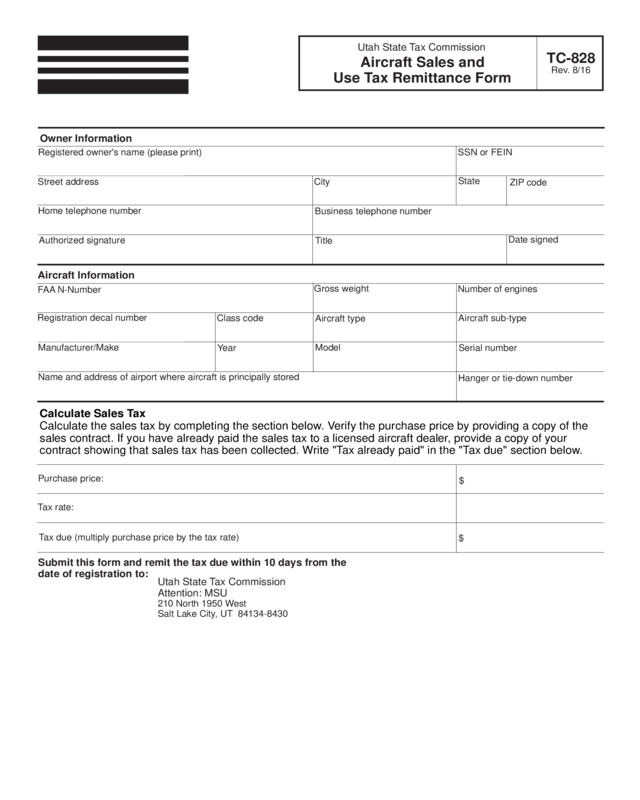

Fillable Printable Tc-828, Aircraft Utah Sales And Use Tax Remittance Form

Fillable Printable Tc-828, Aircraft Utah Sales And Use Tax Remittance Form

Tc-828, Aircraft Utah Sales And Use Tax Remittance Form

Calculate Sales Tax

Calculate the sales tax by completing the section below. Verify the purchase price by providing a copy of the

sales contract. If you have already paid the sales tax to a licensed aircraft dealer, provide a copy of your

contract showing that sales tax has been collected. Write "Tax already paid" in the "Tax due" section below.

Submit this form and remit the tax due within 10 days from the

date of registration to:

TC-828

Rev. 8/16

Aircraft Sales and

Use Tax Remittance Form

Home telephone number

Manufacturer/Make

Tax due (multiply purchase price by the tax rate)

Year

Model

Authorized signature

Name and address of airport where aircraft is principally stored

Title

Date signed

Hanger or tie-down number

Business telephone number

Serial number

Owner Information

Aircraft Information

Registered owner's name (please print)

FAA N-Number

Purchase price:

$

$

Gross weight

Number of engines

Street address

Registration decal number

Tax rate:

SSN or FEIN

Class code

City

Aircraft type

State

Aircraft sub-type

ZIP code

Utah State Tax Commission

Attention: MSU

210 North 1950 West

Salt Lake City, UT 84134-8430

Utah State Tax Commission

Clear form