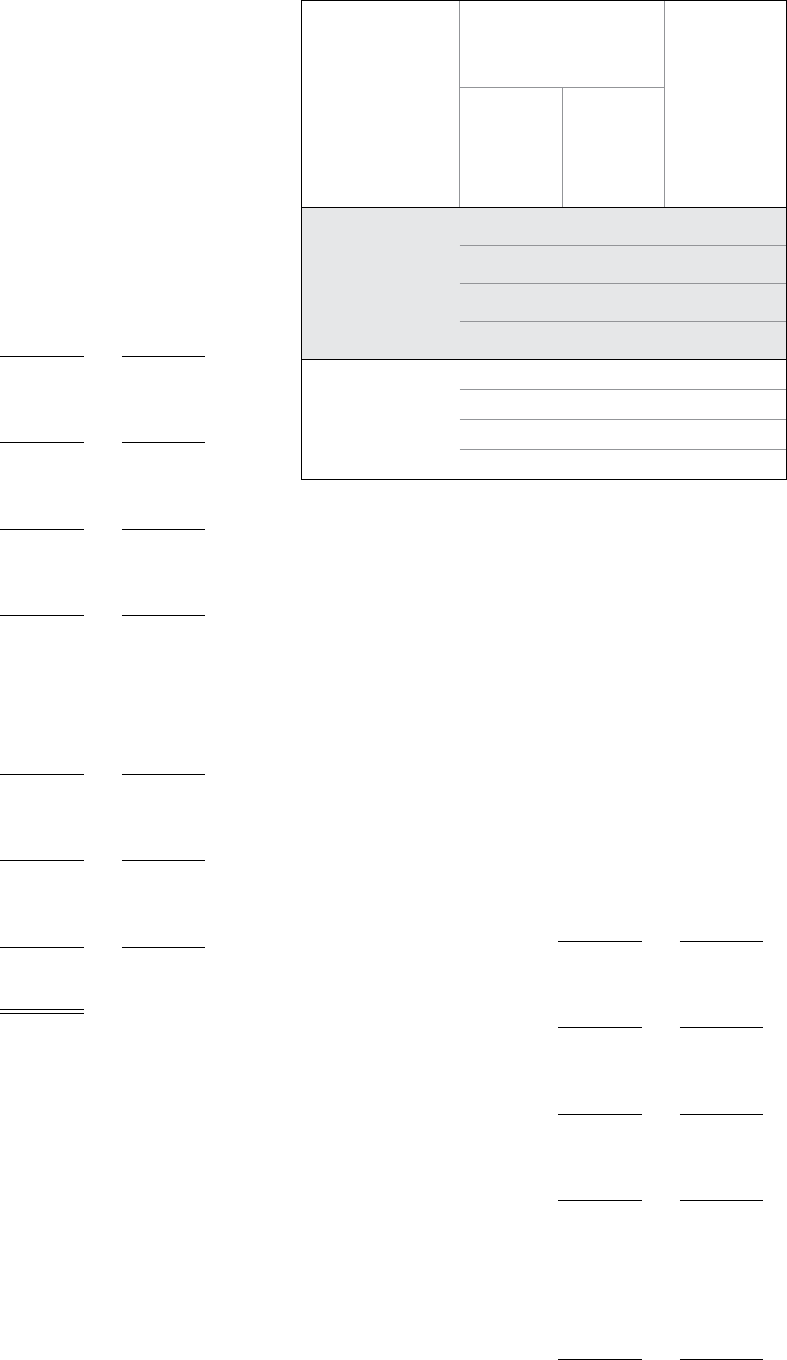

Example 2. In 2016, Neil and David received a $25,000 credit

for contributing to the Child Care Fund. For 2016, their tax

reported on line 29 is $16,500. Here’s how they will com-

plete the table:

Code

Amount from

prior year

Amount awarded

this year

Total claimed

this year

841 $0.00 $25,000.00 $16,500.00

.00 .00 .00

.00 .00 .00

Neil and David will carry forward $8,500 ($25,000–$16,500)

to tax year 2017.

Example 3. The same as example 2, except that Neil and

David also contributed to the Child Care Fund in 2015.

Their 2015 credit was $10,000. They were able to claim

$3,000 and carried forward $7,000 to 2016. Here’s how they

will complete the table, reporting the 2015 and 2016 credits

on the same line:

Code

Amount from

prior year

Amount awarded

this year

Total claimed

this year

841 $7,000.00 $25,000.00 $16,500.00

.00 .00 .00

.00 .00 .00

They will carry forward $15,500 [($7,000+$25,000)–$16,500]

to tax year 2017.

Example 4. Valerie and Tony received a $6,000 credit for

contributing to the University Venture Development Fund

in 2016. Their 2016 tax reported on line 29 is $0.00. Here’s

how they will complete the table:

Code

Amount from

prior year

Amount awarded

this year

Total claimed

this year

864 $0.00 $6,000.00 $0.00

.00 .00 .00

.00 .00 .00

Example 5. Senait installed a solar heating system for her

backyard swimming pool in 2016. She was awarded a $6,000

residential energy tax credit. The provisions of this credit

limit the amount that can be claimed each year to $1,500

(along with any amount carried forward from the previous

year). Senait may claim $1,500 in 2016; $1,500 in 2017; $1,500

in 2018; and $1,500 in 2019. Her 2016 tax reported on line 29

is $2,000. Here’s how she will complete the table:

Code

Amount from

prior year

Amount awarded

this year

Total claimed

this year

861 $0.00 $1,500.00 $1,500.00

.00 .00 .00

.00 .00 .00

Even though Senait’s tax reported on line 29 is $2,000, the

credit is limited to $1,500 per year. She is only able to claim

$1,500 in 2016.

Example 6: Chad and Jolene have $3,200 of unused riparian

land credit originally awarded in 2011 that can be claimed

in 2016. They also qualified for a 2016 residential energy

credit of $2,500, of which they may claim $1,500 in 2016 and

$1,000 in 2017. Their 2016 tax reported on line 29 is $4,500.

Because 2016 is the last year the riparian land carryforward

can be claimed, they will claim all of the $3,200 credit first.

Chad and Jolene will also claim $1,300 of their 2016 residen-

tial energy credit. Here’s how they will complete the table.

Code

Amount from

prior year

Amount awarded

this year

Total claimed

this year

862 $3,200.00 $0.00 $3,200.00

861 $0.00 $1,500.00 $1,300.00

.00 .00 .00

Chad and Jolene are only able to claim $1,300 of the resi-

dential energy credit because their total amount claimed

this year box cannot equal more than their tax reported

on line 29 [$4,500–($3,200+$1,300)]. The remaining $200

($1,500–$1,300) of the residential energy credit that cannot

be claimed in 2016 will be carried forward to 2017.

Section 5: Refundable credits (codes 890–895)

Refundable credits can only be claimed on your current

year’s tax return; however, any amount that is more than

your tax will be refunded to you. For detailed information

regarding refundable credits, refer to Publication OR-17.

Step 1: Complete the table in Section 5 with credits you’re

claiming that have a code between 890–895. Fill

in the code and amount being claimed for each

refundable credit. Each code should only be listed

once.

Step 2: Fill in the total of all refundable credits. Enter this

amount on Form OR-40, line 36.

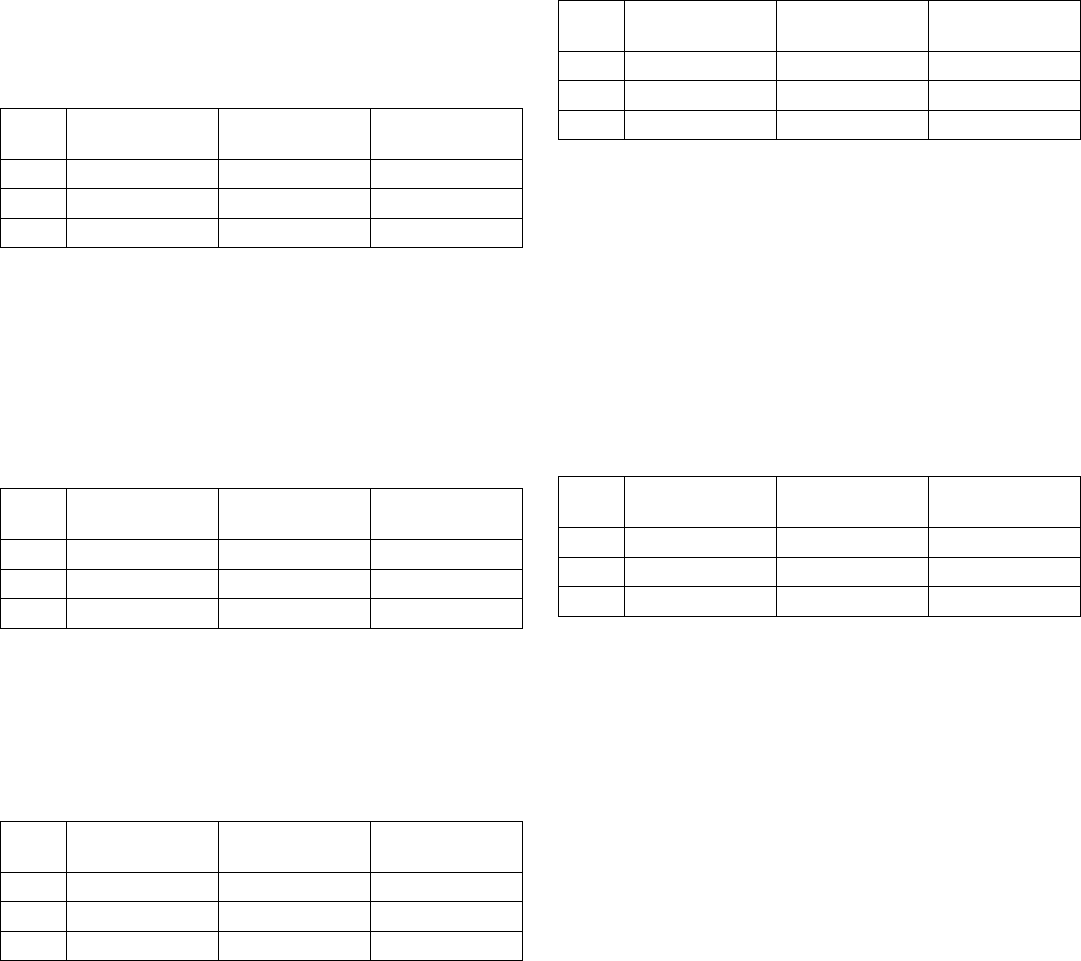

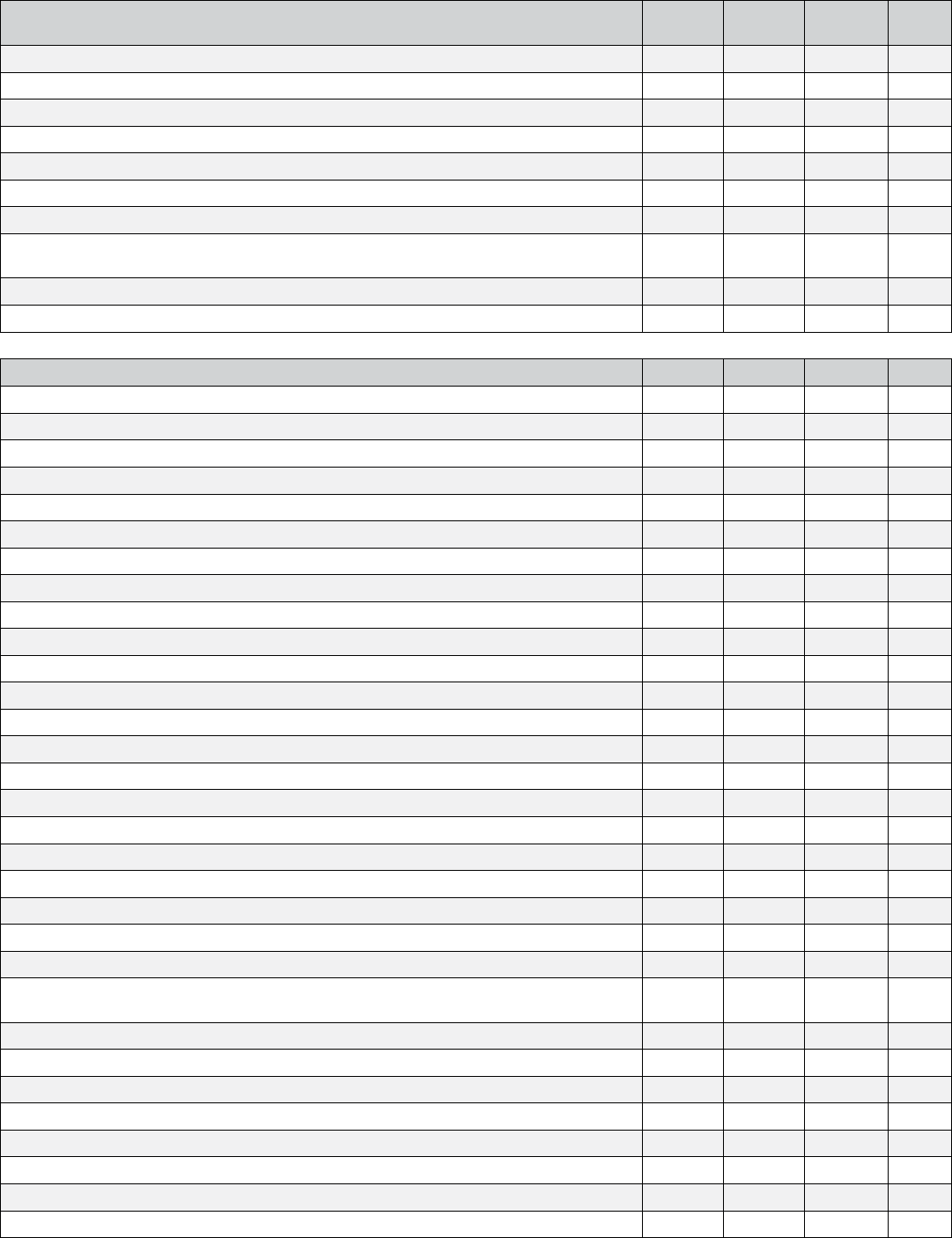

Numeric codes are required when you are claiming or reporting an adjustment, addition, subtraction, modification, or credit on

Schedule OR-ASC or OR-ASC-NP. If you have multiple items that use the same code, add them together and enter the total as a

single item. Include Schedule OR-ASC or OR-ASC-NP when you file your return.

Adjustments—Schedule OR-ASC-NP, Section 1 only. OR-40 OR-40-N OR-40-P Code

Certain business expenses of reservists, performing artists, and fee-basis government

o cials–Form 1040, Line 24

X X 002

Health savings account deduction – Form 1040, Line 25 X X 003

Penalty on early withdrawal of savings–Form 1040, Line 30 X X 004

Any other adjustments reported on Form 1040, Line 36, or Form 1040NR, Line 35 X X 005

Domestic production activities deduction–Form 1040, Line 35, or Form 1040NR, Line 34 X X 006

Additions—Schedule OR-ASC, Section 1 or OR-ASC-NP, Section 2. OR-40 OR-40-N OR-40-P Code

Domestic production activities deduction X X X 102

Claim of right income repayments X 103

Disposition of inherited Oregon farmland or forestland X X X 106

Federal election on interest and dividends of a minor child X X X 107

Federal income tax refunds X 109

Net operating loss—non-Oregon source X X X 116

Oregon 529 College Savings Plan non-quali ed withdrawal X X X 117

Oregon deferral of reinvested capital gain X X X 118

Partnership and S corporation modi cations for Oregon X X X 119

Business credit—unused X X X 122

Prescription drug plan subsidies X X X 123

Federal law disconnect X X X 131

Accumulation distribution from a trust X X X 132

Fiduciary adjustment from Oregon estates and trusts X X X 133

Gambling losses claimed as an itemized deduction X 134

Oregon-only Schedule A items X 135

Refund of Oregon-only Schedule A items from a prior year X 136

Individual Development Account non-quali ed withdrawal X X X 137

Oregon IDA Initiative Fund donation credit add-back X 138

Lump-sum distribution from a quali ed retirement plan X X X 139

Passive foreign investment company income X X X 140

Child Care Fund contributions X 142

Oregon Production Investment Fund contributions X 144

Renewable Energy Development Fund contributions X 145

University Venture Development Fund contributions X 146

Income taxes paid to another state X X X 148

Basis of business assets transferred to Oregon X X X 150

Depletion in excess of property basis X X X 151

Oregon Department of Revenue

Publication OR-CODES

Numeric Codes for Oregon Adjustments, Additions, Subtractions,

Modifications, and Credits

Effective for tax year 2016

Page 1 of 4, 150-101-432 (Rev. 12-16)

Additions—Schedule OR-ASC, Section 1 or OR-ASC-NP, Section 2.

(Continued from page 1)

OR-40 OR-40-N OR-40-P Code

Depreciation di erence for Oregon X X X 152

Federal depreciation disconnect X X X 153

Gain or loss on sale of depreciable property with di erent basis for Oregon X X X 154

Passive activity losses X X X 155

Suspended losses X X X 156

Federal estate tax on income in respect of a decedent X 157

Interest on state and local government bonds outside of Oregon X X X 158

Federal subtraction for retirement savings rollover from Individual Development

Account

X X X 159

Charitable donations not allowed for Oregon X 160

WFHDC medical expenses X 163

Subtractions—Schedule OR-ASC, Section 2 or OR-ASC-NP, Section 3. OR-40 OR-40-N OR-40-P Code

American Indian X X X 300

Artist's charitable contribution X 301

Construction worker and logger commuting expenses X X X 303

Federal gain previously taxed by Oregon X X X 306

Federal pension income X X X 307

Federal education credits (tuition and fees deduction) X X X 308

Federal income tax from a prior year X 309

Fiduciary adjustments from Oregon estates and trusts X X X 310

Foreign tax X 311

Individual Development Account contributions X X X 314

Interest and dividends on U S bonds and notes X X X 315

Land donation to educational institutions X X X 316

Interest from state and local government bonds X X X 317

Military active duty pay X X X 319

Mortgage interest credit X 320

Net operating loss X X X 321

Oregon lottery winnings X X X 322

Partnership and S corporation modi cations for Oregon X X X 323

Oregon 529 College Savings Plan deposit X X X 324

Oregon income tax refund X X 325

Previously taxed employee retirement plans X X X 327

Public Safety Memorial Fund award X X X 329

Railroad Retirement Board bene ts: tier 2, windfall/vested dual, supplemental, and

railroad unemployment bene ts

X X X 330

US government interest in IRA or Keogh distributions X X X 331

Scholarship awards used for housing expenses X X X 333

Legislative Assembly salary and expenses X X X 335

Film production labor rebate—Greenlight Oregon Labor Rebate Fund X X X 336

Mobile home park capital gain X X X 338

Capital Construction Fund (CCF) contributions X X X 339

Federal business and health coverage credits X X X 340

Income on a composite return X X 341

Publication OR-CODESOregon Department of RevenuePage 2 of 4, 150-101-432 (Rev. 12-16)

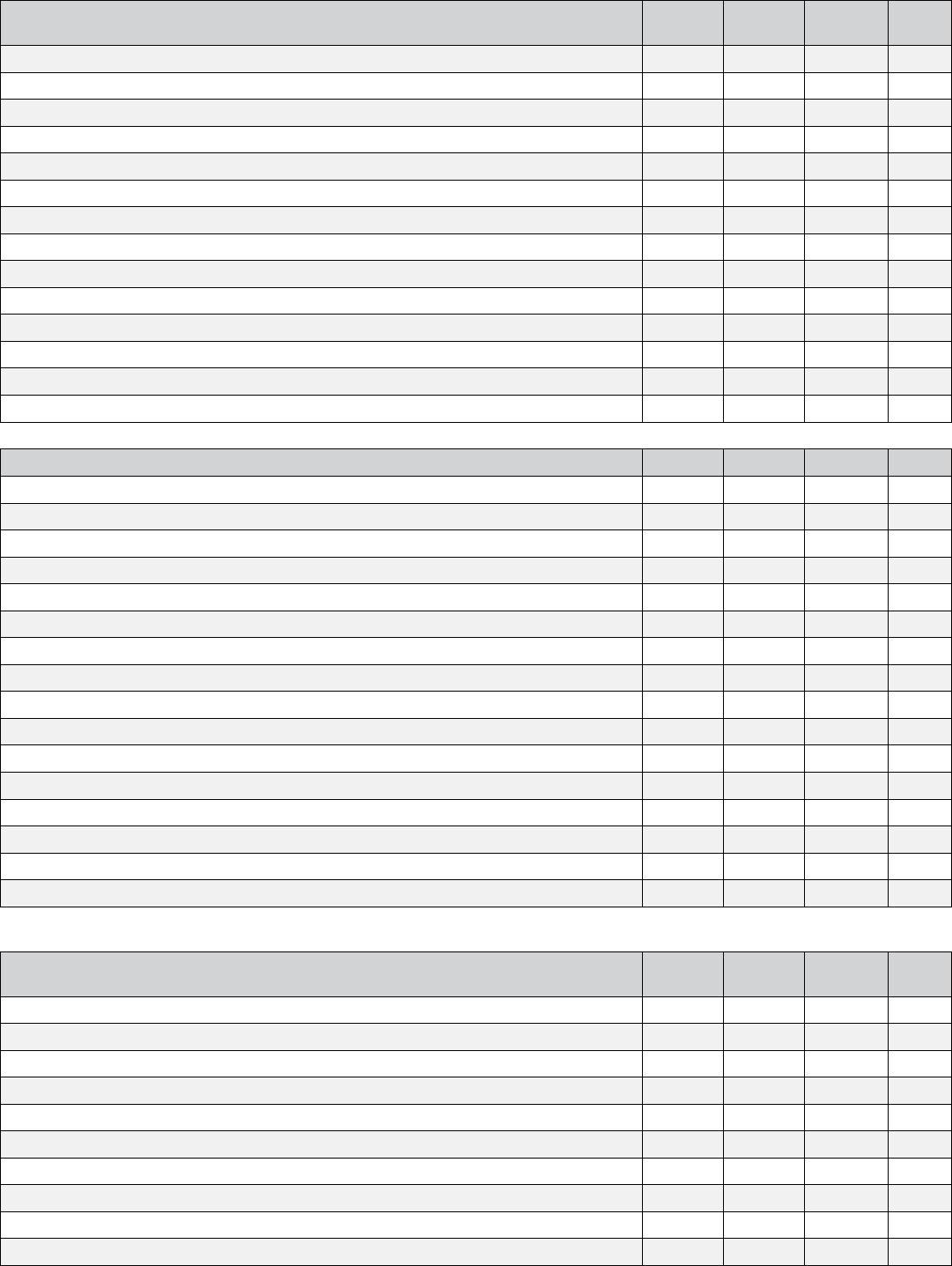

Subtractions—Schedule OR-ASC, Section 2 or OR-ASC-NP, Section 3.

(Continued from page 2)

OR-40 OR-40-N OR-40-P Code

Oregon Investment Advantage X X X 342

Mobile home tenant payment X X X 344

Taxable bene ts for former RDPs X X X 347

Previously-taxed IRA conversions X X X 348

Discharge of indebtedness X X X 350

Special Oregon medical X X X 351

DISC dividend payments X X X 352

Depreciation di erence for Oregon X X X 354

Gain or loss on sale of depreciable property with di erent basis for Oregon X X X 355

Passive activity losses X X X 356

Suspended losses X X X 357

Basis of business assets transferred to Oregon X X 358

Marijuana business expenses not allowed on the federal return X X X 359

ABLE account deposit X X X 360

Modi cations—Schedule OR-ASC-NP, Section 4 only. OR-40 OR-40-N OR-40-P Code

Artist’s charitable contribution X 600

Federal income tax refunds X X 601

Federal tax from a prior year X X 602

Foreign tax X X 603

Gambling losses claimed as an itemized deduction + X X 604

Federal estate tax on income in respect of a decedent X X 605

Mortgage interest credit deduction X X 607

Federal health coverage credit X X 609

Child Care Fund contributions + X X 642

Oregon Production Investment Fund contributions + X X 644

Renewable Energy Development Fund contributions + X X 645

University Development Venture Fund contributions + X X 646

Oregon IDA Initiative Fund donation credit add-back + X X 648

Claim of right income repayment + X X 649

Charitable donations not allowed for Oregon X X 650

WFHDC medical expenses + X X 651

+ Must be entered as a negative number.

Standard credits—Schedule OR-ASC, Section 3 or OR-ASC-NP,

Section 5.

OR-40 OR-40-N OR-40-P Code

Income taxes paid to another state X X X 802

Mutually-taxed gain on the sale of residential property X X X 806

Oregon Cultural Trust contributions X PR PR 807

Oregon Veterans' Home physicians X PR PR 808

Political contributions X X 809

Reservation enterprise zone X PR PR 810

Retirement income X X X 811

Rural emergency medical technicians X PR PR 812

Rural health practitioners X PR PR 813

Pass-through income taxes paid to another state X X X 815

Publication OR-CODESOregon Department of RevenuePage 3 of 4, 150-101-432 (Rev. 12-16)

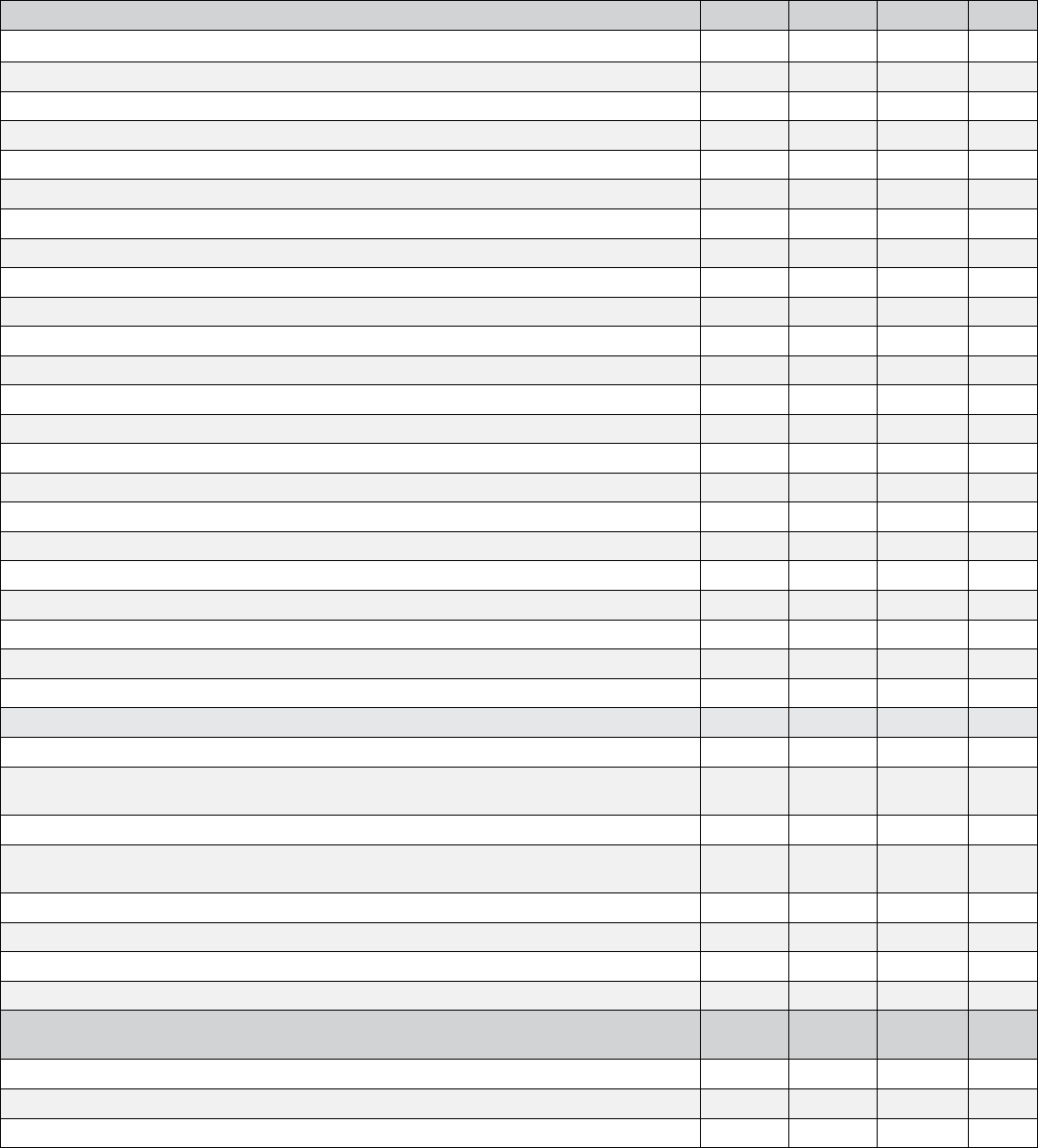

Carryforward credits—Schedule OR-ASC, Section 4 or OR-ASC-NP, Section 6. OR-40 OR-40-N OR-40-P Code

Agriculture workforce housing X PR PR 835

Biomass production/collection X PR PR 838

Business energy X X X 839

Child and dependent care carryforward X PR PR 840

Child Care Fund contributions X X X 841

Crop donation X PR PR 843

Electronic commerce zone investment X PR PR 845

Employer-provided dependent care assistance (carryforward only) X X PR 846

Employer scholarship X PR PR 847

Energy conservation projects X X X 849

Fish screening devices X PR PR 850

Oregon IDA Initiative Fund donation X X X 852

Oregon Low Income Community Jobs Initiative/New Markets X X X 855

Oregon Production Investment Fund contributions X X X 856

Pollution control facilities X X X 857

Renewable Energy Development Fund contributions X X X 859

Renewable energy resource equipment manufacturing facility carryforward X X X 860

Residential energy X PR PR 861

Riparian land carryforward X PR PR 862

Transportation projects X X X 863

University Venture Development Fund contributions X PR PR 864

Alternative Fuel Vehicle Fund contributions carryforward X X X 865

Reforestation of underproductive forestlands X X X 867

Carryforward credits available only to S corporation shareholders.

Agriculture workforce housing loans (S corporation) X X X 836

Alternative fuel vehicle fueling stations, carryforward only

(S corporation)

X X X 851

Alternative quali ed research activities (S corporation) X X X 837

Contribution of computers or scienti c equipment for research,

carryforward only (S corporation)

X X X 842

Lender’s credit: a ordable housing (S corporation) X X X 854

Lender’s credit: energy conservation, carryforward only (S corporation) X X X 848

Long-term rural enterprise zone facilities (S corporation) X X X 853

Quali ed research activities (S corporation) X X X 858

Refundable credits—Schedule OR-ASC, Section 5 or OR-ASC-NP,

Section 7.

OR-40 OR-40-N OR-40-P Code

Claim of right X PR PR 890

Mobile home park closure X X X 891

Working Family Household and Dependent Care (WFHDC) X PR PR 895

PR indicates a credit that must be prorated.

Publication OR-CODESOregon Department of RevenuePage 4 of 4, 150-101-432 (Rev. 12-16)