Fillable Printable Tax Rates, Wage Limits, And Value Of Meals And Lodging (De 3395)

Fillable Printable Tax Rates, Wage Limits, And Value Of Meals And Lodging (De 3395)

Tax Rates, Wage Limits, And Value Of Meals And Lodging (De 3395)

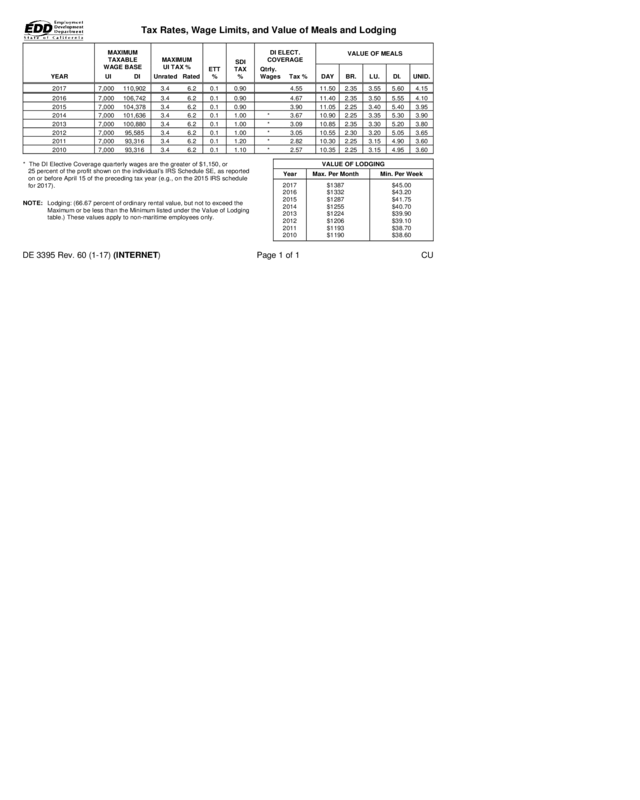

Tax Rates, Wage Limits, and Value of Meals and Lodging

YEAR

MAXIMUM

TAXABLE

WAG E BASE

UI DI

MAXIMUM

UI TAX %

Unrated Rated

ETT

%

SDI

TAX

%

DI ELECT.

COVERAGE

Qtrly.

Wages Tax %

VALUE OF MEALS

DAY

BR.

LU.

DI.

UNID.

2017

7,000

110,902

3.4

6.2

0.1

0.90

4.55

11.50

2.35

3.55

5.60

4.15

2016

7,000

106,742

3.4

6.2

0.1

0.90

4.67

11.40

2.35

3.50

5.55

4.10

2015

7,000

104,378

3.4

6.2

0.1

0.90

3.90

11.05

2.25

3.40

5.40

3.95

2014

7,000

101,636

3.4

6.2

0.1

1.00

*

3.67

10.90

2.25

3.35

5.30

3.90

2013

7,000

100,880

3.4

6.2

0.1

1.00

*

3.09

10.85

2.35

3.30

5.20

3.80

2012

7,000

95,585

3.4

6.2

0.1

1.00

*

3.05

10.55

2.30

3.20

5.05

3.65

2011

7,000

93,316

3.4

6.2

0.1

1.20

*

2.82

10.30

2.25

3.15

4.90

3.60

2010

7,000

93,316

3.4

6.2

0.1

1.10

*

2.57

10.35

2.25

3.15

4.95

3.60

* The DI Elective Coverage quarterly wages are the greater of $1,150, or

25 percent of the profit shown on the individual’s IRS Schedule SE, as reported

on or before April 15 of the preceding tax year (e.g., on the 2015 IRS schedule

for 2017).

NOTE:

Lodging: (66.67 percent of ordinary rental value, but not to exceed the

Maximum or be less than the Minimum listed under the Value of Lodging

table.) These values apply to non-maritime employees only.

VALUE OF LODGING

Year Max. Per Month Min. Per Week

2017

2016

2015

2014

2013

2012

2011

2010

$1387

$1332

$1287

$1255

$1224

$1206

$1193

$1190

$45.00

$43.20

$41.75

$40.70

$39.90

$39.10

$38.70

$38.60

DE 3395 Rev. 60 (1-17) (INTERNET) Page 1 of 1 CU