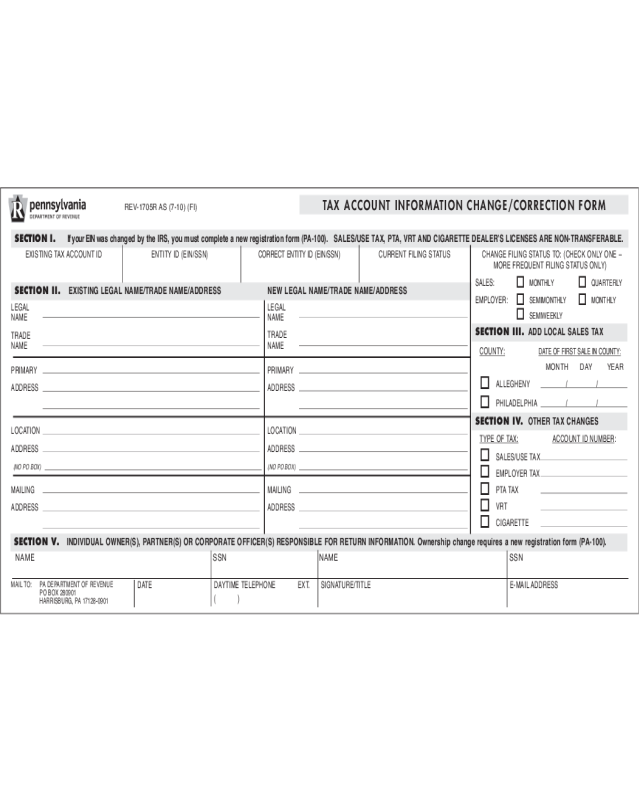

Fillable Printable Tax Account Information Change/Correction Form - Pennsylvania

Fillable Printable Tax Account Information Change/Correction Form - Pennsylvania

Tax Account Information Change/Correction Form - Pennsylvania

MAILING

ADDRESS

SECTION V.

INDIVIDUAL OWNER(S), PARTNER(S) OR CORPORATE OFFICER(S) RESPONSIBLE FOR RETURN INFORMATION. Ownership change requires a new registration form (PA-100).

NAME SSN NAME SSN

DATE DAYTIME TELEPHONE EXT. SIGNATURE/TITLE E-MAIL ADDRESS

( )

MAIL TO: PA DEPARTMENT OF REVENUE

PO BOX 280901

HARRISBURG, PA 17128-0901

SECTION III.

ADD LOCAL SALES TAX

COUNTY: DATE OF FIRST SALE IN COUNTY:

ALLEGHENY / /

PHILADELPHIA / /

SECTION IV.

OTHER TAX CHANGES

TYPE OF TAX: ACCOUNT ID NUMBER:

SALES/USE TAX

EMPLOYER TAX

PTA TAX

VRT

CIGARETTE

MAILING

ADDRESS

SECTION I.

If your EIN was changed by the IRS, you must complete a new registration form (PA-100). SALES/USE TAX, PTA, VRT AND CIGARETTE DEALER’S LICENSES ARE NON-TRANSFERABLE.

EXISTING TAX ACCOUNT ID ENTITY ID (EIN/SSN) CORRECT ENTITY ID (EIN/SSN) CURRENT FILING STATUS CHANGE FILING STATUS TO: (CHECK ONLY ONE –

SECTION II.

EXISTING LEGAL NAME/TRADE NAME/ADDRESS NEW LEGAL NAME/TRADE NAME/ADDRESS

REV-1705R AS (7-10) (FI)

TAX ACCOUNT INFORMATION CHANGE/CORRECTION FORM

MONTH DAY YEAR

PRIMARY

ADDRESS

PRIMARY

ADDRESS

LOCATION

ADDRESS

(NO PO BOX)

LOCATION

ADDRESS

(NO PO BOX)

LEGAL

NAME

TRADE

NAME

LEGAL

NAME

TRADE

NAME

MORE FREQUENT FILING STATUS ONLY)

SALES:

MONTHLY

QUARTERLY

EMPLOYER

:

SEMIMONTHLY

MONTHLY

SEMIWEEKLY

This form is to be used to report Entity ID (federal EIN/SSN), business name, address cor-

rections, a change to a more frequent filing status and/or to register to collect and

remit local sales tax. This form may also be used to change/correct information for other

business taxes. Sales/use tax, PTA, VRT and cigarette dealer’s licenses are

non-transferable. E-TIDES users may make changes directly to their accounts at

www.etides.state.pa.us using the Enterprise Maintenance function.

SECTION I.

Enter your eight-digit Account ID Number. Update your federal EIN if it has been

changed by the Internal Revenue Service. A new registration form (PA-100) must be

completed if you have received a new EIN. To change to a more frequent filing status,

check the appropriate block for sales tax or employer withholding. A change in filing

status will be effective only at the beginning of a filing period.

SECTION II.

Complete this section if your legal and/or trade name changed or if correcting an error.

However, if your legal and/or trade name changed as a result of a business reorgani-

zation (e.g., incorporation or a change in ownership), a new registration form (PA-100)

must be completed. If the Primary, Location and/or Mailing Address changed, complete

this section. A Post Office Box is not acceptable for a physical location.

SECTION III.

If a business opens a new location in Allegheny and/or Philadelphia county(ies), and it

does not currently report the local sales tax for that/these county(ies), complete this

section. Enter the date(s) of the first sale from either one or both counties, if applicable.

SECTION IV.

If changing information for other taxes, check the appropiate box and enter the corre-

sponding Account ID Number(s).

SECTION V.

If there are changes to the individual owner(s), partner(s), or corporate officer(s)

responsible for return information, complete this section.

If the owner(s), partner(s), or corporate officer(s) changed as a result of the

restructure of a business (e.g., incorporation or a change in ownership), a new reg-

istration form (PA-100) must be completed to obtain a new Account ID Number(s).

SIGN AND DATE THE FORM

Include a daytime telephone number and title. Mail the completed form to:

PA Department of Revenue, PO BOX 280901, Harrisburg, PA 17128-0901.

REGISTRATION METHODS

Register over the Internet at www.paopenforbusiness.state.pa.us. To obtain a paper

registration form (PA-100) and instructions, call 1-888-PATAXES (1-888-728-2937),

download the form from the department’s website at www.revenue.state.pa.us or

contact the Taxpayer Service and Information Center at (717) 787-1064; Service for

Taxpayers with Special Hearing and/or Speaking Needs 1-800-447-3020 (TT only).

INSTRUCTIONS FOR COMPLETING THE TAX ACCOUNT INFORMATION CHANGE/CORRECTION FORM (REV-1705)