Fillable Printable Tc-90Cb - Utah State Tax Commission

Fillable Printable Tc-90Cb - Utah State Tax Commission

Tc-90Cb - Utah State Tax Commission

US

T

C

O

RI

G

INAL F

O

RM

You can complete this form in TAP at tap.tax.utah.gov/TaxExpress.

Check below

►

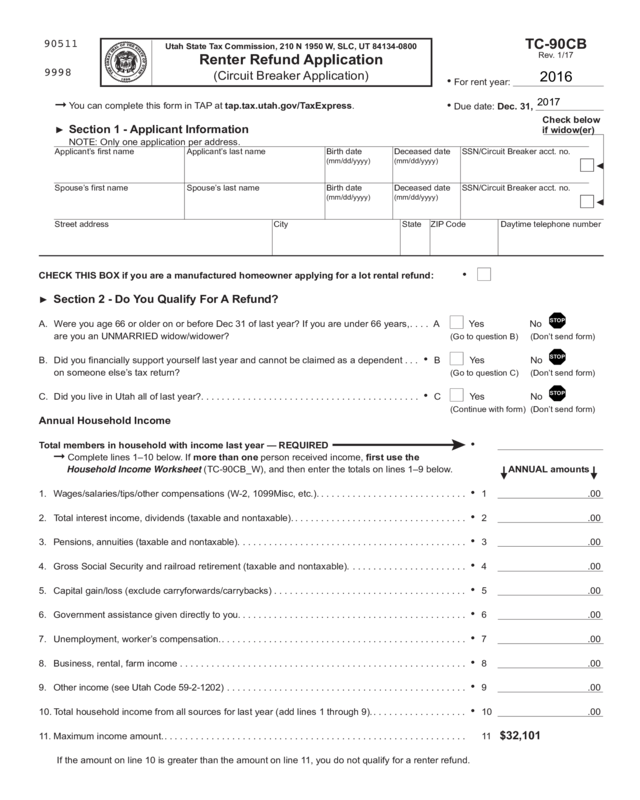

Section 1 - Applicant Information if widow(er)

NOTE: Only one application per address.

Applicant’s first name Applicant’s last name Birth date Deceased date SSN/Circuit Breaker acct. no.

(mm/dd/yyyy) (mm/dd/yyyy)

Spouse’s first name Spouse’s last name Birth date Deceased date SSN/Circuit Breaker acct. no.

(mm/dd/yyyy) (mm/dd/yyyy)

Street address City State ZIP Code Daytime telephone number

CHECK THIS BOX if you are a manufactured homeowner applying for a lot rental refund: •

► Section 2 - Do You Qualify For A Refund?

A. Were you age 66 or older on or before Dec 31 of last year? If you are under 66 years,. . . . A Yes No

are you an UNMARRIED widow/widower?

(Go to question B) (Don’t send form)

B. Did you financially support yourself last year and cannot be claimed as a dependent . . . • B Yes No

on someone else’s tax return?

(Go to question C) (Don’t send form)

C. Did you live in Utah all of last year?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . • C Yes No

(Continue with form) (Don’t send form)

Annual Household Income

Total members in household with income last year — REQUIRED •

Complete lines 1–10 below. If more than one person received income, first use the

Household Income Worksheet (TC-90CB_W), and then enter the totals on lines 1–9 below.

ANNUAL amounts

1. Wages/salaries/tips/other compensations (W-2, 1099Misc, etc.). . . . . . . . . . . . . . . . . . . . . . . . . . . . . • 1 .00

2. Total interest income, dividends (taxable and nontaxable). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

• 2 .00

3. Pensions, annuities (taxable and nontaxable). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

• 3 .00

4. Gross Social Security and railroad retirement (taxable and nontaxable). . . . . . . . . . . . . . . . . . . . . . .

• 4 .00

5. Capital gain/loss (exclude carryforwards/carrybacks) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

• 5 .00

6. Government assistance given directly to you. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

• 6 .00

7. Unemployment, worker’s compensation.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

• 7 .00

8. Business, rental, farm income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

• 8 .00

9. Other income (see Utah Code 59-2-1202) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

• 9 .00

10. Total household income from all sources for last year (add lines 1 through 9). . . . . . . . . . . . . . . . . . .

• 10 .00

11. Maximum income amount.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

$32,101

If the amount on line 10 is greater than the amount on line 11, you do not qualify for a renter refund.

STOP

STOP

STOP

►

►

90511

Utah State Tax Commission, 210 N 1950 W, SLC, UT 84134-0800

Renter Refund Application

(Circuit Breaker Application)

TC-90CB

Rev. 1/17

9998

•

For rent year:

•

Due date: Dec. 31,

Clear form

2016

2017

US

T

C

O

RI

G

INAL F

O

RM

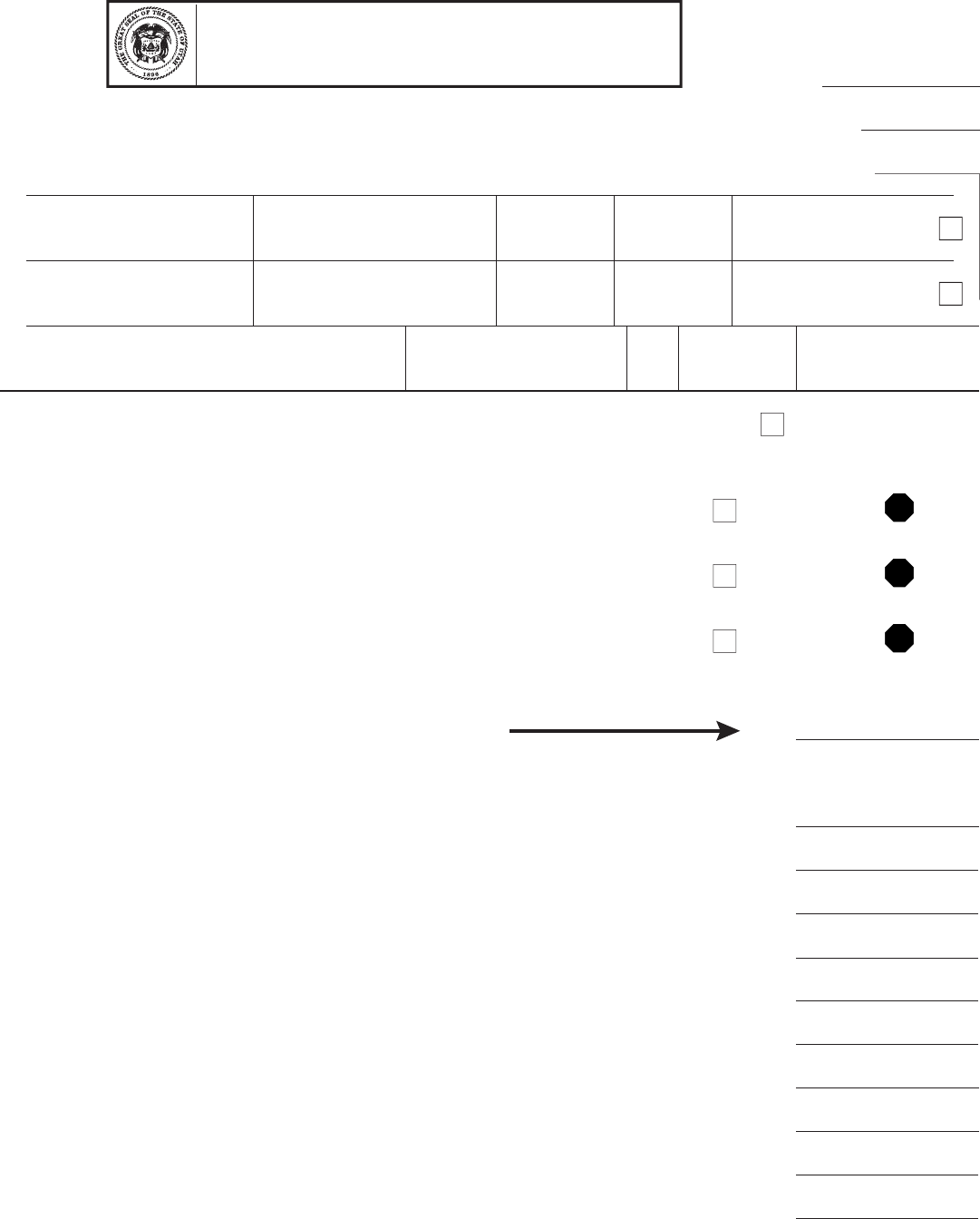

► Section 3 - Last Year’s Rent Information (see instructions)

List each place you rented last year. Enter the total months you lived at each address LAST YEAR ONLY.

Enter the total amount of rent YOU paid ONLY. If you received rental assistance, only enter the portion of rent YOU paid

out-of-pocket. Do NOT include other fees (such as cable, storage, parking, pet, cleaning, late payment, etc.).

#1 Rental address Landlord name Landlord phone no. • Months last • Total rent paid last year

year at address at this address

.00

• Check if gas is included in rent • Check if electricity is included in rent

#2 Rental address Landlord name Landlord phone no. • Months last • Total rent paid last year

year at address at this address

.00

• Check if gas is included in rent • Check if electricity is included in rent

#3 Rental address Landlord name Landlord phone no.

• Months last • Total rent paid last year

year at address at this address

.00

• Check if gas is included in rent • Check if electricity is included in rent

► Section 4 - Residency Status, Certification and Signature

Under state and federal law, we are prohibited from processing this application or issuing a credit to any person who fails

to provide residency status information.

Check ONE (providing false information subjects the signer to penalties for perjury):

• 1. I am a U.S. citizen.

• 2. I qualify under 8 U.S.C. 1641 and I am present in the U.S. lawfully.

If you checked box 2, you must file this form in person and bring proof of your I-94 Number and/or Alien Registration Number.

• I-94 Number*: • Alien Registration Number*:

*The I-94 (arrival/departure) number and the Alien Registration Number are issued by the U.S. Citizenship and Immigration Service.

Under penalties of perjury, I declare to the best of my knowledge and understanding, all the information on this application is

true, correct and complete.

Complete and sign this application, then mail to:

UTAH STATE TAX COMMISSION Fax: 801-297-7574

210 N 1950 W Phone: 801-297-6254

SALT LAKE CITY, UT 84134

TC-90CB pg. 2

Signature of applicant Date Signature of spouse Date

Preparer’s name and address or organization (if applicable)

Preparer’s phone number

90512

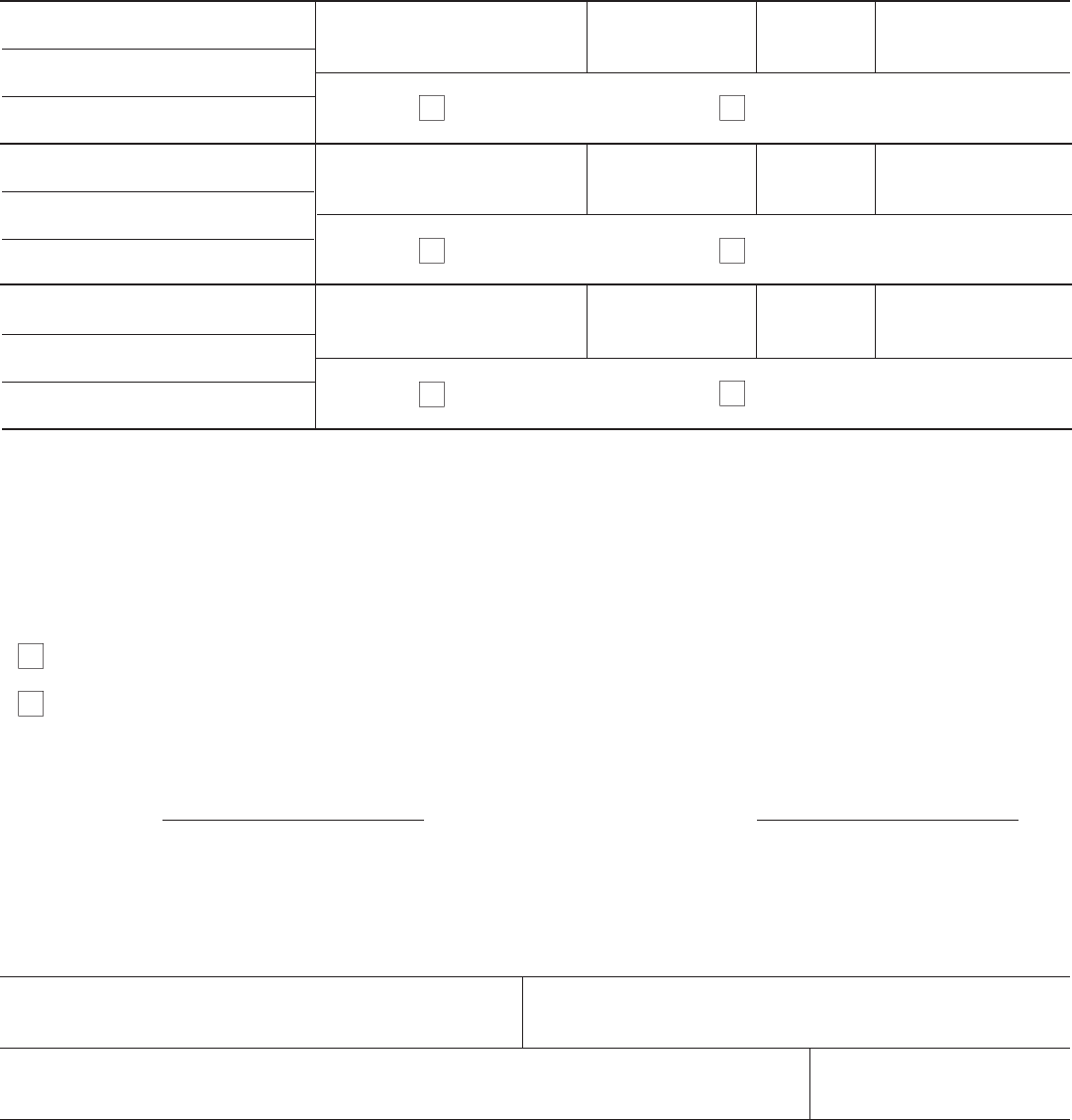

A. You B. Your Spouse C. Other Person D. Other Person E. Other Person F. Totals

in Household #1 in Household #2 in Household #3

Name. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Social Security Number. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1. Wages/salaries/tips/other

compensation (W-2,

1099Misc., etc.)

2. Total interest income

and dividends (taxable

and nontaxable)

3. Pensions and annuities

(taxable and nontaxable)

4. Gross Social Security

& railroad retirment

(taxable and nontaxable)

5. Capital gain/loss

(exclude carryforwards/

carrybacks)

6. Government assistance

given directly to you

7. Unemployment,

worker’s compensation

8. Business, rental and

farm income

9. Other income (alimony,

nontaxable interest, etc.)

See Utah Code 59-2-1202

NOTE: If you entered numbers on lines 3, 5, 6, or 8, keep copies of federal returns and schedules with your records.

90513

Household Income Worksheet TC-90CB_W

t

Use this worksheet if you were not the only person in your household with income last year.

t

On each line, enter total ANNUAL amounts for the whole year.

t

For each line, add the amounts in columns A through E and enter the total in Column F.

t

Enter the totals from column F in Section 2 (Household Income) of the Renter Refund Application.

.00 .00 .00 .00 .00 .00

.00 .00 .00 .00 .00 .00

.00 .00 .00 .00 .00 .00

.00 .00 .00 .00 .00 .00

.00 .00 .00 .00 .00 .00

.00 .00 .00 .00 .00 .00

.00 .00 .00 .00 .00 .00

.00 .00 .00 .00 .00 .00

.00 .00 .00 .00 .00 .00

USTC ORIGINAL FOR

no

no

Se

Se

T

T

Renter Refund Application Instructions

Submit only ONE application per address.

Report total

ANNUAL amounts for income and rent — do NOT report monthly

amounts.

Section 1 – Applicant Information

• You must complete all fields.

• If you are a widow(er) age 66 or older, you do not need to

provide information about your deceased spouse.

• If you are an unmarried widow(er) under age 66, check the

widow(er) box and enter your spouse's name, birth date,

death date and SSN or account ID. A surviving spouse must

have been a member of the deceased spouse's household at

the time of their death, and be unmarried at the time the

claim is filed.

Section 2 – Do You Qualify For a Refund?

You must answer questions A - C.

Annual Household Income

•

Enter the total number of members in the household on

the first line of this section.

• Household income is ALL INCOME received from ALL

PERSONS living in the household last year, not just the

applicant. If the applicant is the only household member with

income, complete lines 1 - 9.

• If more than one household member received income, you

must complete the Household Income Worksheet. Take the

totals from column F of the worksheet and copy them to

Section 2, lines 1 - 9 of the application. Submit BOTH the

application AND the worksheet.

• Keep all federal returns and schedules with your records in

case of Tax Commission review.

Section 3 – Annual Rent Information

For each location entered, you must complete all fields. Keep

proof with your records showing how much rent was paid

(receipts, bank copies of cancelled checks, etc.).

Section 4 – Residency Status, Certification and Signature

• Enter your residency status. Check ONE box ONLY. If you

check box 2, you must file this form in person and show proof

of your I-94 and/or Alien Registration Number.

• To present proof of your I-94 or Alien Registration Number

please go to one of the following Tax Commission locations:

210 North 1950 West 2540 Washington Blvd., 6th Floor

Salt Lake City, Utah 84134 Ogden Regional Center

Ogden, Utah 84401

150 East Center #1300 100 South 5300 West

Provo, Utah 84606 Hurricane, Utah 84737

Sign the application. If a preparer completed this form on

your behalf, enter the preparer’s name, address and phone

number.

What To Attach

Send the following with your application (also keep a copy for

your records):

• TC-90CB, pages one and two.

• TC-90CB Schedule W if more than one household member

received income.

What To Keep

• Your federal returns and schedules.

• All other supporting documentation, including proof of income

and rent paid.

We will review and determine eligibility for refund. You may be

required to submit more information to support your claims.

NOTE: Your refund may be delayed and/or reduced if you

enter monthly figures for income or rent.

If you are a homeowner or manufactured homeowner

applying for a property tax credit, you must file form TC-90CY

with the county where the property is located by Sept 1 of this

year. Contact your local county agency for more information.

See Pub 36 for more information about property tax relief. Get

Pub 36 online at tax.utah.gov/forms/pubs/pub-36.pdf.

For More Information Contact:

Utah State Tax Commission

801-297-6254, or

1-800-662-4335 ext. 6254

Davis County Aging Services

801-525-5050

Salt Lake County Aging Services

385-468-3200

Utah County Aging Services

801-229-3800

Washington County Aging Services

435-634-5712

Also visit us online at tax.utah.gov

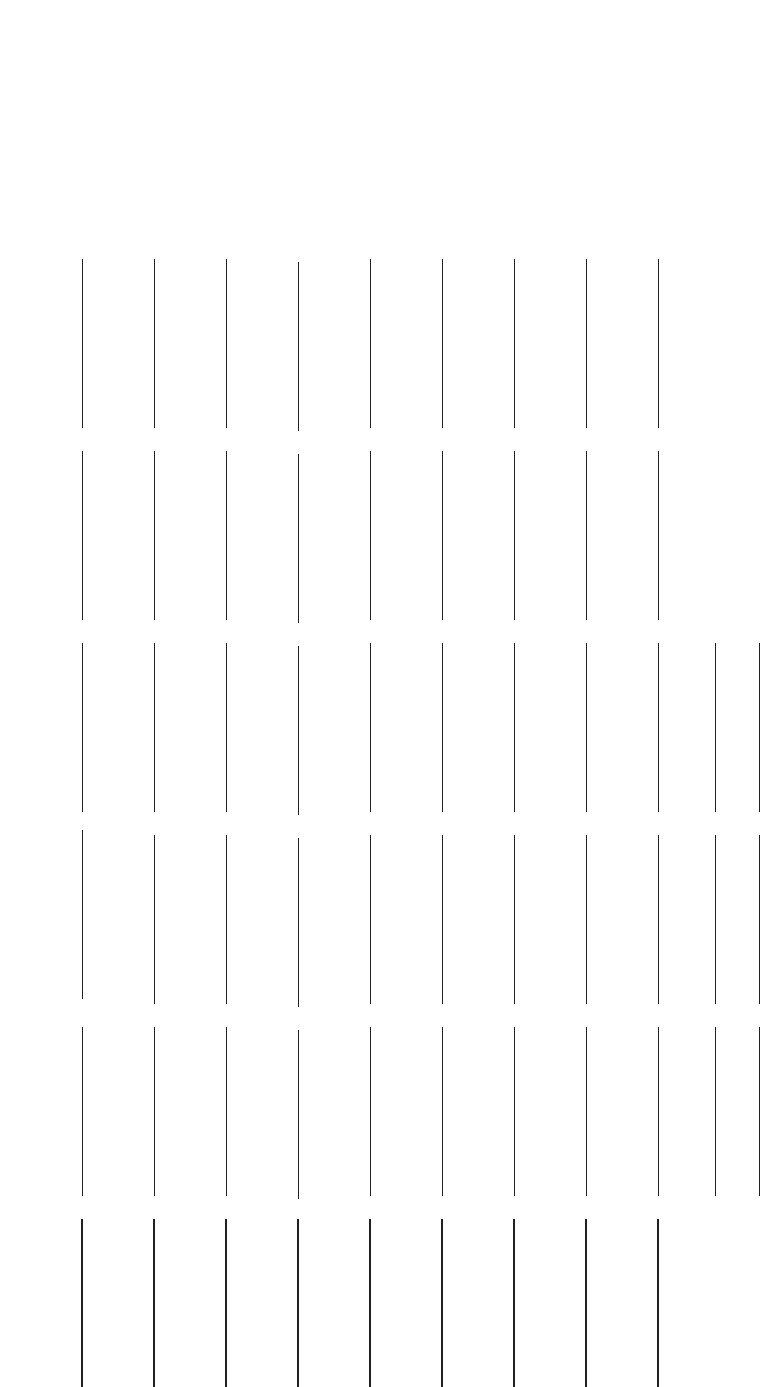

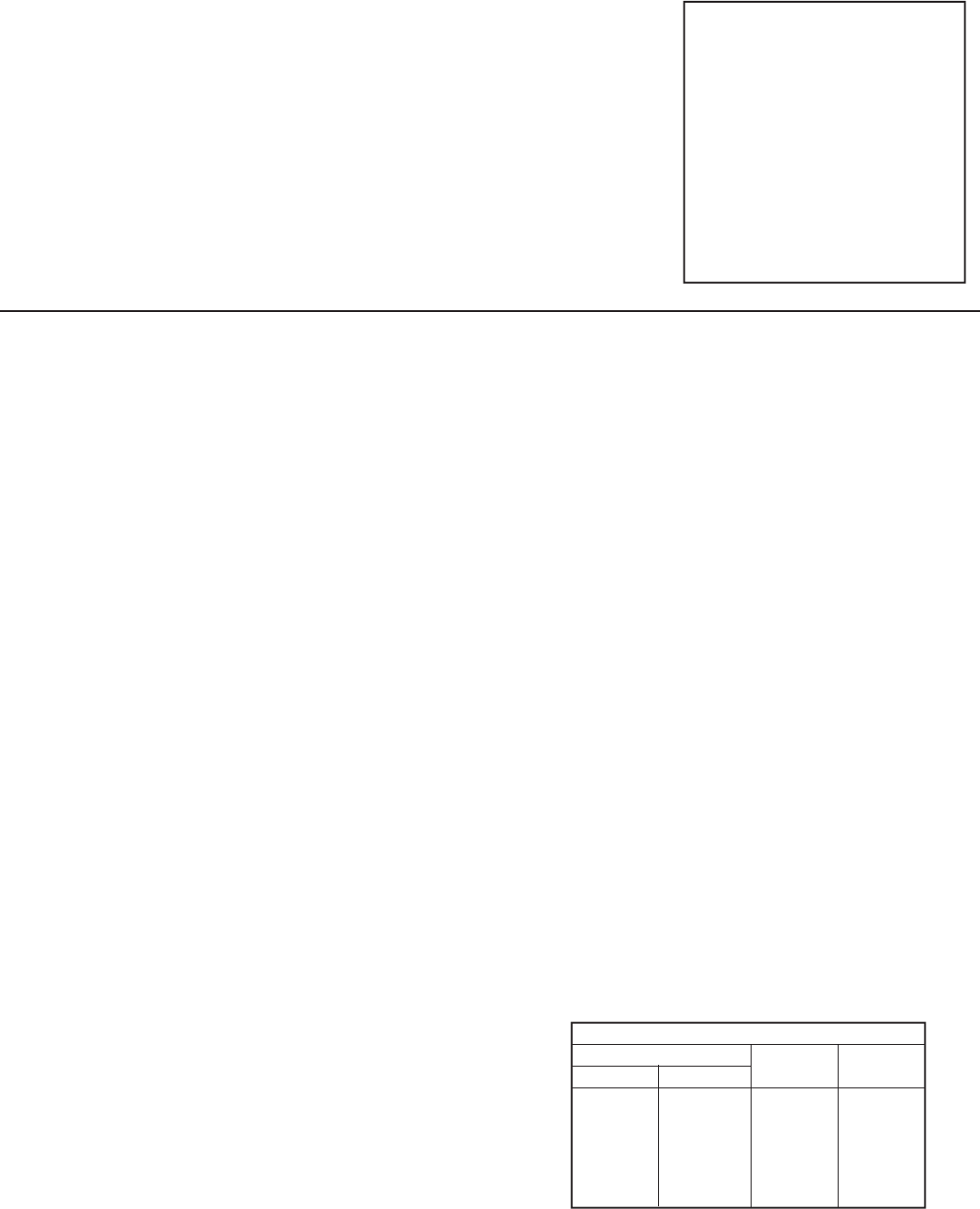

Renter Refund Schedule

2016 Household Income Limits

Renter Refund Maximum

Lower Upper

% of rent Renter Refund

$0 $10,913 9.5% $951

10,914 14,553 8.5% 829

14,554 18,190 7.0% 711

18,191 21,828 5.5% 533

21,829 25,468 4.0% 415

25,469 28,890 3.0% 237

28,891 32,101 2.5% 117

Renter Refund Application TC-90CB

instructions