Fillable Printable Special Needs Trust Template

Fillable Printable Special Needs Trust Template

Special Needs Trust Template

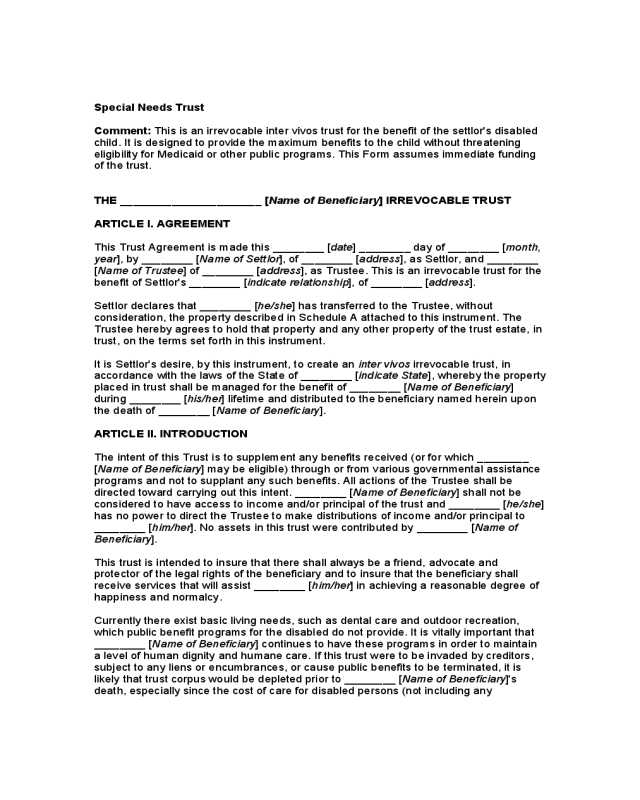

Special Needs Trust

Comment:

This is an irrevocable inter vivos trust for the benefit of the settlor's disabled

child. It is designed to provide the maximum benefits to the child without threatening

eligibility for Medicaid or other public programs. This Form assumes immediate funding

of the trust.

THE ______________________ [Name of Beneficiary] IRREVOCABLE TRUST

ARTICLE I. AGREEMENT

This Trust Agreement is made this ________ [date] ________ day of ________ [month,

year

], by ________ [Name of Settlor], of ________ [address], as Settlor, and ________

[

Name of Trustee] of ________ [address], as Trustee. This is an irrevocable trust for the

benefit of Settlor's ________ [

indicate relationship], of ________ [address].

Settlor declares that ________ [

he/she] has transferred to the Trustee, without

consideration, the property described in Schedule A attached to this instrument. The

Trustee hereby agrees to hold that property and any other property of the trust estate, in

trust, on the terms set forth in this instrument.

It is Settlor's desire, by this instrument, to create an

inter vivos irrevocable trust, in

accordance with the laws of the State of ________ [

indicate State], whereby the property

placed in trust shall be managed for the benefit of ________ [

Name of Beneficiary]

during ________ [

his/her] lifetime and distributed to the beneficiary named herein upon

the death of ________ [

Name of Beneficiary].

ARTICLE II. INTRODUCTION

The intent of this Trust is to supplement any benefits received (or for which ________

[

Name of Beneficiary] may be eligible) through or from various governmental assistance

programs and not to supplant any such benefits. All actions of the Trustee shall be

directed toward carrying out this intent. ________ [

Name of Beneficiary] shall not be

considered to have access to income and/or principal of the trust and ________ [

he/she]

has no power to direct the Trustee to make distributions of income and/or principal to

________ [

him/her]. No assets in this trust were contributed by ________ [Name of

Beneficiary

].

This trust is intended to insure that there shall always be a friend, advocate and

protector of the legal rights of the beneficiary and to insure that the beneficiary shall

receive services that will assist ________ [

him/her] in achieving a reasonable degree of

happiness and normalcy.

Currently there exist basic living needs, such as dental care and outdoor recreation,

which public benefit programs for the disabled do not provide. It is vitally important that

________ [

Name of Beneficiary] continues to have these programs in order to maintain

a level of human dignity and humane care. If this trust were to be invaded by creditors,

subject to any liens or encumbrances, or cause public benefits to be terminated, it is

likely that trust corpus would be depleted prior to ________ [

Name of Beneficiary]'s

death, especially since the cost of care for disabled persons (not including any

emergency needs) is high.

The Trustee, in the Trustees sole discretion, may receive property from others as trust

assets during and/or after Settlor's lifetime.

ARTICLE III. TRUST ESTATE

All property subject to this instrument from time to time is referred to as the ''trust estate''

and shall be held, administered, and distributed according to this instrument.

The trust estate consists of the property (plus the proceeds and undistributed income of

the property) that is listed in Schedule A and that is hereafter transferred to the trust by

the Settlor or by others as permitted herein.

ARTICLE IV. DISTRIBUTIONS OF INCOME AND PRINCIPAL

A. Distribution

The Trustee shall, in the Trustee's sole and absolute discretion, distribute so much

income and principal to or for the benefit of the beneficiary as the Trustee shall, in the

Trustee's sole discretion, determine in order to provide supplemental benefits, as

hereinafter defined, to the benefits receivable by the beneficiary through or from various

governmental assistance programs. The Trustee is prohibited from making any

distribution to any governmental entity to replace or reimburse or supplant any public

assistance benefit of any county, state, federal or other governmental agency which has

a legal responsibility to serve persons with disabilities which are the same or similar to

the impairment(s) of the beneficiary herein, and shall not distribute trust assets to or for

the benefit of the beneficiary for such needs as would be provided for in the absence of

this trust by governmental financial assistance and/or benefits and/or by any provider of

services. In no event shall trust property be distributed in such manner that any

governmental financial assistance, which would be available to the beneficiary if this

trust did not exist, is in any way reduced, diminished, altered or denied. All terms of this

trust, wherever they may appear, shall be interpreted to conform to this primary goal,

namely that the governmental financial assistance which would otherwise be available to

the beneficiary if this trust did not exist will in no way be reduced, diminished, altered or

denied. However, a distribution may be made by the Trustee, in the Trustee's sole

discretion, in order to meet a need of the beneficiary for supplemental benefits not

otherwise met by governmental financial assistance.

The Trustee shall, on an annual or more frequent basis, consult with an attorney with

appropriate expertise in the area of public benefits and trust law to review state and

federal legislation, regulations, and other requirements so that the public benefits

eligibility of the beneficiary is not jeopardized by inappropriate actions or distributions by

the Trustee. The cost of such attorney consultations shall be paid by the Trustee from

Trust assets.

B. Beneficiary

This trust shall be primarily for the benefit of ________ [Name of Beneficiary], and the

rights of the remainder beneficiary(ies) shall be of secondary importance. The Trustee

shall not be required to distribute income currently. The Trustee shall not be held

accountable to any beneficiary if part or all of the principal shall be depleted as a result

of distributions under this trust in accordance with the terms of this trust. Any income not

distributed shall be added to and become a part of the principal.

Any determination made by the Trustee in good faith as to the manner in which or the

extent to which the powers granted by this trust shall be exercised shall be binding and

conclusive upon all persons who might then or thereafter have or claim any interest in

the trust property.

1. Supplemental Benefit/Special Needs

The Trustee shall pay to or apply for the benefit of ________ [Name of Beneficiary] for

________ [

his/her] lifetime, such amounts of principal or income, up to the whole

thereof, as the Trustee in its discretion may from time to time deem necessary or

advisable for the satisfaction of ________ [

Name of Beneficiary]'s special needs, and

any income not distributed shall be added to the principal. As used in this instrument,

''special needs'' refers to the requisites for maintaining the beneficiary's good health,

safety and welfare when, in the discretion of the Trustee, such requisites are not being

provided by any public agency, office or department of the State of ________ [

indicate

State

], or of any other state, or of the United States.

The term ''special needs'' or ''supplemental benefits'' would or could include, but not be

limited to, health services not otherwise available, programs of training, education and

treatment, equipment, supplemental dietary needs, and travel. The aforesaid

specifications of supplemental benefits are illustrative only.

2. Spendthrift Provision

No interest in the principal or income of this trust shall be anticipated, assigned or

encumbered, or shall be subject to any creditor's claim or to legal process, prior to its

actual receipt by the beneficiary. Furthermore, it is Settlor's intent, as expressed herein,

that because this trust is to be conserved and maintained for the special needs of

________ [

Name of Beneficiary], no part of the corpus thereof, neither principal nor

undistributed income, shall be subject to the claims of voluntary or involuntary creditors

for the provision of care and services, including residential and/or institutional care, by

any public entity, office, department or agency of the State of ________ [

indicate State],

or any other state, or the United States, or any other governmental agency.

3. Public Benefits

Settlor declares that it is Settlor's intent, as expressed herein, that because ________

[

Name of Beneficiary] is disabled and will be unable to maintain and support ________

[

himself/herself] independently, the Trustee shall, in the exercise of its best judgment

and fiduciary duty, seek support and maintenance for ________ [

him/her] from all

available public resources, including Supplemental Security Income (SSI), ________

[

Medicaid or equivalent state program], and federal Social Security Disability Insurance

(SSDI). In making distributions to the beneficiary for ________ [

his/her] special needs,

as herein defined, the Trustee shall take into consideration the applicable resource

limitations of the public assistance programs for which the beneficiary is eligible.

4. Commingling

No public assistance benefits for the beneficiary of this trust shall be added to this trust.

5. Supplemental

It is further Settlor's intention that no part of the interest earned by or the corpus of the

trust created herein shall be used to supplant or replace public assistance benefits of

any county, state, federal or other governmental agency which has a legal responsibility

to serve persons with disabilities.

For purposes of determining the beneficiary's ________ [

Medicaid or equivalent state

program

] or any other public benefits programs eligibility, no part of the principal or

income of the trust estate shall be considered available to said beneficiary. In the event

the Trustee is requested by any department or agency administering ________

[

Medicaid or equivalent state program] or any other benefits to release principal or

income of the trust to or on behalf of a beneficiary to pay for equipment, medication, or

services which ________ [

Medicaid or equivalent state program] or any other

government benefit program is authorized to provide, or in the event the Trustee is

requested by any department or agency administering ________ [

Medicaid or equivalent

state program

] or any other benefits to petition the court or any other administrative

agency for the release of trust principal or income for this purpose, the Trustee is

authorized to deny such request and is authorized to defend, at the expense of the trust

estate, any contest or other attack of any nature of the provisions of or on sub-parts 1

through 8 inclusive of this section.

In addition, it is Settlor's hope, which is precatory, and not mandatory, that the trust

property shall be expended for such advocates, both legal and non-legal, as may be

necessary in order to protect any and all rights of the beneficiary as well as to protect the

integrity of this trust.

6. Termination

This trust shall cease and terminate upon the depletion of its assets or upon the death of

the beneficiary of this trust. If terminating on the death of the beneficiary, the Trustee

shall distribute any remaining principal and income to ________ [

name of charity], a

nonprofit charity, to be used for charitable purposes of the organization as its governing

board in its sole discretion shall determine.

7. Ineligibility

In determining whether the existence of the trust has the effect of rendering said

beneficiary ineligible for SSI, ________ [

Medicaid or equivalent state program], or other

public benefits, the Trustee is hereby granted full and complete discretion to initiate

either administrative or judicial proceedings, or both, for the purpose of determining

eligibility, and all costs relating thereto, including reasonable attorney fees, shall be a

proper charge to the trust estate.

8. Expenses

Upon the death of ________ [Name of Beneficiary], the Trustee, in the Trustee's sole

discretion, may pay all or any expenses of such beneficiary's funeral, and expenses

related to administration and distribution of the trust estate (including fees of the Trustee,

________ [

his/her] attorney, and other agents) if, in the Trustee's sole discretion, other

satisfactory provisions have not been made for the payment of such expenses. The

Trustee shall make no payments for obligations incurred for said beneficiary's health,

support and maintenance if the Trustee shall determine in [

his/her] sole discretion that

payment therefore is the obligation of any county, state, federal, or other governmental

agency, which has a legal responsibility to serve persons with disabilities which are the

same as or similar to the impairment(s) of said beneficiary herein.

ARTICLE V. DESIGNATION OF TRUSTEE

A. Trustee

________ [Name of Trustee] shall serve as initial Trustee. In the event that ________

[

Name of Trustee] ceases to act as Trustee, ________ [Name of Alternate Trustee], of

________ [

address], shall act as Trustee. In the event that this trust is activated during

the Settlor's lifetime, the Settlor shall thereafter neither act as Trustee nor have the

power to appoint or remove a Trustee.

If there is no named successor Trustee who accepts appointment, the Trustee or if the

Trustee fails to act, the beneficiary of the trust may secure at the expense of the trust the

appointment of a successor Trustee by a court of competent jurisdiction. Any corporate

Trustee so appointed shall be a corporation organized under the laws of any State or of

the United States authorized by law to administer trusts and maintaining a full-time trust

department. Any Trustee hereunder shall be an independent corporate or individual

Trustee (as defined under Internal Revenue Code Section 674) and shall not be a

beneficiary hereunder. Appointment shall be effective upon acceptance of the successor

Trustee as of the date the prior acting Trustee ceased to act.

B. Incapacity of a Trustee

If a Trustee cannot administer the trust because of incapacity, during any period of

incapacity the successor Trustee named herein (or appointed as provided herein) shall

act as Trustee, having all rights and powers granted to the Trustee by this instrument.

Incapacity shall mean any physical or mental condition of the Trustee, whether arising

from accident, illness or other cause, which renders the Trustee unable to conduct the

regular affairs of the trust estate, including but not limited to the endorsement for receipt

of funds and writing of checks for disbursement of funds from the trust estate, which

condition of incapacity is probable to extend for a period greater than ninety days.

Incapacity shall be conclusively established if either the Trustee's regularly attending

physician or two doctors, authorized to practice medicine in the State of ________

[

indicate State], (or in any State or country in which the Trustee is then residing) issue

written certification to that effect.

In the absence of certification, a Co.-Trustee or successor Trustee or beneficiary(ies)

hereunder may petition the court having jurisdiction over this trust to remove a Trustee

and, if there is no other acting Trustee, replace him or her with the successor Trustee.

Neither a Trustee nor beneficiary who so petitions the court shall incur liability to any

beneficiary of the trust or to the substituted Trustee as a result of this petition, provided

the petition is filed in good faith and in the reasonable belief that the substituted Trustee

is incapacitated or otherwise cannot act.

In like manner it may be determined that the Trustee has regained capacity.

C. Resignation

Any Trustee may resign at any time by giving written notice of resignation to the Settlor,

and/or the other Trustee(s) then acting, if any, and if there are none, then to the

beneficiary, or to ________ [

his/her] attorney in fact or conservator if ________ [he/she]

is incapacitated. Any such resignation shall become effective at such date as the

Trustee and the Settlor, or the said beneficiary (or ________ [

his/her] attorney in fact or

conservator) may agree, but no later than thirty (30) days after such written notice.

D. Death of Trustee

Death of a Trustee shall be evidenced by a certified copy of the death certificate

delivered to the successor Trustee.

E. Bond

No bond shall be required of any person named in this instrument as a Trustee, for the

faithful performance of his or her duties as Trustee, but a subsequently named Trustee

or successor Trustee may be required to be bonded, in accordance with the terms of

appointment.

F. Co.-Trustee

During such time as two or more persons are acting as Co.-Trustee, the powers of a

Trustee may be delegated to one or more of the Trustees from time to time by execution

of a written instrument signed by all of the then-acting Trustees.

No financial or investment action shall be taken on the sole signature of a Trustee. A

checking account may, however, be established for single signature use by either or

both of the Co.-Trustees. The total maximum balance of any such account(s) shall not

exceed the average semi-annual total return earnings of the trust.

G. Successor Trustee

1. A successor Trustee shall succeed to all title to the property of the trust estate and all

powers, rights, discretions, obligations and immunities of the Trustee hereunder with the

same effect as though such successor had been originally named Trustee.

2. No successor Trustee shall be liable for any act, omission or default of a predecessor

Trustee or Trustees. Unless requested in writing within sixty (60) days of appointment by

an adult beneficiary of a trust, no successor Trustee shall have any duty to investigate or

review any action of a predecessor Trustee or Trustees, and the successor Trustee may

accept the accounting records of the predecessor Trustee or Trustees showing assets

on hand without further investigation and without incurring any liability to any person

claiming or having an interest in the trust.

3. Any third person dealing with the successor Trustee shall accept, and shall be

absolutely entitled to rely upon, the statement of the successor Trustee that it has

become the successor Trustee in accordance with the provisions of this Article; and shall

be under no obligation to make any investigation into the facts or circumstances of the

assumption of authority by the successor Trustee.

4. The successor Trustee shall not be made subject to any claim or demand by a Settlor

or by any beneficiary of the trust estate by reason of its commencing to act as successor

Trustee in accordance with the provisions of this Article.

H. Reimbursement and Compensation

An independent Trustee may receive reasonable compensation. Any Trustee shall be

reimbursed for expenses paid on behalf of the trust estate.

A Trustee shall be entitled to reimburse himself or herself for any personal costs incurred

in the administration of this trust.

I. Report and Account

When Settlor is not acting as Trustee, the Trustee shall make an annual report to

________ [

Name of Person designated to receive report], of ________ [address]. The

financial records of the Trustee shall be open at all reasonable times to inspection by

these named individuals.

J. Personal Liability of Trustee

No Trustee named in this instrument shall be personally liable to any beneficiary or to

the Settlor, or to the heirs of either, or to any creditor of the trust or trust estate, for the

Trustee's acts or failure to act, except for willful misconduct or gross negligence. No

Trustee shall be liable or responsible for any act, omission, or default of any other

Trustee.

ARTICLE VI. TRUSTEE'S POWERS

Settlor grants to the Trustee discretion and complete power to administer the trust estate

as a fiduciary. In addition to those powers now or subsequently conferred to the Trustee

by law, such grant shall include without limitation the powers listed in this Article:

A. To Receive Assets

To receive, take possession of, sue for, recover, and preserve the assets of the trust

estate, both real and personal, coming to the Trustee's attention or knowledge, and the

rents, issues and profits arising from such assets.

B. To Retain Initial Assets

To retain the initial assets of the trust estate without liability for loss, depreciation, or

diminution in value resulting from such retention until the Trustee decides to dispose of

such assets.

C. To Invest

To invest and reinvest all or any part of the trust estate in any common or preferred

stocks, shares of investment trusts and investment companies, bonds, debentures,

mortgages, deeds of trusts, mortgage participations, money market funds, mutual funds,

index funds, notes, real estate, or other property the Trustee in the Trustee's discretion

selects. The Trustee may continue to hold in the form in which received (or the form to

which changed by reorganization, split-up stock dividend, or other like occurrence) any

securities or other property the Trustee may at any time acquire under this trust, it being

the Settlor's express desire and intention that the Trustee shall have the full power to

invest and reinvest the trust funds in the manner, under the circumstances then

prevailing (specifically including but not limited to the general economic conditions and

the anticipated needs of the trust and its beneficiaries), that persons of prudence, and

diligence acting in a similar capacity and familiar with those matters would use in the

conduct of an enterprise of a similar character and with similar aims, to attain the goals

of the Settlor under this instrument without being restricted to forms of investment that

the Trustee may otherwise be permitted to make by law; and to consider individual

investments as part of an overall investment strategy; and the investments need not be

diversified.

D. To Manage Securities

To have all the rights, powers and privileges of an owner of the securities held in trust,

including, but not by way of limitation, the power to vote, give proxies, and pay

assessments; to participate in voting trusts and pooling agreements (whether or not

extending beyond the term of the trust); to enter into shareholders' agreements; to

consent to foreclosure, reorganizations, consolidations, mergers, liquidations, sales, and

leases, and incident to any such action, to deposit securities with and transfer title to any

protective or other committee on such terms as the Trustee may deem advisable; and to

exercise stock options and to exercise or sell stock subscriptions or conversion rights.

E. To Handle Financial Accounts

To handle trust funds, including deposits and withdrawals, in any savings or other

account, interest-bearing or non-interest-bearing, in any currency whatsoever, with any

bank, financial institution, or other depository, or deposit such trust funds in investment

certificates or time certificates or other investment paper.

F. To Make Contracts and Carry Out Agreements

To enter into contracts, which are reasonably incident to the administration of the trust.

G. To Borrow

To borrow money from any source, excluding an individual Trustee, with any such

indebtedness being repayable solely from the trust estate or a part of it, and to pledge or

encumber the trust estate, or a part of it, as security for such loans.

H. To Determine Income and Principal

Except as otherwise specifically provided hereunder, to determine all matters of trust

accounting in accordance with the provisions of the Principal and Income Law of the

State of ________ [

indicate state], from time to time existing; and if there is no provision

therein, in accordance with generally accepted accounting principles in the Trustee's

discretion, which principles shall be consistently applied.

I. To Employ Agents and Delegates

To employ investment counsel, custodians of trust property, brokers, accountants,

lawyers, realtors, social workers, care managers, rental agents, therapists,

housekeepers, and other agents in those instances where the Trustee, in the exercise of

discretion, deems it necessary, and to pay reasonable fees in connection therewith from

principal or income, or both; to be free from liability for neglect or misconduct of any such

agent, provided such agent was selected and retained with reasonable care; at its

discretion to obtain a correspondent trust fiduciary or other agent to hold real property

located in another jurisdiction.

J. To Litigate

To prosecute, defend, contest or otherwise litigate legal actions or other proceedings for

the protection or benefit of a trust or the Trustee; to pay, compromise, release, adjust, or

submit to arbitration any debt, claim or controversy; and to insure the trust against any

risk, and the Trustee against liability with respect to third persons.

K. To Prepare Tax Returns and Make Elections

To prepare and file returns and arrange for payment with respect to all local, state,

federal, and foreign taxes incident to this agreement; to prepare all necessary fiduciary

income tax returns; to make all necessary and appropriate elections in connection

therewith in its discretion.

L. To Carry Insurance and Collect Insurance Proceeds

To carry, at the expense of the trust, insurance of such kinds and in such amounts as

the Trustee deems advisable to protect the trust estate and the Trustee personally

against any hazard.

M. To Seek and Maintain Public Benefits for a Beneficiary

To take any and all steps necessary, in the Trustee's discretion, to obtain and maintain

eligibility of any beneficiary under this trust for any and all public benefits and entitlement

programs. Such programs include but are not limited to Social Security, Supplemental

Security Income, Medicare, ________ [

Medicaid or equivalent state program], and In

Home Support Services.

N. Restrictions on Powers

Notwithstanding the provisions of this Article, none of the powers enumerated herein nor

any power accorded to a Trustee generally pursuant to law shall be construed to enable

the Settlor, the Trustee, or any other person (a) to purchase, exchange or otherwise deal

with or dispose of the principal or income of this trust for less than an adequate or full

consideration in money or money's worth, or (b) to borrow the principal or income of this

trust, directly or indirectly, without adequate interest or security. No person, other than

the Trustee, shall have or exercise the power (a) to vote or direct the voting of any stock

or securities of this trust, (b) to control the investment of property of this trust either by

directing investments or reinvestments or (c) to reacquire or exchange any property of

this trust by substituting other property of any equivalent value.

O. Relinquishment of Power

The Trustee shall have the power to relinquish and/or disclaim irrevocably the power of

the Trustee for the duration of the trust and for any and all acting thereafter as Trustee to

distribute principal to ________ [

Name of Beneficiary].

ARTICLE VII. ADMINISTRATIVE PROVISIONS

A. Additions to Trust

Settlor may add to the trust estate by Will, deed or otherwise. Subject to the approval of

the Trustee in writing, other persons or entities may add to the trust.

B. Nonassignment

No beneficiary of a trust created herein shall anticipate, assign, or encumber, or subject

to any creditor's claim or to legal process any interest in principal or income before its

actual receipt by any beneficiary. The beneficial interest in this trust and the principal

and income rights shall be free from interference or control by any creditor of a

beneficiary and shall not be liable to attachment, execution, bankruptcy, or other process

of law.

C. Perpetuities Savings Clause

Except as otherwise specified, this trust shall terminate upon the death of ________

[

Name of Beneficiary], or earlier upon full distribution of the trust estate.

D. Choice of Law

The validity of this trust and the construction of its beneficial provisions shall be

governed by the laws of the State of ________ [

indicate state], in force from time to time.

This paragraph shall apply regardless of any change of residence of a Trustee or any

beneficiary, or the appointment or substitution of a Trustee residing or doing business in

another state.

Notwithstanding the foregoing, the validity and construction of this trust in relation to any

real property located in a jurisdiction outside the State of ________ [

indicate state], shall

be determined under the laws of such jurisdiction. If the situs or place of administration

of the trust is changed to another state, the law of that state shall govern the

administration of the trust.

E. Construction

1. Gender and Number

In this instrument, in all matters of interpretation, whenever necessary to give effect to

any provision of this instrument, the masculine shall include the feminine and neuter and

vice versa, the singular shall include the plural, and the plural shall include the singular.

2. Headings

The headings, titles, and subtitles are inserted solely for convenient reference and shall

be ignored in any construction of this instrument.

3. Articles

Whenever this document refers to a provision contained in a specific article, section,

paragraph or subparagraph, the reference shall be to that article, section, paragraph or

subparagraph of this instrument.

4. Statutes, Codes and Regulations

All references to specific statutes, codes, or regulations shall include any successors.

5. Trustee and Fiduciaries

All references to Trustee, or any other fiduciary shall refer to the individuals or

institutions serving from time to time in such capacity under this instrument.

6. ''Shall'' and ''May''

The use of the word ''shall'' or the term ''is to'' indicates a mandatory direction, while the

use of the word ''may'' or the terms, ''wish that'' or ''desire that'' indicate a permissive, but

not mandatory, grant of authority.

F. Definitions

1. Class Terms

In this instrument, the term ''issue'' refers to lineal descendants of all degrees, and the

terms ''child,'' ''children,'' ''issue,'' and ''descendants'' and other class terminology include

claimants whose membership in the class is based on birth out of wedlock or adoption,

provided the person so born or adopted lived for a significant time during minority

(before or after adoption, in the case of adoption) as a member of the household of the

relevant natural or adoptive parent or the household of that parent's parent, brother,

sister, or surviving spouse. The rights of a person who would be included in a class gift

term on this basis, or on the basis of birth in wedlock, are not affected by subsequent

adoption of that person (or of one through whom he or she claims) by another, whether

within or outside the family.

2. Notice

''Notice'' throughout this trust agreement shall be in writing and shall either be personally

delivered or mailed with postage prepaid in a manner reasonably designed to

communicate the information contemplated.