Fillable Printable Sf-428-C

Fillable Printable Sf-428-C

Sf-428-C

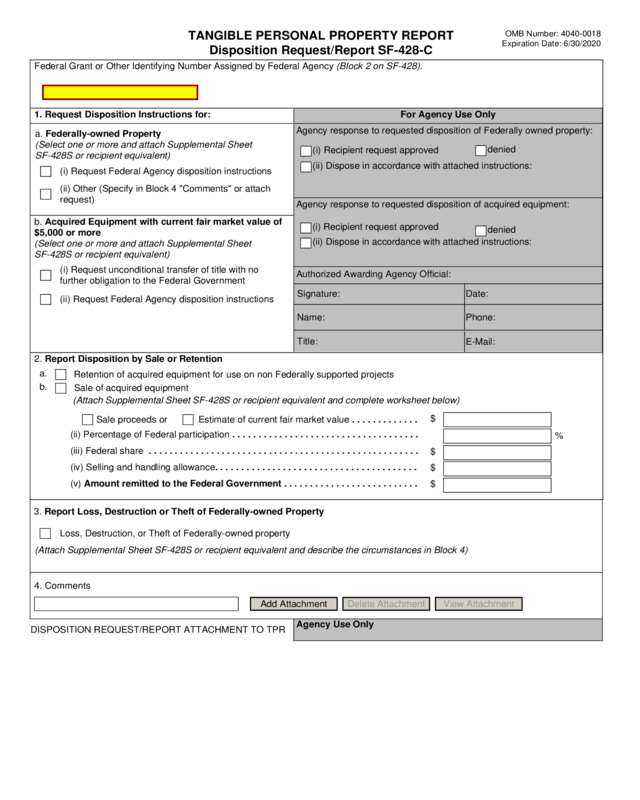

TANGIBLE PERSONAL PROPERTY REPORT

Disposition Request/Report SF-428-C

OMB Number: 4040-0018

Expiration Date: 6/30/2020

Federal Grant or Other Identifying Number Assigned by Federal Agency (Block 2 on SF-428).

1. Request Disposition Instructions for:

a. Federally-owned Property

(Select one or more and attach Supplemental Sheet

SF-428S or recipient equivalent)

(i) Request Federal Agency disposition instructions

(ii) Other (Specify in Block 4 "Comments" or attach

request)

b. Acquired Equipment with current fair market value of

$5,000 or more

(Select one or more and attach Supplemental Sheet

SF-428S or recipient equivalent)

(i) Request unconditional transfer of title with no

further obligation to the Federal Government

(ii) Request Federal Agency disposition instructions

a.

Retention of acquired equipment for use on non Federally supported projects

2. Report Disposition by Sale or Retention

Sale of acquired equipment

(Attach Supplemental Sheet SF-428S or recipient equivalent and complete worksheet below)

b.

(i)

Sale proceeds or

Estimate of current fair market value . . . . . . . . . . . . .

$

(ii) Percentage of Federal participation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

(iii) Federal share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

(iv) Selling and handling allowance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

(v) Amount remitted to the Federal Government . . . . . . . . . . . . . . . . . . . . . . . . . .

$

For Agency Use Only

Agency response to requested disposition of Federally owned property:

(ii) Dispose in accordance with attached instructions:

denied

(i) Recipient request approved

denied

(i) Recipient request approved

(ii) Dispose in accordance with attached instructions:

Agency response to requested disposition of acquired equipment:

Name:

Title:

E-Mail:

Phone:

Authorized Awarding Agency Official:

Signature:

Date:

3. Report Loss, Destruction or Theft of Federally-owned Property

Loss, Destruction, or Theft of Federally-owned property

(Attach Supplemental Sheet SF-428S or recipient equivalent and describe the circumstances in Block 4)

4. Comments

DISPOSITION REQUEST/REPORT ATTACHMENT TO TPR

Agency Use Only

Add Attachment

Delete Attachment

View Attachment

Instructions for Disposition Request/Report: SF-428 Attachment C

A. General Instructions:

2

This Attachment is to be used by recipients when required to request disposition instructions or to report disposition of

Federally-owned property or acquired equipment under Federal assistance awards at any time other than award closeout

(i.e., during the award period or after closeout as long as the Federal Government retains an interest in the item.

Recipients provided Federally-owned property for use under Federal assistance awards are required to request

disposition instructions from the awarding agency when the Federally-owned property is no longer needed for the

authorized purpose. Recipients may be required to request disposition instructions for equipment acquired with award

funds (acquired equipment) when an item is no longer needed for use on Federally-sponsored activities. Recipients may

also be required to provide compensation to the awarding agency when acquired equipment is sold or retained for use on

activities not sponsored by the Federal Government. This attachment is intended to assist recipients in providing

appropriate information to the awarding agency. Note: If the Federal awarding agency has exercised statutory authority

to vest title to acquired equipment in the recipient with no further obligation to the Federal government, you are not

required to request disposition instructions or to report disposition (i.e., sale or retention for non Federal use) of those

items of equipment.

Federal Grant or Other Identifying Number Assigned by Federal Agency. Enter the Federal grant, cooperative

agreement or other Federal financial assistance award instrument number or other identifying number assigned to the

Federal financial assistance award.

1. Request Disposition Instructions for: Use this section to request Federal awarding agency disposition instructions

when required by the award provisions.

a. Federally-owned Property. Consists of items that were furnished by the Government. Check applicable boxes to

indicate the requested Federal awarding agency action for items that are no longer needed for use on the award

specified in Block 2.

(ii) To request a specific disposition, e.g., transfer to another award.

(i) To request Federal agency disposition instructions.

b. Acquired Equipment with a current fair market value of $5,000 or more. Note: Fair market value means the

best estimate of gross sales proceeds if the property were to be sold in a public sale. Check applicable boxes to

indicate the requested Federal awarding agency action.

(i) To request approval to trade-in or sell to offset costs of replacement equipment.

(ii) To request Federal agency disposition instructions for equipment acquired with award funds.

2. Report Disposition by Sale or Retention. Use this section when required to compensate the Federal awarding

agency for its interest in acquired equipment with a current fair market value of $5,000 or more that you have sold or

retained for use on non Federally supported activities. Check applicable blocks to indicate the type of action being

reported and complete the worksheet to calculate the amount of compensation due to the awarding agency for its interest

in the equipment.

(i) Enter the total amount received if the equipment has been sold. Enter an estimate of the current fair market

value if the equipment will be retained for use on non Federally funded projects.

a. Retention of acquired equipment for use on non-Federally supported projects.

b. Sale of acquired equipment.

Worksheet

(ii) Enter the percentage of Federal Government participation in the award under which the equipment was

acquired.

(iii) Enter the dollar amount of sales proceeds (or estimate of current fair market value) multiplied by the

percentage of Federal Government participation listed in (ii).

(iv) If the equipment was sold, enter the amount of selling and handling expenses. Enter zero if the supplies

will be retained for use on non Federally funded projects.

(v) Enter the amount of the Federal share in (iii) less the selling and handling expense listed in (iv). Indicate in

Block 4 how the funds are being returned to the government. For example, attached check made out to the

Awarding Agency/U.S. Treasury or electronic remission.

Agency use only. This section is reserved for Federal agency use only.

4. Comments. Provide any explanations or additional information in this block. Attach additional sheets if necessary.