Fillable Printable Schedule Reg-1-R Responsible Party Information

Fillable Printable Schedule Reg-1-R Responsible Party Information

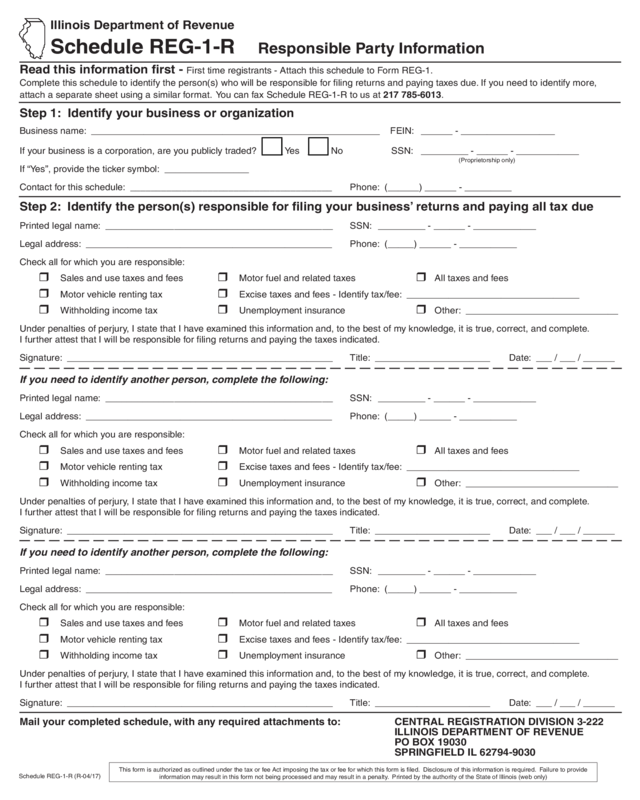

Schedule Reg-1-R Responsible Party Information

Illinois Department of Revenue

Schedule REG-1-R Responsible Party Information

Read this information first - First time registrants - Attach this schedule to Form REG-1.

Complete this schedule to identify the person(s) who will be responsible for filing returns and paying taxes due. If you need to identify more,

attach a separate sheet using a similar format. You can fax Schedule REG-1-R to us at 217 785-6013.

Step 1: Identify your business or organization

Business name: __

_____________________________________________________

FEIN: ______ - __________________

If your business is a corporation, are you publicly traded? ____ Yes ____ No SSN: _________ - ______ - ____________

(Proprietorship only)

If “Yes”, provide the ticker symbol:

________________

Contact for this schedule:

_______________________________________

Phone: (______) ______ - _________

Step 2: Identify the person(s) responsible for filing your business’ returns and paying all tax due

Printed legal name:

___________________________________________

SSN: _________ - ______ - ____________

Legal address: _______________________________________________ Phone: (_____) ______ - ___________

Check all for which you are responsible:

Sales and use taxes and fees Motor fuel and related taxes All taxes and fees

Motor vehicle renting tax Excise taxes and fees - Identify tax/fee: _________________________________

Withholding income tax Unemployment insurance Other:

_____________________________

Under penalties of perjury, I state that I have examined this information and, to the best of my knowledge, it is true, correct, and complete.

I further attest that I will be responsible for filing returns and paying the taxes indicated.

Signature:

___________________________________________________

Title: ______________________ Date: ___ / ___ / ______

If you need to identify another person, complete the following:

Printed legal name:

___________________________________________

SSN: _________ - ______ - ____________

Legal address: _______________________________________________ Phone: (_____) ______ - ___________

Check all for which you are responsible:

Sales and use taxes and fees Motor fuel and related taxes All taxes and fees

Motor vehicle renting tax Excise taxes and fees - Identify tax/fee: _________________________________

Withholding income tax Unemployment insurance Other:

_____________________________

Under penalties of perjury, I state that I have examined this information and, to the best of my knowledge, it is true, correct, and complete.

I further attest that I will be responsible for filing returns and paying the taxes indicated.

Signature:

___________________________________________________

Title: ______________________ Date: ___ / ___ / ______

If you need to identify another person, complete the following:

Printed legal name:

___________________________________________

SSN: _________ - ______ - ____________

Legal address: _______________________________________________ Phone: (_____) ______ - ___________

Check all for which you are responsible:

Sales and use taxes and fees Motor fuel and related taxes All taxes and fees

Motor vehicle renting tax Excise taxes and fees - Identify tax/fee: _________________________________

Withholding income tax Unemployment insurance Other:

_____________________________

Under penalties of perjury, I state that I have examined this information and, to the best of my knowledge, it is true, correct, and complete.

I further attest that I will be responsible for filing returns and paying the taxes indicated.

Signature:

___________________________________________________

Title: ______________________ Date: ___ / ___ / ______

Mail your completed schedule, with any required attachments to: CENTRAL REGISTRATION DIVISION 3-222

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19030

SPRINGFIELD IL 62794-9030

Schedule REG-1-R (R-04/17)

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this information is required. Failure to provide

information may result in this form not being processed and may result in a penalty. Printed by the authority of the State of Illinois (web only)

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Reset

Print