Fillable Printable Tc-90Cy - Utah State Tax Commission

Fillable Printable Tc-90Cy - Utah State Tax Commission

Tc-90Cy - Utah State Tax Commission

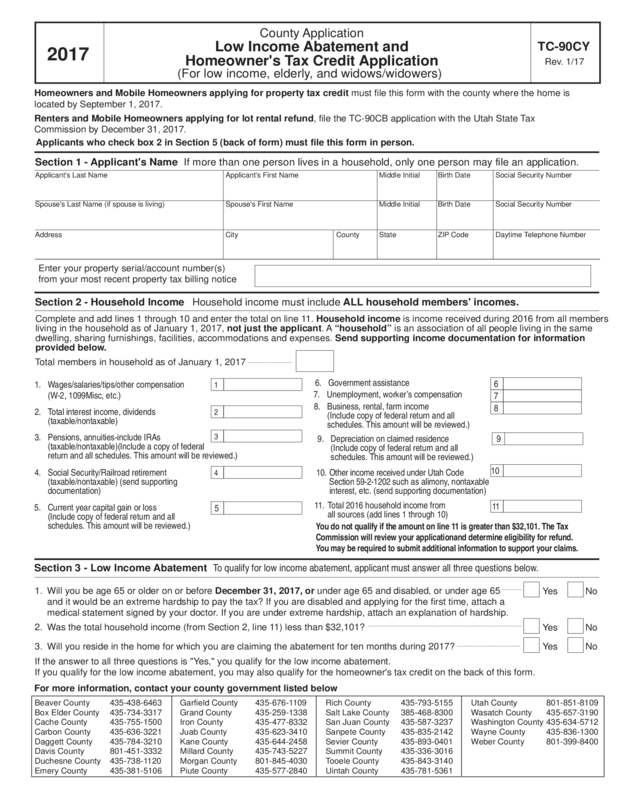

County Application

Low Income Abatement and

Homeowner's Tax Credit Application

(For low income, elderly, and widows/widowers)

TC-90CY

Rev. 1/17

Homeowners and Mobile Homeowners applying for property tax credit must file this form with the county where the home is

located by September 1, 2017.

Renters and Mobile Homeowners applying for lot rental refund, file the TC-90CB application with the Utah State Tax

Commission by December 31, 2017.

Section 1 - Applicant's Name If more than one person lives in a household, only one person may file an application.

Applicant's Last Name Applicant's First Name Middle Initial Birth Date Social Security Number

Spouse's Last Name (if spouse is living) Spouse's First Name Middle Initial Birth Date Social Security Number

Address City County State ZIP Code Daytime Telephone Number

Enter your property serial/account number(s)

from your most recent property tax billing notice

Section 2 - Household Income Household income must include ALL household members' incomes.

Complete and add lines 1 through 10 and enter the total on line 11. Household income is income received during 2016 from all members

living in the household as of January 1, 2017, not just the applicant. A “household” is an association of all people living in the same

dwelling, sharing furnishings, facilities, accommodations and expenses. Send supporting income documentation for information

provided below.

Total members in household as of January 1, 2017

Section 3 - Low Income Abatement To qualify for low income abatement, applicant must answer all three questions below.

Yes No

1. Will you be age 65 or older on or before December 31, 2017, or under age 65 and disabled, or under age 65

and it would be an extreme hardship to pay the tax? If you are disabled and applying for the first time, attach a

medical statement signed by your doctor. If you are under extreme hardship, attach an explanation of hardship.

Yes No

2. Was the total household income (from Section 2, line 11) less than $32,101?

Yes No

3. Will you reside in the home for which you are claiming the abatement for ten months during 2017?

If the answer to all three questions is "Yes," you qualify for the low income abatement.

If you qualify for the low income abatement, you may also qualify for the homeowner's tax credit on the back of this form.

For more information, contact your county government listed below

You do not qualify if the amount on line 11 is greater than $32,101. The Tax

Commission will review your applicationand determine eligibility for refund.

You may be required to submit additional information to support your claims.

Applicants who check box 2 in Section 5 (back of form) must file this form in person.

1. Wages/salaries/tips/other compensation

(W-2, 1099Misc, etc.)

1

5. Current year capital gain or loss

(Include copy of federal return and all

schedules. This amount will be reviewed.)

5

2. Total interest income, dividends

(taxable/nontaxable)

2

6. Government assistance

6

3. Pensions, annuities-include IRAs

(taxable/nontaxable)(Include a copy of federal

return and all schedules. This amount will be reviewed.)

3

7. Unemployment, worker’s compensation

7

4. Social Security/Railroad retirement

(taxable/nontaxable) (send supporting

documentation)

4

8. Business, rental, farm income

(Include copy of federal return and all

schedules. This amount will be reviewed.)

8

11. Total 2016 household income from

all sources (add lines 1 through 10)

10. Other income received under Utah Code

Section 59-2-1202 such as alimony, nontaxable

interest, etc. (send supporting documentation)

10

11

9. Depreciation on claimed residence

(Include copy of federal return and all

schedules. This amount will be reviewed.)

9

Beaver County 435-438-6463

Box Elder County 435-734-3317

Cache County 435-755-1500

Carbon County 435-636-3221

Daggett County 435-784-3210

Davis County 801-451-3332

Duchesne County 435-738-1120

Emery County 435-381-5106

Garfield County 435-676-1109

Grand County 435-259-1338

Iron County 435-477-8332

Juab County 435-623-3410

Kane County 435-644-2458

Millard County 435-743-5227

Morgan County 801-845-4030

Piute County 435-577-2840

Rich County 435-793-5155

Salt Lake County 385-468-8300

San Juan County 435-587-3237

Sanpete County 435-835-2142

Sevier County 435-893-0401

Summit County 435-336-3016

Tooele County 435-843-3140

Uintah County 435-781-5361

Utah County 801-851-8109

Wasatch County 435-657-3190

Washington County 435-634-5712

Wayne County 435-836-1300

Weber County 801-399-8400

2017

Clear form

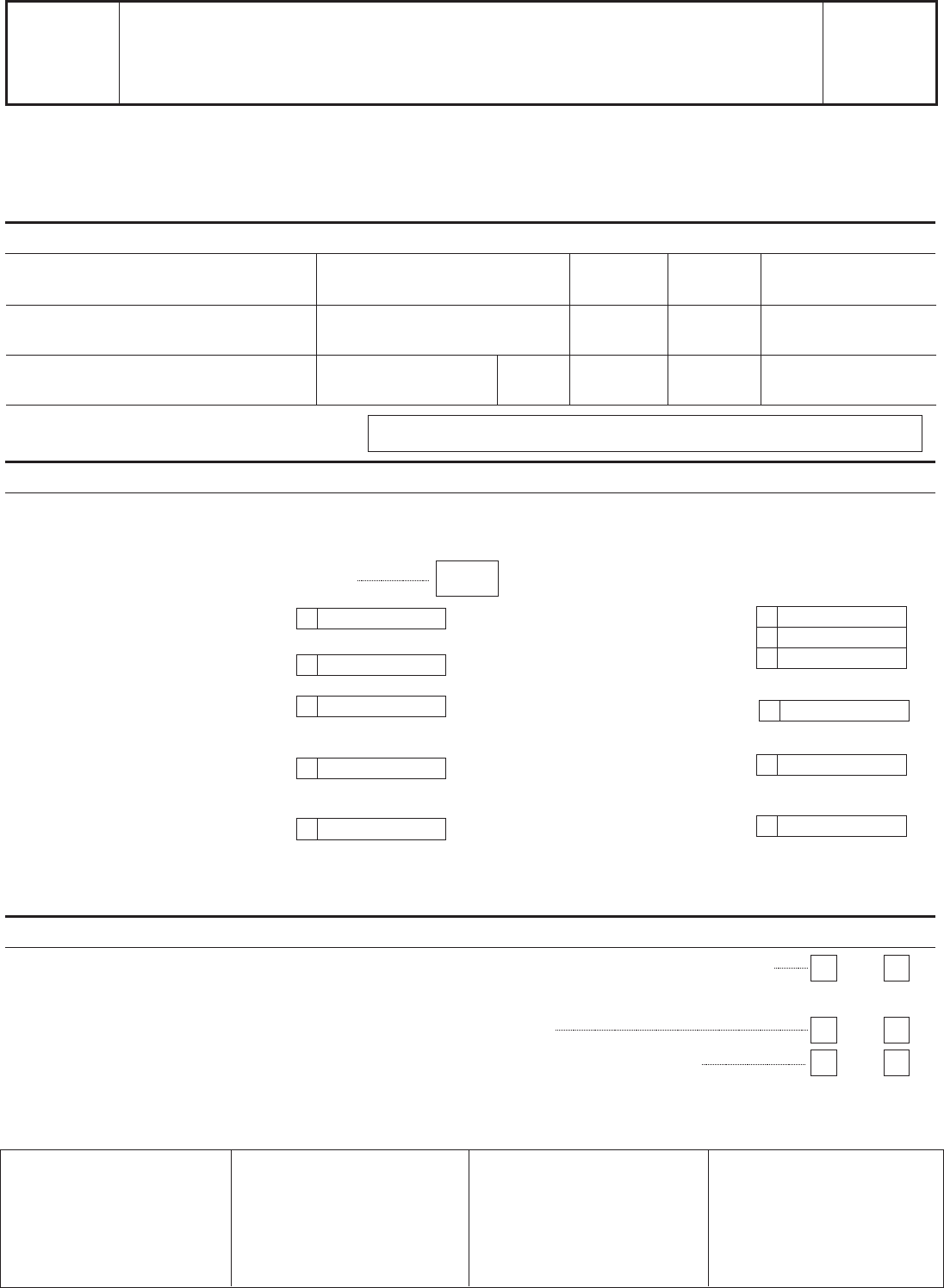

Section 4 - Homeowner's Tax Credit Applicant must answer all 4 questions.

Yes No

1. Will you be age 66 or older on or before December 31, 2017, or Are you a widow or widower? If you are a

widow or widower, enter your spouse's date of death:__________________________.

Yes No

2. Was the total household income (from Section 2, line 11) less than $32,101?

Yes No

3. Will you furnish your own financial support for 2017 (You cannot be claimed as a dependent on someone

else's tax return for 2017.)

Yes No

4. Will you live in Utah for the entire year of 2017?

You must be domiciled in Utah for the entire 2017 calendar year to be eligible.

If your name is not listed as the property owner of the Property Tax Billing Notice, attach legal documentation of ownership.

Only property tax on applicant's primary residence is eligible for property tax credit.

Is the home located on property that exceeds one acre?

Yes No If yes, total number of acres

Is any portion of the home rented out?

Yes No If yes, what percent is rented

Is a portion of the home used for business?

Yes No If yes, what percent is used

You must have owned the home on January 1, 2017 to qualify.

If you qualify for property tax credit, you may also qualify for low income abatement, on the front of this form.

Section 6 - Certification and Signature Read certification, sign and date.

Under penalties of perjury, I declare to the best of my knowledge and understanding, this information is true, correct and complete.

Signature of applicant Date Signature of spouse (Spouse must sign if home is owned in joint tenancy) Date

XX

Preparer's name and address or organization (if not applicant) Preparer's telephone number

For Tax Commission Use Only For County Use Only

CB used by county CB available (max-used) Tax amount

CB rent possible CB rent issue <= CB available

Blind and/or veteran

Homeowner's Valuation Reduction (additional 20%)

Circuit breaker

Low income abatement

Net tax due

County government approval

Date approved

Section 5 - Residency Status of Applicant

Under penalties of perjury, I declare that I am a U.S. citizen OR that I qualify under 8 U.S.C 1641 and am present in the

United States lawfully.

Signature of applicant

Date signed

Under state and federal law we are prohibited from processing this application or issuing a credit to any person who

fails to provide this information.

Check one (providing false information subjects the signer to penalties for perjury):

1. I am a U.S. citizen and have provided my Social Security Number on the front of this form.

2. I qualify under 8 U.S.C. 1641 and I am present in the U.S. lawfully. I-94 Number*:

_______________

Alien Registration Number*:

_______________

*The I-94 (arrival/departure) number and/or the Alien Registration

Number are issued by the U.S. Citizenship and Immigration Service.

If you checked box 2, you must file this form

in person and bring proof of your I-94 Number

and/or Alien Registration Number.

X

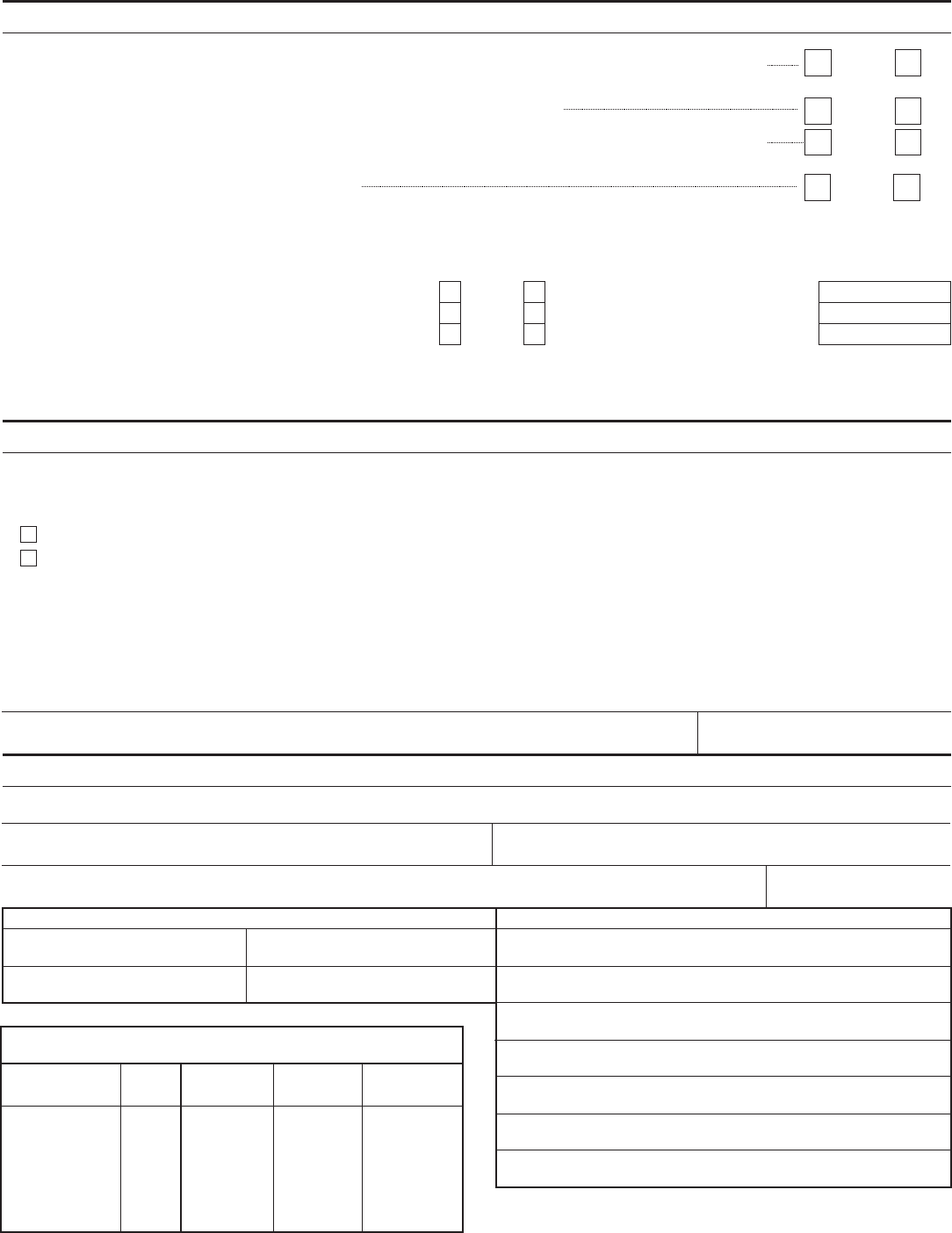

Property Tax Credit / Renter Refund Schedule

2016 Household

Maximum

Renter Refund Total Maximum

Total Maximum

Income

Homeowner

% of Lot Rent Renter Refund

Homeowner &

Tax Credit

Rental Refund

$0 $10,913 $951 9.5% $951 $1,902

10,914 14,553 829 8.5% 829 1,658

14,554 18,190 71 1 7.0% 71 1 1,422

18,191 21,828 533 5.5% 533 1,066

21,829 25,468 415 4.0% 415 830

25,469 28,890 237 3.0% 237 474

28,891 32,101 1 17 2.5% 1 17 234