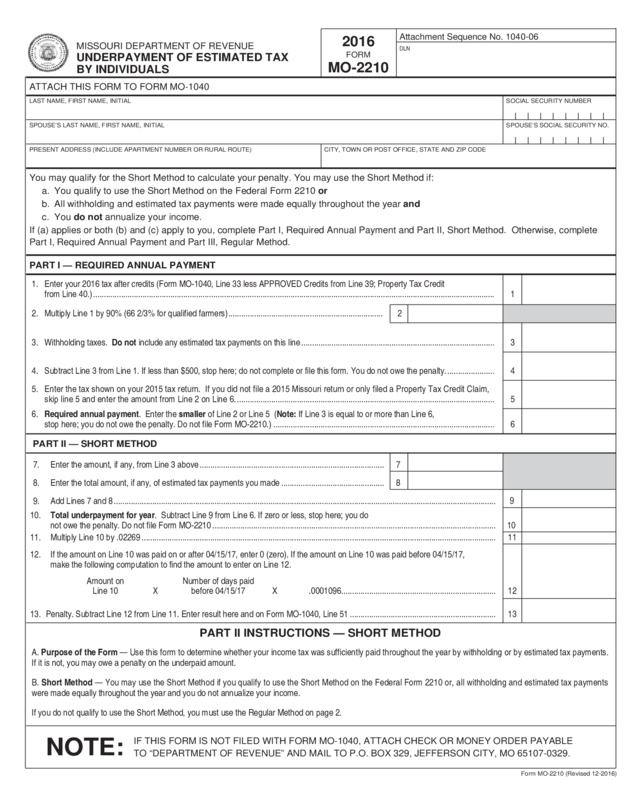

Fillable Printable Underpayment Of Estimated Tax By Individuals Form Mo-2210

Fillable Printable Underpayment Of Estimated Tax By Individuals Form Mo-2210

Underpayment Of Estimated Tax By Individuals Form Mo-2210

7. Enter the amount, if any, from Line 3 above ...................................................................................... 7

8. Enter the total amount, if any, of estimated tax payments you made ................................................ 8

9. Add Lines 7 and 8 ..................................................................................................................................................................................

10. Total underpayment for year. Subtract Line 9 from Line 6. If zero or less, stop here; you do

not owe the penalty. Do not file Form MO-2210 .................................................................................................................................... 10

11. Multiply Line 10 by .02269 ..................................................................................................................................................................... 11

12. If the amount on Line 10 was paid on or after 04/15/17, enter 0 (zero). If the amount on Line 10 was paid before 04/15/17,

make the following computation to find the amount to enter on Line 12.

Amount on Number of days paid

Line 10 X before 04/15/17 X .0001096 ........................................................................ 12

13. Penalty. Subtract Line 12 from Line 11. Enter result here and on Form MO-1040, Line 51 .................................................................... 13

MISSOURI DEPARTMENT OF REVENUE

UNDERPAYMENT OF ESTIMATED TAX

BY INDIVIDUALS

2016

FORM

MO-2210

Form MO-2210 (Revised 12-2016)

ATTACH THIS FORM TO FORM MO-1040

LAST NAME, FIRST NAME, INITIAL SOCIAL SECURITY NUMBER

SPOUSE’S LAST NAME, FIRST NAME, INITIAL SPOUSE’S SOCIAL SECURITY NO.

PRESENT ADDRESS (INCLUDE APARTMENT NUMBER OR RURAL ROUTE) CITY, TOWN OR POST OFFICE, STATE AND ZIP CODE

NOTE:

IF THIS FORM IS NOT FILED WITH FORM MO-1040, ATTACH CHECK OR MONEY ORDER PAYABLE

TO “DEPARTMENT OF REVENUE” AND MAIL TO P.O. BOX 329, JEFFERSON CITY, MO 65107-0329.

You may qualify for the Short Method to calculate your penalty. You may use the Short Method if:

a. You qualify to use the Short Method on the Federal Form 2210 or

b. All withholding and estimated tax payments were made equally throughout the year and

c. You do not annualize your income.

If (a) applies or both (b) and (c) apply to you, complete Part I, Required Annual Payment and Part II, Short Method. Otherwise, complete

Part I, Required Annual Payment and Part III, Regular Method.

PART I — REQUIRED ANNUAL PAYMENT

1. Enter your 2016 tax after credits (Form MO-1040, Line 33 less APPROVED Credits from Line 39; Property Tax Credit

from Line 40.) ........................................................................................................................................................................................... 1

2. Multiply Line 1 by 90% (66 2/3% for qualified farmers) ........................................................................ 2

3. Withholding taxes. Do not include any estimated tax payments on this line .......................................................................................... 3

4. Subtract Line 3 from Line 1. If less than $500, stop here; do not complete or file this form. You do not owe the penalty. ...................... 4

5. Enter the tax shown on your 2015 tax return. If you did not file a 2015 Missouri return or only filed a Property Tax Credit Claim,

skip line 5 and enter the amount from Line 2 on Line 6.

........................................................................................................................ 5

6. Required annual payment. Enter the smaller of Line 2 or Line 5 (Note: If Line 3 is equal to or more than Line 6,

stop here; you do not owe the penalty. Do not file Form MO-2210.) ....................................................................................................... 6

PART II INSTRUCTIONS — SHORT METHOD

A. Purpose of the Form — Use this form to determine whether your income tax was sufficiently paid throughout the year by withholding or by estimated tax payments.

If it is not, you may owe a penalty on the underpaid amount.

B. Short Method — You may use the Short Method if you qualify to use the Short Method on the Federal Form 2210 or, all withholding and estimated tax payments

were made equally throughout the year and you do not annualize your income.

If you do not qualify to use the Short Method, you must use the Regular Method on page 2.

PART II — SHORT METHOD

DLN

Attachment Sequence No. 1040-06

9

Reset Form

Print Form

NOTE:

IF THIS FORM IS NOT FILED WITH FORM MO-1040, ATTACH CHECK OR MONEY ORDER PAYABLE

TO “DEPARTMENT OF REVENUE” AND MAIL TO P.O. BOX 329, JEFFERSON CITY, MO 65107-0329.

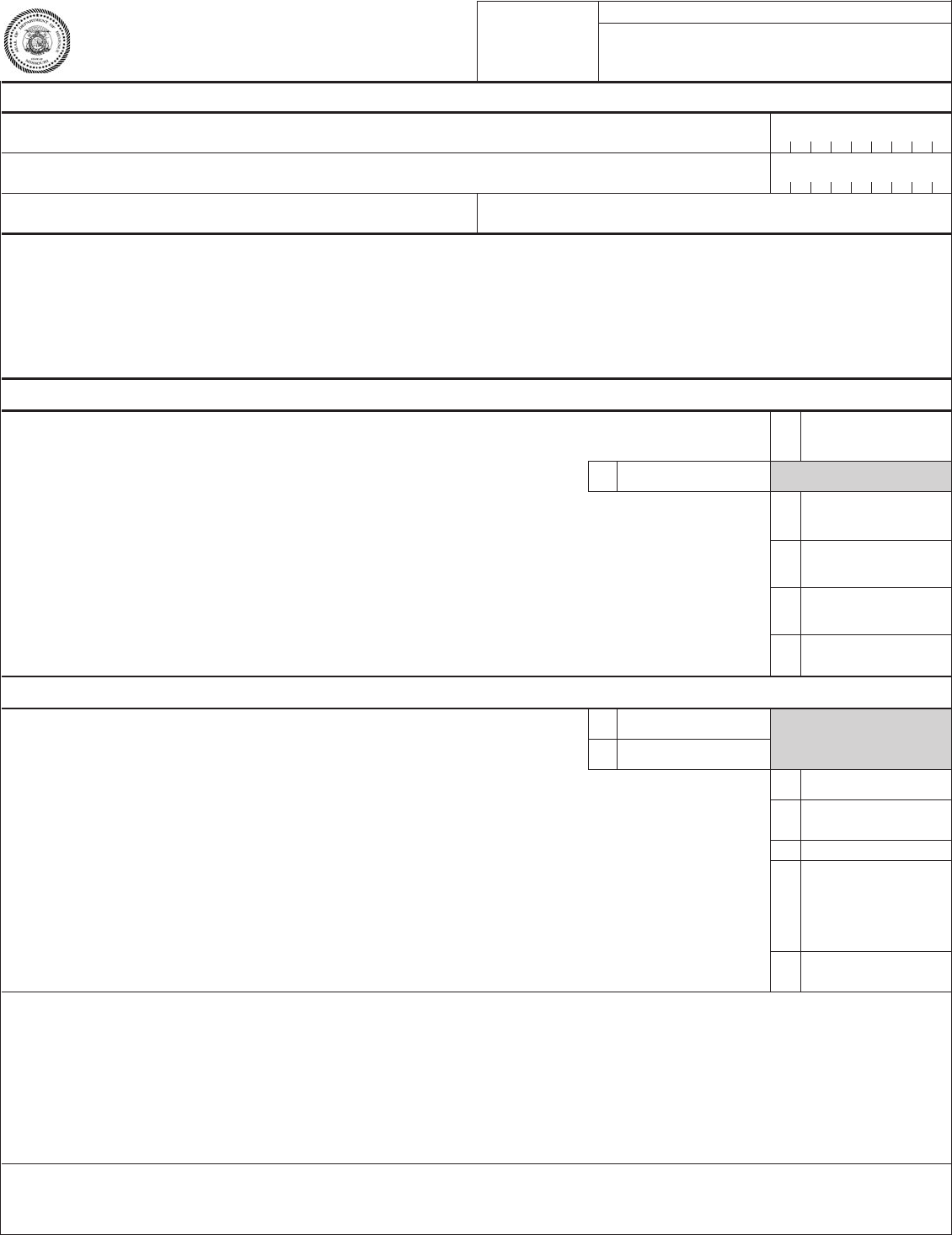

14. Required annual payment (Enter payment as computed on Part I, Line 6) ............................................................................................

15. Required installment payments .......................................................................

16. Estimated tax paid ...........................................................................................

17. Overpayment of previous installment ..............................................................

18. Total payments ................................................................................................

19. Underpayment of current installment ............................................................

19a. Overpayment of current installment ............................................................

19b. Underpayment of previous installment ........................................................

19c. Total overpayment ......................................................................................

19d. Total underpayment ....................................................................................

DUE DATES OF INSTALLMENTS

APR. 15, 2016 JUNE 15, 2016 SEPT. 15, 2016 JAN. 15, 2017

25% OF 2015 TAX 50% OF 2015 TAX 75% OF 2015 TAX 100% OF 2015 TAX

25% OF TAX 50% OF TAX 75% OF TAX 100% OF TAX

22.5% OF TAX 45% OF TAX 67.5% OF TAX

90% OF TAX 90% OF TAX 90% OF TAX

NAME AS SHOWN ON FRONT SOCIAL SECURITY NUMBER

PART III — REGULAR METHOD

SECTION A — FIGURE YOUR UNDERPAYMENT (COMPLETE LINES 14 THROUGH 19)

If you meet any of the exceptions (see instruction D) to the penalty for ALL quarters, omit Lines 14 through 19 and go directly to Line 20.

Page 2

SECTION C — FIGURE THE PENALTY (Complete Lines 25 through 29)

25. Amount of underpayment ................................................................................

26. Date of payment, due date of installment, or April 15, 2017,

whichever is earlier .........................................................................................

27a. Number of days between the due date of installment, and either the

date of payment, the due date of the next installment, or

December 31, 2016, whichever is earlier ........................................................

27b. Number of days from January 1, 2017 or installment date to date

of payment or April 15, 2017 ............................................................................

28a. Multiply the 3% annual interest rate times the amount on Line 25 for the

number of days shown on Line 27a. ................................................................

28b. Multiply the 4% annual interest rate times the amount on Line 25 for the

number of days shown on Line 27b. ................................................................

28c. Total penalty (Line 28a plus Line 28b) .............................................................

29. Total amounts on Line 28c. Show this amount on Line 51 of Form MO-1040 as “Underpayment of Estimated Tax Penalty”.

If you have an underpayment on Line 50 of Form MO-1040, enclose your check or money order for payment in the amount equal to the

total of Line 50 and the penalty amount on Line 51. If you have an overpayment on Line 49, the Department of Revenue

will reduce your overpayment by the amount of the penalty .....................................................................................................................................

SECTION B — EXCEPTIONS TO THE PENALTY (see instruction D)

(For special exceptions see instruction I for service in a “combat zone”, and instruction J for farmers.)

20. Total amount paid and withheld from January 1 through the installment

date indicated ..................................................................................................

21. Exception No. 1 — prior year’s tax

2015 tax ...............................................

22. Exception No. 2 — tax on prior year’s income using 2016

rates and exemptions ..............................................................................................

23. Exception No. 3 — tax on annualized 2016 income ........................................

24. Exception No. 4 — tax on 2016 income over 3, 5 and 8-month periods .........

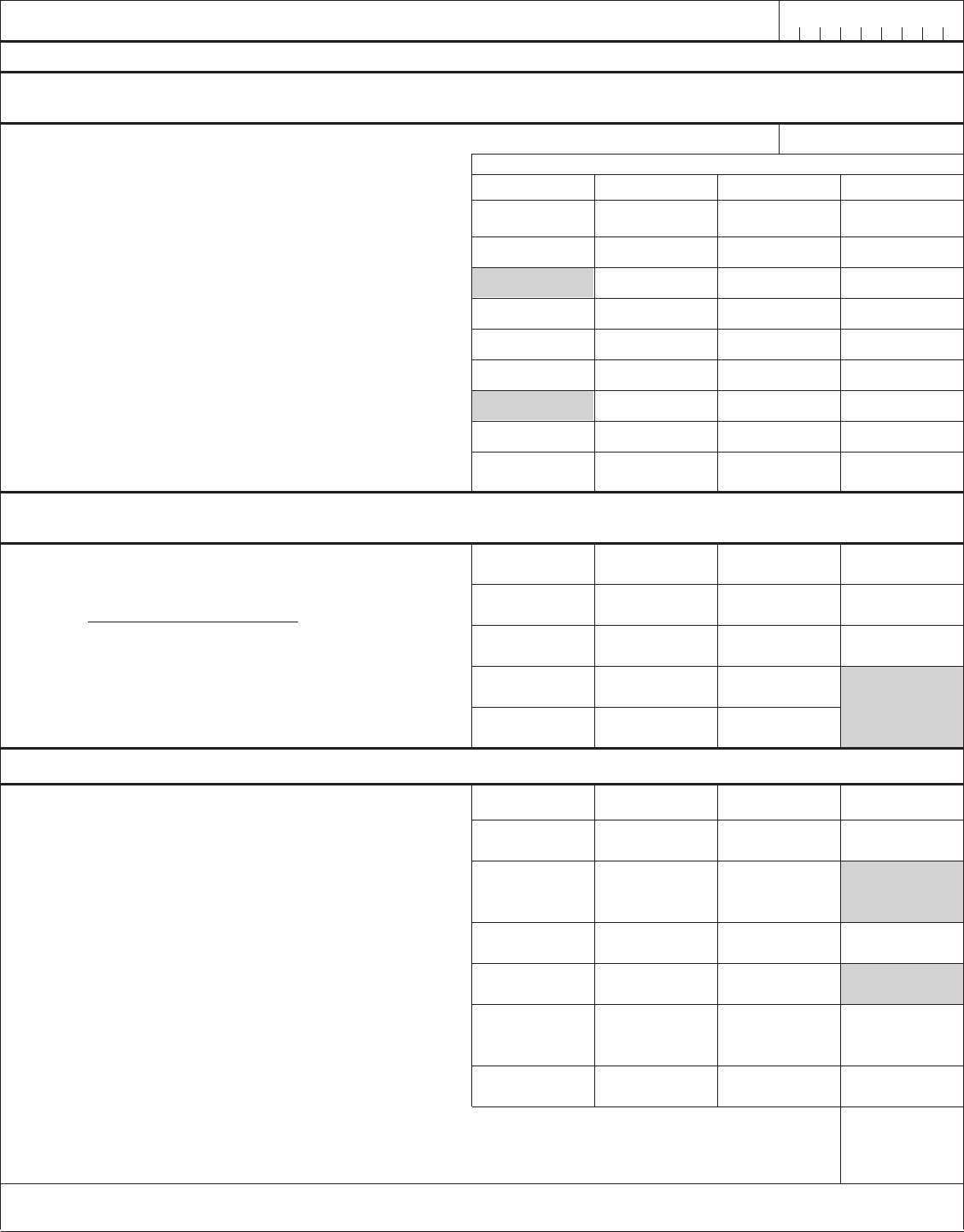

Form MO-2210 (Revised 12-2016)

A. Purpose of the Form — Use this form to determine whether your income

tax was sufficiently paid throughout the year by withholding or by estimated

tax payments. If it is not, you may owe a penalty on the underpaid amount.

B. Filing an Estimated Tax Payment and Paying the Tax for Calendar

Year Taxpayers — If you file returns on a calendar year basis and are

required to file Form MO-1040ES, you are generally required to file an

estimated tax payment by April 15, and to pay the tax in four installments.

(If you are not required to file an estimated tax payment until later in the year

because of a change in your income or exemptions, you may be required to

pay fewer installments.) The chart below shows the due date for estimated

tax payments and the maximum number of installments required for each.

PART III INSTRUCTIONS — REGULAR METHOD

Period

Requirements

First Met

Due Date

of

Estimated

Tax Payments

Maximum Number

of Installments

Required

Between January 1 and April 1 April 15 4

Between April 2 and June 1 June 15 3

Between June 2 and Sept.1 Sept. 15 2

After Sept. 1 Jan. 15 1

When the due date falls on a Saturday, Sunday, or legal holiday, the estimated

tax payment will be considered timely if filed on the next business day.

C. Fiscal Year Taxpayers — Fiscal year taxpayers should substitute for

the due dates above, the 15th day of the first and last months of the second

quarter of your fiscal year; the 15th day of the last month of the third quarter;

and the 15th day of the first month of your next fiscal year.

D. Exception to the Penalty — You will not be liable for a penalty if your

2016 tax payments (amounts shown on Line 20) equal or exceed any amount

determined for the same period under the following exception provisions.

You may apply a different exception to each underpayment. Please enclose

a separate computation page for each payment. If none of the exceptions

apply, complete Lines 15 through Line 29.

The percentages shown on Lines 21, 22, and 23, for the April 15, June 15,

and Sept. 15 installment dates, are for calendar year taxpayers required to

pay installments on four dates.

Exception 1 — Prior Year’s Tax. — This exception applies if your 2016 tax

payments equal or exceed the tax shown on your 2015 tax return. The 2015

return must cover a period of 12 months and show a tax liability.

Exception 2 — Tax on Prior Year’s Income using 2016 Rates and Exemptions

— This exception applies if your 2016 tax withheld and estimated tax

payments equal or exceed the tax that would have been due on your 2015

income if you had computed it at 2016 rates. To determine if you qualify for

this exception, use the personal exemptions allowed for 2016, but use the

other facts and law applicable to your 2015 return.

Exception 3 — Tax on Annualized 2016 Income — This exception applies

if your 2016 tax payments equal or exceed 90 percent of the tax on your

annualized taxable income for periods from the first of the year to the end of

the month preceding that in which an installment is due. To annualize your

taxable income, follow these four steps.

(a) Figure your adjusted gross income less itemized deductions from the

first of your tax year up to and including the month prior to that in which

an installment is due; or, if you use the standard deduction, figure your

adjusted gross income for that period.

(b) Divide the result of step (a) by the number of months in your computation

period.

(c) Multiply the result of step (b) by 12.

(d) Subtract the deduction for personal exemptions, federal tax and, if

you did not itemize, subtract the standard deduction. The result is your

annualized taxable income.

Exception 3 may not be used for the fourth installment period.

Example I (combined return with one dependent)

1. Wages, received during Jan., Feb., and Mar ................... $6,000

2. Self-employment income during Jan., Feb., and Mar. ............$4,000

3. Adjusted gross income ..................................$10,000

4. Annualized income ($10,000 ÷ 3 x 12) ......................$40,000

5. Less:

(a) Standard deduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$12,600

(b) Exemptions (2 x $2,100) + (1 x $1,200) ....................$5,400

(c) Federal tax (joint return) ................................$1,525

6. Annualized taxable income ...............................$20,475

7. Income Tax (from Missouri tax chart). . . . . . . . . . . . . . . . . . . . . . . . .$1,003

If your tax withheld and estimated tax payment for the first installment period

of 2016 were at least $226 (22.5 percent of $1,003) you do not owe a penalty

for that period.

Exception 4 — Tax on 2016 Income Over Periods of 3, 5, and 8 months –

This exception applies if your 2016 tax payments equal or exceed 90 percent

of the tax on your taxable income for periods starting from the first of the year

to the end of the month preceding that in which an installment is due. This

exception does not apply to the fourth quarter. To determine if this exception

applies for the first three quarters, figure your taxable income from January

1, 2016 to the end of the month preceding that in which an installment is due.

Then compute your tax on that amount as though it represented your taxable

income for 2016.

Example II

(combined return with one dependent, using standard

deduction)

(1) (2) (3) (4) (5)

Computation Income Tax 90 percent Tax

Period of Tax Withheld

Jan. 1 to Mar. 31 $15,000 $0 $0 $275

Jan. 1 to May 31 $21,665 $80 $72 $458

Jan. 1 to Aug. 31 $31,665 $595 $536 $733

Since the amounts in column (5) are greater than those in column (4) for each

of the first three computation periods, there is no penalty for the first three

installment periods.

E. Figure the Addition to Tax — For Line 27a, enter the number of days

from the due date of the installment to the date of payment or December 31,

2016, whichever is earlier. If the payment date on Line 26 is December 31,

2016, or later and the due date of the installment is April 15, 2016, then enter

260 days; for June 15, 2016, 199 days; and for September 15, 2016, 107

days.

For Line 27b, enter the number of days from January 1, 2017, or the 2017

installment due date to date of payment or appropriate due date of return,

whichever is earlier. If the payment date is April 15, 2017, enter 105 days for

the first, second, and third quarters and 90 days for the fourth quarter.

F. Tax Withheld — You may consider an equal part of the income tax

withheld during the year as paid on each required installment date, unless

you establish the dates on which the withholding occurred and consider it

paid on those dates.

G. Overpayment — Apply as credit against the next installment any installment

overpayment shown on Line 19a that is greater than all prior underpayments.

H. Installment Payments – If you made more than one payment for any

installment, enclose a separate computation for each payment. If you filed

your return and paid the balance of tax due on or before January 31, 2017,

consider the balance paid as of January 15, 2017.

I. Exception from the Addition to Tax for Service in a Combat Zone —

You may be exempt from a penalty for underpayment of estimated tax if you

served in the U.S. Armed Forces in an area designated by the President as a

combat zone under conditions which qualified you for hostile fire pay. If you

are exempt for this reason, write on Line 19, for the applicable installment

dates, “Exempt, combat zone.”

J. Farmers — If (1) your Missouri gross income from farming is at least

two-thirds of your total Missouri gross income and (2) you filed a Mis souri

Individual Income Tax Return and paid tax on or before March 1, 2017, you

are exempt from charges for underpayment of estimated tax. If so, write on

Line 1, “Exempt, farmer”.

If you meet this gross income test but did not file a return or pay the tax when

due, complete this form with respect to the last quarter only. Qualified farmers

would enter all of Line 14 in the fourth quarter and calculate the appropriate

underpayment.

Page 3Form MO-2210

Form MO-2210 (Revised 12-2016)

2016

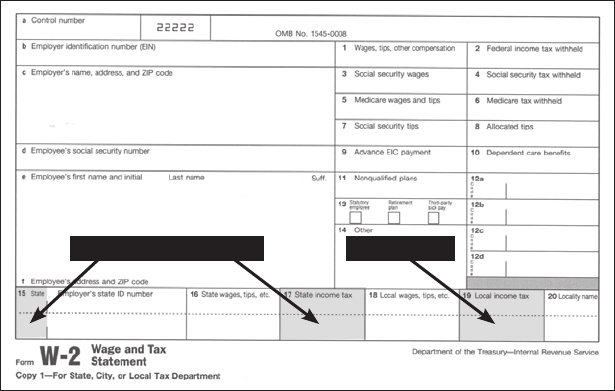

Missouri Taxes Withheld

Diagram 1: Form W-2

Earnings Tax

14. Enter the required annual payment, as computed on Part

I, Line 6.

15. Divide the required annual payment (Line 14) by the

number of required installments. If the estimated tax

was the result of a change in income or exemptions

during the year, you may require fewer installments.

Other wise, divide the required annual payment by four

and place the amount in each column. (See instructions

for farmers.)

16. Enter the amount of tax paid during the installment

period. (The tax withheld throughout the year may be

considered as paid in four equal parts on the due date of

the installment, unless a different date is established.)

17. Enter the amount, if any, of overpayment reported on

Line 19c from the previous installment period.

18. Enter the sum of Line 16 and Line 17.

19. If the amount on Line 15 is greater than the amount on

Line 18, enter the difference here. You have underpaid

for the installment period. If not, skip this line and go to

Line 19a.

19a. If the amount on Line 18 is greater than the amount on

Line 15, enter the difference here. You have overpaid for

the installment period.

19b. Enter the amount of the underpayment (if any) from Line

19d of the previous column.

19c. and 19d.

If you filled in Line 19 of this column, add the amount on

Line 19b to the amount on Line 19 and enter that total on

Line 19d. If you filled in Line 19a of this column, and the

amount on Line 19a is greater than any amount on Line

19b, enter the difference on Line 19c. You are overpaid.

If the amount on Line 19b is greater than the amount on

Line 19a, enter the difference on Line 19d. You are

underpaid. See page 3 for instructions for Lines 20

through 24.

25. If you have an underpayment for the installment period

and none of the exceptions on Lines 20 through 24

apply, enter on Line 25 the amount of the underpay-

ment on Line 19d. If you do not have an underpay-

ment, or if an exception applies, leave this blank and

skip the remaining lines of the column.

26. Enter the date a payment was made on the installment,

the due date of the following installment, or April 15, 2017,

whichever is earlier. If more than one late payment

was made to cover the installment, attach a separate

computation for each payment during the installment

period.

27a. Enter the number of days from the due date of the

installment to the date entered on Line 26.

27b. Enter the number of days from January 1, 2017 (or a

later date, if the installment date was after January 1)

until either the date of the payment or April 15, 2017,

whichever is earlier.

28a. Multiply the amount on Line 25 by the number of

days on Line 27a. Divide this amount by 366 days

and multiply the product by three percent. This is the

penalty accruing on the underpayment during 2016.

28b. Multiply the amount on Line 25 by the number of days

on Line 27b. Divide this amount by 365 days and

multiply the product by four percent. This is the penalty

accruing on the underpayment during 2017.

28c. Add the amounts on Lines 28a and 28b.

29. Add the sum of the amounts on Line 28c in the final

column, if applicable.

Line-by-Line Instructions

Complete Lines 15 through 19d for each installment period, then complete Lines 25 through 29.

Form MO-2210 Page 4