Fillable Printable Sf3106

Fillable Printable Sf3106

Sf3106

Continue on Reverse

(You MUST complete both sides of this application)

U.S. Office of Personnel Management

5 CFR 843

SF 3106

Revised March 1996

Previous editions are not usable

NSN 7540-01-249-5576

3106-104

See the attached sheets for instructions and

information concerning your application for

refund of retirement deductions and a

Privacy Act Statement.

Form Approved:

OMB Number 3206-0170

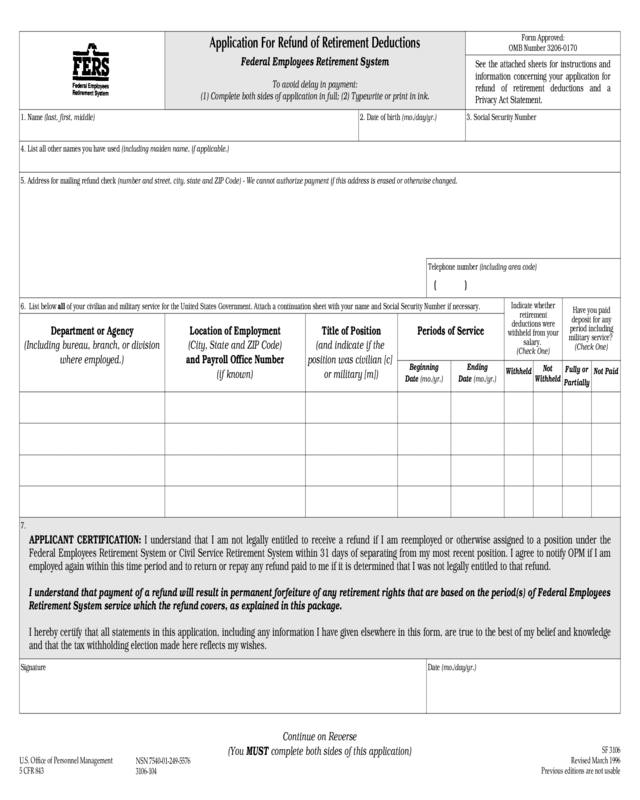

Application For Refund of Retirement Deductions

Federal Employees Retirement System

To avoid delay in payment:

(1) Complete both sides of application in full; (2) Typewrite or print in ink.

6. List below all of your civilian and military service for the United States Government. Attach a continuation sheet with your name and Social Security Number if necessary.

Department or Agency

(Including bureau, branch, or division

where employed.)

Location of Employment

(City, State and ZIP Code)

and Payroll Office Number

(if known)

Title of Position

(and indicate if the

position was civilian [c]

or military [m])

Periods of Service

Indicate whether

retirement

deductions were

withheld from your

salary.

(Check One)

Have you paid

deposit for any

period including

military service?

(Check One)

Beginning

Date (mo./yr.)

Ending

Date (mo./yr.)

Withheld

Not

Withheld

Not Paid

Fully or

Partially

7.

APPLICANT CERTIFICATION: I understand that I am not legally entitled to receive a refund if I am reemployed or otherwise assigned to a position under the

Federal Employees Retirement System or Civil Service Retirement System within 31 days of separating from my most recent position. I agree to notify OPM if I am

employed again within this time period and to return or repay any refund paid to me if it is determined that I was not legally entitled to that refund.

I understand that payment of a refund will result in permanent forfeiture of any retirement rights that are based on the period(s) of Federal Employees

Retirement System service which the refund covers, as explained in this package.

I hereby certify that all statements in this application, including any information I have given elsewhere in this form, are true to the best of my belief and knowledge

and that the tax withholding election made here reflects my wishes.

Signature Date (mo./day/yr.)

3. Social Security Number

4. List all other names you have used (including maiden name, if applicable.)

1. Name (last, first, middle) 2. Date of birth (mo./day/yr.)

5. Address for mailing refund check (number and street, city, state and ZIP Code) - We cannot authorize payment if this address is erased or otherwise changed.

Telephone number (including area code)

( )

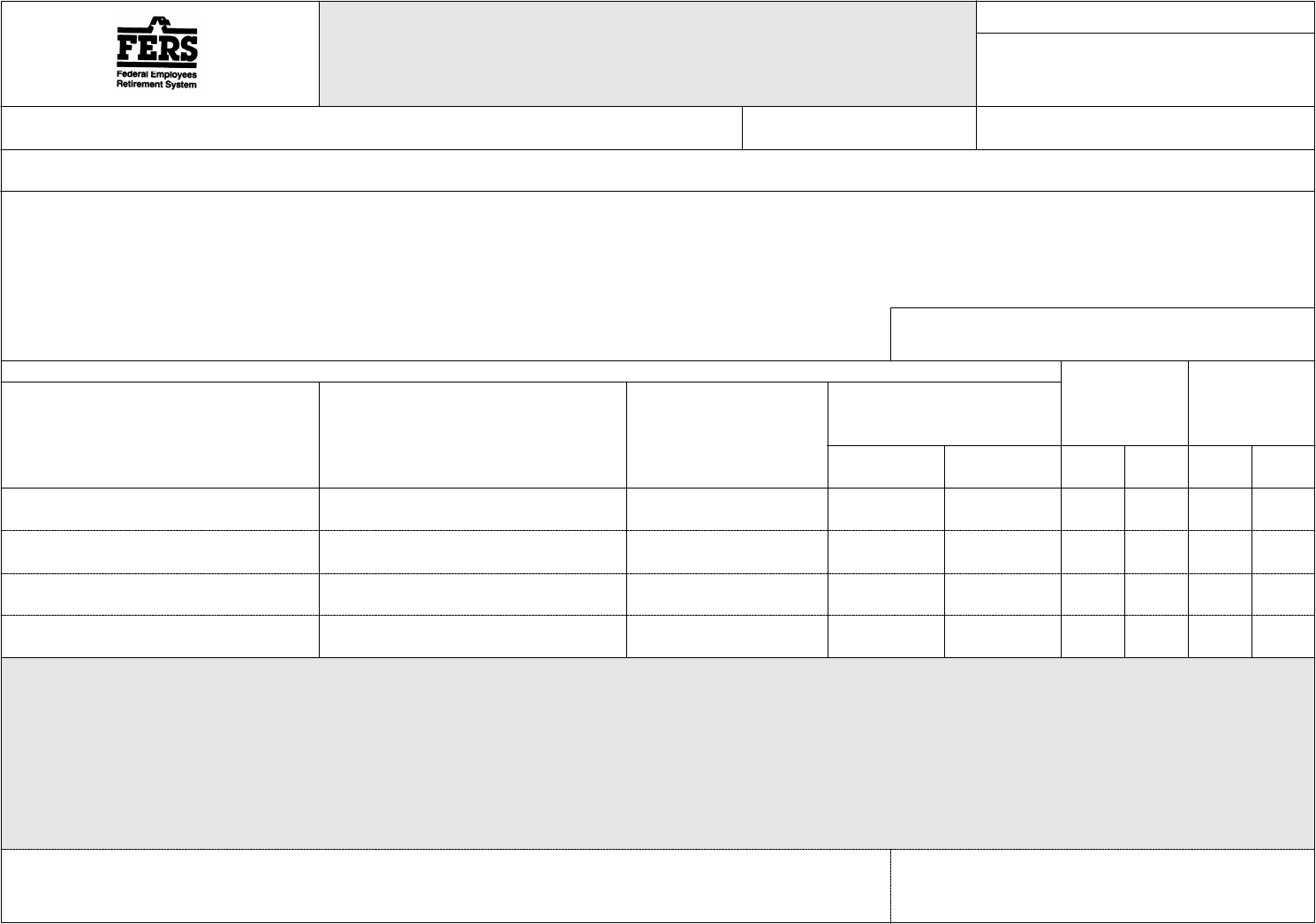

8. Have you accepted any further employment with the Federal government or the Government of the District of Columbia (or arranged for such employment) to become effective within 31 days from the ending date of your

last period of service?

For agency use only: I certify that this agency received this Standard Form 3106 on the date shown.

Signature of agency official

Title

Date received (mo./day/yr.)

Agency Payroll Office number

Are you now married? If "Yes," complete SF 3106A, Current/Former Spouse's Notification of Application for Refund of Retirement Deductions, or other required information described in this package.13.

14. Have you been divorced?

No

Yes. If your answer is "yes" and you have a total of at least 18 months of creditable civilian service, complete an SF 3106A (attached) for each living former spouse to whom you were

married for at least 9 months. List the former spouses in the space given below.

Yes, list the name of your current spouse:

12. Indicate how you wish to have Federal income tax withheld from the interest portion of your refund. Please refer to Special Tax Notice Regarding Rollovers in this package before making your decision. Since the

amount of your interest is calculated after we receive your application, please make one choice in both Part A (if the interest portion is under $200) and in Part B (if the interest portion is greater than $200).

Part A If my total interest is less than $200.

Withhold Federal income tax from the interest portion of my refund payment. (In this instance, 10% of the interest will be withheld.)

Do not withhold Federal income tax from the interest portion of my refund payment.

I elect to have my interest computed and a rollover package with all my options sent to me before I decide how the interest portion should be paid. (Electing this option delays

payment of your refund at least an additional 30 days.)

Part B If my total interest is $200 or greater.

I elect to have all of the taxable portion paid to me, less 20% Federal income tax withholding.

I elect to rollover the interest portion into an IRA. My financial institution or retirement plan has completed the financial institution certification form. (See next page.) If you want

the rollover amount sent to your mailing address so you can personally deposit it into your IRA, check here: [ ] (In this case, we will make the check payable to your IRA

Account in care of your address.)

Reverse of SF 3106

Revised March 1996

No, skip items 9, 10, and 11. Continue with item 12.Yes, continue with item 9.

9. If you answered "Yes" to Item 8, are Federal Employees' Retirement System or Civil Service Retirement

System deductions being withheld from your salary during such employment?

10. Date of new appointment. (Expected date if not yet reemployed.)

Yes No

11. Department or agency, including bureau, or division, and location (City, State, ZIP Code) where you are (or will be) employed.

Warning: Any intentional false statement in this application or willful misrepresentation relative thereto is a violation of the law punishable by a fine

of not more than $10,000 or imprisonment of not more than 5 years, or both. (18 U.S.C. 1001)

Name of former spouse Date of marriage Date of divorce

No

This notice contains important Federal income tax and other information

you will need before you decide how to receive your lump sum payment

from the Federal Employees’ Retirement System (FERS). To be of service to

our customers, the Office of Personnel Management has worked with the

Internal Revenue Service to present a general explanation of how Public

Law 102-318 affects those who receive our benefits. However, the IRS

remains the authority on tax matters and questions. Requests for

additional or clarifying information should be directed to them. The official

tax publications which govern how benefits are taxed are referenced at the

end of this notice. OPM does not stock IRS publications. We cannot provide

official tax information nor can we advise individuals on tax matters. The

following discussion applies to the taxable portion of your lump sum

payment.

Sum mary

The interest portion of your refund payment from OPM is taxable and is

eligible for “rollover.” You can have all or any part of your interest payment

either 1) paid in a “direct rollover” or 2) paid directly to you. A rollover is

a payment of the taxable portion of your FERS benefit to your individual

retirement arrangement (IRA) or to another employer retirement plan. This

choice will affect the tax you owe.

If you choose a direct rollover of the interest —

• Your in ter est will not be tax able in come in the year it is paid, and no

in come tax will be with held.

• Your in ter est pay ment will be made di rectly to your IRA, or, if you

choose, to an other em ployer re tire ment plan that ac cepts your

rollo ver.

• Your in ter est pay ment will be tax able in come later when you take it

out of the IRA or the em ployer re tire ment plan.

If you choose to have the interest paid to you —

• You will receive only 80% of the interest, because OPM is required to

withhold 20% of the payment and send it to the Internal Revenue

Service as income tax withholding to be credited against your taxes.

• Your interest will be taxed in the year it is paid unless you roll it over.

You may be able to use special tax rules that could reduce the tax you

owe. However, if you receive the payment before age 59½, you also

may have to pay an additional 10% tax.

• You can roll over the interest by paying it to your IRA or to another

employer retirement plan that accepts your rollover within 60 days

after you receive the payment. The amount rolled over will not be

taxed until you take it out of the IRA or employer retirement plan.

• If you want to roll over 100% of the interest to an IRA or an employer

retirement plan, you must find other money to replace the 20% that

was withheld. We cannot refund the 20% once it has been withheld. If

you roll over only the 80% you receive, you will be taxed on the 20%

that was withheld and not rolled over.

More In for ma tion

I. Pay ments That Can and Can not Be Rolled Over

Certain payments from OPM are “eligible rollover distributions.” This

means they can be rolled over to an IRA or to another employer retirement

plan that accepts rollovers. In general, only the “taxable portion” of your

payment is an eligible rollover distribution. The following types of

payments cannot be rolled over:

Non-taxable Payments. In general, the non-taxable portion of your

payment is not an eligible rollover distribution. Your retirement

contributions are non-taxable when they are paid to you and cannot be

rolled over.

Required Minimum Payments. Beginning in the year you reach age 70½ ,

a certain portion of your payment cannot be rolled over because it is a

“required minimum payment” that must be paid to you. You must compute

and exclude this amount from a direct rollover if you will be age 70½ or

older when the payment is made.

II. Di rect Rollo ver

You can choose a direct rollover of all or any portion of the interest portion

of your refund. In a direct rollover, the eligible rollover distribution is paid

directly from OPM to an IRA or another employer retirement plan that

accepts rollovers (or is sent to you in a check made payable to the IRA or

other retirement plan). If you choose a direct rollover, you are not taxed on

the payment until you later take it out of the IRA or the employer

retirement plan.

OPM will not pay a direct rollover or withhold tax on taxable payments

under $200, but recipients themselves may roll over such payments tax

free within 60 days after receipt. The minimum direct rollover amount is

$500 if you designate part of your payment as a direct rollover with the

remainder payable to you. OPM will pay a direct rollover to only one IRA or

retirement plan at any one time.

Direct Rollover to an IRA. You can open an IRA to receive the direct

rollover (The term “IRA,” as used in this notice, includes individual

retirement accounts and individual retirement annuities.) If you choose to

have your payment made directly to an IRA, contact an IRA sponsor

(usually a financial institution) to find out how to have your payment made

in a direct rollover to an IRA at that institution. If you are unsure of how to

invest your money, you can temporarily establish an IRA to receive the

payment. However, in choosing an IRA, you may wish to consider whether

the IRA you choose will allow you to move all or part of your payment to

another IRA at a later date, without penalties or other limitations. See IRA

Publication 590, Individual Retirement Arrangements, for more

information on IRAs (including limits on how often you can roll over

between IRAs).

Direct Rollover to an Employer Retirement Plan. If you are employed

by a new employer that has a retirement plan and you want a direct

rollover to that plan, ask the administrator of that plan whether it will

accept your rollover. An employer retirement plan is not legally required to

accept a rollover. If your new employer’s retirement plan does not accept a

rollover, you can choose a direct rollover to an IRA.

III. Pay ment Paid to You

If you have the interest payment made to you, it is subject to 20% Federal

income tax withholding. The payment is taxed in the year you receive it

unless, within 60 days after receiving it, you roll it over to an IRA or

another plan that accepts rollovers. If you do not roll it over, special tax

rules apply.

Mandatory Federal Income Tax Withholding. If you receive interest,

OPM is required by law to withhold 20% of that amount. This amount is

sent to the IRS as income tax withholding. For example, if your interest

payment is $3000, only $2400 will be paid to you because OPM must

withhold $600 as income tax. However, when you prepare your income tax

return for the year, you will report the full $3000 as interest on your

refund. You will report the $600 as tax withheld, and it will be credited

against any income tax you owe for the year.

Sixty-Day Rollover Option. You can still decide to roll over all or part of

the interest payment to an IRA or another employer retirement plan that

accepts rollovers within 60 days after you receive the payment. The portion

of your payment that is rolled over will not be taxed until you take it out of

the IRA or the employer retirement plan.

You can roll over up to 100% of the interest payment, including an amount

equal to the 20% that was withheld. If you choose to roll over 100%, you

must find other money within the 60-day period to contribute to the IRA or

the employer retirement plan to replace the 20% that was withheld. On the

other hand, if you roll over only the 80% that you received, you will be

taxed on the 20% that was withheld.

Example: If your interest payment is $3000, and you choose to have it

paid to you, you will receive $2400 and $600 will be sent to the IRS as

income tax withholding. Within 60 days after receiving the $2400, you may

roll over the entire $3000 to an IRA or employer retirement plan. To do

this, you roll over the $2400 you received from OPM, and you will have to

find $600 from other sources (your refund, savings, a loan, etc.). In this

case, the entire $3000 is not taxed until you take it out of the IRA or

employer retirement plan. If you roll over the entire $3000, when you file

your income tax return you may get a refund of the $600 withheld.

If, on the other hand, you roll over only $2400, the $600 you did not roll

over is taxed in the year it was withheld. When you file your income tax

return, you may get a refund of part of the $600 withheld. (However, any

tax refund is likely to be larger if you roll over the entire $3000.)

Additional 10% Tax If You Are Under Age 59½.

If you receive a payment

before you reach age 59½ and you do not roll it over, then, in addition to

the regular income tax, you may have to pay an extra tax equal to 10% of

the interest payment. The additional 10% tax does not apply to your

payment if it is (1) paid to you because you separate from service with your

employer during or after the year you reach age 55, (2) paid because you

retire due to disability (as determined by IRS), (3) paid to you as equal (or

almost equal) payments over your life or life expectancy (or you and your

beneficiary’s lives or life expectancies), or (4) used to pay certain medical

expenses. See IRS Form 5329, Return for Additional Taxes..., for more

information on the additional 10% tax.

How To Ob tain Ad di tional In for ma tion

This notice summarizes only the Federal (not State or local) tax rules that

might apply to your payment. The rules described above are complex and

contain many conditions and exceptions that are not included in this

notice. Therefore, you may want to consult with a professional tax advisor

before you take a payment of your refund from OPM. Also, you can find

more specific information on the tax treatment of payments from qualified

retirement plans in IRS Publication 575, Pension and Annuity Income,

IRS Publication 590, Individual Retirement Arrangements, and IRS

Publication 721, Tax Guide to U.S. Civil Service Retirement Benefits.

These publications are available from your local IRS office or by calling

1-800-TAX-FORMS.

Special Tax Notice Regarding Rollovers

Spe cial In for ma tion for Ap pli cant

1. You must complete all questions 1 through 14 on the refund

application. Additionally, your financial institution must complete the

certification if you elect to roll over the interest payable into an IRA.

Your current and/or living former spouse(s) must each complete a

separate SF 3106A to document notification of your application if you

are or have been married.

2. Payment of a refund of your Federal Employees Retirement System

(FERS) deductions will permanently eliminate your retirement rights

for the period(s) of FERS service which the refund covers. You will not

be permitted to pay the money back, even if you are later reemployed

in the government. The service involved cannot be used in computing

annuity benefits that you may later become entitled to receive under

FERS nor can it be used in determining length of service for annuity

eligibility purposes. Payment of the refund will end eligibility any

former spouse(s) may have to coverage under the Federal Employees

Health Benefits Program. Payment of the refund does not, however,

affect credit for leave or other non-retirement purposes.

3. A refund of retirement deductions is usually paid within one month of

receipt of the application at OPM unless information is missing that is

needed to process the application. It cannot be paid prior to 31 days

after the date of separation from a position subject to FERS or Civil

Service Retirement System (CSRS) or within 31 days before the

earliest commencing date of any annuity for which you are eligible,

including an annuity which must be reduced for age.

Payment of a refund is prohibited if you are currently employed in a

position subject to FERS or CSRS deductions or will be eligible to

retire within 31 days from the date of OPM’s receipt of the refund

application.

4. Interest will be paid on your FERS refund at the same rate earned by

government securities if the period(s) of service which the refund

covers totals more than one year.

5. For additional information about your benefits if you decide not

to apply for this refund, see the booklet FERS (RI 90-1), which is

available from your agency.

6. Do not offer this application to a person or a financial institution as

collateral or security for a loan. A former employee must apply for a

refund personally and payment must be made directly to him or her

(except direct rollovers, as described in the Federal Tax Information

section). However, outstanding debts to the U.S. Government can, at

the Government’s request, be withheld from a refund, provided all

legal requirements are met.

Trans fers to FERS

Completion of this application will authorize OPM to refund all retirement

deductions to your credit under both FERS and CSRS. Any interest payable

is computed using the rules for the retirement system under which the

deductions are credited.

If you have deductions creditable under CSRS and receive a refund, you

can pay back the amount of the CSRS deductions plus interest if you are

later reemployed in the Federal government. The CSRS service can be used

in determining length of service for annuity eligibility even if you do not

repay the money. If you want only a refund of your CSRS deductions and

not your FERS deductions, attach a signed statement to your completed

application.

For additional information, see the FERS Transfer Handbook (RI 90-3)

which is available from your agency.

Fed eral Tax In for ma tion

Applicants are permitted to roll over the interest from their refund of

retirement contributions to an individual retirement arrangement (IRA) or

another retirement plan. If OPM pays the interest to you, 20% Federal

income tax must be withheld. (The non-taxable amount of your payment,

the actual contributions, can only be paid to you and cannot be rolled

over.)

If the interest payable in your refund is less than $200, we are not

required to withhold 20% for Federal income tax and we cannot roll over

any of the taxable amount. You can still roll over an amount equal to the

interest on the refund personally after we send the payment to you.

You must complete both Part A and Part B of Question 12 on the refund

application, instructing us how to pay any interest you may be due to

receive. Part A tells us how to pay your interest if it turns out that it is less

than $200. In Part B you tell us how to pay your interest if it turns out to

be $200 or more. Since we cannot tell you how much your interest will be

until we receive your application and complete the calculation, you can

instruct us to prepare an election form telling you the amount of interest

you can roll over (if it is over $200) after we compute the benefit. If you ask

for this detailed information, your case will be held until we send and

receive your written election, usually a delay of payment of at least 30 days.

If under Part B on Question 12 you elect to roll over the interest portion

into an IRA, your financial institution or retirement plan must complete

the certification printed below, before we can process your election.

More information is given in the Special Tax Notice Regarding Rollovers

on the reverse of this page. Consult a qualified tax advisor or the Internal

Revenue Service if you need more information on tax matters. OPM cannot

provide you with tax publications or tax advice.

If you do not complete an election in Question 12, Part A, we will pay your

interest directly to you and will withhold 10% for Federal income tax. If you

do not complete an election in Part B, we will pay your interest directly to

you and will withhold 20% for Federal income tax. You have the option to

roll over part or all of the interest yourself within 60 days after you receive

the payment.

Pri vacy Act State ment

Title 5, U.S. Code, Chapter 84, Federal Employees Retirement System,

authorizes solicitation of this information. The data you furnish will be

used to determine your eligibility to receive a refund of retirement

deductions. This information may be shared with national, state, local or

other charitable or social security administrative agencies to determine and

issue benefits under their programs, or with law enforcement agencies

when they are investigating a violation or potential violation of the civil or

criminal law. Executive Order 9397 (November 22, 1943) authorizes use of

the Social Security number to distinguish you and people with similar

names. Furnishing your Social Security number, as well as other data, is

voluntary, but if you do not do this, OPM may be unable to determine your

eligibility to receive a refund of retirement deductions.

Where to File Your Ap pli ca tion

1. If you have been separated 30 days or less, this application should be

forwarded to the office in which you were last employed. If you need to

check on the status of your application, first verify that your former

agency has sent it, along with your records, to OPM.

2. If you have been separated more than 30 days, forward this

application to the Office of Personnel Management, Federal Employees

Retirement System, P.O. Box 200, Retirement Operations Center,

Boyers PA 16017.

3.

If you want to withdraw your Thrift Savings Plan account balance, ask

your agency for information. This is not the form you would use.

Pub li c Bur den State ment

We think this form takes an average 27 minutes per response to complete,

including the time for reviewing instructions, getting the needed data, and

reviewing the completed form. Send comments regarding our estimate

or any other aspect of this form, including suggestions for reducing

completion time to the Reports and Forms Management Officer, U.S. Office

of Personnel Management, 1900 E Street NW, Washington, DC 20415.

Instructions For Completion of Your Application For Refund of Retirement Deductions

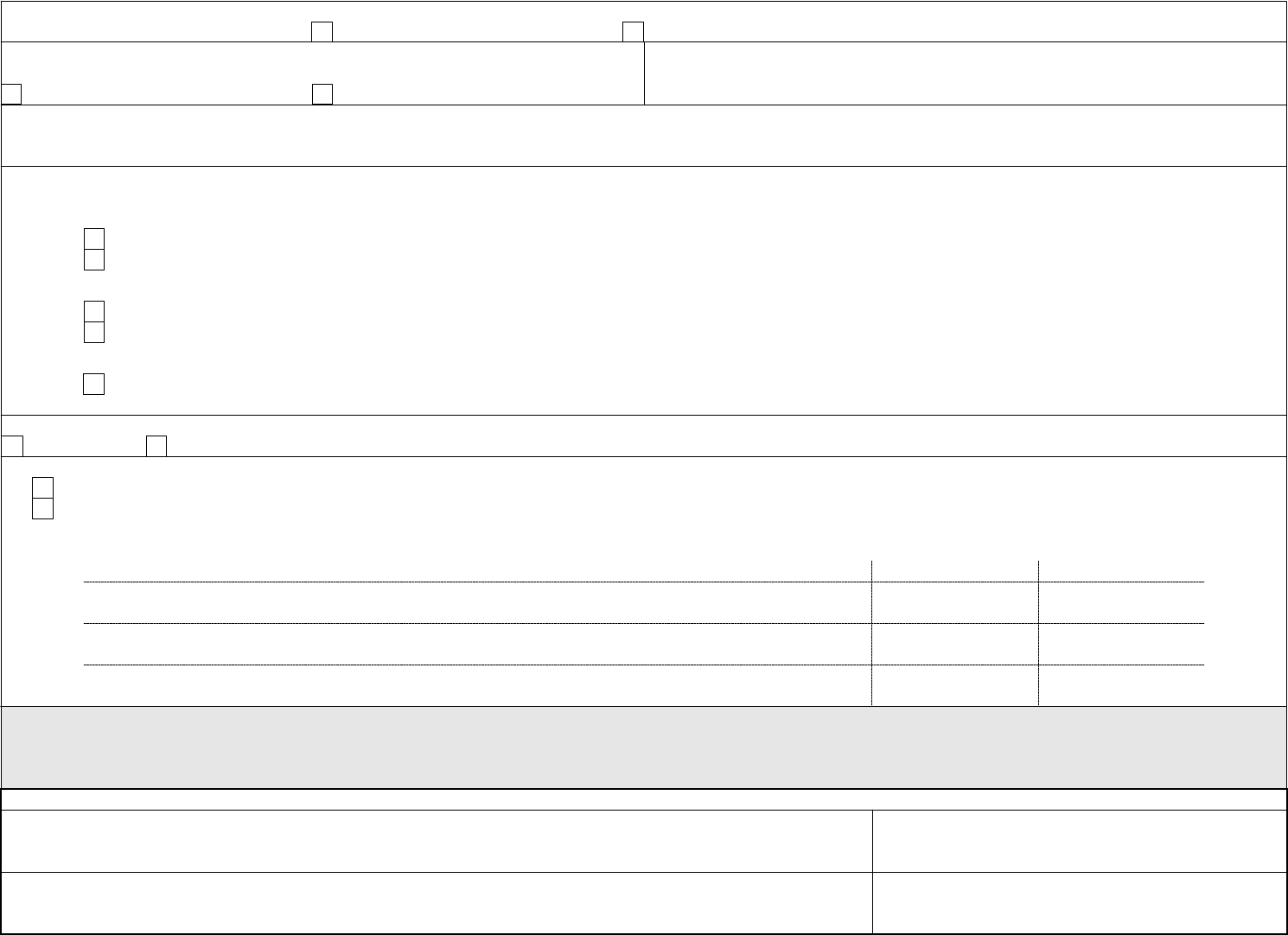

Cer ti fi ca tion By Fi nan cial or Re tire ment Plan

If Applicant Elects to Roll Over Interest Paid with a Refund of Retirement Deductions

This must be completed by your financial institution or retirement plan.

Name of applicant Social Security number

Name of institution or retirement plan IRA Account number Address of institution or retirement plan

Certification: As a representative of the financial institution or plan named above, I confirm the account

number for the individual named above and the address. I certify that the financial institution or plan

named above agrees to receive funds from the individual and deposit them in an eligible IRA or

retirement plan as defined in the Internal Revenue Code.

Typed or printed name of certifying representative Daytime phone number (including area code)

Signature of certifying representative Date of certification (mo./day/yr.)