Fillable Printable Tax Auditor Flyer (De 8078B)

Fillable Printable Tax Auditor Flyer (De 8078B)

Tax Auditor Flyer (De 8078B)

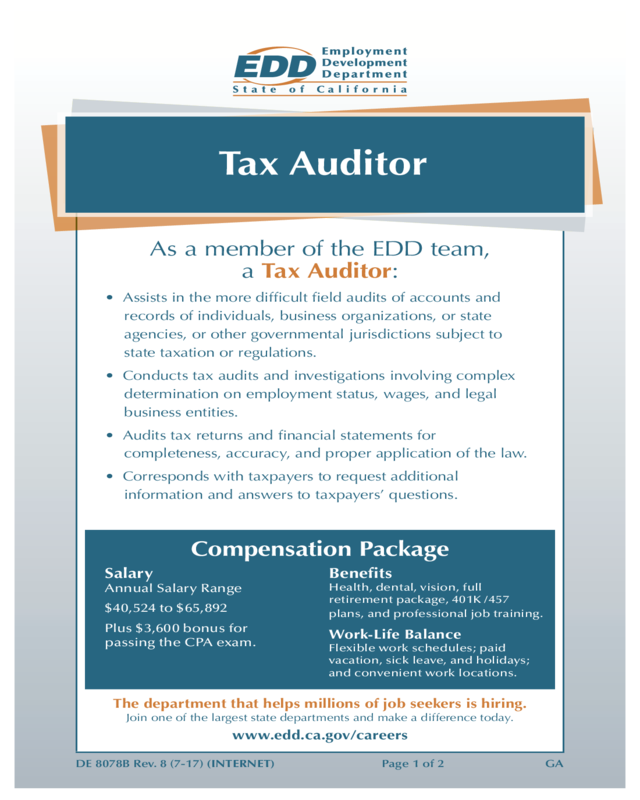

As a member of the EDD team,

a Tax Auditor:

• Assists in the more difficult field audits of accounts and

records of individuals, business organizations, or state

agencies, or other governmental jurisdictions subject to

state taxation or regulations.

• Conducts tax audits and investigations involving complex

determination on employment status, wages, and legal

business entities.

• Audits tax returns and financial statements for

completeness, accuracy, and proper application of the law.

• Corresponds with taxpayers to request additional

information and answers to taxpayers’ questions.

The department that helps millions of job seekers is hiring.

Join one of the largest state departments and make a difference today.

www.edd.ca.gov/careers

Compensation Package

Salary

Annual Salary Range

$40,524 to $65,892

Plus $3,600 bonus for

passing the CPA exam.

Benefits

Health, dental, vision, full

retirement package, 401K /457

plans, and professional job training.

Work-Life Balance

Flexible work schedules; paid

vacation, sick leave, and holidays;

and convenient work locations.

Tax Auditor

DE 8078B Rev. 8 (7-17) (INTERNET) Page 1 of 2 GA

DE 8078B Rev. 8 (7-17) (INTERNET) Page 2 of 2 GA

Minimum Qualifications

EITHER I: Equivalent to graduation from college, with a

specialization in accounting. (Registration as a senior student

in a recognized institution will admit applicants to the

examination, but they must produce evidence of successful

completion of the curriculum and the prescribed courses

(before they may be considered eligible for appointment.)

OR Il: Completion of a prescribed professional accounting

curriculum* given by a residence or correspondence

school of accountancy including courses in elementary

and advanced accounting, auditing, cost accounting, and

business law.

OR IlI: Completion of the equivalent of 19 semester units

of course work, 16 units of which shall be professional

accounting courses given by a collegiate-grade residence

institution including courses in elementary and advanced

accounting, auditing and cost accounting; and three semester

units of business law.

(*Applicants who will complete course work requirements

outlined under II and III above during the current quarter or

semester will be admitted to the examination, but they must

produce evidence of successful completion of the curriculum

and the prescribed courses before they may be considered

eligible for appointment.)

For more information, contact:

EDDRecruiter@edd.ca.gov

The EDD is an equal opportunity employer/program. Auxiliary aids and services

are available upon request to individuals with disabilities.